Eugene Gologursky/Getty Images Entertainment

Summary

This article follows my previous coverage on Lucid Group, Inc. (NASDAQ:LCID) on 21 October 2021, which was within my article on Hong Kong property conglomerate Great Eagle (OTCPK:GEAHF). Great Eagle was an early Lucid investor and owns 13.4 million shares in Lucid Group. At the time of my bullish rating on Lucid, its stock price was at $25 levels. In the ensuing time since, Lucid soared up to a high of $57.75 in November 2021. Investors would have done well in booking some gains during the surge, as, following this, Lucid stock did a round trip back down to $24 levels as I write this.

Now that Lucid is back down to its levels seen last October, is it a good time to buy? There are two major factors for the recent price weakness in Lucid. The first is the revision down in 2022 Lucid Air production numbers from its previous 20,000 guidance to a range of 12k to 14k. The second is the major correction in forward-looking growth stocks since last year into March. Even amidst the market rally and rebound in forward-looking growth stocks from March’s lows, Lucid’s stock price has lagged that of many other major forward-looking growth names.

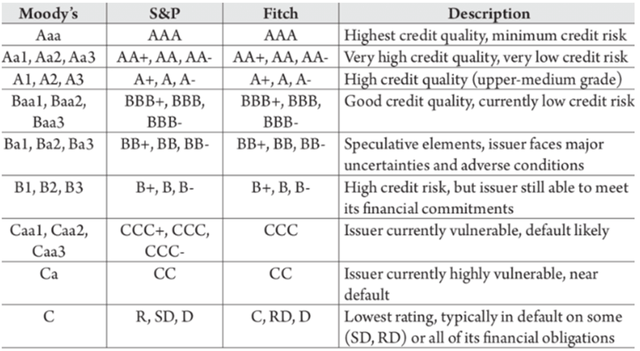

There are significant catalysts and major news that the market has overlooked on Lucid amidst its price weakness. Saudi Arabia’s sovereign wealth fund Public Investment Fund (“PIF”) is a 62.7% shareholder of Lucid Group. PIF has a Moody’s credit rating of A1, the same as Saudi Arabia’s credit rating (A1 Moody’s/A- S&P/A Fitch). PIF’s credit rating was recently issued in February ahead of a first green bond issuance.

The planned green bond by PIF augers well for Lucid, too, as either this or future green bond issuances might be used for Lucid’s production or vertical expansion plans, such as the production facility in Saudi Arabia announced during earnings. Lucid also issued a green convertible note issuance last December, which was highly bullish for the company, as it is a low-cost (1.25% interest, high hurdle price conversion) all-weather funding source that Lucid could tap on in the future.

Based on my assessment that I discuss below, Lucid Group should have a credit rating equivalent of at least A3, two notches below PIF’s credit rating. One should note that such a rating would place it higher than any other US car maker. For comparison, both Tesla (TSLA) and Ford (F) are junk-rated, with a Ba1 and Ba2 rating from Moody’s respectively. General Motors (GM) is Baa2 rated.

Credit rating chart

Credit ratings chart (Researchgate)

Accolades for the Lucid Air have continued to flow in. Cars.com most recently anointed Lucid Air the Top Luxury EV award, and InsideEVs described the Air as being worthy of the “Tesla killer” badge. This follows multiple other car awards, including MotorTrend’s 2022 Car of the Year award. As Cars.com puts it, “the first offering from upstart Lucid, the 2022 Air, is simply a next-level EV and a game changer for the market.” Today, there are several reports of Tesla testing the Lucid Air at Tesla’s test track, the ultimate compliment.

Lucid’s best-in-class Air model and game-changing technological advantage is important to the long-term fundamental thesis of Lucid in two ways. The first is in Lucid’s scaling of its own production and model expansion. The second lies in the potential future licensing of Lucid’s technology and the route it takes to do this.

With PIF’s backing and Lucid’s competitive advantages, I view that Lucid should/will acquire strategic stakes in smaller conventional global carmakers. This would accrue strategic and financial benefits to each company and provide Lucid the avenue to share its technology, driving Lucid’s impact globally on a faster and greater scale.

Lucid, with its numerous advantages, has the path to be the next great “impact investment” company in the motor world by directly accelerating the change in the numerous smaller carmaker groups which are constrained in their ability to move significantly into EV. Lucid’s announcement of its Saudi Arabia production facility is very bullish news, because this could be the first step in a potential long-term multi-carmaker EV production hub that is overseen by its parent/affiliate company Lucid Group. Refer here to previous media report on Saudi Arabia’s plans to build a domestic multi-carmaker industry producing “cars of the future.”

We should also note Lucid’s history of vertical expansion since its beginnings as an electric battery producer and the other ongoing vertical expansions it has in its pipeline beyond its car production and technology licensing. Looking ahead, Lucid has its cutting-edge Energy Storage System battery from last year’s prototype that can be a major future business by itself. The number of job openings for ESS positions at Lucid indicates a possible acceleration in those plans. With the recent confirmation of Lucid’s production facility in Saudi Arabia, we should also note the previous speculation that Lucid will be engaged for a major energy storage project in Saudi Arabia in its future city of Neom, which is to be powered entirely by renewable energy.

Based on its market cap of $40.58billion, Lucid trades at 2.9x Price/2025 projected sales and 28.1x Price/2022 forecast sales, assuming 13k Lucid Airs are delivered this year. There are two major peers to compare Lucid Group’s forward valuation to. The first is Tesla. Tesla has an average analyst estimate of $83.4billion in revenue for 2022, putting it at 13.4x Price/2022 forecast sales. At the same time, we should note that Lucid has a paltry 3.7% of Tesla’s current market cap. The next is Ferrari (RACE), which has a similar market cap to Lucid Group (Ferrari $40.64billion), trades at 8.65x Price to Sales and shipped 11,155 cars in 2021.

Given Lucid’s best-in-class technology and product, financial strength and the scaling runway ahead, Lucid stock is significantly undervalued versus its long-term growth ahead.

Company results

Lucid reported results on 28 February, reducing its 2022 Lucid Air production numbers from previous 20,000 guidance to 12k to 14k, due to supply chain issues. A major reason for this was Lucid’s “insistence on the highest quality parts,” as explained by Peter Rawlinson during the earnings call.

Lucid’s SUV Project Gravity was pushed into 1st half of 2024. On the other hand, Lucid Air reservations increased to 25k from 13k in November. Lucid’s order book already stretches into its 2023 production, and this is without future fleet off-take from Saudi Arabia, and investee companies of PIF.

Credit rating equivalent

Lucid has a large cash pile of $6.2 billion at December 2021 to provide runway well into 2023, with the additional ability to tap many sources of capital including government financing, debt, or equity. In fact, with Lucid’s existing cash position, the ability to tap both government and debt funding at a low cost of capital, and its recent convertible note issuance, there would be no need to look at direct equity financing in the coming years with its dilutive impact. This is unlike scores of forward-looking growth companies and other EV peers which are going to need to raise equity fund raising in the future.

Refer to comments during the conference call.

John Murphy

Okay. That’s very helpful. And then just a second question around the Saudi facility. Do you expect the financing to come from internal funds that you have? Or do you think the public investment fund will be a key component funding that capacity addition, I should say, even expansion, but the incremental addition of that facility in Saudi Arabia? It just sounds like there would be a lot of interest in the diversification from their standpoint, so they might be able to or willing to put more capital in. I’m just curious what your expectations are there.

Sherry House, CFO

Well, first of all, we ended the year with $6.26 billion of cash in the balance sheet. So that in and of itself funds us really well into 2023. So as we look to launch these efforts here in 2022, we already have the cash available to us to be able to use. I mean as we move forward with our forward business plan, we plan to leverage many sources of capital. It could come from governments that could come from the capital markets, whether it be debt or equity. And right now, we see just a tremendous number of opportunities for funds. So we’re going to look at what’s going to be in the best interest of the shareholders. and be really opportunistic looking for cash that is efficient.

Consider, also, Lucid’s convertible note issuance in December, which was issued with a low 1.25% annual interest. The note, issued when Lucid’s stock price was elevated, has a high 50% hurdle conversion rate or a conversion price of $54.78 per share. This was a highly attractive, low-cost fund raising for Lucid, and demonstrates the financial standing in which Lucid is viewed.

Next, let’s look at the strategic importance of Lucid Group for its majority shareholder PIF, which has assets under management of about $600 billion. First, PIF owns 62.7% of Lucid Group. Next, PIF has stated its long-term support for Lucid. For example, PIF providing offtake for Lucid’s production. Refer to Barron’s September 2020 interview with PIF Governor Yasir al-Rumayyan:

“But I can tell you about another of our companies in the U.S.-Lucid Motors. I think it’s going to be the best electric-vehicle company in the world. They just announced that their charge range is 500-plus miles, which is more than 130 miles more than the second best…

In the second stage, we are going to open the markets for Lucid in Saudi Arabia, we’re going to have their manufacturing facility in Neom, most likely, or maybe some other location, and we can give them some kind of offtake for the domestic purchases from the government, automobile procurement, and they can immediately hit the ground running.

Finally, we have the announcement of Lucid’s strategically important production facility in Saudi Arabia, mentioned above.

These numerous factors collectively can be deemed an implicit guarantee of support by PIF for Lucid Group. On the other hand, Lucid Group does operate with autonomy from PIF. Therefore, Lucid Group is unlikely to be deemed of the same credit rating equivalent as PIF. I consider a rating two notches lower than a PIF credit rating equivalent for Lucid Group to be appropriate, or an A3 equivalent at Moody’s. This would place Lucid Group above all other US carmakers.

Licensing opportunities, potential strategic acquisitions and verticals expansion

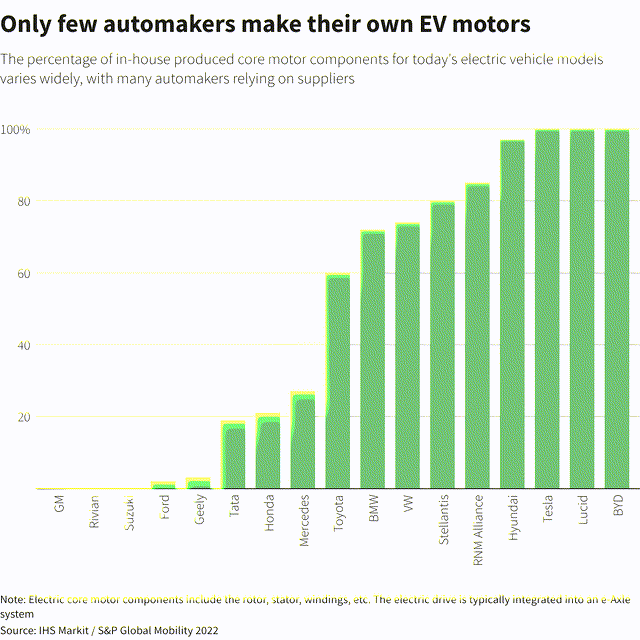

Car and Driver ranks the top EV range vehicles here. We can see just how much ahead Lucid is in its EV technology versus the established carmakers. The question is, apart from Lucid’s scaling of production, how does Lucid translate its superior competitive advantage into business opportunities for licensing? As Reuters notes, there are only three automakers globally that make 100% of their own EV motor components in-house: Tesla, BYD. and Lucid.

During the call, Peter Rawlinson also spoke on Lucid’s open-mindedness for partnerships and the licensing of their EV technology:

I mean, I think our efficiency, our connectivity, the sensor suite are significant points of attraction for such partnerships in the autonomous vehicle space or as it relates to other in-cabin monetization opportunities.

I think we really recognize that we are in the process of creating a Lucid Air computer on wheels. And that software development is a huge part of that. We’ve been focused upon developing software as much as hardware in the past year, we brought in significant leadership from Apple and other disruptive technology companies to take our digital engineering leadership. We remain very open-minded on this front, and we’re excited about potential for partnerships.

However, there has not been anything announced yet. I believe both that Lucid should and is awaiting the right opportunity to enter a strategic partnership and investment into a smaller conventional carmaker, rather than merely licensing its technology. Lucid has developed the best EV technology, and its impact in the world will only be felt by Lucid’s scaling, and by the sharing of its technological advantages (via having a strategic investment in a conventional carmaker).

Likewise, Lucid’s development of a Lucid Air computer on wheels should be viewed as being a product whose underlying technology will be shared with a mass market carmaker in time. It is Lucid which commands the best-in-class product and technology, the talent, and a financial advantage over established conventional carmakers. There are scores of small global carmaker groups which make desirable cars but lack the resources to make the required leap in EV and technology. Such an investment by Lucid would be tremendously bullish for both Lucid and the carmaker it invests into, and applauded by the market.

Lucid would have an interest in a carmaker with larger current production numbers through which Lucid could transfer its superior technology, and the target carmaker would benefit from best-in-class technology it has access to and reduced development costs. As a newer carmaker, we should note that Lucid’s supply chain constraints might be affected by having less established relationships and relative small volume with suppliers. Lucid’s investment into an established conventional carmaker will thus enable better materials access and component sharing between the two companies.

Ultimately, I believe that Lucid could acquire strategic interests in several small global carmakers, license its technology in a similar way to a software company, and truly revolutionize the auto car world with its technology transfer.

With that in mind, let’s explore who are a couple of potentially suitable candidates that Lucid could acquire a stake in, that would serve as examples of potential target investee companies for Lucid.

Aston Martin

British sports car maker Aston Martin has a market cap of only GBP1.15billion or in $1.5billion in dollar terms. Its first electric vehicle is set to be a long way off, in 2026, presumably due to a combination of both financial and EV technological constraints. Lucid could buy a stake or acquire Aston Martin outright. However, Mercedes does have a minority stake in Aston Martin, and any such strategic investment by a new shareholder may need to involve Mercedes agreement.

Mazda

Mazda has a market cap of JPY559billion or $4.51billion. One of the smallest of the Japan carmakers, the carmaker punches above its weight in making stylish and sporty vehicles but has relatively limited plans in EV. Meanwhile, Mazda’s similar sized peer Honda announced a partnership with GM to jointly develop EVs this week.

Interestingly, Mazda may be the carmaker with the best strategic fit for a partnership and investment from Lucid. Lucid’s SVP of brand and design, Derek Jenkins, was Head of Design at Mazda until 2015, when he left Mazda to join Lucid. Look at the Lucid Air and Jenkins’ designs at Mazda (CX-5, 6, 3 etc) and one can see the sleek design handiwork of Jenkins. Mazda is acclaimed for its stylish model range and the high quality of interior design and materials, which is often compared with those of luxury carmakers. Lucid’s acquiring a stake in Mazda, helping Mazda accelerate into EV and lending Lucid’s financial clout could make a lot of sense for both companies.

Furthermore, neither of these two carmakers would have any significant overlap with Lucid’s high-end focus in its first production years. A potential partnership with Aston Martin brings a potential sports car range indirectly, whilst Mazda brings a potential premium mass market range.

Valuation and short interest

We should note the high short interest that Lucid has (20.58% of float) and examine the types of short sellers who are potentially betting against Lucid. In doing so, we can also be cognizant of the bearish argument and potential downside risks to Lucid stock price to consider when investing.

There will be those betting against Lucid, with the view that we are in a prolonged bear market, and the recent market rally from lows is a bear market bounce (with comparisons to the 2001 dot-com crash). If such is the case, then growth and forward-looking growth stocks would face a significant hit versus value stocks when the market correction resumes. I certainly do not view we are into a prolonged bear market and view the market’s sell-off from January to March as being a correction.

But if one is of the view that the market correction is set to resume into a bear market, forward-looking growth stocks like Lucid will surely see a more significant impact in stock price. Similarly, there are those who believe that there will be a coming market cycle renaissance for classic value’s domination, like the 2000s post-dot com era. I do not view that we are entering a Graham value-style long-term cycle, but if such were the case, it would not be ideal timing to buy into forward-looking growth.

Inevitably, Lucid has the classic value-style short-seller betting against it (with overlap between the first category of those with views of a bear market outlook). This is similar to the type of classic value short sellers who have bet against Tesla over the years. To put it simplistically, as with Tesla, the classic value short-seller’s view is that Lucid is overvalued versus conventional established carmakers valuations, and the large established carmakers are making significant strides into EV. In Lucid’s case, bears will argue that it is even more overvalued, given the company’s relatively low production numbers at the beginning of production.

The blind spot of classic value style bets against a forward-looking growth stock is the belief that classic value is indefinitely superior as an investment style. The reality is that Phil Fisher-style growth, and its off shoot of forward-looking growth, are both major long-term investing styles. No specific style has an indefinite superiority for all time, nor is any universally applicable. Therefore, for longs and potential longs in Lucid, we need to assess Lucid as we would when considering investing in other stocks in the category of forward-looking growth. Like growth and forward-looking growth investing broadly, one must look into the future and form a view of how they consider a forward-looking growth company will perform.

Autonomous driving technology companies Waymo and Cruise, both of which have no revenue and are still some ways till commercialization, have private market valuations of about $30 billion each (GM’s Cruise was considering an IPO although this appears to be put on hold). Like Lucid, both have invested billions in their cutting-edge technology. For the autonomous driving companies, their valuations are based on both the technology and forward-looking revenue that their technology will presumably entail.

Lucid, which is trading with a $40 billion valuation – not too much more than these companies – has a superior technology over its carmaker competitors and already has begun production. That production is set to scale significantly in coming years. As mentioned, based on 2025 projected sales, Lucid trades at a 2.9x multiple. If projections are met or exceeded over the next few years to 2025, this is certainly a highly undemanding valuation. In my view, the stock could more than double within this time horizon from here.

With a best-in-class product, a strong order book, and further future demand set to come from Saudi Arabia and from corporate fleets, there is far less uncertainty in long-term demand for Lucid versus many peers. Similarly, the financial strength that Lucid has and strategic importance with its majority shareholder PIF, gives Lucid a clear path to 1) scale vehicle production and 2) vertical expansion. The licensing of its technology, potential acquisition of stakes in smaller carmakers, and expansion of its Energy Storage Solution into a major long-term business is also not factored into projections. This could result in a major acceleration in future revenue.

One needs to make an assessment on Lucid’s ability to achieve virtuous-cycle growth in the coming years, and my view is a resounding yes. In the near-term, too, there are a host of potential positive news catalysts such as those detailed previously.

Given that Lucid has a clear pathway to Tesla-like long-term growth, one would expect a degree of correlation with Tesla’s stock performance. If Tesla, the granddaddy of EVs and virtuous cycle growth, is seeing stock price highs, then similar excitement should arguably flow to Lucid as well. However, Tesla and Lucid’s stock prices have seen a marked divergence, with Tesla’s price strength growing amidst strong delivery numbers whilst Lucid has seen price weakness. Lucid trades at a paltry 3.7% of Tesla’s market cap. To me, there is a significant mispricing in Lucid currently. I view the current $24 and below levels as an attractive level to buy.

Like Tesla’s earlier years, there will be significant stock price volatility that Lucid is likely to experience, and its fair share of detractors. However, Lucid is set for an incredible long-term journey ahead, and, in time, may bring investors to ask, what is “the next Lucid?”

Be the first to comment