MarsBars

Commercial mortgage REITs remain an attractive asset class with high dividend yields, even when they are supposed to benefit from the impact of rising rates. This was seen in Blackstone Mortgage Trust’s (BXMT) strong Q2 results, with strong originations and bottom line growth.

This brings me to Granite Point Mortgage Trust (NYSE:GPMT), which hasn’t yet reported its second-quarter results, but may see a similar benefit. GPMT hasn’t seen the same uptick in its share price that BXMT has, and in this article, I highlight why this may present a high yield buying opportunity.

Why GPMT?

Granite Point Mortgage Trust is a relative newcomer to the commercial mREIT space. It went public in 2017, and last year, made the shareholder-friendly move of internalizing its management. This helps to align the interests of shareholders and management, since external managers receive a part of their compensation based on the size of AUM.

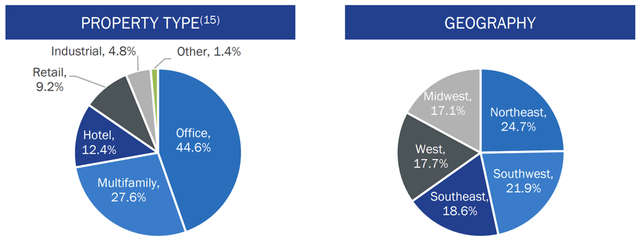

GPMT maintains a broadly diversified portfolio of commercial real estate loans that are backed by 99% senior first mortgages. Its portfolio also carries a safe 63% weighted average loan to value ratio. At present, the loan portfolio carries a $3.8 billion balance spread across 103 investments. As shown below, the portfolio is diversified by geography and asset type, with office, multifamily, and hotels comprising 85% of the total balance.

GPMT Portfolio Mix (Investor Presentation)

GPMT is making good headway, as it resolved three of four loans on nonaccrual status during its first quarter, reducing its nonaccruals ratio to 2.7% of the total loan portfolio. It’s also seeing strong interest collections, with 100% of borrowers making their contractual payments in accordance with loan agreements. Moreover, GPMT is reasonably leveraged at 2.5x debt to equity.

Moreover, GPMT fully repaid $225 million of borrowings under its higher-cost senior secured term loan facilities while releasing approximately $180 million of capital through refinancing 2 de-levered legacy funding vehicles, resulting in lower cost of funds. Distributable earnings came in at $0.24 per share, and management expects these actions to improve its quarterly run-rate net interest income by $0.05 to $0.06 per share.

Looking forward, GPMT maintains a strong investment pipeline worth $200 million, and management plans on taking leverage up to 3.0-3.5x to help with funding. It’s also well-positioned for a rising rate environment with 98% of its portfolio being floating rate.

Risks to the growth thesis include potential for market volatility in the near term, and higher interest rates may affect borrowers’ finances. However, given peer BXMT’s strong Q2 results, I don’t see this as being much of a factor for GPMT’s second-quarter results. This is also supported by management’s favorable outlook in the last conference call:

We continue to see a healthy flow of attractive lending opportunities and are focused on properties with favorable fundamentals. Given the ongoing uncertainties with respect to global events, the pandemic, supply chain disruptions, inflation, rising interest rates and credit spreads, we remain disciplined in our approach to investing, underwriting and loan structure. Given our liquidity and leverage, we are well positioned to take advantage of wider loan spreads and remain opportunistic in further improving our capitalization.

With the amount of volatility global markets are experiencing, we believe that U.S. commercial real estate will continue to be viewed as a safe haven asset class by long-term fundamental investors. And our strategy of lending on a senior floating rate basis against institutional quality real estate should generate attractive risk adjusted returns over time.

While GPMT’s quarterly dividend of $0.25 per share is slightly under-covered by the $0.24 in distributable EPS last quarter, I see potential for coverage to improve due to the aforementioned management actions, which could benefit quarterly EPS by $0.05 to $0.06.

In addition, at the current price of $10.72, GPMT trades at a material discount to book value. As shown below, GPMT’s price to book ratio of just 0.53x sits well below historical norms. Sell side analysts have a consensus Buy rating on the stock with an average price target of $12.38, implying a potential one-year 25% total return including dividends.

GPMT Price-to-Book (Seeking Alpha)

Investor Takeaway

GPMT is a high-yielding commercial real estate lender that’s reasonably leveraged, with a strong investment pipeline and favorable outlook. It maintains a safe investment portfolio comprised primarily of senior first mortgages with a healthy weighted average loan to value ratio.

Meanwhile, the stock trades at a material discount to book value and offers an attractive dividend yield. For these reasons, I believe GPMT is a compelling high-yield opportunity at the current price.

Be the first to comment