grandriver/E+ via Getty Images

As mostly a small-cap value investor, to say year-to-date 2022 has been eventful would be an understatement. Today, I decided to share a new nano-cap/micro-cap company, Sypris Solutions, Inc., with SA free site readers. This sure looks like a stock/company with a compelling setup for 2022. The company trades a reasonable valuation, has about $5 million of net cash, and has big revenue tailwinds in all of its segments. If you believe management’s FY 2022 guidance, then the stock is way too cheap at $2.30 per share (or roughly a $50 million market capitalization). Based on this guidance, I am modeling $0.28 in EPS for FY 2022.

Like so many nano-cap/micro-cap stocks, I would argue SYPR got swept up in the nasty November 2021 spin cycle, with shares down north of 40% from its early November 2021 highs through yesterday, February 24, 2022. Although on November 10, 2021, when Sypris reported its Q3 FY 2021 results, the company did walk back its raised full year FY 2021 revenue growth numbers, driven by persistent supply chain challenges. However, it appears that the big sell off in its shares, though, coincided with aggressive and widespread micro-cap/small cap selling that has taken place since the second half of November 2021 – February 24, 2022, as opposed to that guidance per se.

In other words, the market, perhaps driven by the algos, sniffed out it was a grand time to aggressively sell small caps and I noticed, at least anecdotally, frequent instances of capitulation throughout the micro-cap land/smaller small cap space. Let’s face it, a company with a $50 million market capitalization isn’t widely owned by big buy-side players, as it is too small and too thinly traded for them to be involved. Therefore, ownership of these type of stocks tends to be diffuse and share tend to be held by dare I say lower conviction owners, perhaps more sensitive to inherent volatility. In other words, it is very easy for the market to throw the baby out with the bathwater, even if the underlying fundamentals of a company are really strong.

What They Do

Sypris Solutions, Inc. (SYPR) has two segments: Technologies and Electronics.

Sypris Technologies is a supplier of forged or machined components for Class 8 trucks as well as manufacturer of specialized component in the oil and gas supply chain.

Sypris Electronics is manufacturer of components in the aerospace and defense industries.

(For reader that would like a more granular understanding of each segment, I share those details in the appendix section, which can also be found in Sypris’ 10-K.)

Q4 FY 2021 Guidance And FY 2022 Guidance

If you believe management’s guidance, then Sypris Solution should be able to generate $0.25 to $0.30 in EPS in FY 2022.

Enclosed below is the guidance (as of November 10, 2021).

Looking forward to the balance of 2021, we now believe that revenue for the year will increase 20% to 25% year over year, which is lower than our prior guidance due to the impact of short-term supply chain constraints on our business and that of our customers. Margins on the other hand are expected to increase 400 basis points to 500 basis points during the fourth quarter on a year over year basis, while cash flow from operations is still expected to post a strong double digit increase over the prior year’s performance.

We believe that this possible momentum will carry forward into 2022 with revenue forecast increase 25% year-over-year, margins are expected to create an additional 200 basis points or cash flow from operations is expected to once again improve materially when compared to that of the prior year.

(Source: SYPR’s Q3 FY 2021 conference call)

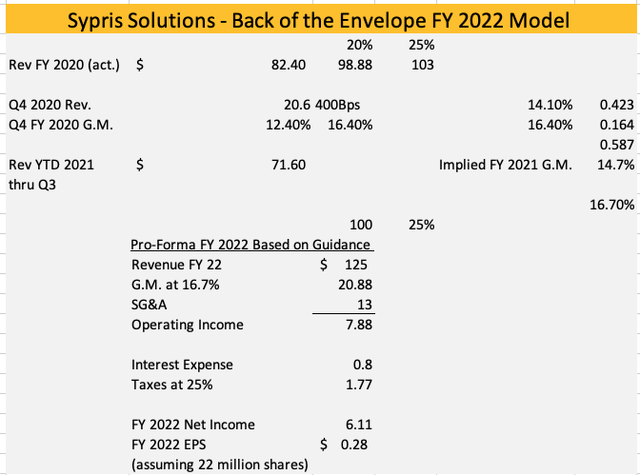

I built a very simple back-of-the-envelope model to translate what the guidance means when converted/translated into EPS.

This simply required going through Sypris’ 10-K and 10-Qs to get the actual prior values and gross margins and then just doing the simple math based on management’s guidance. Based on this, I arrive at pro-forma FY 2022 EPS of $0.28, for a stock that closed yesterday at $2.30 per share.

I would argue that a debt-free company with 25% revenue growth should trade at a market multiple, of say 18X to 20X EPS, at least in the short term. Naturally, to own the stock, you have to believe that this management team can deliver in FY 2022.

So a multiple of 18X x $0.28 in FY 2022 pro-forma EPS translates to a $5 stock price for Sypris, which would be more than double from yesterday’s closing price.

The FY 2022 Revenue Tailwinds

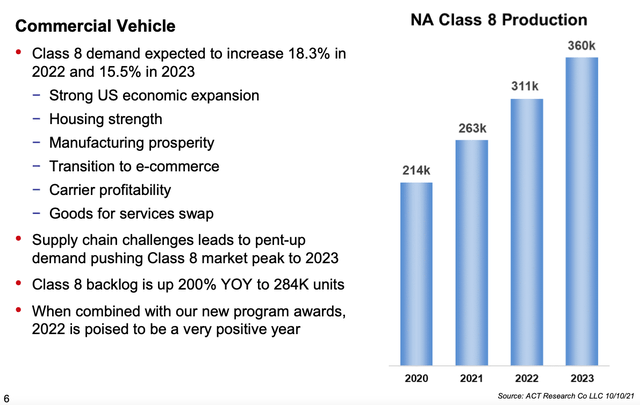

Class 8 trucking, its largest segment, can’t keep up the demand for new vehicles.

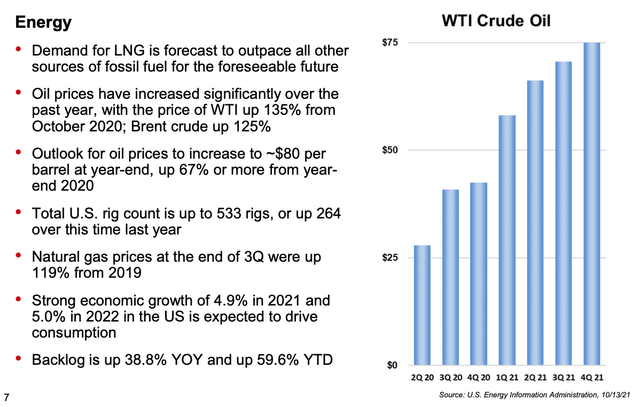

Within Sypris Technologies, there is the oil and gas sub-sector. Oil and gas prices are materially higher than in 2020, and the company’s backlog is up significantly.

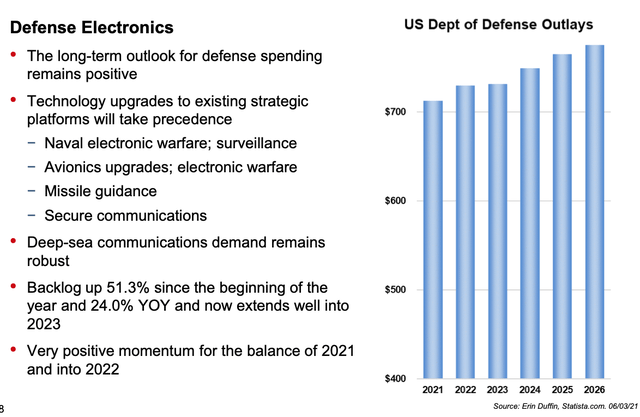

Sypris Electronics has a number of platforms that are gaining traction and this backlog is up nicely and extends into FY 2023.

Putting It All Together

The reason this opportunity exists is twofold 1) there has been widespread and aggressive selling, bordering on “capitulation type selling” throughout much of micro-cap/smaller small cap land (sub $500 million market caps.) and 2) historically, this is a company that has flat to inconsistent revenue growth, weak gross margins, and that historically is essentially an EPS breakeven type of company.

However, if you believe management’s FY 2022 guidance, then FY 2022 certainly looks like an inflection point. Back to back 20% + full year revenue growth and expanding gross margins means significantly more absolute gross margin dollars. These gross margin dollar then spread out over flat to flattish SG&A spending translates to material operating leverage and real EPS.

What gives me further confidence is the strong tailwinds that can be measured in the micro sense by management’s clear line of sight in the form of backlogs and in the macro sense by the strong demand signals for its two segments.

This sure looks like an under-the-radar and classic Second Wind Capital type of idea. I really like the setup here, and I am recommending shares of Sypris Solutions at $2.30!

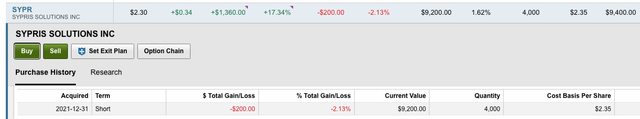

And for perspective, I sized this bet at 6% and have been patiently long shares since 12/31/2021 (see enclosed below).

Appendix:

The company’s description of its two segments from its 10-K.

Sypris Technologies:

“Through Sypris Technologies, we are a significant supplier of forged and machined components, serving the commercial vehicle, off-highway vehicle, recreational vehicle, automotive, industrial and energy markets in North America. We have the capacity to produce drive train components including axle shafts, transmission shafts, gear sets, steer axle knuckles, and other components for ultimate use by the leading automotive, truck and recreational vehicle manufacturers, including General Motors Company (GM), Freightliner LLC (Freightliner), Mack Truck, Navistar International Corporation (Navistar), PACCAR, Inc. (PACCAR), Volvo Truck Corporation (Volvo) and Bombardier Recreational Products (BRP). We support our customers’ strategies to outsource non-core operations by supplying additional components and providing additional value-added operations for drive train assemblies. We also manufacture high-pressure closures and other fabricated products for oil and gas pipelines.

Our manufacturing contracts for the truck components and assemblies markets are often sole-source by part number. Part numbers may be specified for inclusion in a single model or a range of models. Where we are the sole-source provider by part number, we are generally the exclusive provider to our customer of those specific parts for the duration of the manufacturing contract.

Sypris Technologies also manufactures energy-related products such as pressurized closures, insulated joints and other specialty products, primarily for oil and gas pipelines and related energy markets. This product line is an important source of diversified revenues and is becoming an area of greater focus for the Company going forward. We are committed to exploring new product developments and potential new markets, which will also be an increasing area of focus for the Company going forward.

Sypris Technologies represented approximately 55% of our net revenues in 2020.”

Sypris Electronics:

“Sypris Electronics generates revenue primarily through circuit card and full box build manufacturing, high reliability manufacturing, systems assembly and integration, design for manufacturability and design to specification, for customers in the aerospace and defense electronics markets. This includes circuit card assemblies for electronic sensors and systems including radar and targeting systems, tactical ground stations, navigation systems, weapons systems, targeting and warning systems and those used in the nation’s high priority space programs.

We provide our customers with a broad variety of value-added solutions, from low-volume prototype assembly to high-volume turnkey manufacturing. Our manufacturing contracts for the aerospace and defense electronics market are generally sole-source by part number. Our customers include large aerospace and defense companies such as Northrop Grumman Corporation (Northrop Grumman), L3Harris Technologies (L3Harris), Collins Aerospace Systems, BAE Systems (BAE) and Analog Devices, Inc. (ADI). We serve as a subcontractor on U.S. government programs and do not serve as a prime contractor to the U.S. government.

The engineering and manufacturing of highly complex components for the aerospace and defense industries is a fragmented industry with no dominant player in the market. The industry has continued to grow with more companies developing printed circuit board assembly capabilities and others entering the market via mergers and acquisitions of smaller companies. This competitive business environment, along with the impact of federal government spending uncertainties in the U.S. and the allocation of funds by the U.S. Department of Defense has challenged Sypris Electronics over the past several years.”

Be the first to comment