kynny

Smaller Chips Have The Potential to Make a Big Difference For TSM

Investors are always looking for the next big investment. A stock that has the potential to deliver outsized returns while hedging against significant downside, but traditionally U.S. investors focus their efforts on domestic stocks due to the availability of information & the trust factor of putting their money into a name within American borders. Taiwan Semiconductor (NYSE:TSM) has the potential to be a lower risk higher reward non-U.S. stock for investors with heavy relations to U.S. names such as Apple (AAPL) & Advanced Micro Devices (AMD).

TSM is one of the world’s largest semiconductor foundries. It has an enviable track record of consistent earnings growth delivering well over 1,000% returns since their inception in the late 80’s. It is well-positioned to benefit from the ongoing semiconductor boom despite potential headwinds ahead. While the stock is not extremely cheap (P/S ratio > 4x Sales), it is trading at a significant discount to its long-term 5-year average valuation. We believe the stock has significant upside potential as the company executes on its growth plans of creating nano sized chips to continue to differentiate themselves from the competition (Figure 1).

TSMC

Figure 1. The evolution of the microchip over the lifetime of TSMC

In this article, we will explain why we believe TSM is a screaming buy at its current price. we will also discuss the risks and potential downside of investing in TSM and outline upside vs. downside potential of investment in this international semiconductor leader.

Current Valuation

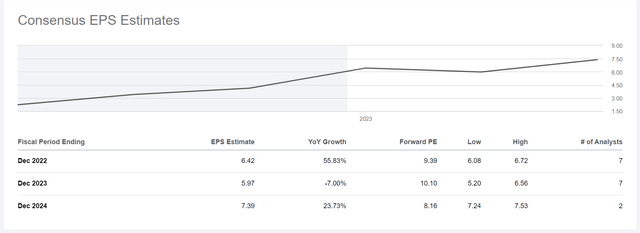

As of November 2022, Taiwan Semiconductor’s stock is currently valued at around $60 per share. This is a significant decrease from the stock’s all-time high of around $140, which was reached in January. Despite this recent dip in value due to tough macroeconomic conditions, Taiwan Semiconductor’s stock is still displaying solid growth and projects this to continue for the most part going forward. TSM’s forward price to earnings is ~9.4x earnings (Figure 2). Not bad at all of for a stock that has averaged over 16% annual earnings growth on average over the last 5 years.

Figure 2. Earnings Have grown on average 16.7% over the last 5 years for TSM and this trend looks to continue for the most part according to analysts’ estimates

Looking forward, analysts believe that Taiwan Semiconductor’s stock will continue to rise as the company benefits from the growing demand for semiconductors. Wall Street analysts give TSM an average price target of around $111 which would indicate over 85% upside. With the pandemic driving an increase in online activity that appears to be a new normal with stay at home workers, semiconductor companies like Taiwan Semiconductor can expect recent growth to be here to stay for the most part.

We believe a $90 price target by the 2nd half of 2023 is not unreasonable if macroeconomic conditions bounce back in coming months based off of current PE ratio levels. This would be a conservative upside of ~50% from early November prices which is a solid return along with a ~3% dividend.

Risks

When it comes to investing in technology stocks, there is always a certain amount of risk involved. But with Taiwan Semiconductor, that risk is mitigated by the fact that they are one of the world’s largest contract chipmakers. This means that TSM is less exposed to the ups and downs of the consumer markets then AMD or Nvidia (NVDA) for example, and is more insulated from economic fluctuations that we have seen over the last 9 months.

However, there are still some risks to consider before investing in TSM. For one, the company is reliant on a small number of clients, including Apple, AMD, and Nvidia. This concentration of business could pose a problem if one of these clients were to reduce or eliminate their business with TSM. Additionally, the company is facing increased competition from its Chinese rivals, who are making significant investments in their own semiconductor businesses.

Despite these risks, TSM remains a strong investment in our opinion. The company has very little debt in comparison to their overall size and as long as they stay ahead of competitors, their customers have no reason to move to other chip suppliers in the foreseeable future.

Overall Conclusions

In conclusion, Taiwan Semiconductor is a good investment in our opinion due to its current undervaluation of as much 50% conservative upside. The company is the world’s largest contract chipmaker, and even if the U.S. seeks to bring chip production within domestic borders, they will be years behind the behemoth that is TSMC. Downside risk is limited with the stock trading at pre-pandemic levels. Taiwan Semiconductor’s stock is as good of a way as any to play the semiconductor sector, and it is likely to provide shareholders with long-term capital appreciation due to consistent growth and demand. The stock offers nice upside with mitigated further downside risk in what has been a tough to predict market so far through 2022.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment