Jay Yuno/E+ via Getty Images

by Alex Rosen

Summary

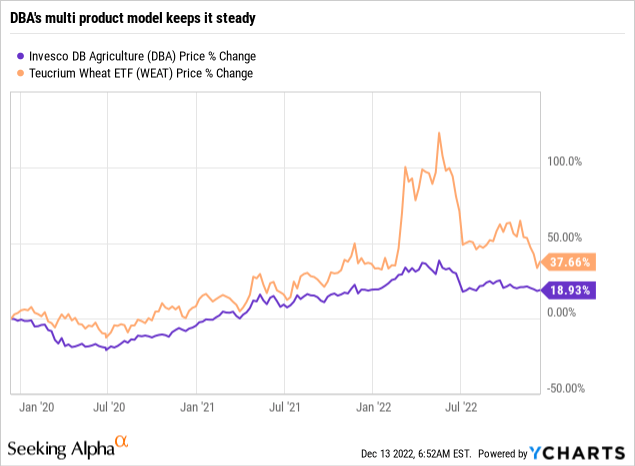

Invesco DB Agriculture ETF (NYSEARCA:DBA) tracks an index of agricultural commodities index futures. The fund holds futures in ten specific areas of agriculture. Year to date, the fund is trading flat, and is up about 7% over the past three years combined. The fund has a very high expense ratio of .93%, though that is not uncommon for a futures fund that is actively managed. Overall, we rate DBA a hold because we believe in the future of food.

Strategy

According to the Invesco fund prospectus, DBA seeks to track changes in the level of the DBIQ Diversified Agriculture Index Excess Return™ (DBIQ Diversified Agriculture Index ER or Index) plus the interest income from the Fund’s holdings of primarily US Treasury securities and money market income less the Fund’s expenses.

The fund’s holdings include livestock to offset under-weighting heavily produced commodities like corn and wheat, and chooses the contracts it holds based on the shape of the futures curve. The underlying index includes corn, soybeans, wheat, Kansas City wheat, sugar, cocoa, coffee, cotton, live cattle, feeder cattle, and lean hogs.

Investors will receive a K-1 annually. The fund rebalances every November.

Proprietary ETF Grades

-

Offense/Defense: Offense

-

Segment: Commodities

-

Sub-Segment: Agriculture

-

Correlation (vs. S&P 500): Low

-

Expected Volatility (vs. S&P 500): Low

Holding Analysis

DBA holds a small portfolio of ten futures contracts. The fund includes livestock in exchange for under-weighting heavily produced commodities like corn and wheat. Additionally, it holds contracts for sugar (13%), soybeans (13%), live cattle (13%), corn (12%), cocoa (11%), wheat (11%), coffee (11%), lean hogs futures (8%), feeder cattle (4%) and cotton (3%). All are very recognizable commodities and well within the expectations for what you would imagine an agriculture fund to hold.

Whatever assets in the fund that are not invested in futures contracts are held in either T-bills or the Invesco Government and Agency Portfolio.

Strengths

The U.S. agriculture sector is one of the most heavily subsidized and regulated industries in the world. The Federal government farm bill, passed every five years, ensures that America does not have food insecurity issues. It sets and regulates the price and production levels of crops and livestock throughout America.

The American government, like the governments of all sovereign nations, has a vested interest in making sure its people have enough affordable food to eat. However, unlike most countries, the U.S. Government has the power to ensure that actually happens.

DBA’s strength lies not in domestic supply and demand curves, but in global shocks. Two of the five largest wheat exporters in the world are Ukraine and Russia. The ongoing war between the two countries has created a food insecurity issue as well as an increase in prices.

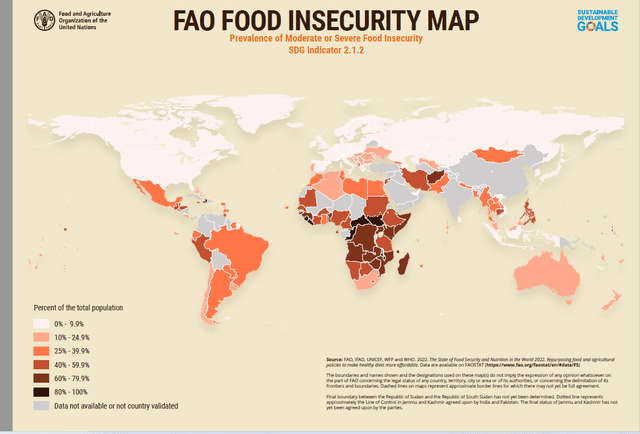

Almost 1 billion people go to bed hungry every night (Food and Agricultural Organization of the United States)

Weaknesses

DBA invests in a sector that is highly regulated and subsidized to ensure no individual commodity becomes too expensive, or too cheap.

As the chart above shows, the onset of the war in Ukraine led to legitimate concerns about both supply and cost. Thankfully, saner heads have prevailed and the export of wheat has resumed, but who knows for how long.

Earlier this year, Russia banned the export of wheat, barley rye and corn for three months, and sugar for six months. The global agriculture sector is in a very precarious situation right now, and demands for food stuffs has increased. As a result, the futures market is in a great state of flux and is extremely hard to predict despite the heavy hand of intervention from the U.S. Government.

Opportunities

The World food shortages could potentially be a boon for U.S. commodity prices. The world’s loss is DBA’s gain. Steady consistent commodity prices allow for long-term planning and government strategizing. Shocks to the system like a war in major agrarian states, supply chain issues, or climate change that leads to drought and famine all contribute to rising commodity prices. Right now, all of these factors are in play. The only thing that is really preventing an even more dramatic increase in agricultural products is the tight government controls on the sector and global organizations that subsidize food prices.

Threats

With commodities like agriculture, it is always a possibility that the bottom of the market can fall out. When COVID essentially shut down the world, global agricultural prices fell by almost 10% across the board. The world food supply chain is an extremely complex system that can be affected by the slightest little variance.

Subsidies make sure that prices never get too low, but they also discourage overproduction, making it a very narrow path in which to succeed.

Proprietary Technical Ratings

-

Short-Term Rating (next 3 months): Hold

-

Long-Term Rating (next 12 months): Hold

Conclusions

ETF Quality Opinion

Unlike a typical ETF which holds a portfolio of stocks based on a particular region or sector or cap size, commodities futures ETFs have a different model altogether. It can be argued that they really aren’t ETFs in the traditional sense, but commodity funds. Whether it be oil, or gold or agricultural products, they behave very differently than, say, a bond fund, or a U.S. large cap ETF. That being said, within the parameters of what DBA functions, the fund does it well.

It tracks a basket of agricultural futures contracts with an evenly weighted spread, just as it is supposed to do. The only issue we have with its quality is the high expense ratio. It would be nice to see that a little lower, especially on a fund that really isn’t showing particularly high returns.

ETF Investment Opinion

As mentioned, DBA is up 1% YTD, which, compared to the broader S&P, makes it look stellar. The reality is, people have to eat, and governments need to make sure they can provide food for their people. If they have to cut fuel consumption, they will. We like DBA, but its neutral technical analysis picture has us unwillingly to jump into a new position just yet. Thus, we rate DBA a Hold.

Be the first to comment