Alexander Farnsworth/iStock via Getty Images

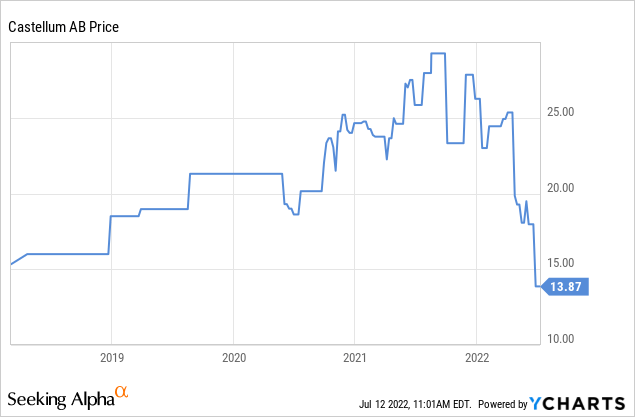

A combination of issues have driven shares of leading Nordics property company Castellum (OTCPK:CWQXF) significantly down. These issues include multiple central banks starting to raise rates, or hinting they will, office occupancy issues due to lower demand that is the result from Covid and the work from home trend taking hold around the world.

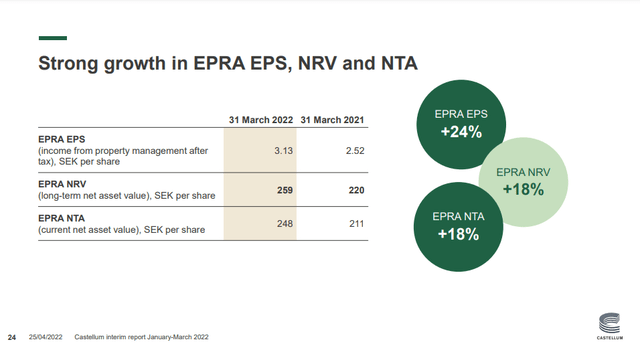

Shares are down despite the company reporting arguably strong results. For example, for Q1 the company reported income from property management up 21% per share, it reported positive net leasing, and a solid and stable financial position with LTV of 37.3%. It also reported very strong growth of ~18% in EPRA NRV, which is a similar metric to book value. Despite these strong results, shares have dropped by more than half from their peak.

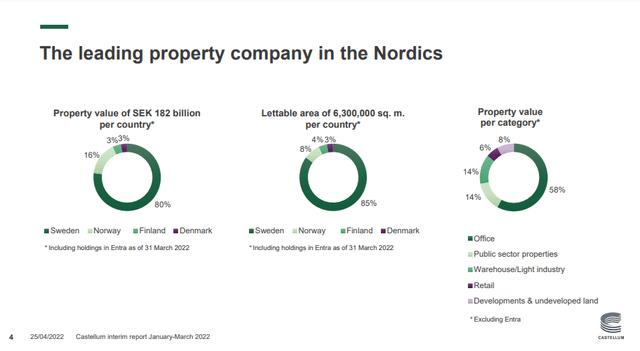

So what is happening? We believe the significant exposure that Castellum has to office buildings is the main thing that is weighing on its share price. In the US market even blue-chip office companies like Boston Properties (BXP) are down significantly from their peak, despite delivering decent results, and a lot of it is probably fear that ‘Work from home’ is here to stay. According to Nordic Property News, office vacancy rates in Stockholm and Gothenburg are at more than twice the levels they were pre-Covid, and the post-Covid recovery hasn’t arrived yet. Castellum’s office property value is about 58% of its total portfolio, and most of the value of the portfolio is in Sweden.

Castellum Investor Presentation

Financials

For the first quarter 2022 Castellum delivered solid results, for example, rental income like-for-like was up +4%, and the value of the property portfolio was up +3%. Earnings per share were up nicely from 2.52 SEK per share to 3.13 SEK per share, and increase of a little over 20%. EPRA NRV and EPRA NTA, both proxies for book value, were up an impressive +18%.

Castellum Investor Presentation

One of the reasons we are not overly concerned about Castellum’s position regarding the office portfolio, is that a lot of it is very high quality. We believe high-quality offices will be less impacted than low-quality office when it comes to the working-from-home trend, as companies consolidate their office space in the best locations. Below we show an example of one of Castellum’s offices, which has E.ON (OTCPK:EONGY) (OTCPK:ENAKF) as a tenant.

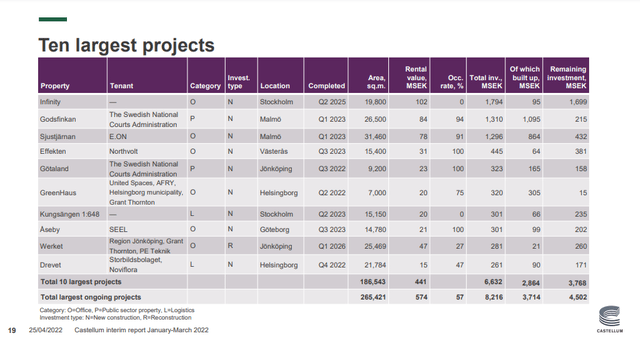

Castellum Investor Presentation

Castellum’s occupancy rate for Q1 2022 was a very decent 93.6%, and most of the development projects which should be completed in the next year or two already have high occupancy levels, as can be seen in the table below.

Castellum Investor Presentation

Balance Sheet

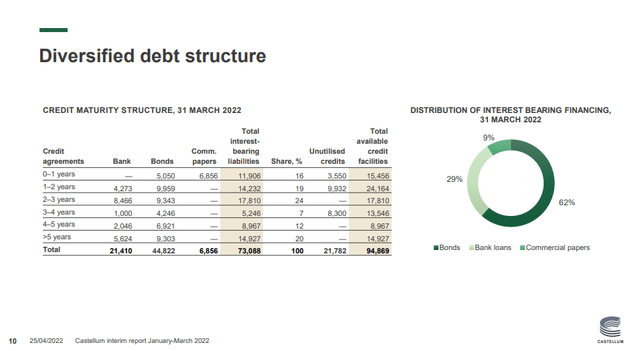

Castellum has a healthy balance sheet and a solid financial position with a Loan-to-value of 37.3%, and interest coverage ratio of 5.0. One thing that we do find a little bit concerning is that a lot of its debt will mature in the next 3 years, and with increasing interest rates this could impact earnings and make refinancing complicated.

Castellum Investor Presentation

ESG

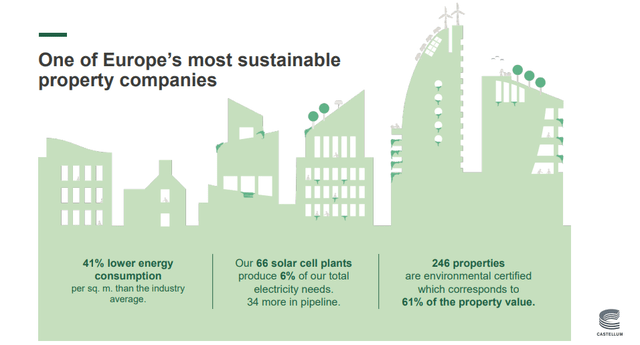

Castellum prides itself on being one of Europe’s most sustainable property companies, with 41% lower energy consumption than the industry average per square meter. It has installed 66 solar plants that cover 6% of its total electricity needs, and has another 34 solar plants in the pipeline.

Castellum Investor Presentation

Valuation

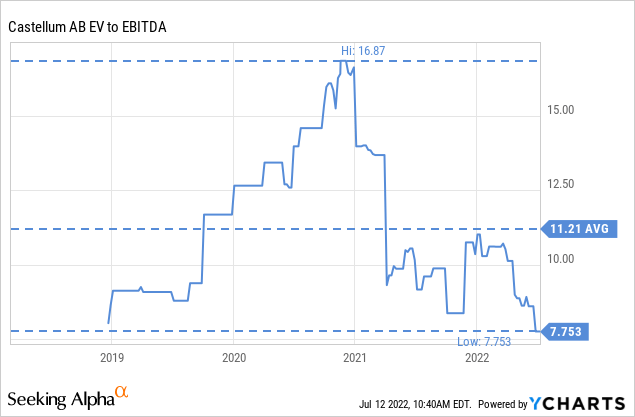

With the share price decline, shares have been left trading at very low valuation multiples. For example, EV/EBITDA is now only ~7.7x, considerably below the average of the last few years of 11.21x.

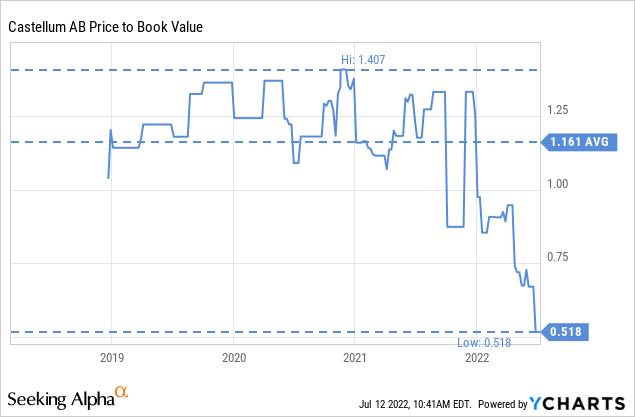

Similarly, shares have gone from trading at a slight premium to book value, to a deep discount to book value.

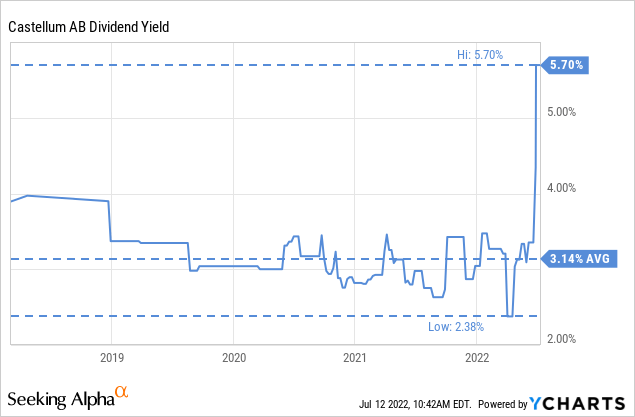

Meanwhile, the dividend has gone from ~3%, to about 5.5% currently. Needless to say, we find the current dividend yield quite attractive.

Risks

The main risk we see with an investment in Castellum is its exposure to the office property market, which is still suffering from the effects of Covid and the work-from-home trend that is taking hold around the world. This risk is somewhat mitigated by the high-quality of the offices in its portfolio, as we believe companies would prefer to consolidate their office space around the best properties. The other important risk is interest rates rising, and we are somewhat concerned that a lot of Castellum’s debt matures in the next 3 years. That said, the company continues to report solid financial numbers.

Conclusion

While there are some risks to an investment in Castellum, we believe these are more than priced in given how much shares have declined. The company has continued reporting solid numbers, the occupancy rate at 93.6% remains strong, and book value has gone up. The company also has an attractive development projects pipeline that should further add to growth in the future. Overall we see a company facing some headwinds, but the low valuation more than makes up for it in our opinion. We are now rating the shares as ‘Strong Buy’.

Be the first to comment