Funtap/iStock via Getty Images

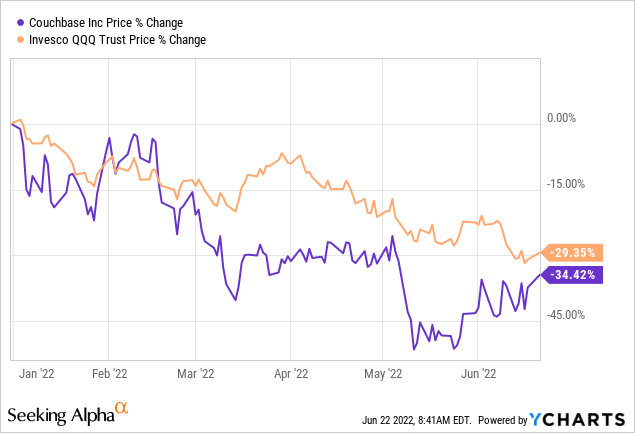

Couchbase’s (NASDAQ:BASE) stock has lost more than 34% of its value since the start of 2022 as it became increasingly clear that the Fed Reserve would have to aggressively increase interest rates to bring down the high inflation. The stock has been more impacted than even the tech-heavy Invesco QQQ Trust (QQQ), but a noteworthy observation is an upside in the first week of June after good first-quarter financial results when the topline guidance was exceeded.

This means that in case the company is able to beat guidance, its share price can rise again, but, in current market conditions where the cost of doing business is rising rapidly as a result of high inflation, this thesis will also focus on the bottom line by analyzing the financial results for the first quarter of 2023 which ended in April this year.

I start by providing an overview of why Couchbase is seeing success in the current digital transformation environment.

Couchbase’s product attractiveness

With more IT workloads moving to the cloud, organizations are faced with challenges of how to manage their databases. Now, unlike front-end applications, databases hold critical corporate data and cannot just be migrated to the public cloud of providers like Microsoft’s (NASDAQ:MSFT) Azure. Reasons vary from IT security to scalability, whereby businesses like travel have to scale up rapidly to meet demand.

Thus, many databases still remain in traditional collocation-type data centers, while some have been migrated to private clouds which have the same ease-of-use features as Amazon’s (NASDAQ:AMZN) AWS for example but provide more customized security. Different use cases have resulted in databases residing in three different environments, namely the public cloud, private cloud, and corporate data centers with administrators now faced with interoperability and performance challenges when managing them.

Here, one of Couchbase’s strengths is that it has been able to address the difficulties of managing data across different clouds with its fully manageable Capella DBaaS (database-as-a-service) which can run in any cloud including multi-cloud and hybrid clouds (or a combination of public and private clouds). This means a single management interface for different databases which makes it easier for the administration team to manage and cheaper for the IT budget.

Another of the company’s strengths when compared to Apache CouchDB which is used by competitors, is that the database has a No SQL engine which permits rapid scaling of a corporation’s data while having a nice-to-use SQL interface which most database administrators are used to. At the same time, it supports use cases ranging from centralized databases located in big metro data centers to those located at the edge where more enterprises are now keeping their data as more analytics is carried out at the far end of the network.

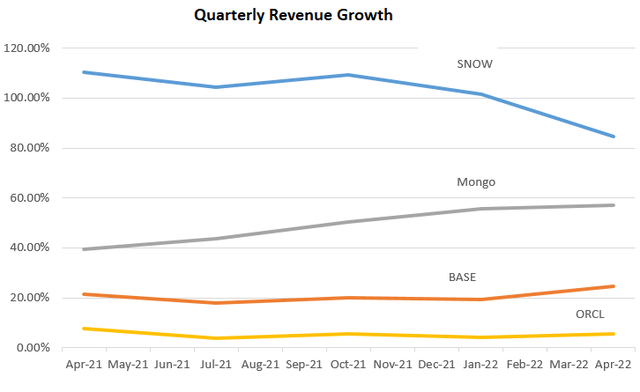

Empowered by its products, Couchbase is the only database provider to have seen a distinctive pickup in sales in its latest reported quarter, as shown in the red chart below.

Chart built using quarterly sales data from (Seeking Alpha)

Its rate of growth may be much lower than for Snowflake (SNOW) in blue above, but, the fact that Couchbase’s chart is trending higher in 2022 while competitors are either flat or on a downtrend shows renewed demand for its products after the pandemic surge.

Now, it is important to assess whether this uptrend in sales can be sustained for the rest of this year, considering that inflation is high and that in anticipation of recession fears, CFOs may be trimming down on IT budgets. This can in turn impact the revenues of IT software companies.

Recurring Revenues and Profitability

For this purpose, I consider the annual recurring revenues (“ARR”), an important metric for SaaS (software as a service) companies which include the flat subscription fees paid by customers (on a monthly or annual basis) plus the money obtained from product upgrades after accounting for any losses from cancellations. For Couchbase, the ARR of $139.7 million represented a 27% year-on-year increase. This was more than the 25% revenue growth in Q1 signifying that more money is being obtained out of existing subscriber plans and for this purpose, the company can rely on some large customers.

Another useful metric that becomes useful during uncertain times is RPO Or Remaining Performance Obligation, which basically measures the backlog. This metric shot up by 68% to $169 million, or much more than the $123.5 million of revenues generated for the whole of FY-2022 which ended in January.

In addition to the cloud business, the company continues to see momentum for large deals and expansion for its more traditional RDBMS database business, namely with Couchbase server 7.

On the other hand, given the strong dollar, and extreme fluctuations in exchange rates as central banks around the world adjust their currencies to fight inflation, another metric I focus on for companies that sell products outside the U.S. is ARR at constant currency. This was 31% for Q1 and shows immaterial impact from foreign currency fluctuations up to now but needs to be monitored further as the dollar gains more strength.

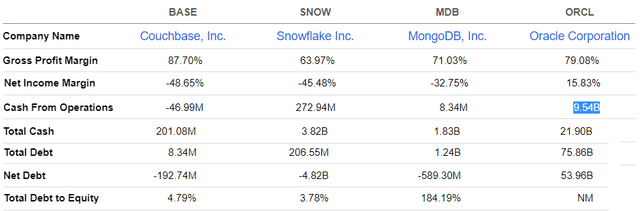

Furthermore, the negative net income for the last nine quarters shows that the company is spending heavily on operations, more than the amount it generates. Along the same lines, cash from operations is also on the negative side signifying that money is being used instead of being generated as is the case with peers in the table below.

Comparison with peers (Seeking Alpha)

Still, at 87.7%, Couchbase has the best gross margins metric, which is even higher than Oracle (ORCL) despite the fact that it has a much lower revenue base on which to spread its fixed costs. This shows that Couchbase is being more efficient in how it configures its platform.

Moreover, while the company operates at a loss (when considering both GAAP and non-GAAP figures), I noticed that the management did show awareness about expenses during Q1’s earnings call and has taken some measures to address the problem. Thus, despite costs still increasing, non-GAAP marketing expenses when considered as a percentage of revenues fell by 1% in Q1. It was the same for research expenses which fell more steeply, to 36% from 43% a year ago.

On the other hand, administration expenses were higher by 2% and this again needs to be monitored in view of the high wage inflation and tight labor market. Thus, the main risk for smaller plays like Couchbase is having to pay high salaries to retain staff, which can drive up operating costs and cause a further drain on cash. This can in turn induce significant volatility in the stock when financial results are announced.

Valuations and key takeaways

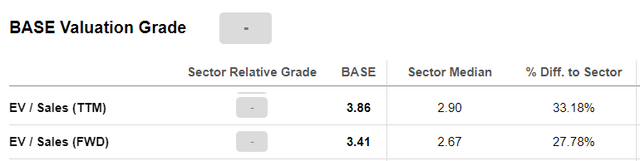

As for valuations, these are still higher relative to the IT sector by at least 27% both when looking at trailing and forward price-to-sales multiples (table below), and consequently, Couchbase remains a highly valued company. Still, due to its market cap of less than $700 million, the company could constitute an acquisition target for large cash-rich software plays.

Valuation metrics (Seeking Alpha)

The company is well-positioned to take on the $60 billion database market both with its enterprise and cloud-based solutions, to address the need for more flexibility among hybrid and multi-cloud customers. However, competition remains tough and Couchbase has to spend on marketing and sales to generate growth. It also has to spend on R&D to transform into a cloud-first database play.

Thus, while improving profitability remains a priority, in practice, things may take time as this will also depend on the capability to continue scaling revenues rapidly. For this purpose, Couchbase’s ability to grow without resorting to any recent acquisition is a positive. Other positives are partnerships forged with hyperscalers like AWS and Google (NASDAQ:GOOG) for widespread availability of Capella to subscribers.

Till it becomes profitable, the database play can rely on $205 million of cash, or enough to finance non-GAAP operating costs of around $44 million for five more quarters. Furthermore, considering that there are $159 million of revenues sitting in the backlog and only $8.3 million of debt, Couchbase has money to sustain operations longer, unless it makes a costly acquisition.

Finally, despite operating at a loss, Couchbase possesses the necessary attributes in the form of product strength and recurrent revenues which make it a worthwhile stock to put on your watchlist while waiting for the company to cut down losses. In this respect, one metric to watch for during the financial results in September is a reduction of non-GAAP operating loss, from $12.3 million in Q1 to $11.8 million in the second quarter as per the mid-point of the guidance.

Be the first to comment