Bill Pugliano/Getty Images News

Article Thesis

Ford (NYSE:F) reported much stronger than expected quarterly results. Guidance for the current year is healthy, too, despite headwinds from inflation and a potential slowdown of the economy. Since Ford has pulled back quite a lot from the highs that were hit in early 2022, the company is not trading at an expensive valuation at all. Ford’s EV business continues to progress, and the company has upped its shareholder returns via a hefty 50% dividend hike. Overall, Ford does look like a solid EV and income play right here.

Ford Is Faring Much Better Than Expected

During the second quarter, Ford saw its revenue rise by 57% year over year, easily beating estimates. This was partially made possible by an easy comparison to the weak quarter one year earlier when lockdowns and other COVID measures and supply chain issues had a large impact. Not all those issues ceased to exist, but they have become less impactful over time, allowing Ford to grow its revenues at a hefty pace. In fact, Ford even outperformed Tesla (TSLA), the “growth king” in the automobile space, as Tesla only grew its revenue by 42% in the same time frame — which is still pretty nice for an automobile company, of course.

When it comes to profitability, the company did very well, too. Adjusted earnings per share came in at $0.68, or a little more than $2.70 annualized — relative to a share price of $15, that’s a pretty high level of profitability. Earnings did, like revenues, beat estimates easily, as EPS came in a massive 50% ahead of estimates. Analysts clearly were very wrong with their assumptions, likely due to them underestimating Ford’s pricing power and ability to push higher input costs through to customers.

Many commodities have risen in price over the last year, including ones that are important for the automobile industry, such as steel, aluminum, copper, lithium, nickel, and so on — the last three are especially important for electric vehicles. Higher raw material costs lead to pressure on profit margins, as long as manufacturers are not increasing the prices they demand for their vehicles. Luckily, Ford has been able to push prices upwards without hurting its sales momentum. Ford’s unit sales during the quarter were up 35% year over year, which is compelling. But thanks to an average sales price increase of ~16%, Ford was able to grow its revenue by well above 50% over the same time frame. This mid-teens price increase on a per-vehicle basis allowed Ford to more than offset headwinds from higher commodity prices. This is showcased by the company’s gross margin, which expanded by 650 base points. Without its price increases, Ford’s gross margin would have dropped by several hundred base points, which would have resulted in a net loss for the quarter. But thanks to the company’s ability to generate significantly higher revenues per each vehicle it sold, Ford’s profitability rose by a lot.

Price increases can be a double-edged sword, of course. When customers aren’t willing to pay more, price increases can lead to lower sales numbers, as customers are either switching to other brands with lower prices or avoiding purchases altogether. But that was not the case here. Ford did see its sales numbers rise, as shown above. Even more importantly, the company gained market share during the period, as its global share rose from 4.9% in the year-ago quarter to 5.3% in Q2 2022. Ford’s price increases have thus not resulted in customers looking elsewhere — instead, customers were even more willing to buy a Ford, despite the price increases. That’s a very positive and important data point, as it suggests that Ford’s model lineup is attractive compared to what its peers are selling and that its brand is powerful enough to make customers not care too much about the price of the vehicle.

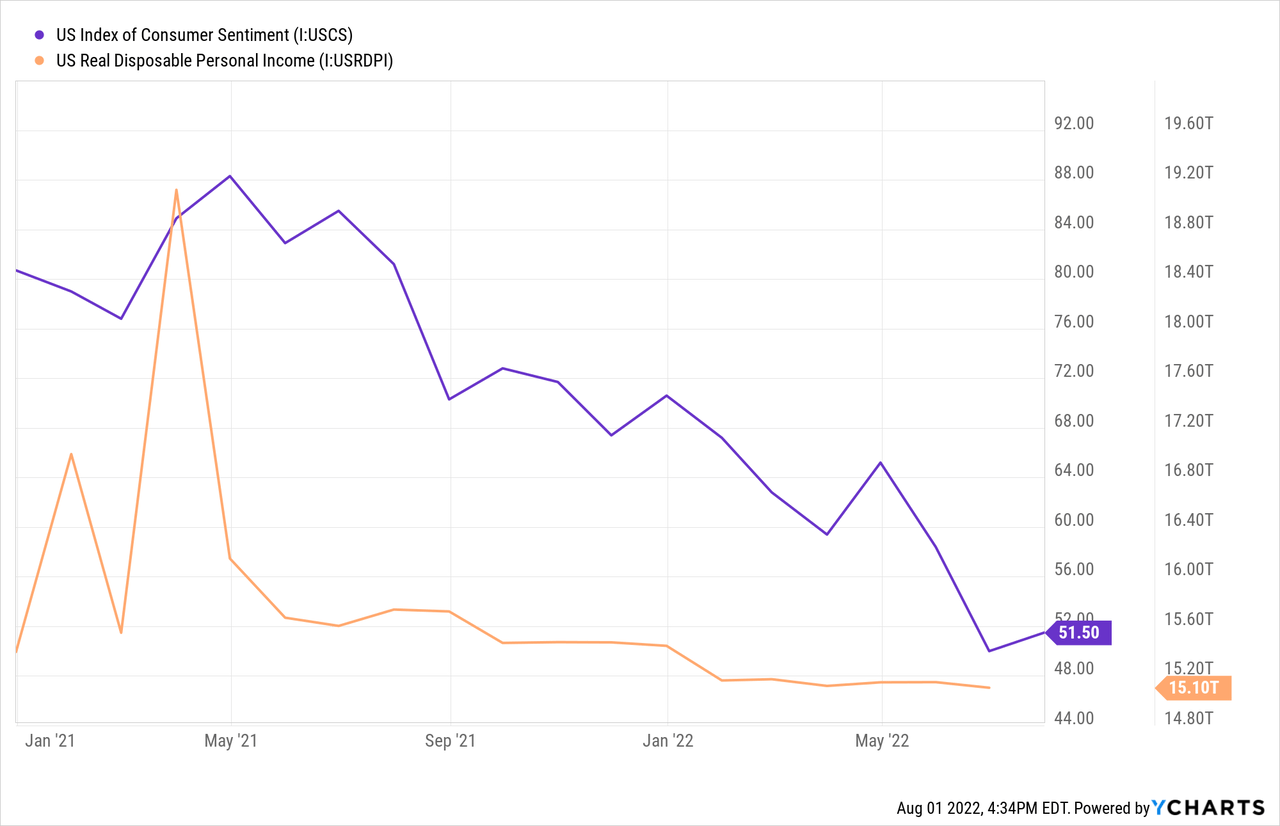

During the pandemic, fiscal and monetary stimulus resulted in high spending power for consumers. This changed in the more recent past, as high inflation and rising interest rates have hurt consumer sentiment and

In the above chart, we see the US consumer sentiment index and the total disposable income (in real terms) in the US. Both have been dropping for the last one and a half years. The fact that Ford didn’t run into any problems with its price hikes is thus somewhat surprising — the average consumer is hurting, but Ford’s customers are more than willing to pay up in order to buy a new Ford. That’s a great position to be in, but investors should keep an eye on these trends, as there is no guarantee that this will remain the case. It is at least possible that Ford will have a harder time pushing through further price increases, especially if consumer sentiment continues to worsen.

Nevertheless, Ford’s guidance for the second half of the current year is very solid, thus management seems to anticipate that a weak consumer will not be a major near-term concern — at least not for Ford, others may feel a larger impact. The company is guiding for $11.5 billion to $12.5 billion of EBIT this year, or $12 billion at the midpoint. Since Ford has already generated $6.0 billion of EBIT in H1, the company is thus assuming that H2 will be equally successful. A recession/economic downturn does thus not have a meaningful impact on Ford, at least according to their base case assumptions. Since the automobile industry generally is sensitive when it comes to the strength of the economy, Ford’s assumptions that H2 will be as strong as H1 can be seen as a sign of confidence or strength.

The Outlook Is Positive

Ford had a strong Q2 and the second half of the current year should be very solid as well. More importantly, Ford has a positive longer-term outlook, based on three reasons.

Ford’s growth investments in the electric vehicles space are paying off. With its F-150 Lighting, Ford is one of the first players to enter the electric truck space in a meaningful manner. Rivian (RIVN), in which Ford owns a stake, is active in this space as well, but Tesla has not yet been able to roll out its Cybertruck in force. Since Ford already has a strong standing in the ICE-powered truck space, it is a natural contender for the electric truck crown. Customers seem to agree, as Ford’s F-150 Lightning has been a huge success so far.

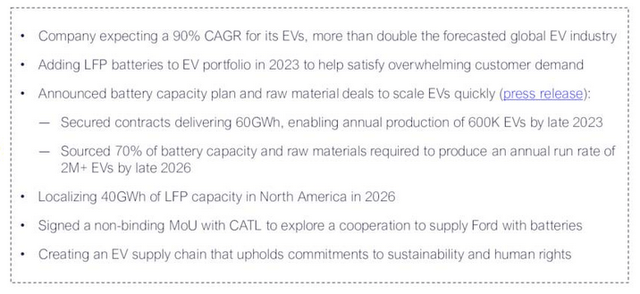

The following slide shows Ford’s success in ramping up its EV business:

With a forecasted 90% annual growth rate, Ford believes that its EV business will grow at close to twice the rate of Tesla’s EV business (50% longer-term forecast). Ford will be growing from a smaller base, which makes a high relative growth rate easier, but if Ford manages to hit that goal, that would be a great success, nevertheless. Strong growth requires a massive amount of batteries and battery materials as well as other EV-related commodities. Ford has done a good job in securing supply chains for its ambitious growth plans, as the 2023 exit run rate could be at a 600,000 level, while the company plans to be able to produce 2 million EVs by the end of 2026. Whether Ford will actually do so is not yet known, but it is clear that Ford is on a good way to scaling up its EV business at a hefty pace. Customers like Ford’s products, such as the Ford Mustang Mach-E, the F-150 Lightning, and the professional-oriented Ford Transit EV are all in high demand. I do believe that Ford will continue to perform well in the EV space, and it could turn into one of the largest players in this field eventually.

Ford also looks solid based on two other factors. Its dividend has recently been increased by 50%, which has lifted its payout back to pre-pandemic levels. At current prices, that makes for an attractive 4% dividend yield, which means that investors will be receiving a very meaningful income stream while holding Ford. Ford also could benefit from multiple expansion over the coming years, as its valuation is relatively low. Based on current guidance for free cash flows of $6 billion in 2022, Ford is trading for just 10x free cash flow, and for just 5x EBITDA. If we get into a major recession, shares would of course have downside potential. But if that can be avoided, and if Ford continues to execute well, shares could rise based on an undemanding valuation today.

Takeaway

Ford had a much more successful Q2 than expected, and the outlook for the second half of the current year is very healthy as well. Despite higher raw material prices and a weaker consumer, Ford’s products are in demand and the company is able to demand premium prices, which benefits its margins.

Ford is executing well in the EV space, has attractive products in the market and continues to add new electric models, and with its 4% dividend yield and undemanding valuation, Ford could be a solid longer-term pick for those seeking a combination of income and EV exposure.

Be the first to comment