DNY59

Investment Thesis

CTO Realty Growth (NYSE:CTO) is obviously trading at a premium, given the elevated EV/NTM Revenue and NTM Price/FFO Per Share valuations against its 5Y and YTD means. The stock has also excellently rallied by 20.03% since the peak recessionary fears, as with the S&P 500 Index at 14.06% since early October 2022, indicating an increased level of optimism in the stock market thus far.

These levels of confidence are of no coincidence, due to CTO’s excellent FQ3’22 earnings call, followed by upbeat October CPI results by early November 2022. 79.4% of analysts already expect a Fed’s pivot by the December meeting, with a 50 basis points hike, similar to the Bank of Canada’s recent moderation. Since Mr. Market is always forward-looking, we may have seen the last of these market bottoms by now, with a potential soft landing through 2023.

Then again, portfolios should also be sized appropriately, since we expect more uncertainties in the short term. Depending on the results of the impending labor and CPI reports by early December, the Feds may be tempted with the fifth consecutive 75 basis points hike, if inflation rates remain elevated. Furthermore, with the speculative raised terminal rates to over 6% against the original projection of 4.6%, this recent recovery could potentially be digested moving forward. Therefore, pointing to CTO’s potential volatility, suitable only for those with higher risk tolerance and attentive monitoring through 2023.

CTO’s Management Proved Prudent In Its Growth Strategy, While Expanding Margins

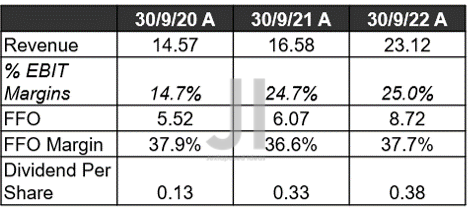

CTO Revenue, EBIT %, FFO ( in million $ ) %, and Dividends

S&P Capital IQ

In its recent FQ3’22 earnings call, CTO reported excellent revenues of $23.12M and EBIT margins of 25%, indicating an increase of 18.8% and relatively in line QoQ, respectively. Otherwise, a tremendous YoY growth of 39.44% and another inline, respectively. Impressive indeed, since the company also expanded its core FFO to $8.72M for the latest quarter, growing its FFO margins by 1.1 percentage points YoY, otherwise a notable contraction of -3.35 points QoQ. The decline in its QoQ performance is partly attributed to the increase in its operating expenses by 20% QoQ and 38.86% YoY to $17.33M in FQ3’22, as with a 33.33% QoQ increase in interest expenses/ YoY by 52.76% to $3.04M.

On the other hand, CTO hiked its dividend payouts by 1.8% YoY post-stock-split to $0.38, indicating excellent forward yields of 7.23%, based on current stock prices. Combined with a $5.84M spent on shares repurchased in the LTM, it is evident that much value has been returned to their long-term shareholders indeed.

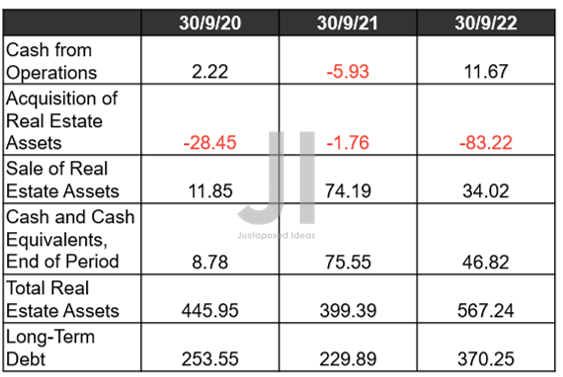

CTO Cash From Operations, Acquisitions, Cash Flow, and Debts ( in million $ )

S&P Capital IQ

The CTO management also proved prudent in its growth strategy, with further acquisition plans frozen for the remainder of FY2022. It is probably attributed to the lower availability of capital funding in the market, as the macroeconomics worsens and the interest rate rises. However, investors need not fret, since the company has also raised its full-year FFO guidance by a favorable 7.6%, contributed by the strength of its growing NOI.

CTO continues to boast an excellent 12% QoQ increase in same-store NOI and by 21.5% YTD in FQ3’22, indicating a robust market demand thus far, despite the tougher YoY comparison and elevated rental rates. With its properties recording a weighted average lease term of 6.5 years at a 94.4% occupancy rate in the latest quarter, the management also proved competent in tempering any immediate headwinds during these uncertain conditions.

Furthermore, with practically zero debts maturing over the next three years and the nearest at $51M by April 2025, we are not concerned about CTO’s forward execution at all. The company’s balance sheet remains robust with $46.82M of cash/ equivalents in FQ3’22 and another $262M of available funding through its revolving credit facility through 2027 and 2028. Thereby, preserving the company’s immediate liquidity and dividend safety through the economic uncertainties over the next two years.

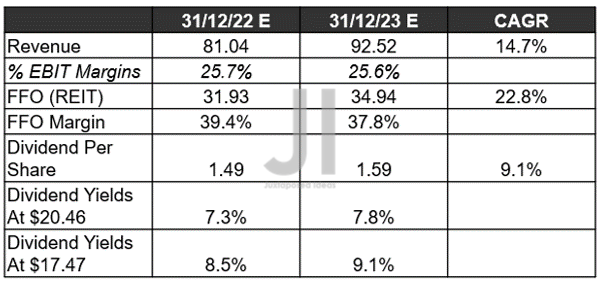

CTO Projected Revenue, EBIT %, FFO ( in million $ ) %, and Dividends

S&P Capital IQ

Over the next two years, CTO is also expected to report revenue and FFO growth at a CAGR of 14.7% and 22.8%, respectively. Exemplary indeed, against its hyper-pandemic levels of 25.05%/19.74%, respectively. Furthermore, the company will deliver improved profit margins ahead with operating/ FFO margins of 25.6% and 37.8%, respectively, against FY2019 levels of 28.2%/31.64% and FY2021 levels of 23.1%/28.09%.

Thereby, also ensuring the growth in CTO’s dividends payout by 6.71% YoY to $1.59 in 2023, despite the Fed’s continuous hike then. Impressive indeed, since these numbers indicate a more than decent forward dividend yield of 7.8%, against its 4Y average of 9.61% and the sector median of 4.32%. Otherwise, bold investors who had loaded up during the recent rock-bottom levels of $17.47, would have enjoyed similarly high yields of 9.1% next year. Not too bad indeed, since it significantly improved the stock’s risk/reward ratio.

So, Is CTO Stock A Buy, Sell, or Hold?

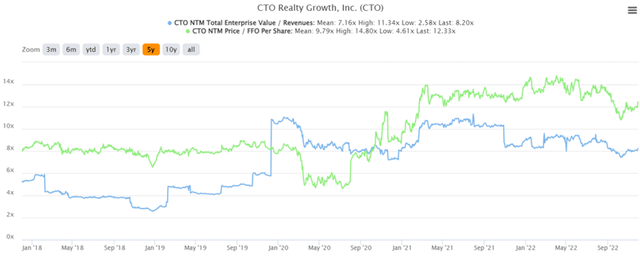

CTO 5Y EV/Revenue and Price/FFO Per Share Valuations

CTO is currently trading at an EV/NTM Revenue of 8.20x and NTM Price/FFO Per Share 12.33x, higher than its 5Y mean of 7.16x and 9.79x. Otherwise, lower than its YTD mean of 8.67x and 13.26x, respectively. Thereby, pointing to its slight overvaluation against its historical execution.

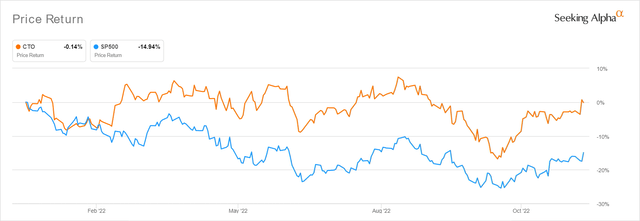

CTO YTD Stock Price

Nonetheless, the CTO stock is also trading relatively attractive at $20.97, down -9.10% from its 52 weeks high of $23.07. Despite the 22.06% premium from its 52 weeks low of $17.18, consensus estimates remain bullish about its prospects, due to their price target of $24.00 and a 12.62% upside from current prices.

Depending on individual investors’ risk tolerance and investing trajectory, the CTO stock will be somewhat speculative, due to its inherent slight premium from the pandemic boom. Though the stock currently trades near its 200-day moving average, keen investors have also missed the recent rock-bottom levels, with it trading above its 50-day moving average. Then again, this deal is made rather sweet with its excellent forward dividend yields of 7.8%, despite the recent recovery. Therefore, we cautiously rate the CTO stock as a speculative Buy for now.

In the meantime, bottom-fishing investors may try waiting for a moderate retracement to the high $10s, since those levels would also offer an improved margin of safety for long-term investing and portfolio growth.

Be the first to comment