simon2579/E+ via Getty Images

A great character from a great movie once said “Sometimes you eat the bar, and sometimes the bar, well, he eats you.” Now, the character in question is an American, so some allowances need to be made for his mispronunciation of the word “bear”, but the wisdom is certainly there. You can’t win ’em all. I thought of that quotation as I sat down to write this article. It’s been three months since I changed perspectives and took a small bullish position in Cara Therapeutics Inc. (NASDAQ:CARA), and in that time, the “bar” has very much eaten me. “Cara” is “friend” in the Irish language (thank you for brining back the painful lessons from language class by the way), and so far it’s been a friend of the “who needs enemies” variety. Specifically, the shares are down about 33% against a loss of 17.5% for the S&P 500. I characterised the investment as “speculative” and as a “lottery ticket”, and so I thought it would be interesting to review the investment to see if it’s worth adding to, holding, or cutting my losses and running. I’ll make that determination by looking briefly at the business case here, and by looking at the recently published financials, and by looking at the stock as a thing distinct from the underlying business. I also want to write about insider transactions because I find their timing curious. That’ll lead into a commentary on the options trade I recommended previously.

I know that my writing can be tedious to some. For those people, I offer a thesis statement paragraph that allows them to get the “juice” of my thinking at much less of a “squeeze” of work. There’s no need to thank me. I do this because I’m absolutely obsessed with making your reading experiences as comfortable as possible. I am still of the view that the income statement is troubling here, as evidenced by the fact that the more this company sells, the more it loses. That said, I do like the fact that the capital structure is very solid, and the company has enough cash and short term investments on hand to fund itself until mid-2024. Thus, I’m not worried about bankruptcy risk, or the need for the company to massively dilute current owners. In addition, the shares are actually cheaper on a price to book basis, and so for that reason, I’ll be buying another of the “lottery tickets” that I referenced in my previous article. In particular, I think the February 2023 calls with a strike of $7.50 offer much of the upside at a fraction of the cost that the shares do. I’m hanging on to my shares, but I’m expressing my continued bullishness with calls for reasons I outline more fully below.

Market Update

I feel compelled to update readers about the business, and the opportunity here as I see it. As I’m sure you know, Cara is an early commercial stage bio pharmaceutical company best known for its recently approved KORSUVA treatment for pruritus suffered by chronic kidney disease patients. The treatment is called “Kapruvia” in Europe, and the European approval triggered a $15 million cash milestone payment from Vifor. The company is in an “attractive” joint revenue sharing arrangement with Vifor. Given all of this, it seems that the company is about to generate some significant revenue from the 200,000 patients who suffer from pruritus.

According to the CEO there are a few uniquely compelling elements of this business. Paraphrasing him, this is a captive patient audience, who come in for treatment three days a week, 52 weeks a year. This is distinct from a situation where a physician might see a patient every 2-3 months, and may or may not prescribe a given formulation to that patient. Thus, there’s stronger adoption here than a company would see from a typical prescription market.

Additionally, CARA is not expending commercial dollars to launch this product, and is basically piggybacking on Vifor’s commercial relationships, and infrastructure. Finally, the company will be fully reimbursed by Medicare over the next two years, but it’s reasonable to assume that funding will remain high after that because of utilisation, and because there are no other significant approved therapies for chronic pruritus.

Given this, I think it’s reasonable to suggest that revenue is poised to increase materially over the next couple of years minimum. My hope is that the company will be in a position to throw some of these dollars to the bottom line.

Financial Snapshot

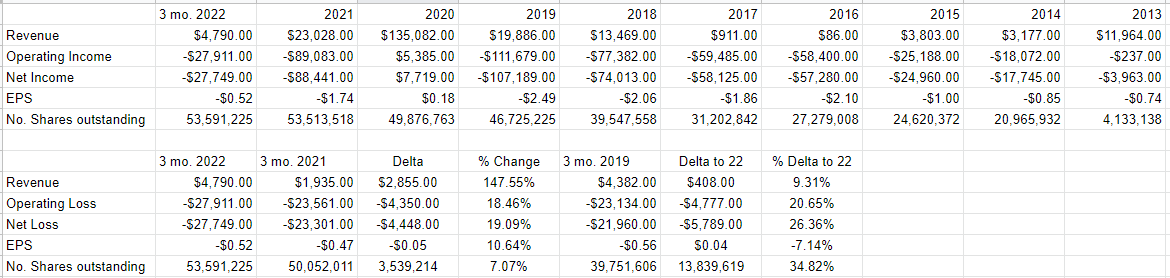

The most recent quarter continued a trend that I’ve spotted previously, and have been disturbed by. The more the company sells, the larger its losses. This is a problem because it raises the very obvious question, “if growing sales doesn’t lead to profits, what does?” In particular, revenue was about $2.85 million, or 147.5% higher than the same period a year ago, but loss increased by over $4.4 million. In case last year was an aberration, I chose to compare the most recent quarter to the same period before the pandemic. Revenue during the most recent quarter was 9.3% greater than it was for Q1 2019, and net loss was $5.8 million greater. For me to “pound the table” on this investment, the company will need to get a handle on the negative relationship between revenue and net income.

That said, I remain impressed by the capital structure here. As of the end of March, cash and marketable securities totaled just over $141 million, against total liabilities of $19.7 million. During the quarter, the company spent ~$25.5 million in operating activities. Given all of this, the company expects that its current cash position is sufficient to fund its currently anticipated operating expenses and capital requirements into the first half of 2024. In a subsequent conversation, the CFO cleared up some potential ambiguity about the burn rate here. The company is being conservative in their estimates, and, because it’s “early days”, they’re assuming no revenue from Korsuva in their pro forma analysis. This is the kind of conservatism I like to see, and I think we can rest assured that mid 2024 at the absolute earliest.

Thus, I’m not concerned about bankruptcy or insolvency risk, and nor do I worry that the company will need to raise much more equity at current prices. I’d be comfortable adding to my small speculative position at the right price.

Cara Therapeutics Financials (Cara Therapeutics investor relations)

The Stock

I’ve made the point that a stock is quite distinct from the underlying business to the point of tedium. Now, a normal person might flinch from this, and decide that it’s a bad idea to be tedious, and would flinch from continuing to do so. Sadly for all of us, I’m not a normal person, so I’m going to lean into that tedium by repeating the point. The excuse I’m going to offer is that I’m only writing this yet again for the benefit of the new people, but that’s only part of it. I can be tedious all day, every day. Anyway, I’ll make the point again. A business and a stock are very different things. A business buys a number of inputs, including clinical trials, performs value adding activities to those, and sells the results eventually at a profit, or so we hope. In the final analysis, that’s what every business is. The stock, on the other hand, is a traded instrument that reflects the crowd’s aggregate belief about the long-term prospects for a given company. The crowd changes its views very frequently, which is what drives the share price up and down. It’s typically the case that the lower the price paid for a given stock, the greater the investor’s future returns. In order to buy at these cheap prices, you need to buy when the crowd is feeling particularly down in the dumps about a given name. This is easier said than done.

I also want to make a related point that the only source of returns from investing in stocks comes from spotting a discrepancy between the crowd’s expectations and future events. If a growth stock, for instance, is expected to grow at 20%, and the shares are priced as though it’ll grow at 20%, there’s not much profit in the trade. This is a painful lesson that I finally learned over many, many years. As the saying goes, “too soon old, too late smart.”

Anyway, as my regulars know, I measure the relative cheapness of a stock in a few ways ranging from the simple to the more complex. On the simple side, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. Once again, cheaper wins.

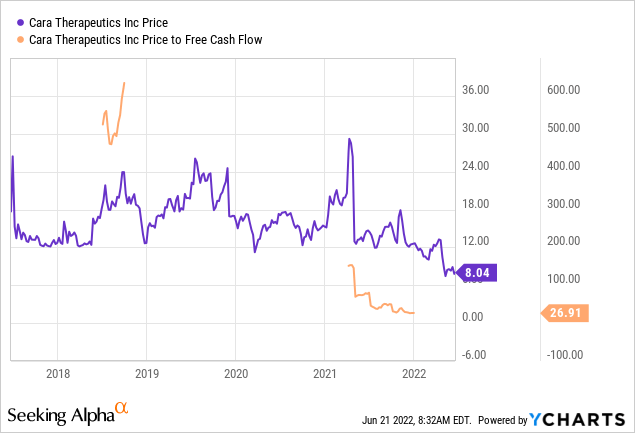

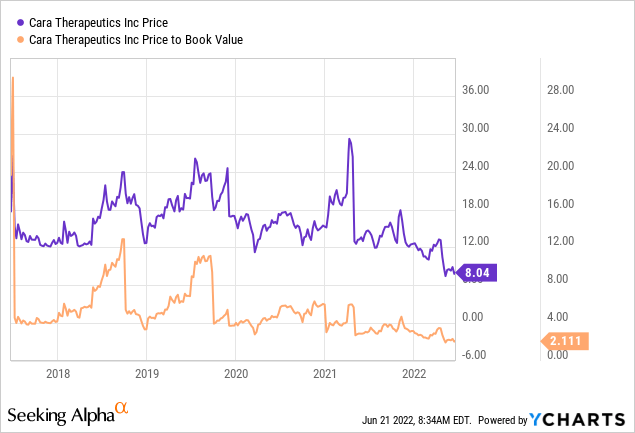

In the previous article on this name, I was pretty happy about the fact that the shares were trading near the low end of their historical range. Specifically, the price to book value was about 2.88 and the price to free cash flow was ~26.7 times. By these measures, shares are about 26.75% on a price to book basis, and are unchanged on a price to free cash basis, per the following:

Given the above, I’d be willing to add to my bullish call here, but I’ll do that via call options.

Insider Transactions

I don’t normally write about stock sales conducted by insiders, because executives sell for a host of reasons. It makes good sense to diversify, obviously. Also, private school tuition needs to be paid, divorces need to be financed, and many unhealthy habits don’t come cheap. I feel compelled to do so in this case, though. I wondered aloud, “if this is so ground breakingly wonderful an investment, why would Scott Terrillion, Joana Goncalves, Frederique Menzaghi, and Christoper Posner collectively sell 7,134 shares in April alone? I zero in on April because that was a particularly significant month for the company. Kapruvia was approved in the European Union on April 28th, and approved by the ancient enemy (U.K.) the next day. The EU approval triggered the $15 million cash milestone payment from Vifor. So, the month of April was significant for the company. I don’t want to assume others are as greedy as myself (they’re likely not), but if I were one of the people who knows this business best, and I saw what they apparently see, I’d find other ways to fund my diversification efforts or my various appetites. I only note it in this case because I find it curious.

One last thing. Before I stop droning on about insider sales, I’ll allay any fears you might have about these executives losing potential profits on their sales. Posner sold at $12.67 (31.5% above last night’s close), and the others sold at $11.91 (27% above last night’s close), so we can all breathe a sigh of relief on their behalf. I hope you’re as gratified by this very bright silver lining as I am. Given all of this, I remain of the view that call options are the best way to “play” this investment. Speaking of call options…

Options Update

Earlier, I bought 300 shares, and the January 2023 calls with a strike of $12.50, for $2.50 each. These calls are currently priced at $.65-$.95, so that trade hasn’t worked out well so far. That said, I think it fair to say that the $2 I’ve lost per call option on these five calls is superior to the $3.50 I’ve lost on my shares. This is why I think the calls are the best way to express a bullish take here.

At the moment, the February 2023 calls with a strike of $7.50 are priced at $2.20-$2.75, and I think that’s the best way to express a bullish perspective here, so I’ll be buying 4 of these. If the shares climb from current prices, the investor will obviously benefit, and if the shares languish, the investor will suffer, but they’ll suffer less than they otherwise would. Additionally, the buyer of these calls exposes only 32% of the capital that would be required to own the stock. In my view, this is another advantage of call options here: they give you much of the upside over the next eight months, at only a fraction of the capital at risk.

One obvious risk to this approach relates to the fact that calls expire, while shares theoretically don’t. That is true, but I think the limited lifespan of a call option is a benefit. It stops us from hanging on, hopefully, to an investment that will come back, eventually…any day now. In other words, calls reduce the opportunity cost of capital that’s just sitting and languishing. In my view, if Cara doesn’t execute over the next eight months, it never will, and I’d rather lose some money on calls than tie up much more capital in vain hope.

Conclusion

I think there are some positives happening at Cara Therapeutics, which is why I’m willing to invest another $1,100 in a bullish stake. If I’m right, and the shares rise, I’ll do well. If I’m wrong, the pain won’t be too great. As I stated in my previous article, I’m of the view that this is a speculative buy, and I’ll be treating it thusly. For that reason, if you’re going to follow me on this trade, I would recommend you do so only with money that you can afford to lose. If this company starts to make decent cash, I think the stock will rally, and carry my calls along with it. If the company fails to do so, I won’t be out too much. Thus, I think it’s a trade with a positively skewed risk reward in the call buyers favour.

Be the first to comment