David Becker/Getty Images News

Thesis

Sony (NYSE:SONY) (OTCPK:SNEJF) is one of my most favored stocks and since I have initiated coverage with a Buy recommendation, Sony shares are up by about 6%. However, following the company’s Q1 results, I turn more cautious on Sony. Although Japan’s leading tech/entertainment group has delivered an overall strong performance, the company surprised with a lower FY 2022 guidance. Moreover, Sony’s Gaming & Network System segment, one of the group’s flagship business units, strongly disappointed the market, including my personal expectations.

That said, while I continue to support a $116.67/share target price long-term, I lower my recommendation from Buy to Hold on a challenging short- to mid-term macro and business outlook.

Given macro-challenges, Sony management stated:

In addition to the Entertainment, Technology & Services (“ET&S”) and Imaging & Sensing Solutions (“I&SS”) segments, which have a relatively high degree of sensitivity to changes in the macro environment, we are paying close attention to changes in the business environment of all our segments including Game & Network Service (“G&NS”), Music, Pictures and Financial Services, and we are taking steps to mitigate risk when managing our business.

Sony’s Q1 Results

The Good

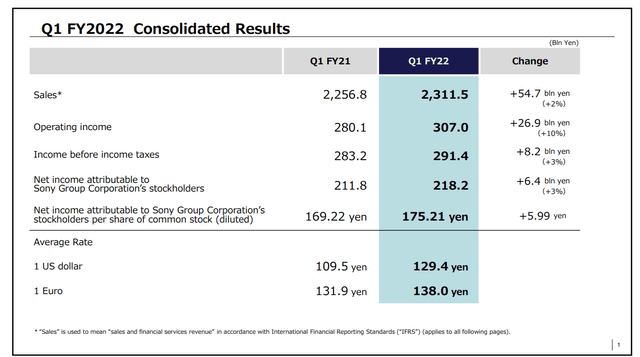

During the period April to end of June, Sony Group’s consolidated revenues increased by about 2% as compared to the same period one year prior, up to 2.3 trillion yen. Respectively, the group’s total operating income increased by about 10% to 307 billion yen. Most notably, both metrics indicate an absolute record for Sony group and highlight that the company is steadily growing and accumulating value — after decades of performance. Sony’s net income attributable to shareholders was recorded at about 218 billion yen, which represents a 3% year-over-year increase.

Sony Investor Presentation Q1 2022

The Bad

Sony forecasted that for the full year 2022, the group is estimated to generate total revenues of about 11.5 trillion yen. This is about 100 billion yen (less than 1%) higher than management’s previous guidance. The company lowered, however, operating income guidance, which is now estimated at 1.110 billion yen for the year, down by about 50 billion as compared to the previous forecast. In that context, Sony noted macro-headwinds and a weaker yen as the main negatives.

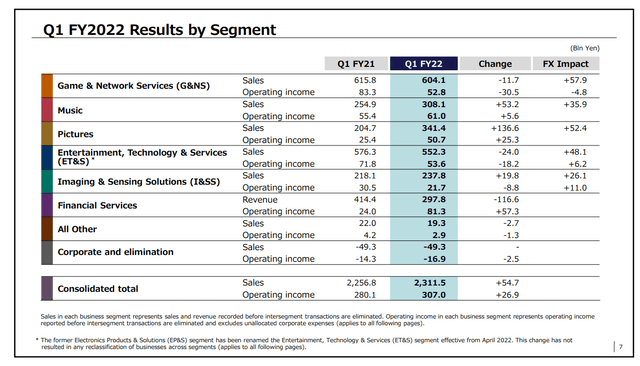

Sony Investor Presentation Q1 2022

Moreover, Sony’s Game & Network Services unit, which accounts for about one quarter of the group’s total sales has experienced a significant slowdown in Q1. G&NS total sales decreased by about 2% year over year to 604 billion yen. Although the company noted favorable currency exchange rates as a tailwind, Sony experienced a ‘decelerating engagement’ in gaming. Most notably, total gameplay time for PlayStation users decreased by about 15% in Q1 as compared to the same period one year prior. And the company highlighted that engagement has been much weaker than anticipated.

That said, Sony recorded a ‘significant’ 30.5 billion yen drop in operating profit for the G&NS segment, down to 52.8 billion yen. The segment was squeezed by both lower software/gaming sales and higher content and game development costs. What’s more, Sony also lowered the FY 2022 outlook for the G&NS segment, given that:

The overall game market has recently decelerated as opportunities have increased for users to go outside due to a reduction in COVID-19 infections in key markets.

Implications & Recommendation

Overall, Sony Q1 performance beat analyst consensus estimates, but the company disappointed the market with respect to guidance. Given the group’s negative performance and outlook for the gaming segment, which is one of the company’s flagship business units, Sony shares traded about 3% lower following the announcement, indicating that the company missed buy-side expectations.

Following Sony’s Q1 results, I too turn more cautious on the company’s stock. While I continue to support the thesis that Sony is poised to be a long-term winner, surfing on the accelerating demand for gaming, entertainment and the metaverse infrastructure/technology, I see mid-term. I see short-to mid-term challenges for the group. Amidst slowing consumer confidence and multi-dimensional macro-headwinds, Sony is likely to face a few difficult quarters. As stated by Hiroki Totoki, Sony’s Executive Deputy President and Chief Financial Officer:

With the large-scale and rapid changes in the business environment this fiscal year, the risks and issues that need to be addressed are wide-ranging and diverse.

That said, while I continue to support a $116.67/share target price, given long-term revenue growth and value accumulation, I lower my Buy recommendation to Hold – as I do not see that Sony will reach my target price within the next 12 – 18 months.

My coverage initiation article: Sony Is Still A Secular Growth Story, After Decades Of Value Accumulation

Be the first to comment