ChrisAt/iStock via Getty Images

It seems that I’m in the mood to take a few trips down memory lane as I dust off some of my older investments for review. It’s been about 44 months since I put out my bullish article on Masonite International Corp. (NYSE:DOOR), and in that time, the shares are up about 29% against a gain of 64% for the S&P 500. Much has happened since, so I thought I’d check on the business again to see if now’s a good time to add to my shares or sell. I’ll make that determination by looking at the financial history here, and by looking at the stock as a thing distinct from the underlying business. I’m going to also write about the buybacks of 2021, because I think doing so will help clarify my perspective on these.

I tell myself that I’m a busy person because I’ve got a few reports to read, and some writing to do, and some coffee to make. If any of my ancestors somehow magically were given a glimpse at the life I live now, “busy” wouldn’t make the top 100 list of words they’d use to describe how I spend my time. Thankfully for me I wouldn’t understand many of their descriptors because my Irish is actually pretty bad, but, knowing what I know of them, I assume the insults would fly fast and thick. If you’re like me, and you suffer from that 2022 version of “busy”, you don’t want to waste time reading superfluous fluff because you have other superfluous fluff to get to. It’s for you people, the legion of other “busy” people that I produce this, the “thesis statement” of my article. It’s for you people, the “doers” who keep society running that I do this. Somehow there’s a link between you reading reports and me heating my house and stocking my bar, so I want to make it as easy as possible for you to read as many reports as you like. In pursuit of this absolute obsession, I have to make your lives easier, I will provide the summary of my argument so you won’t be obliged to read the whole article. Here goes. I think Masonite has performed quite well since I last wrote about the business, but I think the shares are overpriced at the moment. I think management wasted ~$113 million of shareholder wealth last year when they retired shares at a premium price. I also don’t like the deterioration of the capital structure. Most troubling to me, though, is the fact that the shares are trading near record high valuations, and so I want to leave the party. Unfortunately, we’re too far above reasonable strike prices to justify selling puts at current levels. For that reason, all I can do is take my profits, and wait for shares to drop in price before reconsidering this position.

Financial Snapshot

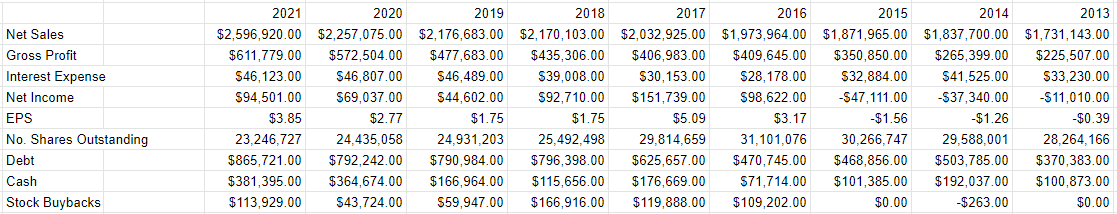

The most recent financial year has been quite good for the company in my view. The top line was superior to both 2020, and 2019, up by 15% and 19.3% respectively. In addition, net income was far higher, up by 37%, and just under 112%, respectively. These results are more impressive in light of the fact that they’re not sudden relief from accrual charges, like goodwill write-downs and the like. In fact, the uptick in the bottom line occurred in spite of an $18.385 million uptick in asset impairment, and a $13.583 million loss on extinguishment of debt expenses for the year.

It’s not all sunshine and lollipops at Masonite, though. The level of debt increased by just under $74 million, or 9.25%. While cash increased by $16.7 million at the same time, there’s no doubt in my view that the capital structure has become more risky. This uptick in debt is more troubling to me in light of the buyback activity.

Buybacks

One of the arguments I remember getting into during the St. Patrick’s Day, uh, “season”, was about buybacks and whether or not they are “unalloyed good” (that was the phraseology of my somewhat pompous interlocutor). I know. Me complaining about someone else being pompous is a bit rich, but leave that aside. I’m of the view that a buyback is neither “good” nor “bad.” It’s good if the shares are bought back at a discount, and it’s bad if they’re bought at a premium to reasonable value.

With that in mind, I’d like to review the recent buyback activity at Masonite. At the beginning of the most recent financial year, the company had shares outstanding totaling 24,435,058. At the end of the year, the share count had dropped to 23,246,727. By concentrating very hard for the better part of a day, I was able to work out that the company had thus retired exactly 1,188,331 shares over the year. Looking at the cash flow statement, we see that the company spent $113.929 million buying back these shares. By referencing the ancient notebooks I filled during my primary school education, I worked out that the company spent $95.87 on average to retire each of these shares. Please “put a pin” in that number, as I’m going to work out whether that was a “good” or “bad” price later in the article.

In the meantime, I’d suggest that it might be a good idea to add to my stake here if the valuation makes sense.

Masonite International Financial History (Masonite International investor relations)

The Stock

I imagine some of my regulars are rolling their eyes a little bit because they know that we’ve come to the “disqualify a reasonable company because of valuation concerns” portion of the program. My discipline about valuation has talked me out of many great, if temporary, returns, and, frankly, missing out when your peers are getting richer is a bit of a downer. To try to defend my perspective, I’m of the view that just because a potential investment is doing well financially doesn’t necessarily mean it’s a good investment. It can be a terrible investment if you overpay for the stock, because it’s not about finding growth. It’s about identifying the disconnect between market expectations, and subsequent reality. Rather than try to argue this point theoretically, I’ll use the example of Masonite itself to make the point. The company released earnings on February 24. If investors bought immediately after earnings, they’re up about 2% as of now. Had someone bought the stock March 18, to pick a date totally at random, they’re down about 9% since. Not enough happened at the business to warrant an 11% swing in returns, so the relatively extreme variance in performance in about three weeks comes down entirely to price paid. This is why I try, though don’t always succeed, to avoid overpaying for a stock, and insist on buying cheap.

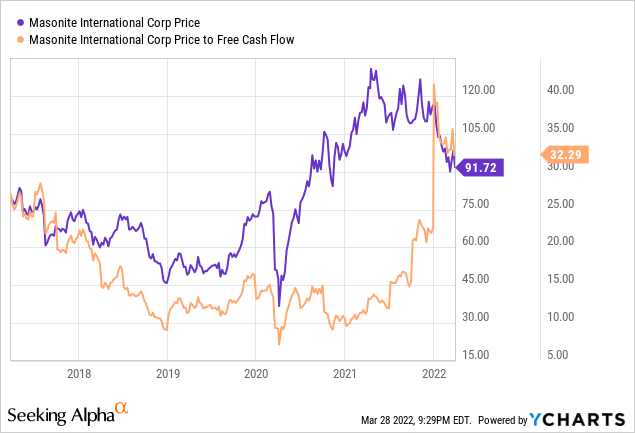

As my regulars may recall because I’ve droned on about it enough, I measure the cheapness (or not) of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at the ratio of price to some measure of economic value like sales, earnings, free cash flow, and the like. Ideally, I want to see a stock trading at a discount to both its own history and the overall market. In case you don’t have your copy of “Doyles trades of 2018” almanac in front of you, I’ll remind you that back then, I got excited by the fact that Masonite was trading very near the bottom of its historical range when it was changing hands at a price to free cash flow of ~17.2 times. It’s now just under 88% more expensive, per the following:

This makes the valuation far less compelling for me, especially in light of the fact that the shares are trading very near their historical high.

Buyback Revisited

Now you may remember that earlier in this article, I asked you to “put a pin” in the average price paid for a retired share. I’d ask you now to, uh, “unpin” that number, because I’m going to use it again. Some people believe that a buyback should be applauded if the stock price is higher than the buyback price and vice versa. Given that I’m obviously skeptical about the validity of a stock price at a given point in time, I take a different approach. I am of the view that a buyback is a positive if the shares are acquired at a reasonable valuation. We can infer from the graph above that the trailing twelve-month free cash flow per share is about $2.84 per share ($91.72/32.29). Thus, shares retired at $95.87 were taken out at a price to free cash flow of ~33.76. So, management took just under $114 million of shareholder wealth and bought back shares at what I consider to be an excessively high price. I would have preferred the dividend, even if it were subject to the ravages of the Canadian tax man.

As my regulars know, in addition to simple ratios, I want to try to understand what the market is currently “assuming” about the future of this company. In order to do this, I turn to the work of Professor Stephen Penman and his great book “Accounting for Value.” In this book, Penman walks investors through how they can apply some high school math to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in the formula. Applying this approach to Masonite at the moment suggests the market is assuming that this company will grow at a CAGR of about 1% over the long term. I consider this to be reasonably pessimistic, actually, which I like to see.

Given my current level of, let’s just call it what it is “paranoia”, I’m not convinced the valuation makes sense here, and so, taking all of the above into account, I’m going to sell my stake.

Options As An Alternative

While I’m not willing to continue to tie up capital at $92 per share, I’m very happy to buy the shares at the same valuation I paid originally. The way I normally do that is to sell deep out of the money put options at strike prices that line up with what I’m willing to pay. Holding all else constant, that lines up to a current price of ~$50. The problem is that the premia on offer for the $50 strike price are too thin to make the exercise worthwhile in my view. For instance, the December Masonite puts with a strike of $50 are currently bid at $0.80, which isn’t worth the effort in my opinion.

Conclusion

I think Masonite International Corporation has had a reasonably good time of it since I bought. The problem is that shares that were compelling at $70 are now expensive in my view. For that reason, I can’t recommend continuing to own the shares, and so I’ll be selling. While I normally like to generate some extra returns from put sales, I can’t in this instance because the premia on offer are too thin in my estimation. For that reason, I’m obliged to sit around and wait for the shares to fall to more normal levels before considering a put sale or stock buy.

Be the first to comment