VvoeVale/iStock via Getty Images

Graphite Helps Fight Climate Change

Tackling climate change requires reducing emissions of CO2 and other highly polluting substances released into the atmosphere by the burning of fossil fuels to generate the energy needed to run cities and industrial areas. Emissions are held responsible for global warming, which scientists also describe as the main cause of climate change.

To reduce CO2 and greenhouse gases to the point of elimination, a gradual revolution in the use of energy resources will take place in the coming years. This requires replacing fossil fuels with renewable energy sources such as wind power, solar power, biomass, etc.

The decarbonization process will be long and will also involve the increased use of less polluting sources than coal and oil, namely gas and nuclear power. In addition, electrification will immediately give a powerful impetus to achieving the global goal of a cleaner, more livable, and more sustainable world ecosystem. The task of electrification will be to make many industrial (e.g., electric ovens), commercial and urban (e.g., electric vehicles) activities electrically powered and no longer dependent on energy from burning fossil fuels.

Raw materials are needed to build renewable energy infrastructure, equip industries with power plants, introduce electric vehicles into private and public mobility, and shield new nuclear power plants. Among the minerals that will ensure that decarbonization does not remain at the project level, graphite is expected to be used extensively in this process.

Syrah Resources Limited in The Fast-Growing Graphite Global Market

Allied Market Research forecasts that the global graphite market, which totaled $14.3 billion 3 years ago, will reach $22 billion by the end of 2027 and will grow at more than 5% per year over the next 5 years.

According to the analyst, the massive use of the mineral in green technologies such as electric vehicles and electric arc furnaces for the steel-making process will certainly be a key factor for companies to continue operating in the graphite market.

In the universe of companies engaged in the exploration and production of graphite to supply various markets worldwide, investors should consider Syrah Resources Limited (OTCPK:SYAAF).

This stock appears to have strong upside potential.

The company is well-positioned to benefit from the expected increase in global demand for lithium-ion batteries for electric vehicles. The company can rely on strong and important graphite operations in Mozambique to supply the global markets with the mineral they need.

Syrah Resources Limited in The Basic Materials Sector

Syrah Resources Limited, headquartered in Melbourne, Australia, is an explorer, appraiser and developer of mineral properties in Mozambique.

Syrah Resources’ principal mineral project is the Balama Project in the Cabo Delgado Province of Mozambique, where the company is engaged in the exploration and development of graphite and vanadium properties.

The company is also evaluating and developing a natural flake graphite facility expansion project at Vidalia in Louisiana for use as an active material in the anode industry.

The company aims to sell natural graphite to the markets of Western countries as well as China, India and South America.

The Graphite Mineral and Its Applications

The mineral’s name “graphite” derives from the Greek “I write” because when a piece of mineral is rubbed on paper it leaves a grayish trail.

Graphite is a soft and slightly flaky mineral. It is greasy to the touch. It is dark gray in color but has a metallic sheen.

This mineral is a good conductor of electricity and heat, non-oxidizable and acid resistant. Graphite only melts at around 3000°C.

Due to its properties, the mineral finds many applications in various industries, including electrical engineering and electronics, metallurgy, and in the chemical industry. It is also used to shield nuclear power plants.

Graphite is also used in the paint industry to make non-oxidizable products and in the petrochemical industry to make compounds and lubricants. When mixed with kaolin, it is used to make pencils.

The Balama Project in Mozambique: Strong Operations and Prospects for Growth

During the third quarter of 2022, the Balama Graphite Mineral Property in Mozambique produced 38,000 tonnes of natural graphite. Production fell nearly 14% sequentially, but the decline was due to factors beyond the company’s control. These were a labor dispute at the facility in September 2022 and disruptions in the global logistics market.

Balama continued to perform very well during the quarter, benefiting from the start-up of a secondary grinding circuit and campaign production runs. Product quality was consistent with the previous quarter, production and recovery rates were notable while grades showed no significant fluctuations.

Balama lamented the impact of September’s industrial action, the crisis in the global logistics market and the increase in fossil fuel prices on graphite production costs of $615 per tonne paid for the quarter.

However, Balama managed to post its first positive result of operating income, and the key takeaway for shareholders should be that the drivers of additional costs were either short-lived or are on the way to disappearing entirely when the triggers wear off. Therefore, it is likely that the positive result of operating profit recorded in the third quarter of 2022 will be repeated going forward, supported by expected reductions in certain operating expenses as production rates continue to improve.

In the third quarter of 2022, sales of natural graphite reached a record volume of 55,000 tons, an increase of 25% compared to the previous quarter. Shareholders will certainly appreciate that all inventory of finished goods, which amounted to approximately 14,000 tonnes, was contracted to customers in Mozambique and the US.

An efficient export department offset some setbacks experienced during the quarter at one of the three Mozambique distributions. So, Syrah Resources Limited was not caught off guard by customer demand for graphite, which the company identified as well-founded. Also, conditions in the container market are expected to continue to improve for the affected distribution.

The electric vehicle industry, Chinese anode production (the main business segment of the company) and positive conditions in overseas markets are driving global demand for graphite and underpinning Syrah Resources’ quarterly sales of 70,000 tonnes of natural graphite. China’s demand is expected to be a major contributor to Syrah Resources’ graphite sales, and supports the prices globally as the production and inventory levels of graphite in the Asian country are insufficient compared to the increasing need for the mineral as an active anode material.

Most likely, the graphite price is increasing across the markets and products due to a strong demand factor, causing Syrah Resources to report a quarterly weighted average price improvement over the quarters.

The weighted average price was $688 per tonne in the third quarter of 2022 versus $662 in the previous quarter and $530 in the last quarter of 2021.

The Ongoing Expansion Project for Vidalia Active Anode Material Facility

The company aims to become a vertically integrated supplier of natural graphite-based active anode material for other operators in the supply chain of electric vehicle batteries in the US and Europe, as well as for original equipment manufacturer [OEM] customers.

A definitive feasibility study is also ongoing to expand the Vidalia facility in Louisiana to 45,000 tonnes of active anode material per year, including the production capacity that is expected to be reached in Q3 2022.

Syrah Resources Limited has entered into an off-take agreement with Tesla, Inc. (TSLA) and is evaluating strategic agreements with Ford Motor Company (F) and South Korean electric vehicle battery manufacturer SK On., Ltd. for the supply of natural graphite-based active anode material from the Vidalia’s plant with an annual capacity of 11,250 tons.

Syrah, Ford and SK On jointly plan to enter into a binding off-take agreement beginning before 2028 for active anode material to be supplied by Vidalia when the plant is expanded.

Syrah Resources Limited is also working with LG Energy Solution, Ltd., a South Korean global energy solutions provider, on a binding off-take agreement to supply 2,000 tonnes per year of natural graphite-based active anode material from Vidalia beginning in 2025, increasing to 10,000 tonnes per year when the capacity of Vidalia is expanded.

In addition, Syrah has entered into a binding off-take agreement with Hiller Carbon LLC, a supplier of specialty carbon products as well as other minerals, to supply nodular graphite fines by-products from the pre-expanded Vidalia plant for a minimum of five years.

Essentially, the company is in the process of transforming Vidalia into a large manufacturing facility that will supply active anode material under many long-term purchase agreements.

To financially support Vidalia’s expansion, the company received a $102 million loan from the US Department of Energy with binding terms.

By the end of 2040, the plant is expected to process the graphite mined in Mozambique into active anode materials for energy storage devices of 2.3 million electric vehicles.

As of September 30, 2022, the balance sheet reported a net cash position of nearly $84 million, while the Altman Z-Score of 2.24 indicates gray areas, meaning that the risk that the company could go bankrupt, although small, is there.

The Stock Valuation

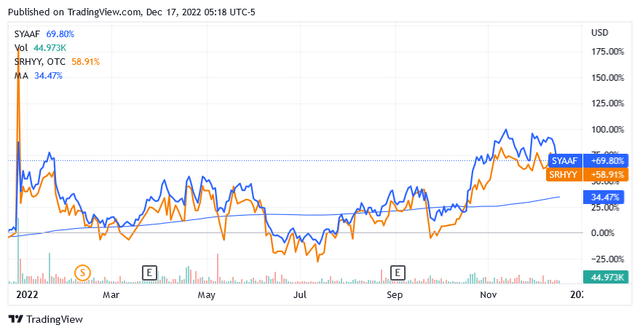

Syrah Resources Limited shares are up nearly 70% so far this year and now the share price of $1.53 (as of this writing) is trading well above the long-term trend of the 200-day moving average of $1.21.

The stock has a market cap of $1.03 billion and a 52-week range of $0.74 to $2.48.

Syrah Resources Limited also trades under the symbol of SRHYY and its share price was $1.57 for a market cap of $1.03 billion and a 52-week range of $0.71 to $5.

After the surge over the past year, the stock price is not low based on the analysis of the above technical indicators.

The share price of this stock is expected to reach a much higher level than the current one due to the increasing adoption of graphite in green technologies and the company’s expansion projects.

However, since share price development is cyclical, there will also be price declines which may be caused by less-than-positive news on electric car production or missed decarbonization targets or problems in the electric car battery supply chain, etc.

There will be no shortage of reasons for the stock price to fall, leading to better returns from lower than current levels.

In the short term, the situation in China with the resurgence of the COVID-19 virus could lead to disruptions in anode production should the government again severely restrict people and economic activities to prevent the spread of the infection, raising concerns about the demand for graphite.

Should this or other headwinds lead to significant weakness in the share price, the investor can use the more favorable entry point and build or increase the position.

Conclusion

Syrah Resources Limited’s share price is sure to reach higher levels than current ones amid strong upward pressure from the increasing adoption of graphite in green technologies in the fight against global climate change and the company’s strong operations and expansion projects.

However, since stock price movements are cyclical, investors may want to buy the stock from lower levels than the current one to maximize the gain. Of course, it is also possible to make money with short selling, which is a very risky investment technique and is, therefore, suitable for very experienced traders. But even these traders will have to consider what is happening at the corporate level and in the graphite markets.

Be the first to comment