Marcus Lindstrom

Published on the Value Lab 20/8/22

The Cushing NextGen Infrastructure Income Fund (NYSE:SZC) is an interesting vehicle for ETF investors. Technically a closed-end fund, it offers a discount to NAV despite a portfolio of valuable infrastructure assets. The yield is impressive and monthly and the infrastructure investments make sense for the current environment. We see the SZC as a clear buy, and a perfect sink for any excess cash that you would want to reserve away from more aggressive, high conviction, single stock exposures.

The Discount

The obvious draw to the issue is the discount of the price from the NAV. Based on shares outstanding figures and the share price, the market cap is around $120 million. The NAV is around $146 million. That’s trading at an 80% discount factor. Considering the quality of the assets contained by the portfolio that is quite remarkable.

Breakdown

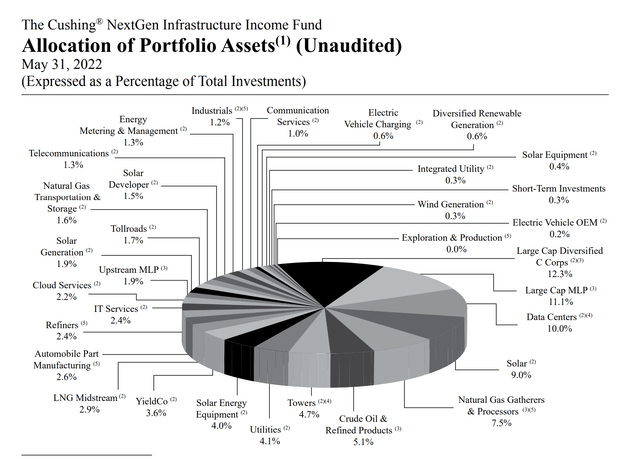

The portfolio is broadly described by the following pie chart.

Allocation (SZC Semiannual Report 2022)

Let’s focus on some of the larger allocations. They have meaningful allocations to towers, featuring some old favorites of ours like American Tower (AMT), a robust REIT with no solvency risks, attractive lease maturity profile and ability to flex to inflation. Next is crude oil and refined products, the former covered by NuStar Energy (NS) and the latter by Delek (DKL). Oil production and refining capacity both are underivested and scarce, and their value adds to the supply chain are defensible for at least another investment and building cycle, about 4 years, if not longer due still to stranded asset concern by capital allocators. Similarly, there is a 7.5% exposure to natural gas. Above it, stocks with solar power generation assets at 9% to provide a renewable angle. Data centers as well, an essential new-industry resource to support computing needs, and also IXs are included within this 10% allocation covered by the oft-discussed Equinix (EQIX), whose network economics favor a high reinvestment model, and whose real estate profile provides downside protection.

Large cap MLPs at 15% are all the pipeline MLPs, like Enterprise Products Partners (EPD) and Energy Transfer (ET), who together transport NGLs and other crude products from logistics centers at the coast to the inland basins and beyond to form the energy product veins of the US. Another pipeline company in Plains GP Holdings (PAGP) which is associated to Plains All American (PAA) adds into a total product pipelines exposure of 20% for the CSZ. On top of that there’s another 12.4% from Kinder Morgan (KMI) and the other C-corp pipeline companies, very similar to the MLP exposures. That brings the US pipeline infrastructure exposure to 33% at this point. With the NGL midstream companies added to the mix we actually get up to almost 40% in crude oil and gas product infrastructure.

Conclusions

So the first 66% of the SZC is covered about 2:3 by super robust telco, renewable and tech exposures and by US pipeline infrastructure respectively. With the highs in oil prices, and concerns about basin producer profitability being higher than the world average in the US in the rear-view, and resilience regardless of the substantial 40% US pipeline exposure, the SZC contains a lot of assets that investors, especially dividend investors, covet.

The yield is 6.5%, and it is paid on a monthly basis to serve definitively as a practical dividend income vehicle. Trading at a NAV discount despite liquid assets, the stock is a godsend for dividend investors. The 6.5% yield is almost completely covered by the distributable cash flow which comes after leverage costs and operating expenses, because the total allocations do end up adding up to a bit more than 100%, but is therefore almost totally sustainable at the levels. The DCF is covered completely by income from this largely dividend-centric portfolio. Trading at a 20% discount, this closed end fund is a buy.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment