KateJoanna/iStock via Getty Images

Thesis

Any day now, Synaptogenix (NASDAQ:SNPX) will release data on its randomized placebo-controlled trial for Bryostatin-1 for Alzheimer’s disease. Earlier Phase 2 trials had failed to show statistical significance, for different reasons, but the company took lessons from it.

Bryostatin-1’s mechanism of action is unique and mostly relates to the function of synapses.

There is a likelihood that Synaptogenix will now report success. Success would be in line with earlier animal reporting, and if we were to believe the company, could show much more than 27% slowing of cognitive decline.

There is little to discredit the chance that Bryostatin-1 may have some effect in Alzheimer’s disease as well as in the other indications targeted by the company.

In case of success, I expect the market to react to the news in a rather drastic manner. The company’s current market cap is less than $40 million at this point, which is much lower than any other Alzheimer’s play I consider of serious interest.

I advise readers to take a look at the financial section in this article as well.

Company

Introduction

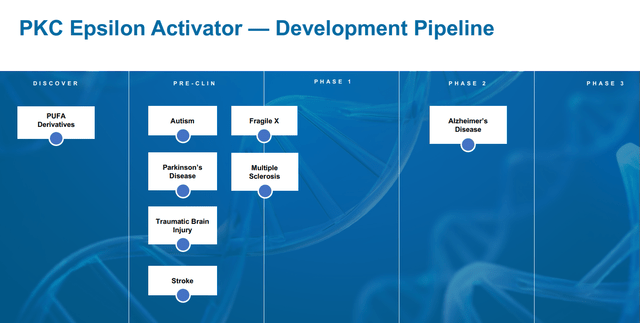

Synaptogenix, previously Neurotrope, has one drug candidate, Bryostatin 1, a PKCε agonist which it would like to see approved in different neurodegenerative indications.

Bryostatin pipeline (Corporate Presentation)

The previous analysis of Synaptogenix on this website from the hand of Seeking Alpha contributor Small Pharma Analyst is more than a year old. In that well-balanced and highly informative analysis, the author had estimated the chances of statistically significant success for Synaptogenix at 25%. Since that article, the company’s shares dropped another 55%, which seems in line with a more general rather indiscriminate inflation-related biotech sell-off we have seen over the past year.

Bryostatin-1: an introduction

Bryostatin-1 is a drug candidate that has been tested amply for the treatment of various cancers, but despite showing some efficacy, never proceeded to a Phase 3 trial. It is still in trials for HIV/AIDS. Clinicaltrials.gov lists about 40 different trials with the drug in different indications. Synaptogenix is testing this drug in neurodegenerative diseases.

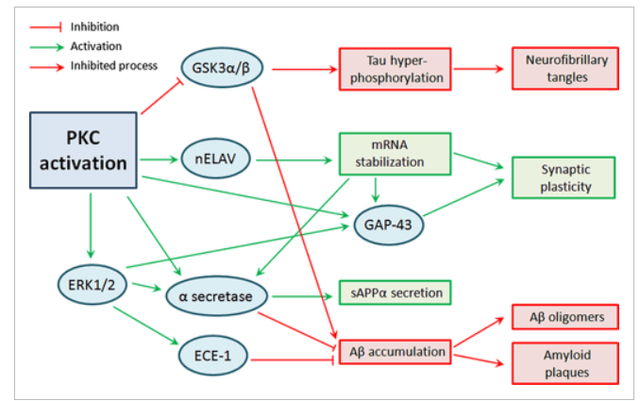

Bryostatin is a PKCε agonist. Protein Kinase C has been considered to be involved in memory and learning, as well as in signaling pathways involved in amyloid and tau.

PKC activation pathways (Wiley Online Library – link to article above)

Restoration of cognitive functions due to Alzheimer’s-related pathophysiologic processes such as amyloid beta oligomers, tau hyperphosphorylation, neuroinflammation, oxidative stress, loss of different growth factors and mitochondrial dysfunction could be achieved by activating endogenous repairing/regenerating mechanisms that are synaptogenic and prevent neuronal death. PKC is reduced in patients with Alzheimer’s disease. Acetylcholinesterase inhibitors, which are the current standard of care for Alzheimer’s disease, apparently act by increasing signalling through muscarinic acetylcholine receptors M1 and M3. In so doing, they would apparently also activate PKC.

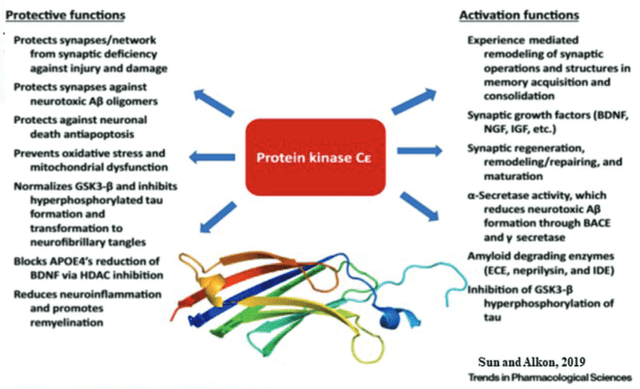

Bryostatin functions (Sun, Alkon, Trends in Pharmalogical Sciences)

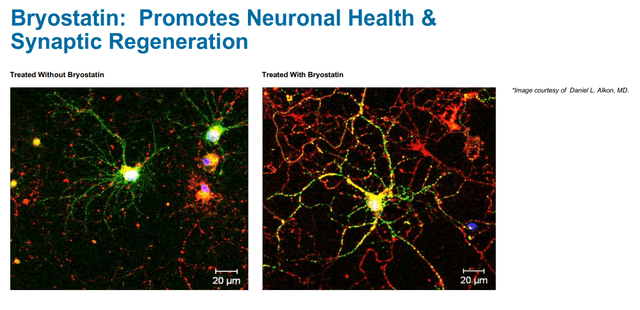

Preclinical studies have shown that the drug may be beneficial in restoring synaptic connections. The drug was shown to restore learning and function in different neurodegenerative disease models. Synaptogenix systematically refers to this slide in that regard.

Bryostatin effect on synapses (Corporate presentation)

Bryostatin-1 has been shown to reduce levels of Aβ, improve behavioral outcome, restore synapses via synaptic growth factors, prevent memory impairment, preserve learning and memory ability, be neuroprotective and improve survival rate in different neurodegenerative animal models.

Bryostatin-1 for Alzheimer’s disease

Three earlier Phase 2 trials

The different previous trials in other indications have allowed the company to skip Phase 1 trial testing and directly run a Phase 2 trial. One may read below why this may have actually led to a failed trial designs in the past.

Two earlier Phase 2 trials showed Bryostatin-1 to be potentially efficacious in pre-specified cohorts with advanced Alzheimer’s disease who are not on memantine, without serious side effects. This efficacy involved improvement of 4.0 points on the Severe Impairment Battery rating scale.

As a reminder, the bar is not that high in my opinion. If Synaptogenix can show similar results as Eisai’s (OTCPK:ESALY) Lecanemab namely a 27% percent slowing of cognitive decline, then interesting things could happen here. Logically, any improvement let alone an improvement in the range of four points over six months on a scale where the market gives multi-billion dollar value to a -0.45 difference over the course of 18 months as well as to companies that could potentially outperform that could be of great value.

Results from the earlier Phase 2 trials

A first Phase 2 trial was in only 9 patients at 20 µg per dose and showed an increase in MMSE score of 1.83 points for the treated cohort, 3 hours after the end of infusion.

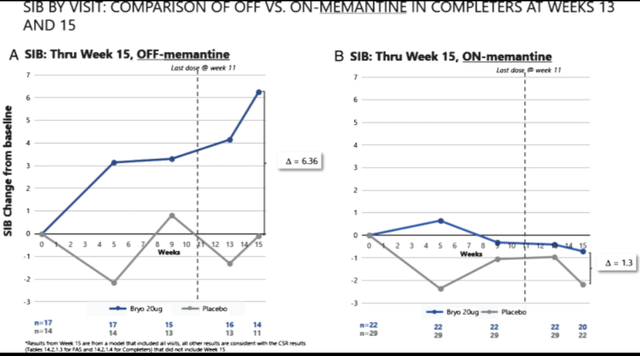

A second Phase 2 trial in Alzheimer’s was in 147 people with MMSE scores between 4 and 15, to be treated with 20 or 40 µg Bryostatin or placebo over the course of 11 weeks. Results showed that the 20 µg dose had a similar dropout rate as placebo, but there was a significantly higher dropout at the 40 µg dose. Adverse events reported were diarrhea, headache, fatigue and weight loss. The study could not report efficacy in the fully patient population, but there was an increase on the severe impairment battery rating scale – suggesting improvement – in the 20 µg dose. A further analysis, which had been prespecified, showed that the improvement only occurred in people who were not on the NMDA-agonist memantine. That improvement was statistically significant (p=0.05).

Second Phase 2 results (Journal of Alzheimer’s Disease)

And 30 days post treatment, the effect seemed to continue versus placebo patients declining. That trend could be interesting.

Second Phase 2 results (Journal of Alzheimer’s disease)

For reference, memantine or Namenda is an NMDA glutamatergic receptor blocking drug, and is part of the current standard of care for patients with Alzheimer’s. Its mechanism of action is different to acetylcholinesterase inhibitors, also standard of care, but it has a similar not disease-modifying effect.

Given the efficacy signal seen in these trials, the company decided to continue the trial, but to exclude patients on memantine. That should have paid off in principle, but again the trial failed to achieve statistical significance.

The third trial was in 108 patients with a 20 µg dosing regimen or placebo, over the course of 13 weeks. The patients who would receive the drug were divided in two groups, having either MMSE scores of 4-9 or 10-15. The trial again showed no statistical significance. However, this time a post-hoc analysis suggested that patients in the MMSE 10-15 group had improved more than their placebo counterparts, who also improved. The company decided to dig deeper into the data and reported three interesting points:

– a significant imbalance (4.8 points) in the baseline SIB scores, by chance, between the Bryostatin-1 treatment group and placebo group;

– a clear signal of benefit in the raw data from the pre-specified patients with MMSE 10-15 scores;

– when using each patient as his/her own control, for the group with MMSE baseline scores 10-15, a statistically significant improvement over baseline of 4.8 points at week 13 for Bryostatin-treated patients.

Peer-reviewed publication: statistically significant improvement over baseline

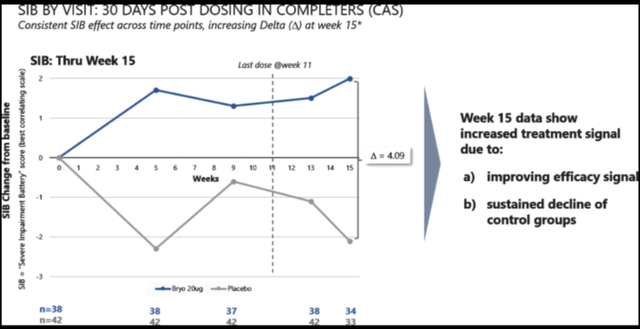

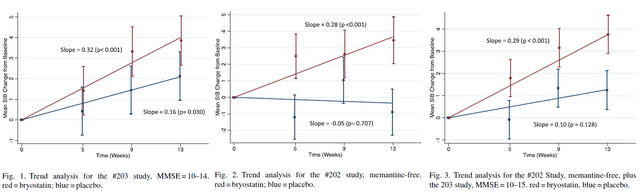

On February 1, 2022, Synaptogenix announced the publication of the peer-reviewed article in the Journal of Alzheimer’s Disease. That publication in essence combines data from both last Phase 2 trials, after statistical analysis and a pooled testing of identical pre-specified cohorts. The results were a highly significant (p<.001) benefit of Bryostatin-1 treatment over the course of 15 weeks. Results have also been included in a poster.

The pre-specified cohort was the group of patients not receiving memantine, as Bryostatin-1 phosphorylates and regulates the NMDA receptor. The analysis takes into account the chance baseline imbalance of 4.9 points on the Severe Impairment Battery rating scale in favor of the placebo group in the latest study. I’ve joined the images of the publication together for better comparison.

Slides peer-reviewed publication (Journal of Alzheimer’s Disease)

The goal of the analysis was to consolidate results from both trials with a pooled analysis and a GEE trend analysis that measures drug benefit as a function of successively increasing numbers of trial doses that included weeks 5, 9, and 13, to avoid potential bias due to baseline imbalance. The analysis showed that patients with MMSE scores in between 10 and 14 who did not receive memantine showed statistically significant improvement on the SIB scale of 4.0 points above baseline.

Current Phase 2 trial: expected topline data in the current quarter

Trial design

Synaptogenix’ fourth Phase 2 trial in AD is a six-month randomized and placebo-controlled study in moderately severe Alzheimer’s patients with MMSE scores of 10-18 at baseline, who are not taking memantine. The primary endpoint at 28 weeks is the SIB scale. Patients will not be on the drug for six months straight, but will receive 7 doses of 20 µg bryostatin or matching placebo during the first 12 weeks, then there is a 30 day interval to assess persistence of the drug’s action, and then a second 7 dose course will start for the rest of the trial duration. Assessments on the Severe Impairment Battery rating scale will be made at regular intervals during the 28-week study as well as 4 months after the final dose. The primary endpoint is the total SIB score assessment obtained at Week 28, following completion of 2 courses of treatment. Randomized enrollment has, this time round, been controlled for balanced baselines in the treatment and placebo cohorts.

Safety

No adverse safety issues have been seen so far. Synaptogenix also informed investors that Bryostatin-1 treatment has been extended to include double the number of doses. Patients will have been observed for as long as three months after all dosing cessation given the persistence of benefit that had been seen in earlier studies.

Completion

The trial itself mentions November 2, 2022 as estimated completion date. Synaptogenix has announced that it plans to announce topline data during the current quarter of 2022, and the company is optimistic about the trial’s potential to:“[…]reflect the same or greater benefit already observed for patients in identical, previously treated pre-specified cohorts in our previous Phase 2a pilot trials. […] Benefits of at least 4.0 SIB scores, above baseline, are likely to be clinically meaningful, and therefore have the potential to treat the underlying disease as well as to provide symptomatic relief.”

Defining success

As mentioned above, the bar for success in Alzheimer’s disease at this time is much lower than improvement. ‘Success’, as I would define it in light of recent data from Eisai, would be doing equally as good as a 27% slowing of cognitive decline. This would represent a 0.45 change compared to normal decliners on the Severe Impairment Battery rating scale. To put that into context, though I have not found a clear number of average decline in AD patients on the SIB scale, I did find numbers of average decline of in between 0.82 and 1.41 points over the course of six months on the short version of the SIB scale. This may give an indication of how Alzheimer’s patients normally progress.

For reference, Synaptogenix’s earlier results, in the moderately affected population that has been focused on, was about a 4-point improvement over baseline over the course of 3 months. The fact that effects are stronger in less-evolved populations is something that is repeatedly seen in Alzheimer’s trials. It appears that, once a certain stage has set in, there is little to be repaired. Synaptogenix considers that results could further improve with time.

Initiation of a dose-optimization study

On July 20, 2022, Synaptogenix has announced that it would start dosing in an additional dose optimization trial. The consideration here was that although the current 20 µg dosing has been found to produce ‘clear cognitive improvement over baseline’, the trial serves to optimize the extent and duration of benefits with the goal to be well positioned to conduct a registration study and to enter the clinic as soon as possible. I understand that approach given the fact that dosing with Bryostatin-1 may be tricky. A dosage that is too low may not lead to any PKC activation, which occurs at a range of 0.2-1.0 nM, but not above apparently.

Share price potential

About 6.2 million people suffer from Alzheimer’s disease in the U.S. alone. The epidemic of Alzheimer’s disease is growing and by 2050, the above number is predicted to increase to approximately 14 million. The Alzheimer’s therapeutics market is valued at $ 4 billion, and is expected to expand at a compounded annual growth rate of 16 % from 2022 to 2030.

In light of its unique mechanism of action, I am liking what this drug has shown so far, yet remain cautious. In the previous analysis by Small Pharma Analyst, he reasoned that good results here could see the price go up a $1 billion market cap. I agree with that analysis. Recently, Maxim’s Jason Mc Carthy has started covering the stock with a price target of $14, which is about 170% up from the current price.

One could criticize Synaptogenix and consider that it has been cherry-picking data. However, the improvements that have been reported seem quite strong and have led to statistically significant results in a prespecified patient population. The failed trials could be a result of flawed trial designs which may have been avoided had the drug been studied more in neurodegenerative models before starting clinical trials, and perhaps some bad luck with an improving placebo patient population in the latest trial. The amount of amyloid-targeting studies having failed is in any case many times higher, and in the end, these have led to moderate successes too.

Bryostatin for Fragile X

Synaptogenix also pursues treatment of Fragile X, has received Orphan Drug Designation for this disease, and has partnered with Nemours A.I. DuPont hospital to initiate a trial in this indication. Fragile X syndrome is marked by intellectual disability and is the leading monogenetic cause of autism spectrum disorder, for which there is no drug treatment at this time. There is preclinical work in autism models suggesting potential success here too. In autistic mouse models, the drug had shown very limited benefit over a 5-week period of treatment, but 13 weeks of treatment showed rescuing of autistic and non-spatial learning deficit cognitive phenotypes. At that time point, the drug also showed reduction of hyperactivity, normalization of nesting behavior and marble burying behavior, with no evidence of tolerance.

The drug’s effect appears to be different from other treatment strategies tested to date, in that the drug shows little acute effect, but strong long-term effects.

However, despite the above, there is not much apparent trial progress. Several other treatment candidates are further advanced for the treatment of Fragile X, such as Zygel from Zynerba Pharmaceuticals (ZYNE). Most of these potential treatments are psychedelics-related, but one of them is Trofinetide from Acadia Pharmaceuticals (ACAD), which is also a late-stage drug candidate for Rett Syndrome.

Bryostatin for multiple sclerosis

On February 23, 2022, Synaptogenix has also announced its plans to develop Bryostatin-1 for the treatment of synaptic loss and cognitive dysfunction in multiple sclerosis, in a collaboration with the Cleveland Clinic. Synaptogenix will develop a protocol together, after which a clinical trial can be started.

Further recent events

A particularly impressive Scientific Advisory Board

On July 26, 2022, Synaptogenix announced changes to its Scientific Advisory Board in preparation for Phase 2 data. That board is chaired by Dr. George Perry, known for his work on oxidative stress in the field of Alzheimer’s disease and editor-in-chief of the Journal of Alzheimer’s disease. The other persons on that board are Prof. Dr. Marwan Sabbagh, Prof. Dr. Paul Coleman, Professor Robert Howard, and Dr. Zaven Khachaturian. This is a particularly remarkable panel of scientific advisors for such a small company.

Additional preclinical work

On April 5, 2022, Synaptogenix announced a further publication of a peer-reviewed article in Frontiers in Aging Neuroscience, showing Bryostatin-1 to stabilize decline in mic with deficient vascular micro-vessels as also seen in Alzheimer’s patients. The treatment stabilized the decline and led to a quantitative increase in new blood vessels.

Ownership

Synaptogenix has a float of 6.3 million shares and an average volume of 61,000 shares.

Insiders own 7.54% of the company, while institutional ownership stands at 10.04%. Short interest is at 4.41%. The latest insider purchases date back to June 14, 2021, at which time director Joshua Silverman had bought 10,000 shares for a total value of 83,000 USD and chief scientific officer Daniel Alkon had bought the same amount of shares, respectively at prices of $8.3 and $8.26.

Financials: Cash Burn, Options, Preferred Shares

At the end of the last quarter, Synaptogenix had a cash position of $28.7 million and zero debt. Its yearly cash burn is $9.1 million. On that basis, operations could continue for somewhat less than three years. However, that cash burn is very moderate compared to other biotech companies. As trials may intensify – as announced – and success could be imminent, I would expect the company to raise cash at some point in the coming year to advance further trials in a perhaps more expedited manner.

Recent sec filings, as amended, have shown that a considerable number of options have been acquired by people at Synaptogenix recently. The initial filings were for about 683,000 shares, which means this is huge. The price of execution is $6.07. The current share price is about $5.

Recently also, the company announced financing of $15 million through the filing of a series B convertible preferred stock. The price of these convertible preferred shares is $1,000, initially convertible into up to 1,935,485 shares of common stock at a conversion price of $7.75 per share, which was about a dollar above the stock price at the time of the announcement. Synaptogenix should redeem these preferred shares in 15 equal monthly installments, commencing on April 1, 2023. Holders of these shares are entitled to dividends of 7% per annum. Warrants to acquire up to an aggregate of 1,935,485 shares of common stock were issued simultaneously. The announcement mentioned that Synaptogenix’ balance sheet has been strengthened by that amount prior to readout of the Phase 2 trial results. This entire financial construction is difficult to read, however, and I could not find confirmation that payment of this amount has actually taken place already. I am a bit wary of this information. Ben Graham has taught me to thread with caution when confronted with these constructions, and as this one is recent, I wanted to make readers attentive to this.

Risks / Competition

The typical risk of investing in a biotech company is potential failure in trials, which is very much present here. Given the multifactorial nature of Alzheimer’s disease, I see an added risk in trials which do not focus on the patient’s underlying biology, which may lead the trial to have non-responders. It is unclear to me whether all of the Alzheimer’s patients have reduced PKC levels, or whether that’s a mean for the entire Alzheimer’s group.

Furthermore, it is hard for me to consider the possibility at this time that Bryostatin-1 could seriously restore cognition in the long term by itself.

Another risk comes from the floor effects as often seen in the SOB or other rating scales. Though this scale is being used by other parties, it has also been known not to be very precise at times.

There is the additional risk of competitive threats, coming from companies such as Biogen (BIIB), Anavex (AVXL), Cassava Sciences (SAVA), INmune Bio (INMB), BioVie (BIVI) or others. I have highlighted potential successes from different companies in the field of neurodegenerative diseases in other articles. The Alzheimer’s space seems to have gained some momentum again.

Conclusion

Synaptogenix plans to report topline data from its fourth Phase 1 randomized placebo-controlled trial in Alzheimer’s disease in the current quarter. That trial has been designed with lessons taken from earlier trials.

Bryostatin-1’s unique mechanism of action, with quite some safety and also efficacy data to build on, could play in its favor. Bryostatin-1 could be one additional therapy for the treatment of Alzheimer’s disease, when the world may need several. With a market cap of less than $50 million, the market is pricing in no chances of success, which is contrary to how the company has presented its data so far. The company has assembled an impressive panel of scientific advisors ahead of the upcoming readout.

The trial does come with some risks, such as those related to the lack of focus on patient subgroups, possible floor effects related to the measuring scale that is being used, and increasing competitive threats now and in the coming years. In case the trial fails yet again, without the company having another drug candidate in its pipeline, further downside is to be expected.

For all the above, though I am bullish on the science and trial design, I will rate the company as a hold, awaiting the data.

Be the first to comment