Smederevac/iStock via Getty Images

Investment Thesis

Syneos Health (NASDAQ:SYNH) was formed via the merger of 2 Contract Research Organisations (“CROs”) with complementary businesses, INC Research and inVentiv Health in 2017, and although it took some time for the new company to find its feet – shares traded within a range of $40 – $60 between mid 2017 and late 2020 – its valuation blossomed between September 2020 and December 2021, rising from $52, to $103, for a 98% gain.

Since the turn of the year, however, Syneos stock has been sliding, falling to a value of $79 at the time of writing, and meaning that the overall share price gain over the past 12 months is just +5%.

There does not seem to be much wrong with Syneos’ financials – the company released its FY21 earnings in mid February, showing top line revenue growth of 18%, to $5.2bn, and a 22% increase in GAAP net income to $235m, for EPS of $2.24, and a PE ratio of 35x. Forecast revenues for FY22 are for $5.6bn – $5.75bn, up 7-10%, and net income of $281 – $300m, up 20-28%.

The $8.2bn market cap company does not pay a dividend, so the investment case in relation to Syneos is really about 2 things primarily – whether the share price can recapture or even exceed former highs, offering investors a >30% upside opportunity, or whether the company could become an acquisition target for one of its CRO rivals.

Rumors had been swirling that LabCorp (LH) – with a $25.5m valuation, the biggest CRO in the industry by market cap – had approached Syneos last November about merging its Covance Clinical Research division, with Syneos management taking over its day-to-day management. Syneos denied that talks had taken place, however, although back in March 2020, it was rumored that management were looking to sell the business.

In the rest of this article, I’ll consider Syneos the business in some more detail, and speculate more about the company’s growth prospects, M&A activity, and whether the company may be able to reward investors with wider profit margins, to match its impressive price to sales ratio of 1.6x.

Given the state of the public biotech sector presently, which is suffering a bear market so bad that most pre-revenue companies have seen valuations by at least 50% over the past 12 months, Syneos to me represents a safe-haven stock, since there are no shortage of newly IPO’d, cash rich biotechs spending hundreds of millions per annum on the drug development and clinical trial process, whilst larger and more stable commercial stage pharmaceuticals also have significant funds to spend on commercialisation efforts as markets get even more competitive.

Both of these scenarios play into the hands of a company like Syneos, plus there is the possibility of Syneos being acquired at a substantial premium to current value, whilst the downside risk seems to be mitigated by the strong top line revenue generation, and profitability.

That is why I would be tentatively bullish on Syneos and can see the stock climbing back towards a triple-digit value over the course of the next 18 months.

Syneos Overview & Performance

Syneos operates 2 business divisions, which are Clinical Solutions and Commercial Solutions. Broadly speaking, Clinical Solutions takes care of the clinical trial process, Phases 1 (safety and tolerability) through 4 (post-marketing studies), providing “bioanalytical services, workforce deployment, full-service clinical studies, real world evidence, and consulting”, whilst Clinical Solutions provides “commercialization services, including deployment solutions, communication solutions (public relations, advertising, and medical communications), and consulting services.” (Source: Syneos 10K submission 2021).

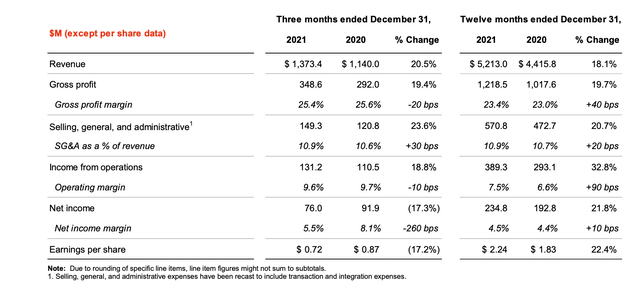

Syneos Q421 and FY21 income statements. (earnings presentation)

As we can see above, and as mentioned, Syneos has a strong year in 2021, driving $5.2bn of revenues, its highest figure since the merger. It should be noted, however, that operations were severely impacted by the pandemic in 2020, with revenues falling from $4.7bn, to $4.4bn between 2019 and 2020, so the outperformance in 2021 is perhaps a little overstated by these results.

It is also worth noting the difference between income from operations of $389m – margin of 7.5% – and net income of $234.8m – margin of 4.5% – which I would put down to the fact that Syneos is fairly indebted, to the tune of $2.84bn. Paying off this debt eats into the funding available for e.g. R&D. staff wages, money for M&A etc. which in a competitive marketplace for CROs, puts Syneos at a slight disadvantage.

For context, LabCorp’s PE ratio is just 11x, net profit margins are 15%, and EPS is $24.6, although these are comfortably the best in the sector. ICON PLC (ICLR), for example, has a PE of 80x, and net profit margin of just 2.8%, although Icon is still integrating its recent acquisition of PRA Health Sciences.

Icon also reported current assets of $1.8bn as of Q421, so although not great news for investors, Syneos’ debt ought not to be too much of a strain on its drive for greater profitability in the long run.

M&A In The CRO Space Is Common – Is Syneos A Genuine Target?

A company born out of a $4.6bn dollar merger just under 4 years ago is unlikely to be afraid of further consolidation Syneos made 2 acquisitions of its own in 2021, completing deals for StudyKIK, a leading clinical trial recruitment and retention company, and RXDataScience, a data analytics and management company, for undisclosed sums, and in 2020, completed the acquisition of Synteract Health, a 700 employee company involved in ~4k clinical trials and 26k trial sites globally, again apparently for an undisclosed sum.

At a more macro level, Icon’s ~$12bn merger with PRA Health has seen it jump from a $10bn market cap challenger to LabCorp, to a $19bn market cap (at the time of writing) enterprise competing at a similar size and scale.

More recently, biotechnology products and services giant Thermo Fisher (TMO) agreed to purchase PPD Inc., a provider of clinical and research services, for $17.4 billion, according to Bloomberg, whilst Goldman Sachs agreed to purchase Parexel International Corp. for $8.5 billion. My belief is that this confirms the attractiveness of the CRO sector, which combines consultancy with patient recruitment and drug development expertise – a heady and lucrative mix with relatively high barriers to entry, and whilst biotechs suffer when their drugs fail, CRO’s still collect their fees.

Could Syneos therefore be an M&A target in 2022 or 2023? A merger with Charles River Laboratories (CRL) might be interesting, since Syneos and CRL are similarly sized today as Icon and PRA Health were when they merged, and that would create 3 industry giants consolidating a traditionally fragmented sector.

Charles River has been performing exceptionally well for investors, growing its share price by >200% over the past 5 years, and growing its revenues to $3.5bn, but in the last year its stock has been less successful, trading broadly flat. Could this be an optimal time for a merger, when both Syneos and CRL’s valuations are at a significant discount to a few months’ previous?

Private equity is another potential M&A opportunity for Syneos – this route may also provide a cash injection to help the company clear its debts and make further acquisitions of its own. And finally, LabCorp, which is based in North Carolina, as Syneos is, may appreciate the opportunity to put distance between itself and Icon in terms of size and scale, and reestablish itself as the major player in its market.

It may help that Syneos’ Chief Development Officer Michael Brooks, who joined in November 2021, was formerly President & Global Head, Clinical Development & Commercialization Services at LabCorp. Alternatively, that could be the reason why the Covance merger rumors surfaced in the first place – Brooks was heavily involved with Covance, apparently – and may have led the medic to jump the gun.

Clients & Client Retention Are Key To Success In CRO – Where Does Syneos Stand

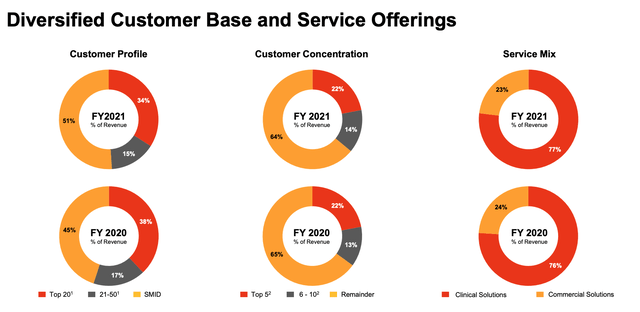

Apparently, when INC Research and inVentiv merged to form Syneos, INC worked mainly with small and mid-sized pharma companies, whilst inVentiv worked mainly with the top 20 biopharmaceutical companies.

Syneos has its own ad agency – GSW-NY which was formed shortly after the merger and caters to Pharma giants such as AbbVie (ABBV), Eli Lilly (LLY), Roche (OTCQX:OTCQX:RHHBY) and Amgen (AMGN), and has experience dealing with a number of blockbuster drug. With that said, the Commercial Solutions Division of Syneos is responsible for just ~23% of Syneos’ revenues, with Clinical Services earning the remaining 77%.

Syneos recently announced a 3-year deal with Pfizer (PFE), with a possible further 2-year extension, to “deliver global product development solutions to support Pfizer’s portfolio”, and my guess would be that the company needs to secure more deals with major Pharmas to ease investor fears over the biotech bear market, and whether working with smaller biotechs has become too risky as their valuations are falling so rapidly, jeopardising their ability to raise funds, and perhaps even pay their clinical trial bills.

The problem here is that CROs are notoriously cagey about revealing who they are working with. Icon, for example, has revealed that its 5 biggest clients contributed ~41% of its revenues in 2020, without specifying who they are. Syneos similarly doesn’t discuss which clients it may be working for, but does seem to have a more diversified mix than e.g. Icon, as we can see below.

Syneos Customer base. (earnings presentation)

It seems that Syneos does have quite significant exposure to the smaller biotech end of the market, which implies more risk, and possibly makes it harder for it to cement a reputation for managing successful, as opposed to unsuccessful trials. Most companies would clearly prefer to work with a CRO whose track record of clinical trial success is strong.

Syneos doesn’t discuss its trial success rate (as far as I am aware), but ultimately, its level of expertise, size, and experience, and charges, are likely a more important factor for biotechs to consider than overall success rate, and Syneos, so far as I can tell, is a Top 5 CRO in a market where I suspect demand exceeds supply.

Conclusion – M&A May Not Happen In 2022 But Syneos Ought To Recover Lost Value, Offering 20-30% Upside Opportunity With Mitigated Downside

I hope the above analysis has been informative / instructive for readers and I have made the reasons for my bullish take on Syneos Health clear, whilst making some of the risks clear.

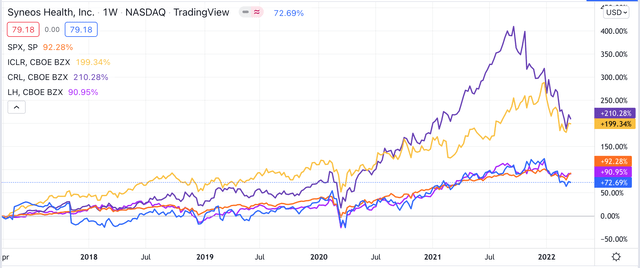

A quick look at the share price performance of the major CRO players helps to make the investment case and risk even more transparent.

Share price performance of SYNH, CRL, ICLR, LH – past 5 years. (TradingView)

Share price performance of SYNH, CRL, ICLR, LH – past 5 years.

Over the past 5 years, we can see that CROs have performed universally well, with the performances of Charles River and Icon especially notable.

Since the beginning of 2022, however, we can see a pronounced dip in stock price performance, and over the past 12 months in fact, only Icon shares have gained more than 10% – +29% for the period.

It may be that the market expected greater outperformance in 2021 after the pandemic headwinds of 2020, and better outlooks for 2022. It could also be the biotech bear market increasing the risk of CROs business models, or it could be some other factor, but I suspect that the correction may be temporary, and that growth will begin to characterize the sector again.

In Syneos Health’s case, I do think that the company may be open to a sale, and conclude that Lab Corp may be the best partner for a merger or buyout, which represents a major upside opportunity for investors.

I am not sure that anything will happen in 2022, but that is not necessarily a negative, as it will give Syneos the opportunity to deliver another solid year of top-line – +10% – and bottom line – +20-30% – growth, with the bottom line growth especially welcome, hinting at an easing of the debt burden and a higher EPS figure for investors.

The biotech bear market also disguises the fact that the sector is not slowing down, with more and more biotechs joining the public markets on the back of high double digit or even triple digit private funding rounds, so there is plenty of cash available in that market still for CROs to benefit from.

The fact that this fact may be hidden somewhat from casual market observers, the M&A rumors, and Syneos’ solid performance all give me hope that the company is more likely to regain prior share price highs of >$100 than lose value in 2022, hence I am taking a bullish stance.

Be the first to comment