sarawuth702/iStock via Getty Images

By Jeff Spiegel, Head of U.S. iShares Megatrend and International ETFs

Key Takeaways

- Electric vehicles (EVs) are seeing accelerated adoption on the back of decreasing costs. Continued advances in battery technology could soon make EVs cost-competitive versus internal combustion engine (ICE) counterparts.

- Autonomous driving functions are becoming commonplace in new car models, and real-world trials are bringing us closer to fully autonomous vehicles (AVs).

- We believe investors can benefit from the growth of EVs and AVs by investing in segments that capture the EV/AV value chain, including EV and AV manufacturers, EV battery producers, EV battery material suppliers, and EV and AV technology enablers.

The electricity-powered and autonomous future of transportation is arriving. EVs are fast taking market share after more than a century of internal combustion engine dominance. And with recent advances in autonomous driving technologies, drivers, too, might become relics of the past.

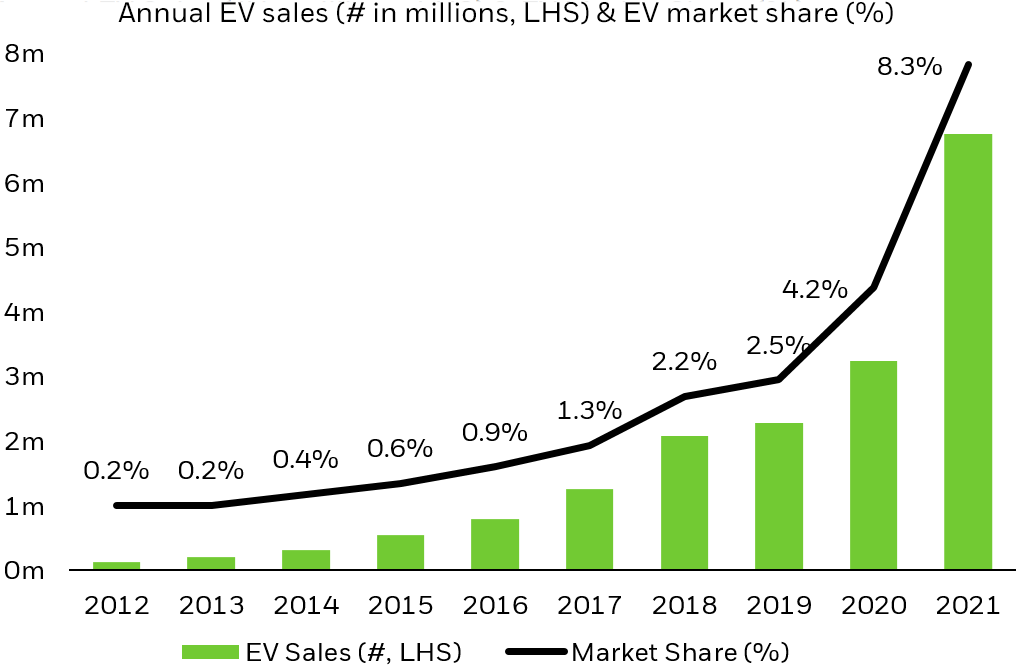

Last year, EVs commanded 8.3% of the global car market, almost doubling their 2020 share and more than tripling their share from 2019.1 After a period of slowed progress, autonomous vehicles (AVs) are also advancing. In 2021, Germany became the first country to approve a conditionally automated driving system. Cars equipped with this system can autonomously navigate traffic with a driver behind the wheel and will hit the road in 2022.2 (But rest assured, we expect these cars to have their own built-in speed limits on the autobahn, even though humans do not.)

We expect EV sales to accelerate further on the back of continued innovation and public and private sector support. Driving systems featuring greater automation are also on the horizon; advances in underlying technologies and heightened data proliferation will bring new AV options to streets soon. In the near future, transportation could become both electric and autonomous, becoming cleaner, safer, and less expensive than ever before.

Exploring Developments In The Electric Vehicle Market

EVs might soon overtake their long-entrenched gas-powered counterparts as consumer demand, innovation, and support from automakers and governments accelerate adoption.

EV demand is surging as sales accelerate

EVs are already the fastest growing automotive segment — annual EV sales more than doubled to reach 6.8m vehicles in 2021, representing all the global auto market’s net growth for the year. This is in stark contrast to 2012, when automakers sold just 125,000 EVs.3

Electric vehicles are rapidly capturing market share from ICE vehicles

Source: EV-Volumes.com, “Global EV Sales for 2021,” 2022.

Chart Description: Combined bar and line chart showing annual electric vehicle unit sales on the left axis ((bar)) and annual electric vehicle share of all car sales ((line)). The chart shows how electric vehicle sales and market share capture accelerated over the past decade, especially the past several years.

EVs are significantly cheaper to purchase than they were a decade ago. While they are still marginally more expensive than ICE vehicles, lower lifetime ownership costs — due to cheaper fuel and maintenance – and environmental sustainability are attracting swaths of consumers who are willing to pay an upfront premium.4 More expansive charging networks and improved battery ranges are also playing a role, making EVs a realistic option for a wider range of drivers. And those drivers are not just in the market for commuters or family haulers. The Ford F-150 is the best-selling vehicle in America and is an iconic symbol of a heartland which many believed would be resistant to going electric. The release in 2022 of the electric version of the pickup truck — and massive associated waiting lists — certainly marks a milestone.

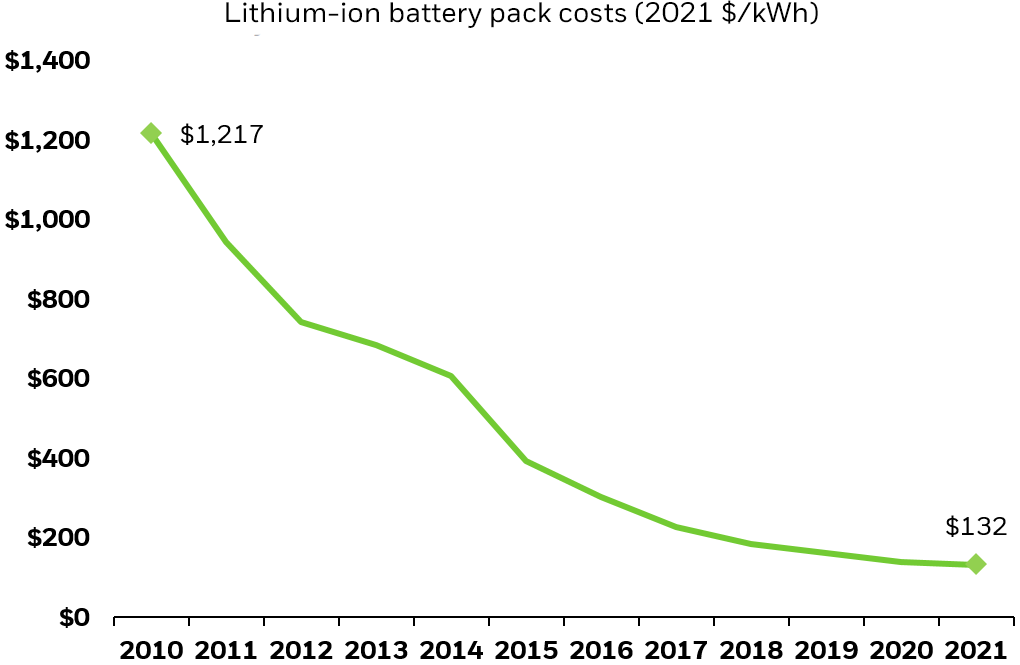

Declining EV battery costs are key to adoption

There would be no EVs on the road without lithium-ion batteries. They are the power storage solution that makes electric cars — and e-bikes, which are seeing similar strong growth –possible. And, as the most expensive component at the heart of EVs, their cost largely dictates the economics of an EV purchase.5

In the past, high battery costs made EVs expensive. This dynamic is changing. Advances in battery technology and rapidly scaling production are driving costs down — today’s lithium-ion batteries are 89% cheaper than they were in 2010.6 Yet, battery packs still represented 30% of EV manufacturing costs at the end of 2020, compared to 18% for engines in traditional vehicles.7 While maintenance and fuel savings make up for this over time, upfront costs must decline further if EVs are to claim market share dominance.8 That journey is already underway, as are innovations which could separately decrease overall EV costs.

Electric vehicle batteries are significantly cheaper than in the past

Source: Bloomberg, November 2021.

Chart Description: Line chart showing lithium-ion battery pack costs since 2010. The chart shows how significantly lithium-ion battery costs have declined.

EVs still cost 22% more than ICE vehicles.9 Several developments could bring them closer in price. Alternative battery chemistries like lithium iron phosphate (LFP) are driving costs lower, while reducing supply chain pressures. LFP batteries use cheaper metals like iron, rather than the more expensive nickel and cobalt. LFP batteries are already seeing success, last year accounting for 57% of battery production in China.10 Sodium-ion batteries, too, show promise, though they are still in development. These batteries use sodium, which is abundant and affordable, unlike lithium, which is becoming increasingly expensive and faces shortages.11

These new battery technologies, along with continued economies of scale and next-gen battery recycling, could bring EVs to parity with ICE vehicles in short time. This could happen as soon as 2025, and potentially sooner with subsidies.12

EV enablers beyond batteries

Automakers and governments are both playing outsized roles in facilitating the transition to electric vehicles.

Global policymakers are allocating public funds and legislative muscle in support of EVs. In 2020, China set an ambitious target for EVs to achieve a 20% market share by 2025.13 Just one year later, country-wide EV sales nearly tripled.14 More recently, in the U.S., President Biden enacted legislation that will invest $15 billion in EVs and charging networks and issued an executive order that establishes a 50% market share goal for EVs by 2030.15,16 In Europe, the EU proposed a 100% reduction of vehicle emissions by 2035, which would effectively ban sales of ICE vehicles, as well as a requirement to install public charging stations along all major roads.17

Outside of the public sector, traditional automakers are committing massive sums to develop electric vehicles in the face of increasing competition from EV incumbents and new policy pressures. Between now and 2030, global car companies are on pace to spend over $515 billion rolling out new EVs, presenting potential for economies of scale and market capture driven by product diversity.18 Many of these companies also plan on investing billions more in charging infrastructure. Charging networks are the lifeblood of EVs and increasing charging station density will help remove the range limitations, decreasing battery costs in the process.

Autonomous Vehicles (AVs) Are Hitting The Road

Continued trials, innovation, and greater regulatory clarity are bringing us closer to autonomous transportation, with several milestones ahead that represent far greater levels of automation.

Each level of automated driving is a milestone on the path to fully autonomous vehicles

| Level | Definition/Description | Fallback | Driving conditions |

|---|---|---|---|

| L0 | No automation | Human driver | |

| L1 | Driver assistanceAutomates either steering or acceleration, with human driver monitoring environment and controlling non automated functions | Human driver | Some conditions |

| L2 | Partial automationAutomates both steering and acceleration, with human driver monitoring environment and performing dynamic driving tasks | Human driver | Some conditions |

| L3 | Conditional automationAutomates all functions, but will sometimes request intervention from human driver | Human driver | Some conditions |

| L4 | High automationAutomates all functions in some conditions, without requiring human intervention | Driving system | Some conditions |

| L5 | Full automationAutomates all functions in all environments, without requiring human intervention | Driving system | All conditions |

Source: Ahmed, H.U.; Huang, Y.; Lu, P.; Bridgelall, R. Technology Developments and Impacts of Connected and Autonomous Vehicles: An Overview. Smart Cities 2022, 5, 382-404.

Progress on autonomous vehicle development

Consumers today can choose from several vehicle transit options across varying degrees of automation. Of these options, robotaxis are the closest to being fully automated. Several driverless robotaxi services are currently in operation, offering public rides to passengers in multiple cities. Driverless private vehicles are earlier stage, though progress is encouraging. Many automakers have successfully rolled out partially automated steering, braking, and acceleration. At the end of 2021, 92% of new car models featured some degree of automated acceleration and 50% could automate certain steering functions.19 The next step is taking human drivers fully out of the equation.

Where do AVs go from here?

A recent survey of auto executives pointed to fully autonomous vehicles reaching streets as early as 2025.20 Getting there will require continued technological advancement and supportive regulatory frameworks. On the technology side, it is less a matter of core technologies existing, than of enhancing and harmonizing them. Cameras, sensors, artificial intelligence (A.I.), edge computing, and network connectivity are already present in today’s partially autonomous vehicles and steady improvements to them are moving the needle. Most importantly, continued trials are serving as teachers for A.I. and establishing goalposts for what needs to improve. These must accelerate for driverless cars to be street ready.

On the policy side, automakers need regulatory clarity so that they can develop technology to conform with future standards. Germany’s approval of conditionally automated vehicles is extremely encouraging, marking the first time that drivers can ride without paying full attention to the road. Encouragingly, frameworks for private vehicles that are fully automated in certain conditions are underway. In January 2022, Japan announced that it is in the process of creating a legal framework for such vehicles.21 We expect AV development to ramp up as more countries follow.

Targeted Exposure To The EV And AV Value-Chains

The NYSE® FactSet Global Autonomous Driving and Electric Vehicle Index “is a rules-based equity benchmark designed to track the performance of globally listed companies involved with Autonomous Driving and Electric Vehicles.”22 To capture these EV and AV companies, the index uses revenue data from FactSet’s Revere Business Industry Classification System (RBICS) and supply-chain data from FactSet’s Supply Chain Relationships databases to determine business involvement across the following segments: EV manufacturers, EV battery producers, EV battery material suppliers, AV manufacturers, and autonomous driving and EV technologies enablers.23

Conclusion

Continued innovation and support from the public and private sectors are bringing us closer to fully electric and automated transportation. This paradigm shift will likely drive immense growth for EVs and AVs that investors can capitalize on by investing in ETFs that capture the EV and AV value chains. We believe this is best achieved by targeting EV and AV stocks that range from EV and AV vehicle manufacturers to companies that produce enabling technologies like EV batteries, EV powertrains, and AV sensors and cameras.

© 2022 BlackRock, Inc. All rights reserved.

1 EV Volumes, “Global BEV & PHEV Sales,” 2021.

2 Mercedes-Benz, “First internationally valid system approval for conditionally automated driving,” December 9, 2021.

3 EV Volumes, “Global BEV & PHEV Sales,” 2021.

4 Consumer Reports,” Electric Vehicle Ownership Costs: Today’s Electric Vehicles Offer Big Savings for Consumers,” October 2020.

5 Bloomberg, “Batteries for Electric Cars Speed Toward a Tipping Point,” December 2020.

6 Bloomberg New Energy Finance, “Battery Pack Prices Fall to an Average of $132/kWh, But Rising Commodity Prices Start to Bite,” November 30, 2021.

7 Bloomberg, “Batteries for Electric Cars Speed Toward a Tipping Point,” December 2020.

8 Consumer Reports,” Electric Vehicle Ownership Costs: Today’s Electric Vehicles Offer Big Savings for Consumers,” October 2020.

9 CNBC, “Here’s whether it’s actually cheaper to switch to an electric vehicle or not — and how the costs break down,” December 29, 2021.

10 Wall Street Journal, “Rising Battery Prices Add Uncertainty to Electric-Vehicle Costs,” February 5, 2022.

11 K. M. Abraham, ACS Energy Letters 2020 5 (11), 3544-3547. DOI: 10.1021/acsenergylett.0c02181

12 Bloomberg New Energy Finance, “The EV Price Gap Narrows,” June 25, 2021.

13 Reuters, “New energy vehicles to make up 20% of China’s new car sales by 2025,” November 2, 2020.

14 IEA, “Electric cars fend off supply challenges to more than double global sales,” January 30, 2022.

15 U.S. Congress, “H.R.3684 – Infrastructure Investment and Jobs Act,” November 15, 2021.

16 White House, “Executive Order on Strengthening American Leadership in Clean Cars and Trucks,” August 5, 2021.

17 Reuters, “EU proposes effective ban for new fossil-fuel cars from 2035,” July 14, 2021.

18 Reuters, “Exclusive: Global carmakers now target $515 billion for EVs, batteries,” November 10, 2021.

19 Consumer Reports, “How Much Automation Does Your Car Really Have?”, November 4, 2021.

20 McKinsey, “What’s next for autonomous vehicles?”, December 22, 2021.

21 Nikkei, “Japan to create legal framework for level 4 self-driving cars,” December 23, 2021.

22 NYSE, “NYSE® FactSet® Global Autonomous Driving and Electric Vehicle Index™ Methodology,” June 7, 2019.

23 Ibid.

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks often are heightened for investments in emerging/ developing markets or in concentrations of single countries.

Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes and than the general securities market.

There can be no assurance that an active trading market for shares of an ETF will develop or be maintained.

Actively managed funds do not seek to replicate the performance of a specified index. Actively managed funds may have higher portfolio turnover than index funds.

This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective.

The information presented does not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy or investment decision.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision.

The information provided is not intended to be tax advice. Investors should be urged to consult their tax professionals or financial professionals for more information regarding their specific tax situations.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Bloomberg, BlackRock Index Services, LLC, Cohen & Steers, European Public Real Estate Association (“EPRA®”), FTSE International Limited (“FTSE”), ICE Data Indices, LLC, NSE Indices Ltd, JPMorgan, JPX Group, London Stock Exchange Group (“LSEG”), MSCI Inc., Markit Indices Limited, Morningstar, Inc., Nasdaq, Inc., National Association of Real Estate Investment Trusts (“NAREIT”), Nikkei, Inc., Russell or S&P Dow Jones Indices LLC or STOXX Ltd. None of these companies make any representation regarding the advisability of investing in the Funds. With the exception of BlackRock Index Services, LLC, which is an affiliate, BlackRock Investments, LLC is not affiliated with the companies listed above.

Neither FTSE, LSEG, nor NAREIT makes any warranty regarding the FTSE Nareit Equity REITS Index, FTSE Nareit All Residential Capped Index or FTSE Nareit All Mortgage Capped Index. Neither FTSE, EPRA, LSEG, nor NAREIT makes any warranty regarding the FTSE EPRA Nareit Developed ex-U.S. Index or FTSE EPRA Nareit Global REITs Index. “FTSE®” is a trademark of London Stock Exchange Group companies and is used by FTSE under license.

© 2022 BlackRock, Inc. All rights reserved. BLACKROCK, BLACKROCK SOLUTIONS, BUILD ON BLACKROCK, ALADDIN, iSHARES, iBONDS, FACTORSELECT, iTHINKING, iSHARES CONNECT, FUND FRENZY, LIFEPATH, SO WHAT DO I DO WITH MY MONEY, INVESTING FOR A NEW WORLD, BUILT FOR THESE TIMES, the iShares Core Graphic, CoRI and the CoRI logo are trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

iCRMH0622U/S-2215351

This post originally appeared on the iShares Market Insights.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment