Annabelle Chih

Investment Thesis

TSMC is the world’s premier contract manufacturer of semiconductor chips. The company is at the industry forefront, constantly improving its current products and creating new ones. TSMC is ready to launch mass production of 3nm chips in the next quarter. The company sees demand for 3nm chips is exceeding that for 5nm chips in the first two years of the technology process launch.

Despite the lower real volume of TSMC’s customers, the company has long-term contracts and is expected to maintain its chip supplies. The ongoing crisis is largely affecting older generations of chips, resulting in the product mix shifting to the company’s products with higher margin.

Even given the geopolitical risks on the part of China and the economic risks on the part of OFAC (Office of Foreign Assets Control), TSMC is now at attractive levels for long-term investors to buy.

TSMC position in the semiconductor market

Right now, volumes are falling in many markets where semiconductors are involved. This applies to GPUs, PCs and laptops, all sorts of home appliances and smartphones. However, TSMC has long-term contracts with suppliers, who do not want to part with these agreements, as they can immediately be replaced by others.

This is what already happened in 2020, when demand for cars dropped sharply, after which automakers reduced the volume of contracts with semiconductor companies. At the same time, the demand for electronics increased significantly as people began to work remotely more. As a result, substitution of industries took place. Then, when the demand for cars recovered, manufacturers were no longer able to find the same volume of chips. The semiconductors crisis in the auto industry is still ongoing.

TSMC is aware of the major markets trends and expects the companies’ semiconductor inventories to replenish in the coming quarters and return to normal levels only by mid-2023. Similarly, we expect recession in the U.S. in Q4 2022 – Q1 2023.

Due to long-term contracts, TSMC will continue to supply semiconductors to customers despite the decline in product demand.

In response to the crisis, TSMC continued to reduce its capital investment program and reduced it from $40 – $44 bn to $36 bn in 2022.

Moreover, TSMC has continued to develop its 3nm technology process and is already preparing to begin mass production in the next quarter. TSMC reports strong demand for the world’s most technologically advanced chips, which is double the demand for 5nm chips during launch.

As a result, we have revised upwards our 2023 revenue forecast for 3nm chips from $1.2 bn to $3.8 bn.

We have slightly revised our revenue forecast upwards from $76.4 bn (+34.5% y/y) to $76.5 bn (+34.7% y/y) for 2022 and from $86.7 bn (+13.4% y/y) to $95.9 bn (+25.3% y/y) for 2023 due to the following:

- Upwards revision of 3nm chips revenue forecast.

- Increase in share of high-performance chips below 7nm, i.e., changes in TSMC’s Product Mix change.

- Upwards revision of volume growth forecast for supercomputer and data center chips from 9% y/y to 11% y/y in 2023.

The strong dollar also supports TSMC, as the company sells its products in USD and incurs expenses in TWD (New Taiwan Dollar [NT]). As a result, TSMC’s gross margin increased to 60.4% or +1.4 p.p. QoQ and +9 p.p. YoY in Q3 2022.

As of Q3 2022, ~0.8 p.p. accounted for the dollar appreciation against NT and 0.6 p.p. for changes in the company’s product mix.

Meanwhile, the company’s operating expenses remain stable.

We expect gross margin to grow in 2023 due to both the stronger dollar and further shift in the product mix toward more technologically advanced chips. As a result, we have revised upwards our 2023 gross margin forecast from 58% to 64%.

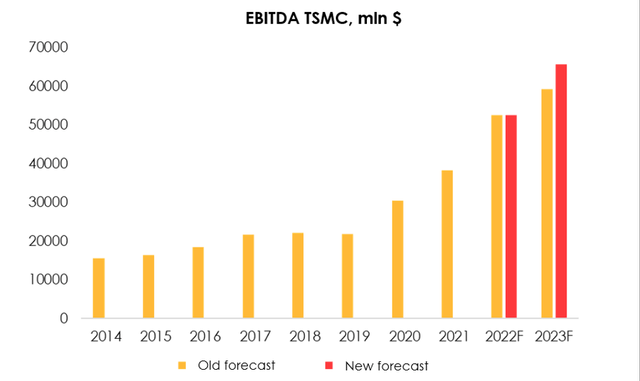

Due the upwards revision of our revenue and gross margin forecasts, we maintain our 2022 EBITDA forecast at $52.5 bn (+37% y/y) and have revised upwards our 2023 forecast from $59.2 bn (+13% y/y) to $65.7 bn (+25% y/y).

TSMC and competition

It is widely known that the competition between chip manufacturers is intense. Not all companies are able to withstand the “arms race” and keep up with the technology leaders.

Now only TSMC, Samsung and Intel participate in this competition. The two largest contract manufacturers behind TSMC, GlobalFoundries (9.5% market share) and UMC (8.5% market share) have long been out of the game. GF dropped out of the race to make 7nm chips in 2018, and UMC is still not making chips smaller than 14nm.

Samsung and Intel are now coming in as laggards. NVIDIA originally worked with Samsung to develop its 40th generation graphics cards. However, Samsung’s tech processes did not allow the 4090 graphics cards to consume less than 600 watts and the 4090 Ti less than 800 watts, which led to power supply meltdowns and required bulky cooling systems.

As a result, NVIDIA cooperates with TSMC, which has a special 4N technology process – modified 5-nm chips. Eventually, the video card 4090 consumes 450 watts, which is 30% less than the Samsung technology.

Obviously, this is not a big problem for Samsung, as the company mainly manufactures chips for itself, and the basis of semiconductor production is the memory (DRAM and NAND).

However, the case is illustrative to briefly describe who is who in the semiconductor chips market. TSMC is an indisputable leader in terms of volume and technology.

TSMC and geopolitics

TSMC leading position makes the company an object of geopolitical intrigue between the U.S. and China. On the one hand, the U.S. pays lip service to the unified China policy, but on the other hand supports Taiwan with weapons and technology, having long ago signed a pact to protect Taiwan.

Now, from a geopolitical point of view, the following risks hang over TSMC:

- At the 20th Party Congress, Xi Jinping did not reject a military solution to the annexation of Taiwan, although he called peaceful unification a more desirable option. China could also develop an economic blockade of the island by blocking Taiwan’s ports. In that case, TSMC technology chips would not be able to be supplied from the island.

- The US has tightened restrictions on technology exports to China, imposing a ban on the sale of semiconductors (based on U.S. technology) to the PRC without special permission.

At the moment, three companies have received permits from the U.S. Department of Commerce for one year – Samsung, SK Hynix and TSMC. All of them have plants in China.

TSMC has a plant in Nanjing, which produces 16nm chips. This plant is the most technologically advanced semiconductor plant in China.

Permission from the U.S. will allow the Nanjing plant to expand to 22/28nm process technology.

After the U.S. sanctions against Huawei, TSMC limited the amount of work with its largest customer in China – HiSilicon Technologies (a subsidiary of Huawei). As a result, the share of TSMC revenue from China fell from 17% (2020) to 13%.

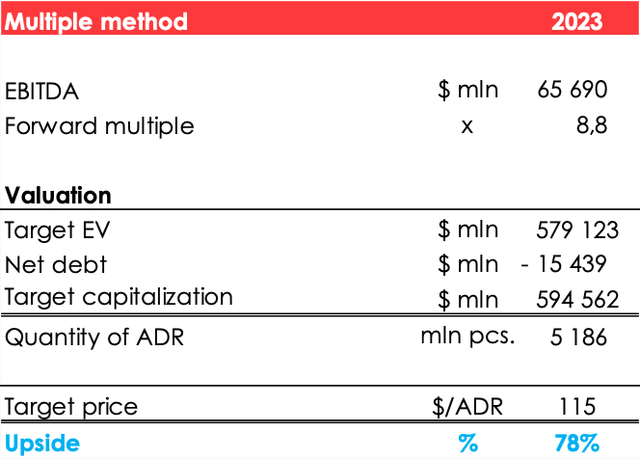

To reflect these risks and incorporate them into the company’s valuation, we decided to use EV/EBITDA – multiples (2015 -2018) as our basic multiples. Since 2019, the basic multiples for the company have increased several times on the back of a bull period in the market cycle and transition to 5-nm chips.

As a result, we have lowered our basic multiples for TSMC from 12.8x to 7.1x.

Valuation

Our TSMC valuation is based on discounted 2023 results at 13% and we believe the TSMC fair value over the next 12 months is $111/ADR. BUY.

Conclusion

Geopolitical risks have brought down TSMC quotes, given that the company’s financial results show steady double-digit growth. We believe the company’s outlook over the long-term horizon is positive and the company itself is a key player across the semiconductor chip industry.

We believe that at current prices, we can already start to take a position by buying stock in 2-3 parts (2% or 3%).

To manage the position, we recommend paying attention to TSMC financial statements, and semiconductor (SIA) related industry research (Canalys).

Be the first to comment