Let’s pay a little homage to everybody’s fave Canadian rock band-Rush! Hulton Archive/Hulton Archive via Getty Images

Introduction

This is an article on a Canadian energy company, and I was really tired of putting up pictures of snowy mountains, and snowed-in drilling rigs. Canada’s put out a lot of good rock over the years, and if you’re like me you’ve played “air guitar” with Alex Lifeson on Today’s Tom Sawyer or other hit they had in the 70’s. So today we honor my favorite Canadian rock band – Rush – with the intro photo. Okay, “Modern Day Warriors,” now put away the air guitars and let’s get down to business.

Tamarack Valley Energy Ltd. (OTCPK:TNEYF) is a company that we haven’t really done right by, in terms of coverage. We last covered them with an internal DDR article about a year and a half ago, where a fairly deep look was taken. It never made it to the free side, so no link. Sorry. While we liked what we saw at the time, we missed the strong buy signal that was being sent to Canadian companies about that time. In this case, that is, we nailed it with Canadian energy companies like Canadian Natural Resources (CNQ), Cenovus (CVE), and others. I rated the company as a hold at $0.97 per share, and it has risen 5X since, before succumbing to the… wait for it… “June Swoon.” (Did I just coin a term?)

Tamarack share price chart (Seeking Alpha)

The company has been busy with acquisitions over the last year and a half, knocking out three of them in cash and stock deals. It’s been an impressive effort, nearly doubling the company’s production and providing a pathway for growth in some of the hottest plays in Canada.

My only gripe is an excessive amount of ESG pandering for a company its size. I get that they are in Canada where this bilge is holy writ, but come on fellas! This is not enough of a gripe to dissuade me from looking at the stock. There’s just too much going right for them. I’ll have a few thoughts about this later in the article.

In this article we will catch up with Tamarack and see if current pricing represents an opportunity.

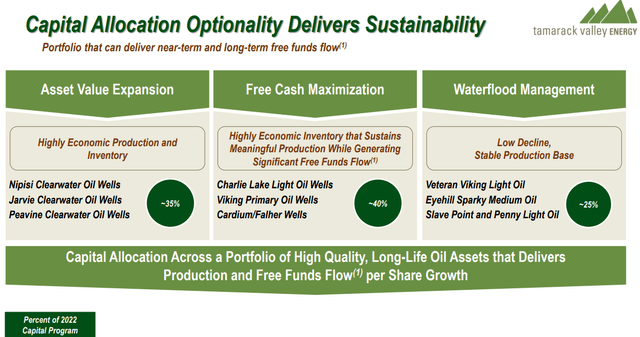

The investment thesis for Tamarack

Tamarack is an oil and gas exploration and production company committed to long-term growth in resource plays in the Western Canadian Sedimentary Basin. Tamarack’s strategic direction is focused on two key principles: targeting repeatable and relatively predictable plays that provide long-life reserves; and using a rigorous, proven modeling process to carefully manage risk and identify opportunities. The Company has an extensive inventory of low-risk, oil development drilling locations focused primarily in the Cardium and Viking fairways in Alberta that are economic over a range of oil and natural gas prices.

Tamarack Investor deck (Tamarack)

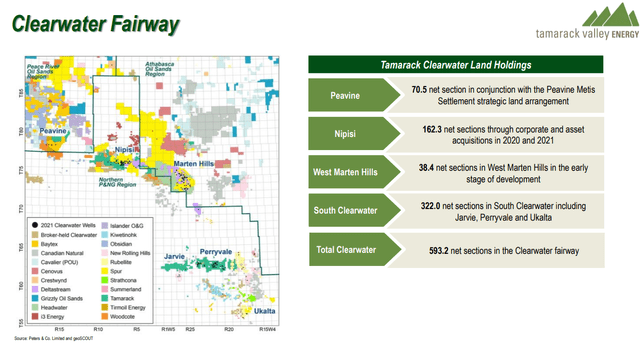

The company has continued filling in gaps in its core areas with a string of acquisitions since our last article. The focus has been on the Clearwater play, that we have discussed in several articles, perhaps most notably the one on Headwater Exploration. The Clearwater play intrigues oil companies because the high perm sandstone flows the heavy, viscous-19 gravity, oil without a frac. This is waterflood country and can be done with much less upfront capex than fracs or steamfloods. I went into this in some detail in the Headwater article, so you might give it a read if you’re new to my work or just need a refresher. Not having to spend money to frac or buy ESG carbon credits for steamflooding is an enormous lure, as I am sure you can well imagine!

Most recently for $93 mm, the company picked up a small privately held independent; Rolling Hills for its Clearwater acreage. Obtaining 70 identified drilling locations, and 2130 BOPD in production, and $61 mm in field netback in that transaction. And, just prior to that obtained the assets of privately held Crestwynd Exploration for $92mm. Crestwynd brought with it 4,500 BOPD of production and $130 mm of field operating netback. Both of these are immediately accretive to the company and extend the life of the Clearwater asset base.

Tamarack Investor deck (Tamarack)

The second area has been Charlie Lake, where in mid-2021 they added privately-held Anegada Oil Corp for $494 mm. Charlie Lake assets of Anegada brought 11.4K BOEPD of light oil and gas, and increased the lateral length potential of Tamarack’s existing Charlie Lake acreage.

Tamarack Investor deck (Tamarack)

In summary, the company has grown by acquisition and incorporated assets that supplemented existing acreage positions in well-established areas. It has a stable of long life assets that can be developed organically with high netback margins and shareholder capital returns de-risked to $35 WTI.

Tamarack Investor deck (Tamarack)

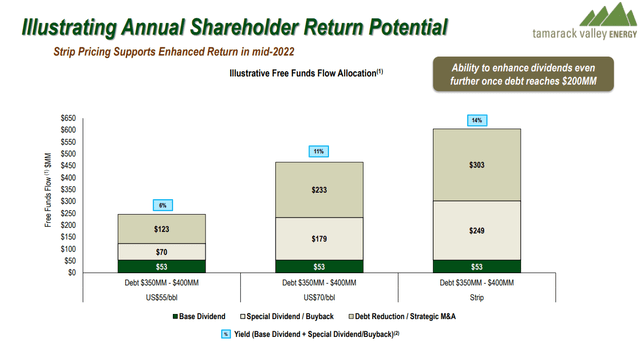

Tamarack is aggressively paying down debt with the highbacks today’s prices allow, and recently instituted a cash dividend in 2021, and increased it for Q-1, 2022.

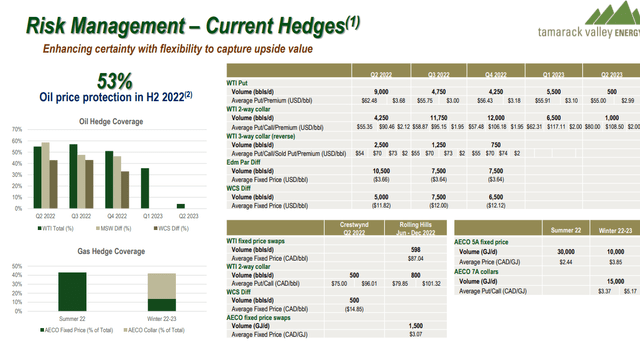

Tamarack is about 53% hedged for 2022 at prices that will entail some losses at settlement time. This declines in 2023 and enhances the high oil prices attractiveness of the company.

Tamarack Investor deck (Tamarack)

A potential catalyst for Tamarack

Everybody wants into the Clearwater play. A number of companies have made moves in that direction over the past year, among them: Rubellite Energy (OTCPK:RUBLF), Baytex Energy (OTCPK:BTEGF), Cenovus Energy (CVE), Obsidian Energy (OBE), Headwater Exploration (OTCPK:CDDRF), and others. The attraction is two-fold. First there is the low-capex, waterflood aspect of the play. Second is the enhanced ESG impact of not needing steamflood or fracs to develop this play.

Tamarack Investor deck (Tamarack)

Tamarack’s Clearwater acreage is in what’s called the “Fairway,” meaning that most of it lies in the sweet spot of the play where interval thicknesses are the greatest, providing more optionality for well placement.

Oil prices have stabilized currently, and while the netback are huge, in the upper $40’s to low $50’s, it should be recognized that they aren’t rising rapidly as the last 6-months. Low cost production will be advantaged in this scenario.

Risk factors

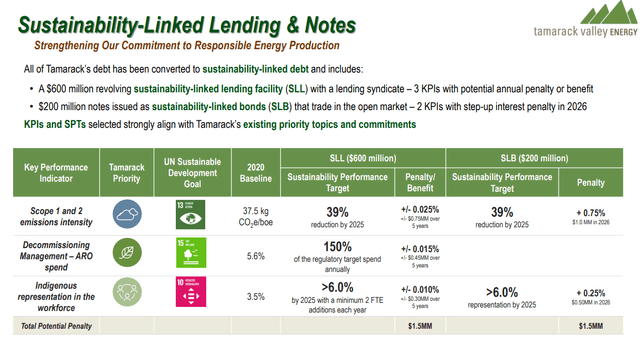

For a company its size, Tamarack is pretty heavy into ESG virtue signaling. It has redone its debt portfolio with ESG targets that include penalties for non-attainment. They aren’t the only company doing this, and I expect this sort of thing will be on the rise as producers look to curry favor with blue nose politicos and bankers.

Tamarack Investor deck (Tamarack)

There are good and bad aspects to this ESG self-flagellation. On the good side, it probably gets them in the door at the Ottawa permitting booth. The downside is the targets themselves can chip away – as they are designed to do – at the company’s profitability if these self-imposed goals are not attained. It would be nice to see this sort of high oil price luxury, ladder-out when oil takes a downturn.

As I said above this is really a sticky-note parking lot, cautionary note, with no immediate impact. Let’s hope it stays that way.

In recent articles, I’ve opined that with the adverse policy signals being sent by governments in Canada and the U.S., commodities like oil and gas are bound to go higher from scarcity. I tried to paint a hopeful picture in them, that sanity was returning to the energy market. It is, but is somewhat bifurcated, with regulatory agencies keeping their foot firmly on the neck of the industry, at the same time the president is asking them to produce more. The risk, of course, is it can always get worse. That would be bad for Tamarack and many of the other companies we cover here. Another sticky on the parking lot!

Q-1 for Tamarack

The company achieved quarterly production volumes of 41,335 boe/d in Q1/22, representing an 73% increase compared to the same period in 2021. Tamarack generated adjusted funds flow of $166.6 million in Q1/22 compared to $42.0 million in the same period in 2021. This led to free funds flow, excluding acquisition expenditures, of $41.2 million.

They generated net income of $26.5 million during the quarter as compared to a net loss of $0.2 million in the same period of 2021. Dividends were declared at $10.6 million during the quarter ($0.0083/share per month), delivering on the Company’s return of capital framework.

Capex ran $106.8 million in exploration and development (E&D) capital expenditures, excluding acquisition expenditures, and $18.6 million on undeveloped land in the Clearwater and Charlie Lake areas during Q1/22.This contributed to the drilling of 18 (17.5 net) Clearwater oil wells, eight (8.0 net) Viking oil wells, seven (7.0 net) Charlie Lake oil wells and five (5.0 net) water source and injector wells.

The company exited the quarter with $556.4 million of net debt and net debt to Q1/22 annualized adjusted funds flow of 0.8x. The company is targeting debt of <$200 mm at strip prices for WTI.

The company recently increased its dividend for the second quarter.

Tamarack Investor deck (Tamarack)

Your takeaway

Tamarack is selling at under 5X OCF after the nearly 50% drawdown to $2.91 we saw in June. The share price has rebounded about 10% since reflecting the oversold condition of the market presently. On a flowing barrel basis using their projected 2022 daily output, they are trading at $40K per barrel, which is a substantial discount to the $80-$90 price realizations now being seen.

11 of the 13 analysts following the company rate it as a BUY. The high target is $12.50 and the low is $6.00. The median is $8.00. In USD these would convert approximately to $5.20 to $10ish per share.

I think investors looking for growth and increasing income should take a careful look at the company at its current price. They should be selling for substantially more, at the very least back to the $5.00 share price they attained in early June. The company’s long life, low decline assets should provide a runway for increased output in years to come without further acquisitions. If they attain the debt level they are targeting of $200 mm the OCF multiple would adjust down to 3.75. To keep it the same as now the share prices would need to adjust back toward the $5.00 level.

As the hedges drop off in 2023, a further boost to OCF will be seen. Higher cash flows would drive the multiple past 5X and put some of those higher analyst estimates in sight. In those scenarios, I think Tamarack makes a compelling case for investment.

Be the first to comment