alberto clemares expósito/iStock via Getty Images

Investment Thesis

W. P. Carey Inc. (NYSE:WPC) continued to deliver stellar performance by FQ3’22, while increasing its profit margins tremendously. The rising inflation has notably aided in the growth of its contractual same-store rent by 3.4% YoY, with an exemplary guidance of 4% in NOI expansion for FY2023.

Despite the worsening macroeconomics in the US and EU, WPC also recorded a stellar collection rate of 99.3% and a portfolio occupancy rate of 98.8% in the latest quarter. There is also no risk of any large move-outs, given the portfolio’s weighted-average lease term of 10.9 years. Combined with its controlled investment activity thus far, we expect the management to continue delivering profitable growth ahead, despite the reduced availability of capital funding in the market.

WPC’s Management Delivered Impressive Cost Efficiency and AFFO Growth

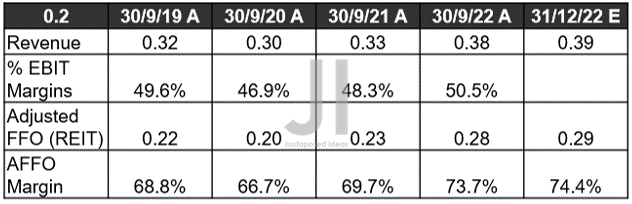

WPC Revenue, AFFO (in billion $)%, and EBIT %

S&P Capital IQ

In its recent FQ3’22 earnings call, WPC reported excellent revenues of $0.38B and EBIT margins of 50.5%, indicating exemplary growth QoQ and YoY, with some post-forma adjustments further expected in the next quarter. It is evident that the management has been highly prudent in its cost efficiency despite the rising inflation. Its operating expenses only increased by 10.41% QoQ and 12.39% YoY, despite growing its assets by 18.05% QoQ and 20.67% YoY at the same time.

Furthermore, WPC has been expanding its AFFO margin to 73.7% by the latest quarter, beyond its pre-pandemic levels of 68.8%. Combined with its raised FY2022 guidance, it is no wonder that market analysts now expect an ambitious AFFO margin of 74.4% for FQ4’22.

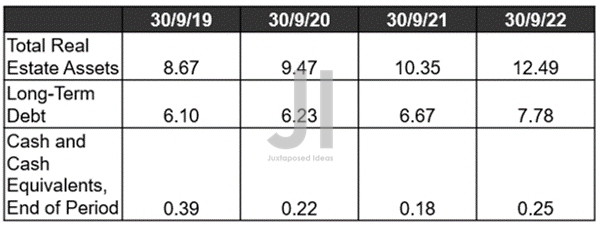

WPC Balance Sheet (in billion $)

S&P Capital IQ

WPC has deftly expanded its portfolio to $12.49B by FQ3’22, notably through the $2.7 Billion Merger with CPA®:18 on August 2022, while also increasing its reliance on long-term debts to $7.78B. However, investors need not worry, since there is none maturing over the next two years, with the earliest at $1B due 2024. The rest of its debts are also remarkably well-laddered through 2023, at strategic sums between $325K to $500K each.

Combined with WPC’s decent balance sheet and robust AFFO generation, we are not overly concerned about its immediate liquidity, significantly aided by its $1.8B revolving credit facility. Especially since, the Feds will continue its rate hikes through 2023, expanding the sector’s same-store rent growth over the next two years before the inflation is truly tamped down.

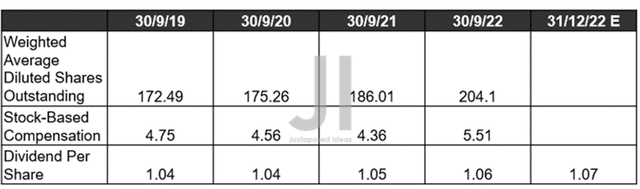

WPC Share Count, Stock-Based Compensation (in million $), and Dividends

In the meantime, WPC already recorded $29.19M of Stock-Based Compensation (SBC) expenses over the last twelve months (LTM), indicating an increase of 18.70% sequentially, or 55.34% from FY2019 levels. Though the company has also spent $6.6M on stock repurchases in the LTM, it is evident that its share count continues to grow by 9.72% YoY, mostly attributed to the recent capital raise. We expect this to be a one-time event, therefore, minimizing the forward share dilution to WPC’s long-term investors.

In the meantime, market analysts expect WPC to increase the FQ4’22 dividend payout by another 0.9% to $1.07, totaling $4.247 for FY2022. Excellent indeed, since it indicates the management’s growing confidence in profit expansion ahead.

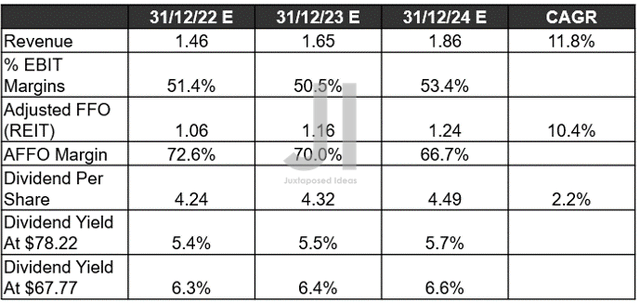

WPC Projected Revenue, AFFO (in billion $) %, EBIT %, and Dividends

Over the next three years, WPC is still expected to report excellent revenue and AFFO growth at a CAGR of 11.8% and 10.4%, respectively, against pre-pandemic levels of 9.4%/16.1% and hyper-pandemic levels of 3.9%/3.7%. However, investors must also note that market analysts expect inflation to fall drastically by 2024, nearly hitting the Feds target of 2%, which may impact the company’s AFFO margin then. The latter is expected to decline tremendously to 66.7% in FY2024, against 69.47% in FY2019 and 69.20% in FY2021. Assuming so, the stock indeed deserves a slight discount on its baked-in premium. We’ll see.

Nonetheless, we must also highlight that WPC’s dividend growth remains safe for now, with market analysts projecting FY2024 dividends of $4.49 and forward yields of 5.7% based on current stock prices. Otherwise, an excellent expansion to 6.6% for those that have loaded up during rock-bottom levels in late September 2022. Not too bad indeed, against its 4Y average yield of 5.53% and sector median of 4.33%.

So, Is WPC Stock A Buy, Sell, Or Hold?

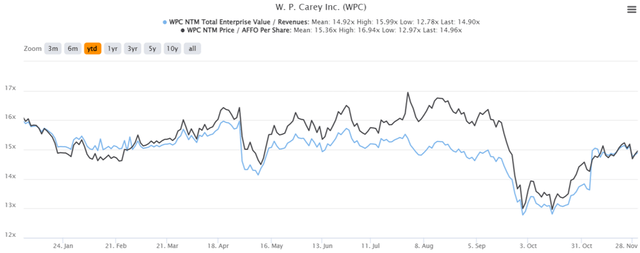

WPC 5Y EV/Revenue and AFFO/Per Share Valuations

WPC is currently trading at an EV/NTM Revenue of 14.90x and NTM Price/AFFO per share of 14.96x, higher than its 5Y mean of 14.72x and 14.59x, respectively. Otherwise, nearing its YTD mean of 14.92x and 15.36x, indicating its slight over-valuation.

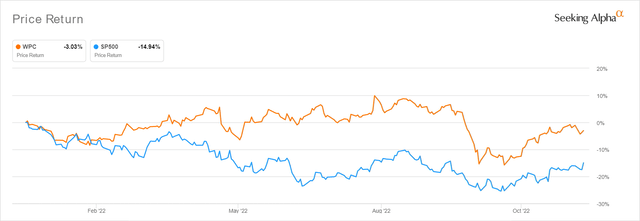

WPC YTD Stock Price

Given the market-wide recovery since October, the WPC stock is also trading rather optimistically at $78.80 at a premium of 16.27% from its 52-week low of $67.77, above its historical 50-day moving average of $75.14. Therefore, maxing out its upside potential from the consensus price target of $82.67.

As a result, we encourage investors to wait for a deeper retracement before adding the stock to their portfolio. Be patient, and do not chase this rally. There might be more chances in the short term, depending on how the November CPI report turns out and, consequently, the Fed’s reaction. Otherwise, more bottom tests may be imminent, if we see another fifth consecutive 75-basis point hike. Interested investors would be well-advised to wait for another low $70s for an improved margin of safety. In the meantime, existing investors should simply sit back and enjoy the excellent dividends.

Be the first to comment