PonyWang

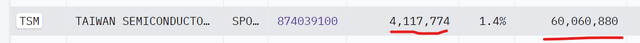

Warren Buffett’s Berkshire Hathaway (BRK.A, BRK.B) is one of the greatest and largest investment firms of all time. The conglomerate has racked up returns of ~20% per year for over 57 years, with Warren Buffett at the helm. It has accomplished this through a highly disciplined and contrarian approach to value investing. In simple terms, Buffett’s philosophy is to invest in “wonderful companies” at undervalued prices. In this case, Berkshire Hathaway has recently invested a staggering $4 billion for ~60 million shares of Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) (“TSMC”), according to a Q3,22 filing with the SEC.

Taiwan Semiconductor (SEC, extracted with author table.)

My investment strategy has always focused on tracking the “smart money” and the greatest hedge funds of all time, in order to use their trades as a datapoint for further research. I am even launching an advanced software tool soon with Seeking Alpha to help with this tracking, feel free to follow to stay updated on that.

In this case, Berkshire Hathaway’s major investment in TSMC is a seal of approval on what is already a great company with high returns on capital and high margins. In early 2022, I wrote a popular post on TSMC which called the company the “Backbone of the Semiconductor Industry.” Since that post, the company’s position is still extremely strong as the leader in the chip manufacturing industry. However, there are still risks given the semiconductor industry is going through a cyclical downturn and heightened tensions have arisen between China and Taiwan. Thus, in this post, I’m going to break down Taiwan Semiconductor’s Business model, earnings report, and reveal its valuation. Let’s dive in.

High-Quality Business Model

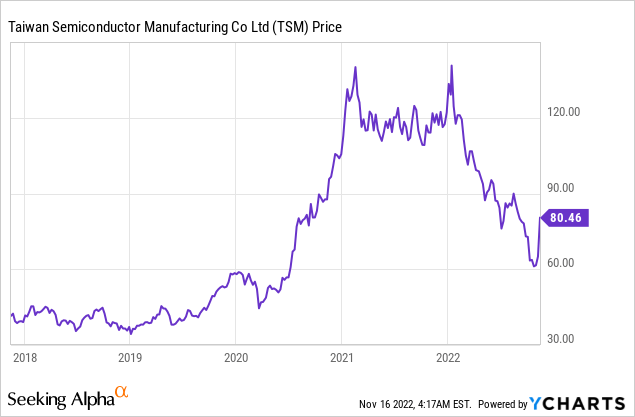

Taiwan Semiconductor is the world’s largest semiconductor manufacturing company which has a 53.6% market share of the industry, as of Q1,22. TSMC is represented by the blue bar below. Its closest competitor is Samsung electronics (SSNNF, SSNLF), which has just a 16.3% share of the global market.

Semiconductor Manufacturing Market share (Statista)

TSMC’s largest customer is consumer electronics giant Apple (AAPL), which made up 25.93% of its total sales volume as of the end of 2021. TSMC has been criticized for its large concentration on a single customer, but having one of the greatest companies in the world with a strong leadership position in smartphones is not all bad. The company also manufactures semiconductor chips for other leading chip designers such as ARM, AMD (AMD), Sony (SONY, SNEJF), and Nvidia (NVDA).

TSM Customers (Bloomberg data)

You may even notice at the bottom of the list above, a competitor to TSMC is also a customer, Intel (INTC). There is a story behind this customer.

Chip designers are continually designing smaller, more powerful and more energy-efficient chips to power our electronic devices. This is great on paper, but semiconductor manufacturing via a foundry is a complex industry, which requires strict discipline, ultra-clean rooms, and continual innovation.

Intel’s 7nm (nanometer) chip was delayed in 2020, due to a production problem. This was a major issue and meant it had to outsource some of its manufacturing to competitor TSMC. But this wasn’t just a short-term issue, as innovation is the key to success in the semiconductor industry. As Intel struggled with its 7nm, TSMC was already producing smaller 5nm chips and now ultra-tiny 3nm (nanometer).

Its largest customer Apple aims to use 3nm technology for its new A-17 Bionic chip which will be in the iPhone 15 (released in 2024). Apple will also gradually transition to using the technology for its new M-series of processors for Mac.

Intel even signed a deal with TSMC for the launch of its Meteor Lake GPU chipsets using 3-nanometer technology. However, Intel has recently announced that it is delaying the launch of its product until 2023/2024. This has affected TSMC’s manufacturing schedule immensely, and the company has had to adjust its 2023 equipment orders to compensate. Manufacturing generally works best at scale, and with Apple the only current customer for 3nm technology, its process will be less efficient. Intel blamed “design and verification issues” for the delay, but I believe there is more to the story. The company is going through a tough time financially and also its relatively new CEO is trying to transform the business. As TSMC is officially a competitor, there may be some reluctance by Intel to sell its soul, although this is purely speculation.

In total, TSMC manufactures around 11,617 products with 281 different technologies for over 510 customers. But all eyes are on its 3nm chip manufacturing, which it is expected to produce for Qualcomm and Apple for 2024.

Growing Financials

In the third quarter of 2022, Taiwan Semiconductor Manufacturing generated $19.23 billion in revenue, which increased by a rapid 29% year over year and beat analyst estimates by $149.37 million. This revenue growth was mainly driven by 5nm process technology which made up 28% of revenue in Q3,22. This was followed by 7nm technology which made up 26% of revenue. By platform, Smartphone revenue increased by 25% sequentially and made up 41% of total revenue in the quarter. This was followed by High-Performance Computing [HPC] applications, which increased by 4% to 39% of the total. Internet of Things [IoT] revenue increased by 33% to make up 10% of revenue.

The variety of applications for Semiconductor chips shows the ubiquity of TSMC, and its position to benefit from the growth in high-tech industries. For example, the Internet of Things [IoT] industry includes Internet-powered devices such as you Alexa, smart lightbulbs, home robots etc. The industry was worth $478 billion in 2022 and is forecasted to grow at a rapid 26.4% compounded annual growth rate [CAGR] reaching a value of $2.5 trillion by 2025.

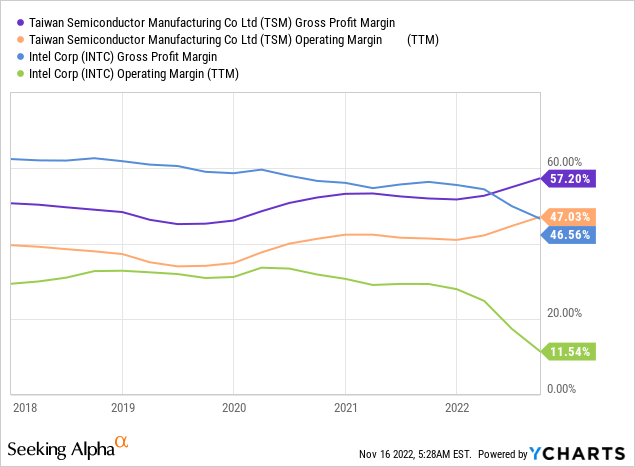

TSMC increased its gross margin by 130 basis points quarter over quarter to 60.4%. This was driven by various cost-improvement strategies and slightly more favorable exchange rates. However, the company still did experience some inflation-based costs which was a headwind.

The company also generated earnings per share of $1.79 which beat analyst estimates by $0.14. As you can see from the chart below, the company has a much higher Operating margin (47%) (orange line) than Intel, which has an 11.5% Operating margin (green line).

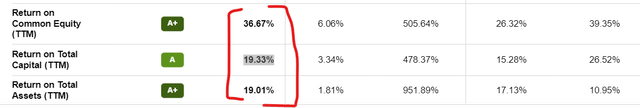

Taiwan Semiconductor Manufacturing also has a high return on Equity of 36.67% and a high return on capital of 19.33%. This is a representation of how well the business is reinvesting and a great measure used by Buffett and value investors.

Return on Capital (Seeking Alpha data)

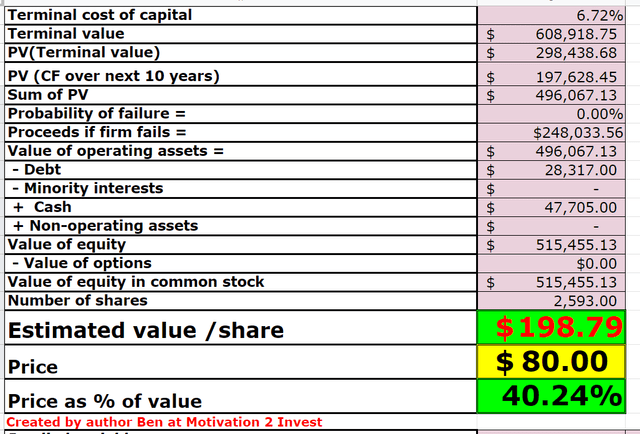

TSM has a solid balance sheet with $47.7 billion in cash and short-term investments. The business does have fairly high debt of $28.3 billion, but just $735 million of this is short-term debt, thus manageable.

The company also has a dividend yield of 2.35%, which isn’t bad considering the growth of the company, and most “tech” companies don’t even pay a dividend.

Advanced Valuation

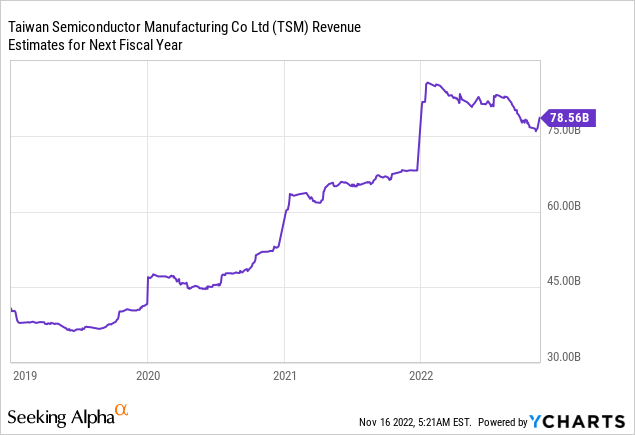

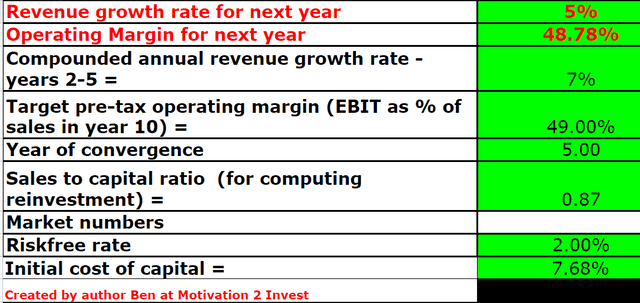

In order to value TSMC I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow (“DCF”) method of valuation. I have been extremely conservative and forecasted just 5% revenue growth for next year, given the cyclical downturn in the semiconductor industry. Then I have forecasted 7% revenue growth per year in years 2 to 5.

Taiwan Semiconductor Manufacturing (created by author Ben at Motivation 2 Invest)

To increase the valuation accuracy, I have capitalized the company’s R&D expenses, which has lifted the operating margin to ~49%.

Taiwan Semiconductor Valuation 2 (created by author Ben at Motivation 2 Invest)

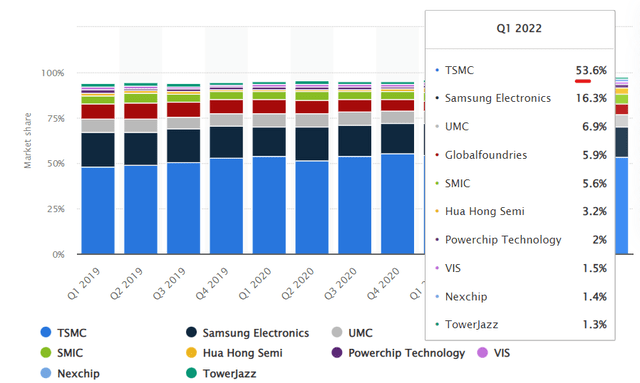

Given these factors, I get a fair value of $198 per share. The stock is trading at just $80 per share at the time of writing, therefore, it is 60% undervalued. In Warren Buffett’s terminology, a stock which is trading significantly below its intrinsic value offers a “margin of safety.”

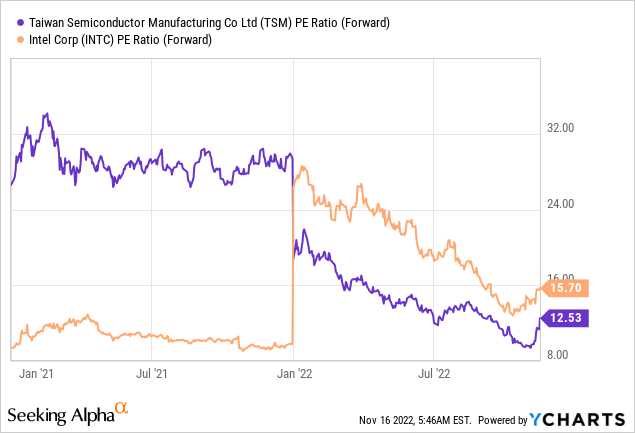

As an extra datapoint, TSM trades at a Price to Earnings ratio = 12.53, which is 42.29% cheaper than its 5 year average. Strangely, this is also cheaper than Intel, which trades at a P/E ratio = 15.7.

Risks

China-Taiwan War

In my previous post on TSMC, I noted that the “biggest risk I can see for TSMC is China.” The Chinese Communist Party [CCP] announced its “Made In China” policy, which has vowed for semiconductor independence from Taiwan. There have even been reports of China stealing chip technology and trying to recruit Taiwanese talent. In addition, the Chinese government believes Taiwan is a part of China, and given the Russia-Ukraine crisis, a war in the region would not be out of the question. The U.S has vowed to protect Taiwan, but at what cost is the question. In a Supply Chain Review Report, the Biden Administration reported that;

“The United States is heavily dependent on a single company – TSMC – for producing its leading-edge chips.”

The report goes on to say this “puts at risk the ability to supply current and future U.S national security and critical infrastructure needs”. To combat this Biden has announced the CHIPS act which aims to make the U.S less dependent on China and external countries. $40 billion of the $52 billion package is expected to offer incentives to TSMC, Intel, Micron and Samsung to build plants in the U.S. For example, TSMC has recently announced a billion-dollar investment plan to build an advanced semiconductor plant in Phoenix, Arizona to manufacture the state of the art, 3nm chips. Although this is great news, it will take some time to build, and if war breaks out between Taiwan-China in the meantime, I imagine the stock price will plunge.

Final Thoughts

Taiwan Semiconductor Manufacturing is the market leader in state-of-the-art chip manufacturing. The company has continued to execute immensely well. and its stock price is deeply undervalued. Berkshire Hathaway’s (Warren Buffett’s) recent investment acts as an extra datapoint and seal of approval for this “wonderful company” which I have covered many times.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment