recep-bg

In theory, the Cambria Tail Risk ETF (BATS:TAIL) makes sense in a diversified portfolio. Investors should view tail hedging like home insurance, paying annual premiums (losses) to protect against a market drawdown.

In practice, tail risk strategies have not performed as advertised in 2022. Part of the issue could be there is too much money chasing the same investments, causing the strategy behaviour to change. Investors who are worried about market drawdowns should consider raising cash in their portfolio instead of chasing complex strategies that underperform.

Fund Overview

The Cambria Tail Risk ETF seeks to provide a hedge against significant market downside. The fund has $327 million in assets and charges a 0.59% expense ratio.

Strategy

The TAIL ETF seeks to achieve its downside protection by investing in a portfolio of ‘out of the money’ (“OTM”) put options on the U.S. stock market. While a portion of the portfolio is used to buy put options, the majority of the portfolio is invested in intermediate term U.S. treasuries. The fund is designed to hedge against market declines and rising volatility. The TAIL ETF expects to produce negative returns in most years when markets are rising or volatility is declining, but provide a hedge when markets decline.

Portfolio Holdings

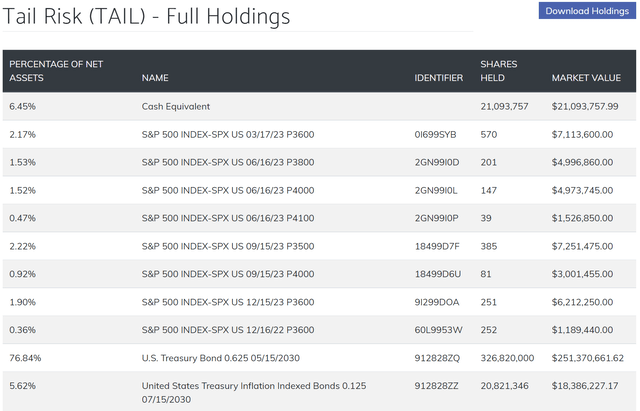

The TAIL ETF invests in a portfolio of S&P 500 Index OTM puts as indicated above. Currently, the hedge portfolio has 11.1% of the fund’s assets and consist of index puts with strikes ranging from 3,500 to 4,100 (8% OTM to 8% ITM), and expiries ranging from December 2022 to December 2023. The rest of the assets are invested in treasuries (76.8% of assets), TIPS bonds (5.6%), and cash (6.5%) (Figure 1).

Figure 1 – TAIL ETF portfolio (cambriafunds.com)

Returns

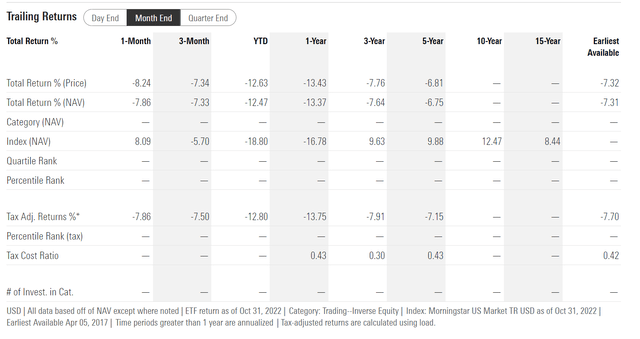

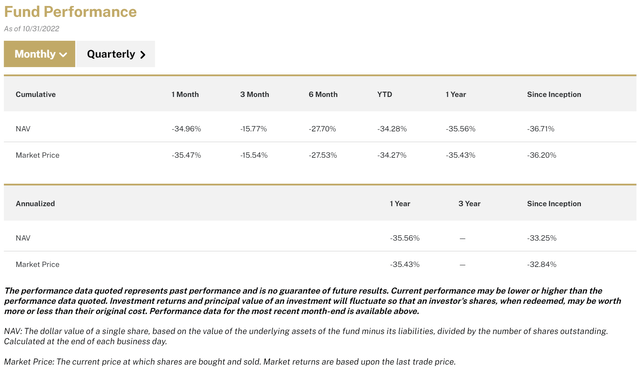

Understandably, the TAIL ETF has had poor long term performance, losing an average of 7.3% per annum since inception (Figure 2). This is because the strategy is like a home insurance policy, you pay the annual premium (i.e. annual loss) and collect a lump sum payout in the event of a fire (i.e. market drawdown). What is not clear is why the fund is down 12.5% YTD to October 31, 2022, when the S&P 500 has suffered the worse bear market since the 2008 Great Financial Crisis.

Figure 2 – TAIL ETF performance (morningstar.com)

TAIL Worked In Prior Drawdown Episodes

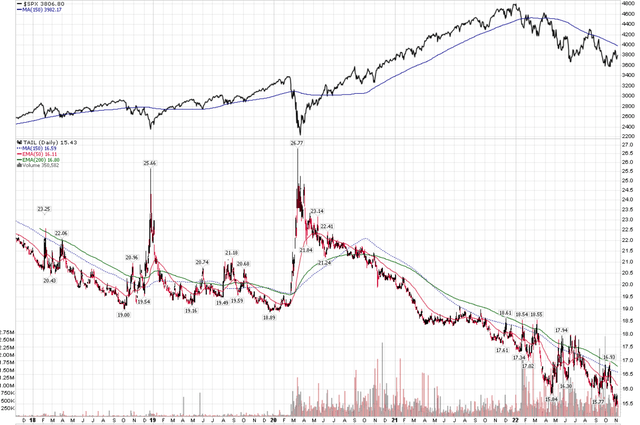

To the TAIL ETF’s credit, its performance against market drawdown had historically been good. In 2018, when the S&P 500 declined almost 20% due to a combination of Fed rate hikes and the U.S. trade war with China, the TAIL ETF rallied 35% from October 2018 lows to December 2018 highs, essentially offsetting the S&P’s 20% decline.

Figure 3 – TAIL ETF has historically worked (Author created with price charts from stockcharts.com)

During the early days of the COVID-19 pandemic, the TAIL ETF worked even better, returning over 40% from January 2020 lows to March 2020 highs compared to a 34% decline in the S&P 500. So why has it not worked this year, as the S&P 500 declined over 25% at one point?

Volatility Spike Is The Missing Ingredient

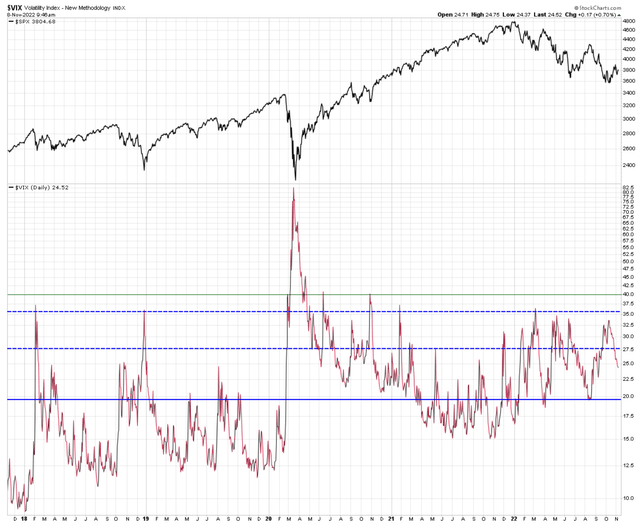

The missing ingredient so far in 2022 has been a volatility spike. While the total market decline in 2022 have been large, it has been a gradual grind lower over 10 months, characterized by persistently high volatility in the 20-30 range (as measured by the VIX Index, see Figure 4).

Figure 4 – VIX spike missing (Author created with price chart from stockcharts.com)

Recall the value of put options have a number of drivers: the underlying price relative to the strike price, the volatility of the underlying, the risk free rate, and the time to expiry. Since the TAIL ETF typically hold deep OTM put options with the underlying price far above the strike price, the value of its option portfolio is chiefly determined by the volatility of the underlying and the time to expiry.

Past episodes (2018 and 2020) saw volatility begin at very low levels (VIX was in the low teens prior to both), and spike multiples higher in a short period of time, which added a lot of value to TAIL’s portfolio of OTM puts. This time around, VIX started in the high teens (meaning the protection was already mildly expensive), and only rallied to 20-30. Furthermore, a long drawn out bear market is detrimental to the TAIL ETF as its portfolio of put options decay over time. Finally, persistently high volatility meant that new hedges added to the portfolio (either through increase in AUM or expiring contracts) were done at expensive levels.

Bond / Stock Correlation Broke Down

To top it off, more than 80% of the TAIL ETF portfolio is invested in treasury bonds and TIPS bonds, relying on the historical negative correlation between bonds and stocks. As the Fed have rapidly increased interest rates in response to soaring inflation, bonds have suffered the worst bear market in history (Figure 5).

Figure 5 – Bonds have suffered worst bear market in history (Reuters)

Too Much Money Chasing Tail Hedges

The problem with tail risk hedging strategies like the TAIL ETF is that in a perfect world, investors should allocate only a small portion of their assets to the tail strategy. When a tail event occurs, they should monetize the tail hedge to offset losses in their core portfolio.

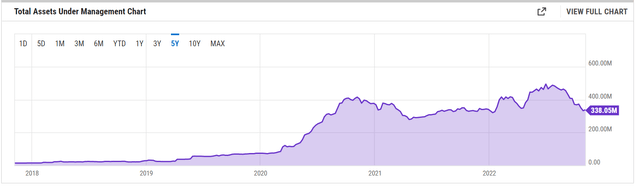

Unfortunately, tail hedging strategies’ amazing performance in March 2020 (an investor who had allocated 3.3% to Mark Spitznagel’s Universa Tail Hedge Strategy would have returned 0.4% vs. a -12% loss in the S&P 500) caused investors to fall in love with tail protection. We can deduce this through the Assets Under Management (“AUM”) of the TAIL ETF, which exploded after the March 2020 episode, and continued to climb throughout the bull market of 2020 to 2021 (Figure 6).

Figure 6 – TAIL ETF AUM (ycharts.com)

The TAIL ETF, and dozens of other public and private funds offering tail hedging through OTM put options, became fashionable and investors threw money at the strategy.

What happens in finance when everyone pursues the same strategy? That strategy stops working, as we are witnessing in real time today. Too much money in OTM puts mean that whenever we have a market downdraft, there is a rush by OTM put holders to monetize their puts, lest the pop in value is eaten away by time decay. This could be the reason why we have not seen the volatility spike that is usually associated with large market drawdowns.

Peer Funds Doing Even Worse

To be fair, the TAIL ETF isn’t even the worst performing tail risk fund. There are reports (around the 11 minute mark in the attached podcast) that Artemis Capital Management, one of the largest player and loudest promoter in the volatility management/tail risk space, is shutting down their tail risk strategies due to poor performance. Simplify ETFs also have a Simplify Tail Risk Strategy ETF (CYA) that is down an incredible 34.3% YTD, even worse than the S&P500 it is trying to hedge against (Figure 7)!

Figure 7 – CYA ETF performance worse than S&P 500 (simplify.us)

Distribution & Yield

The TAIL ETF pays a modest quarterly distribution that amounted to $0.18 in the past twelve months, giving a trailing distribution yield of 1.2% (Figure 8).

Figure 8 – TAIL ETF distribution (Seeking Alpha)

Conclusion

In theory, the TAIL ETF makes sense in a diversified portfolio. Investors should view tail hedging like home insurance, paying annual premiums (losses) to protect against a market drawdown.

In practice, the success of tail risk strategies in gathering assets in the past few years mean that the behaviour of the strategy may have changed, as too much money has been chasing the same investments. So far in 2022, tail risk strategies have not come even remotely close to providing a hedge. Investors who are worried about market drawdowns should consider raising cash in their portfolio instead of chasing complex strategies that underperform.

Be the first to comment