XH4D/E+ via Getty Images

It is easy to be conspicuously ‘compassionate’ if others are being forced to pay the cost.”― Murray N. Rothbard

Today we take a look at a small cap company has good long-term prospects and where an insider is buying shares in a major way. The firm also has a massive cash hoard that accounts for more than half of its overall market capitalization. An analysis follows in the paragraphs below.

Company Overview:

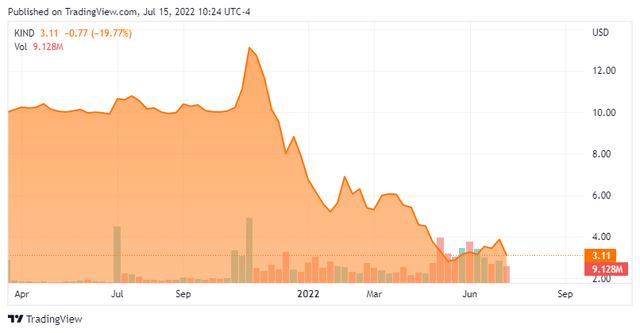

Nextdoor Holdings, Inc. (NYSE:KIND) is a San Francisco based digital platform that connects citizens, businesses, and public services in more than 290,000 neighborhoods in 11 countries, including approximately one-third of U.S. households. The social media construct for communities boasted nearly 37 million weekly active users (WAUs) as of March 31, 2022. It was founded in 2007 and went public in November 2021 when it merged into special purpose acquisition company (SPAC) Khosla Ventures Acquisition Co. II, with its first trade consummated at $11.74 a share. Nextdoor trades just over three bucks a share, equating to a market cap of $1.25 billion.

The company is capitalized by two classes of stock. The 116.6 shares of publicly traded Class A stock confer economic interest and one vote per share, whereas the privately held 269.9 million shares of Class B stock bestow economic interest, ten votes per share, and are convertible into Class A stock.

Platform

The company’s model revolves around notifying people (Neighbors) in a specific geography (Neighborhood) of news, events, and information relative to that locality. Neighbors respond by commenting, which drives further engagement. Neighbors can also use a search function to find local businesses, items that other Neighbors are buying or selling, and information concerning public services. Neighbors post reviews about local businesses and form online groups where they share common interests. Although the platform is in 11 countries, the preponderance of WAUs (29.5 million of 35.9 million, or 82% at YE21) are located in the U.S.

Nextdoor monetizes this network through ad placements from local businesses or big corporations who have a physical storefront in the community via its newsfeed, targeted emails, or search listings. Currently, ~30% of the company’s revenue is derived from small businesses.

Because Neighbors are interacting with other Neighbors who they may later see in person, Nextdoor appeals to a somewhat differentiated – in theory, friendlier – audience than other social media apps. Of Neighbors who visit its app at least once a month, 76% do not visit Snap (SNAP), 57% do not engage with Pinterest (PINS), and 17% do not visit Facebook. Furthermore, with 87% of Neighbors traveling less than 15 minutes to make purchases, 57% shopping local with the purpose of supporting their Neighborhood businesses, and 72% influenced by a recommendation concerning a business, it is easy to see the appeal of local advertising on Nextdoor. The challenge, of course, is to provide enough interesting neighborhood-related content to drive higher weekly active user engagement and retention levels that incentivizes local businesses to advertise. The other challenge is to provide businesses with a platform that easily hits their target audience. Without running down specific product offerings, it is in these areas that Nextdoor is dedicating most of its platform spend.

Stock Price Performance

Not surprisingly, Khosla and PIPE investors saw the next Facebook – now Meta Platforms (META) – in Nextdoor and the market agreed, at one point bidding its stock up to a market cap of $7.2 billion during the day of its public debut, as it was provided with net proceeds of $623.1 million from the reverse capitalization. At that moment, its stock was trading at a ridiculous 33.7x FY21 sales net of cash – sales that grew 56% over FY20. That growth was comprised of a 33% uptick in average annual revenue per weekly active user (ARPU) to $6.13, while WAUs grew 32% to 35.9 million – significant growth but dubiously worthy of double-digit multiples to its top line. Furthermore, the neighborhood social media concern burnt through cash from operating activities of $51.3 million in FY21 after bleeding $41.6 million in FY20, indicating that it was not going to attain profitability anytime soon.

Sporting a nosebleed valuation at a time the market was pivoting away from high-growth, profitless companies – especially those birthed by SPACs – enthusiastic investors became as scarce commodity and as such, shares of KIND have plummeted more than 80% from their intraday all-time high and over 70% from their opening post-merger transaction, now trading at an EV/FY22E sales of 2.2.

1Q22 Earnings & Outlook

While its stock was searching for a bottom, Nextdoor reported 1Q22 earnings on May 10, 2022, posting a loss of $32.9 million (GAAP) and Adj. EBITDA of negative $19.9 million on revenue of $51.0 million versus a loss of $25.1 million (GAAP) and Adj. EBITDA of negative $16.8 million on revenue of $34.4 million, representing a 48% increase at its top line. The growth was driven by a 33% year-over-year increase in WAUs to 36.7 million and a 12% year-over-year increase in ARPU to $1.39, marking the second consecutive quarter of 12% year-over-year ARPU growth after 38% (3Q21) and 59% (2Q21) in the two quarters prior. The company’s top line was $2.7 million better than expectations.

Despite the beat at the top line, management tweaked its full-year guidance lower (based on range midpoints) from $255 million to $254 million, citing the current macroeconomic environment. FY22 Adj. EBITDA margin was and still is expected at 18%, or $45.7 million. Net-net, the report did little to halt the downward momentum in Nextdoor’s stock, as it traded 23% lower over the subsequent two weeks, hitting an all-time intraday low of $2.47 – equating to a market cap of $954 million – on May 24th.

Balance Sheet & Analyst Commentary:

However, the company is awash in liquidity, sporting cash and marketable securities of $711.9 million against no debt as of March 31, 2022. Believing that its message and outlook have not drastically changed – only perceptions regarding its valuation – while only burning through cash from operations of $5.5 million in 1Q22, Nextdoor announced a $100 million share repurchase program on June 1, 2022.

That said, the Street is tepid on Nextdoor’s prospects. The one outperform rating and outdated $16 price target (courtesy of ISI Evercore) was proffered in November 2021, while the four hold ratings were all initiated in 2022, after the risk-off trade became en vogue. Current price objectives for the company’s stock range from $4 to $7. Analysts expect the platform to lose $0.11 a share (non-GAAP) on revenue of $254.5 million in FY22, followed by a loss of $0.05 a share (non-GAAP) on revenue of $339.6 million, representing 32% and 33% annual increases at its top line, respectively.

Not in accordance with the Street’s outlook is board member David Sze, who represents the interests of beneficial owner Greylock 16. He purchased over 5.8 million shares in the mid-to-low $3 area between June 3rd and 7th.

Verdict:

The combination of the board’s share buyback authorization and a director’s purchases put a bid into shares of KIND, which rallied from under $3 to near $4 in early June but are now falling back to pre-buyback announcement levels. This retest of the $3 level allows investors to get in at an EV/FY22E sales of just over 2.

There are clearly secular tailwinds for digital advertising and significant upside if Nextdoor can drive quarterly ARPU. For example, Nextdoor’s 1Q22 ARPU of $1.39 is not even in the same universe as Meta Platforms’ $45.72 for the U.S. and Canada during the same period. It remains to be seen if Nextdoor can grow into profitability, but there is obvious appeal for a platform focused on local events, as well as the giving and receiving of information and advice. In other words, around current levels, Nextdoor holds more long-term upside potential than downside risk and, as such, is worthy of at least a small size holding. There are options available against this equity and they are fairly liquid, so accumulating position via covered calls is an available strategy.

Prison is, simply put, the bottom rung of the welfare ladder.”― Stephen Reid

Be the first to comment