mr.suphachai praserdumrongchai/iStock via Getty Images

Investment Summary

Investing in medical technology (“medtech”) equities is often a hard pill to swallow [no pun intended]. Much of the sector’s successes are defined by clinical trial outcomes, as much as they are from company and market fundamentals. Turning to our latest coverage of Artivion, Inc. (NYSE:NYSE:AORT), we have reiterated our hold call on the stock after an extensive review of our positioning.

In view of the PROACT Xa trial’s withdrawal, we’d remind investors that the long-term economics of AORT’s business model remains largely unchanged. In fact, it was spending $10mm a year on PROACT Xa, and now has availability of these funds due to the studies discontinuation.

Nevertheless, there remains a meaningful overhang from this very event and we see this impacting the share price for some time to come. Without the presence of an additional catalyst to drive alpha, we reiterate our hold rating on AORT.

PROACT Xa overhang a reality for share price upside looking ahead

In our last publication we revised our rating on AORT down given the overhang from its pulled PROACT Xa trial. Recall, the trial was investigating if AORT’s Apixaban label was superior to Warfarin with for patients with the company’s On-X mechanical heart valve in situ. Previously, we were bullish on the company’s prospects given the unmet clinical need for an alternative to Warfarin.

Just as a reminder, Warfarin is a member of the coumarin class of anticoagulant medications that acts as a vitamin K antagonist. It is commonly prescribed to individuals with an increased risk of developing thromboembolic events, such as those with atrial fibrillation, prosthetic heart valves, or a history of venous thromboembolism.

Warfarin interferes with the synthesis of vitamin K-dependent clotting factors in the liver, which are necessary for the coagulation process. More technically, Warfarin prevents vitamin K from participating in the carboxylation process. By inhibiting the production of these factors, warfarin reduces the likelihood of blood clots forming in the body.

The therapeutic effects of warfarin are typically monitored using the international normalized ratio (“INR”), which is a measure of the time it takes for blood to clot. The INR is used to ensure that the blood is thinned to a sufficient degree to prevent blood clots from forming, while also avoiding excessive bleeding.

Despite its effectiveness in preventing thromboembolic events, warfarin has several limitations. It requires regular monitoring to ensure that the INR is within the therapeutic range, and individuals taking warfarin must avoid certain activities that could increase the risk of bleeding. In addition, warfarin can have food and drug interactions, and it may not be suitable for everyone.

Hence, as mentioned, there remains a meaningful need for an alternative to Warfarin, and with Apixaban out of contention for now, this places undue downside risk in the AORT investment debate.

Investors were quick to recognize this as well, swiftly re-rating AORT’s share price to 52-week lows in a matter of weeks following the trial’s withdrawal. It has failed to make a meaningful recovery, despite the growth percentages its latest set of quarterly numbers [discussed below].

AORT Q3 earnings: reasonable growth, despite overhang

Despite the notable headwinds to its share price from the PROACT trial, we still saw a reasonable period of revenue growth from AORT in Q3, totalling $76.8mm. This represents a year-over-year increase of 6% based in GAAP terms and 11% in constant currency (“cc”) compared to the same quarter in the previous year. It pulled this down to an operating loss of $4.1mm, well below the $14.7mm operating profit last year, and a GAAP net loss of $0.34 per share [diluted].

Switching to the divisional highlights, we noted that all product lines experienced growth in cc terms. In particular, with respect to divisional growth routes, we observed these takekouts [all growth in YoY]:

- On-X revenues growing 17%

- Tissue processing revenues climbing 13%,

- BioGlue revenues increasing 500bps

- However, aortic stent graft revenues saw a decrease of 600bps due to currency headwinds.

When considering regional performance from Q3 FY21, it’s worth noting that Asia Pacific (“APAC”) saw a 24% increase in revenues, Latin America saw a 20% increase, North America saw a 12% increase, while Europe saw an 8% decrease.

Moving down the P&L, we observed gross margin pulled in to 63.4%, a drop from the 66.2% from the same period in the previous year. Management said the main reason for this decrease was due to the rising inflationary inputs [wage costs, cost of materials], as well a less favourable sales mix of products within the aortic stent graft and BioGlue lines.

Examining its balance sheet and language on the earnings call, it appeared as if AORT is confident in its financial stability looking ahead. It exited Q3 with $38mm in cash on a debt load of $315mm. Looking at its capital structure, we’d note that AORT also has $30mm available under its existing credit facility. Management says that it does not anticipate needing to draw down on this or to seek external financing for ongoing/future investments or pipeline projects.

Even if market conditions cause interest rates to rise, it says there is additional headroom to service/liquidate debts and continue to invest in growth initiatives beyond PROACT Xa. Speaking of, the conclusion of the PROACT Xa study has provided an extra $10mm in funds for the next two years for AORT. Management says the cash will be reallocated to growing earnings and cash flows. Speaking of the next two years, you can see consensus estimates for AORT’s top-line growth into FY23 below.

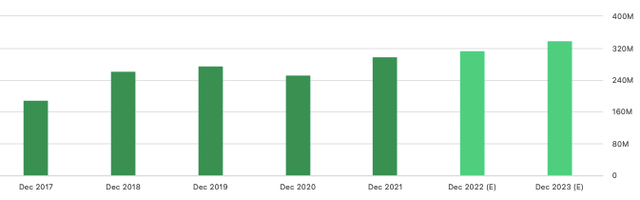

Exhibit 1. AORT FY22–FY23′ consensus revenue estimates

Data: Seeking Alpha, AORT quote page

AORT technical studies also flat

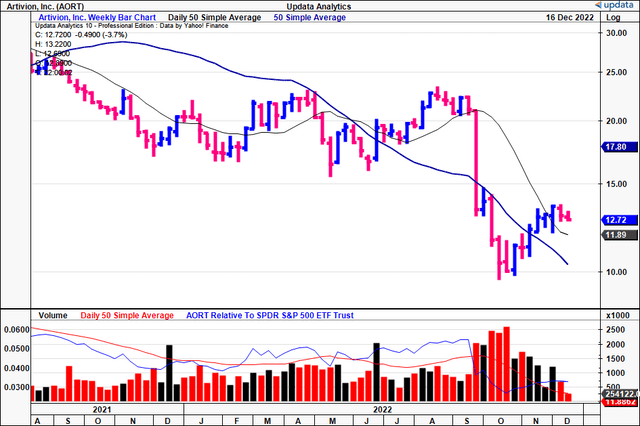

Seeking to gauge more information on the marketplace for AORT, we turned to our technical studies. You can see below that the stock has rallied off a 2-year low for the past 7 weeks. At the same time, it’s crossed above both the 50DMA and 250DMA.

However, you’ll also note that the weekly volume trend has been declining at pace, implying a lack of accumulation. The divergence in share price to volume trend is a sign of heavy resistance in our opinion.

Exhibit 2. AORT weekly price action from 2021–date [weekly bars, log scale].

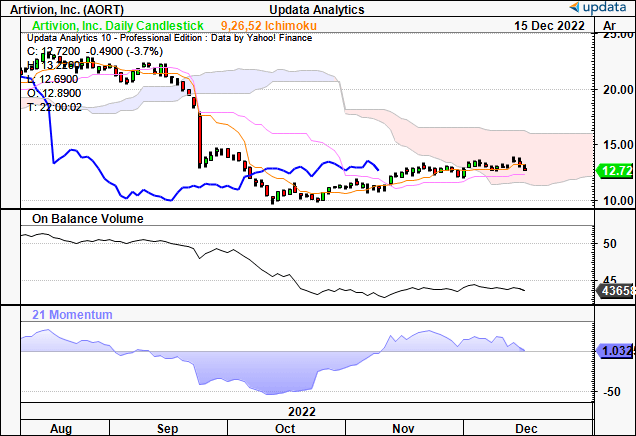

It’s no wonder to see the stock trading flat into the cloud, coupled with flat on balance volume (“OBV”) and momentum that’s back to range. You’ll also see in the cloud chart below that the lag line is well below the cloud. Combined, these three factors confirm our neutral thesis on the stock.

Exhibit 3. Trading below cloud support, lag line, OBV and momentum each implying downside.

Data: Updata

Valuation and conclusion

It’s worth pointing out that analyst consensus estimates price the stock at 20.4x forward EBITDA. We forecast adjusted EBITDA for FY22 of $41mm in our base case, and applying this multiple derives a price target of $20.90. This represents a reasonable upside potential, and therefore advocates against an outright sell rating.

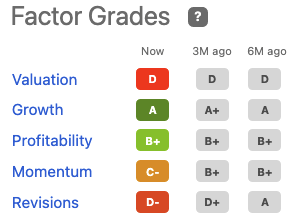

You can see that AORT has a “D” rating from Seeking Alpha’s quantitative factor grades, considering it trades at such lofty trailing multiples.

Exhibit 4. AORT seeking alpha factor grades

Data: Seeking Alpha

With all factors considered, we reaffirm our rating on AORT. There remains too much of an overhang on the share price from the PROACT Xa trial in our opinion, and this could present as a downside risk in a softening broad market. Despite this, there is reason to remain constructive on the stock, as our calculations imply a price target of $20. With this in mind, net-net, rate hold.

Be the first to comment