LaylaBird/E+ via Getty Images

Your hair, if you have it, is likely important to you. In addition to the natural benefits that having healthy hair provides, there’s also the fact that a good hairstyle can leave a positive impression. And as social creatures, this can actually prove valuable in establishing and maintaining interpersonal relationships. One company dedicated to ensuring that our hair needs are taken care of is Olaplex Holdings (NASDAQ:OLPX). From a purely fundamental perspective, the company has done quite well this year. But the stock has taken a slight step back as the broader market declined, likely because of how pricey shares are today. But assuming that the company’s recent growth is an indication of what the future holds, the lofty price the company is trading for may not be unreasonable for some growth-oriented investors. For me, shares have still not fallen far enough to warrant rating this a ‘buy’. But if we continue to see strong fundamental growth and a share price that is declining, it could very well reach that point. Until then, I have decided to retain my ‘hold’ rating on the company.

Performance remains strong

Back in the middle of March of this year, I wrote an article that looked favorably upon Olaplex. At that time, I called the company a great firm, citing the rapid growth that it had achieved in the prior few years. I said that future growth for the company was uncertain, but I also highlighted how optimistic management was when it came to the 2022 fiscal year. My ultimate conclusion was that if the business continues to achieve growth like it had been for the next few years, that share price appreciation for shareholders could be significant. But because of how lofty shares were, I ended up rating the business a ‘hold’, reflecting my belief that the high price would cause the company to more or less match the market’s return for the foreseeable future. So far, this call has not been that far off. While the S&P 500 is down by 4.1%, shares of Olaplex have fallen a slightly greater 6.9%.

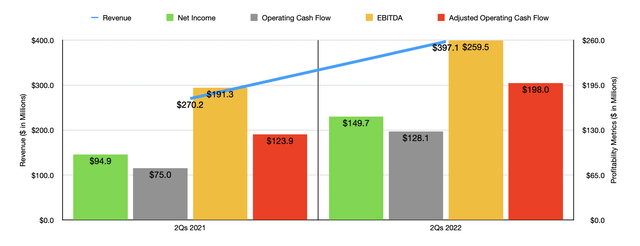

Author – SEC EDGAR Data

This downside has nothing to do with the company’s fundamental performance. Since I last wrote about the firm, we have seen two additional quarters worth of data come out. This data now covers the first half of the company’s 2022 fiscal year. What data we have so far is encouraging. For the first half of the year, revenue came in at $397.1 million. That’s 47% higher than the $270.2 million generated the same time one year earlier. According to management, this growth was driven by strength across the board. Revenue under the professional channel for the company expanded by 43.9%. Growth was even stronger under the specialty retail channel, coming in at 83.9% year over year. By comparison, the direct-to-consumer channel for the company grew a more modest 7.1%.

Management said that the professional category benefited from volume growth that was attributed to sales per point of distribution rising. This means that the places in which it already had a presence saw increased demand. Under the specialty retail channel, growth was driven by the addition of new customers and the net impact of new products the company launched. And under the direct-to-consumer space, the company benefited from strong volume growth from its new products launched since June of last year. A special note needs to be made that at no point in here did I mention price increases. While it’s possible the company did increase some prices, these were not a significant contributor to the upside. That shows that the business has done well in this inflationary environment to the extent that it hasn’t had to push those costs onto its customers, and it’s less likely that a return to more normal levels of activity will push sales down. Investors should view this in a very positive light.

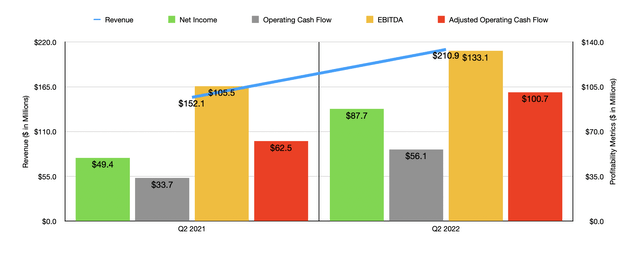

Author – SEC EDGAR Data

On the bottom line, performance has also been strong. Net income in the first half of 2022 came in at $149.7 million. That’s 57.7% above the $94.9 million generated just one year earlier. This came even at a time when the company’s gross margin declined, due in part to inflationary pressures pushing the cost of sales up by 77.2%. At the same time, selling, general, and administrative expenses improved from a cost perspective, dropping from 16.7% of sales in the first half of 2021 to 12.2% the same time this year. Other profitability metrics have also followed suit. Operating cash flow rose from $75 million to $128.1 million. Meanwhile, EBITDA for the company expanded from $191.3 million to $259.5 million.

When it comes to the 2022 fiscal year as a whole, management is now forecasting revenue of between $796 million and $826 million. Adjusted net income should be between $363 million and $379 million. That’s up from the $276 million generated last year. This should also imply GAAP net income for the company of roughly $296.8 million. The only other profitability metric management gave guidance on was EBITDA. The current forecast is for this to be between $504 million and $526 million. If we assume that operating cash flow will rise at a similar rate, then we should anticipate that metric coming in at around $252 million.

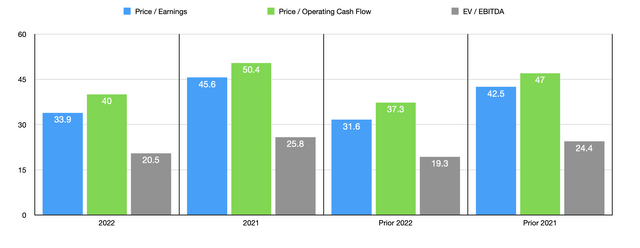

Author – SEC EDGAR Data

Using this data, we can easily value the business. On a price-to-earnings basis, using the forward multiple, the company is trading at a multiple of 33.9. Although lofty, this is lower than the 45.6 reading that we get using 2021 results. And it’s only slightly higher than my prior estimate for 2022 of 31.6. The price to operating cash flow multiple should come in at 40. This is down from the 50.4 reading if we use 2021 figures and is up only slightly from the 37.3 reading that I calculated previously. And the EV to EBITDA multiple should be about 20.5. By comparison, the 2021 multiples gave us a reading of 25.8, while my prior calculation for the firm was 19.3.

To put this all in perspective, I compared the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 19.6 to a high of 52.3. Using the EV to EBITDA approach, the range was from 8.2 to 40.7. In both of these scenarios, four of the five companies are cheaper than Olaplex. Using the price to operating cash flow approach, the range is from 8 to 41.8. And in this scenario, three of the four firms with positive multiples were cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Olaplex | 33.9 | 40.0 | 20.5 |

| Coty (COTY) | 19.6 | 8.0 | 12.5 |

| Natura &Co Holding S.A. (NTCO) | 25.7 | 15.4 | 8.2 |

| The Beauty Health Company (SKIN) | 52.3 | N/A | 40.7 |

| Inter Parfums (IPAR) | 25.5 | 41.8 | 16.2 |

| Edgewell Personal Care Company (EPC) | 20.3 | 15.1 | 10.3 |

Takeaway

The data right now suggests to me that Olaplex continues to grow at a rapid pace. Profitability is also following suit and, on the whole, the company looks quite healthy. I do admit that shares are still off lofty, even relative to similar firms. Sometimes, it can make sense to pay a premium for a quality company that’s growing at a rapid pace. Although some investors doubtlessly believe that’s appropriate here, I’m still not quite convinced. The firm is definitely a quality operator, but shares are not yet cheap enough to warrant my money.

Be the first to comment