anyaberkut/iStock via Getty Images

Synaptics Inc. (NASDAQ:SYNA) is affordable, and I rate it as a buy. The company beat analyst EPS and revenue estimates in its Q4’22 earnings release. For context, SYNA has consistently beat analyst EPS estimates averaging a 1.14% surprise for the past six years (including FY2022) and revenue estimates averaging a 0.27% surprise for the past three years. The company faces near-term headwinds due to weakening Mobile and PC demands. However, their IoT market is doing great and is offsetting revenue losses from its Mobile and PC markets. Assuming that the softening demands in the Mobile and PC business are only temporary, here’s why SYNA’s broad markets and strong market position (especially in the touchpad market) will help the company perform in the long term:

- The IoT segment, accounting for 70% of the company’s revenue in SYNA’s Q4’22, has a lot of growth opportunities, especially in AI, automotive, wireless connectivity, voice activation, and virtual reality technology.

- With a larger Clickpad size gaining market traction, SYNA can benefit in this industry since they are in a strong market position to implement better Clickpad designs.

However, with these two points in mind, SYNA is also facing risks that could change its revenue mix based on its markets. As previously mentioned, the company is experiencing some decline in its Mobile and PC segments. SYNA’s PC market experienced a 10% quarterly revenue decline and was down 3% year over year, while its Mobile market experienced a 20% decline sequentially and 4% year over year. Here are significant risks that investors should know about SYNA:

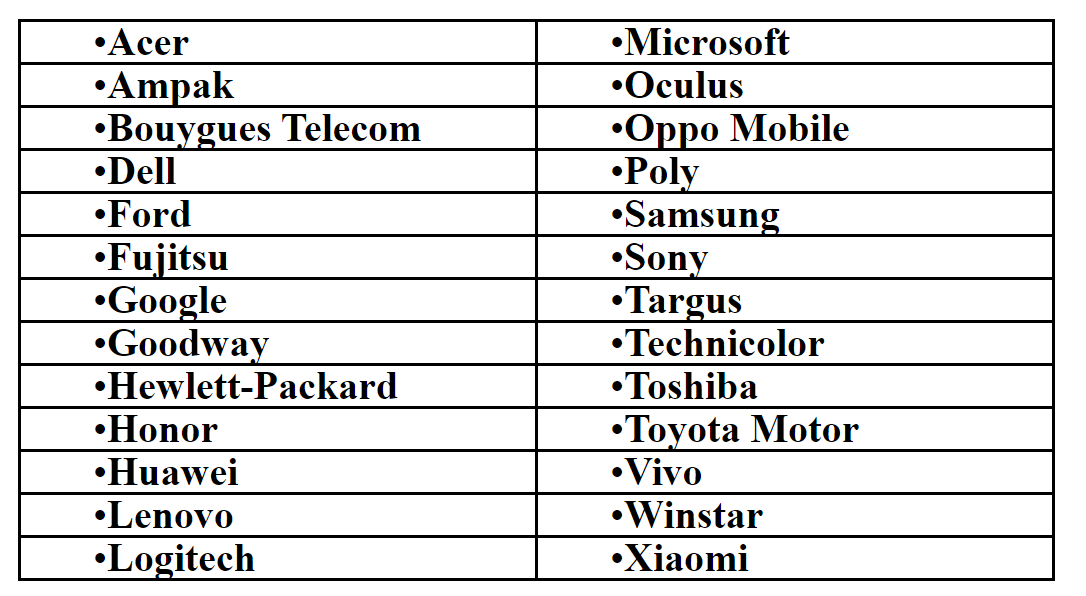

- The PC market is expected to go down. It is forecast to decline by 9.5% in 2022, which can affect SYNA’s PC customers, namely Acer, Dell (DELL), Hewlett-Packard (HPQ), and Lenovo (OTCPK:LNVGY), particularly in their products related to cursor control.

- Similar to the PC market, the Mobile market shipments fell 9% year on year in 2022, which can negatively affect SYNA’s mobile product customers. Because of this, management expects the Mobile business to be down 40% year over year in the September quarter, making the Mobile market account for only 10% of SYNA’s revenue mix.

SYNA is off to a soft FY’23 start. However, management is paying down outstanding debt and plans to have a share repurchase program with available authorization of $577 million.

Brief Overview of the Business

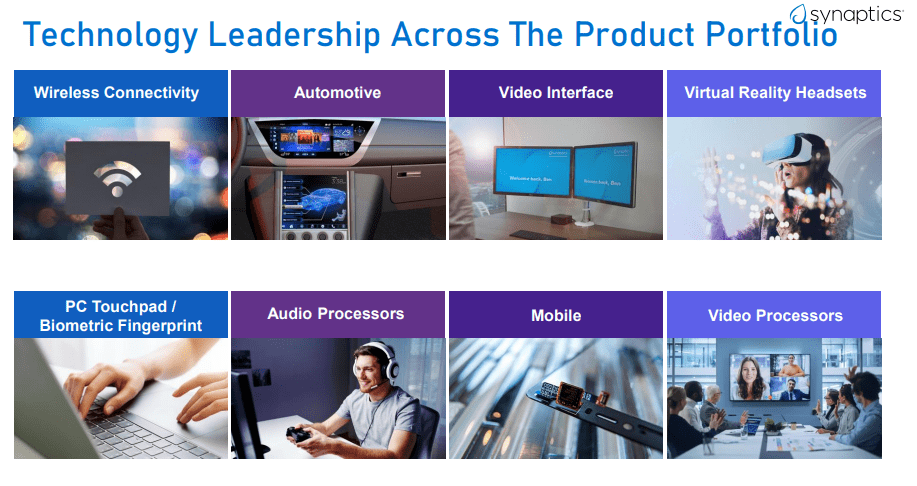

SYNA is a leading provider of semiconductors products and solutions. The company operates in three primary markets: IoT, PC, and Mobile Product Applications Market. You might know them for manufacturing touchpads and other cursor control devices usually found across different notebooks in the PC market. They have a broad product portfolio that consists of products related to:

Synaptics Incorporated Q4’22 Earnings Call Presentation

-

Wireless Connectivity – Wi-Fi, Bluetooth, and GPS.

-

Automotive – Display drivers and touch integrated circuits.

-

Video Interface – High-performance video compression.

-

Virtual Reality Headsets – High connectivity and higher resolution displays for the VR market.

-

PC Touchpad/Biometric Fingerprint – Creating touch-sensitive pads for cursor control.

-

Audio Processors – High-fidelity voice and audio processing.

-

Mobile – Better interfaces on smartphones, tablets, and peripherals.

-

Video Processors – High-performance multimedia encode/decode for high-resolution video processing.

SYNA’s broad markets give them wider growth opportunities, specifically in the IoT market. I’ll talk more about the total addressable market that SYNA can capitalize on based on their IoT market since they’re shifting their focus more on the IoT market, which accounts for 70% of the company’s revenue, growing 87% year over year and 10% sequentially in the company’s Q4’22 earnings results.

Synaptics Incorporated 2021 Annual Report

SYNA provides semiconductor products and solutions to some of the largest automotive, PC, and mobile companies. These companies rely on SYNA’s solutions. However, because global consumer demands are declining across the PC and Mobile market, there isn’t much that SYNA can do to counter the market declines aside from shifting its focus to its trending markets (IoT Markets).

Acquisitions Worth Mentioning

SYNA has made acquisitions over the past years, and I found it helpful to mention some of them as they have impacted the company’s organic and inorganic revenues. In SYNA’s Q4’22 earnings results, the operating expenses in June’s quarter included $9.1 million in acquisition-related costs. Here are SYNA’s recent acquisitions:

- DisplayLink: On July 17, 2020, SYNA and DisplayLink Corporation agreed to acquire all of DisplayLink’s interests, a leader in high-performance video compression technology. The acquisition closed on July 31, 2020, with a purchase of $444 million on March 27, 2021.

- Broadcom (AVGO): On July 2, 2020, SYNA and Broadcom agreed to acquire certain assets, assume certain liabilities, and obtain a non-exclusive license relating to Broadcom’s existing Wi-Fi, Bluetooth, and GPS navigation satellite system with a purchase of $250 million in cash that closed on July 23, 2020.

SYNA spent $23.7 million on acquisition-related costs in the company’s Q4’22 results and $505 in acquisition and investments in FY2022 compared to $627 million in FY2021. These acquisitions help improve SYNA’s technology. DisplayLink offers high-performance video compression technology, which can be used in SYNA’s video processing product lineup. Broadcom offers wireless connectivity such as Wi-Fi, Bluetooth, and GPS that can be used in their wireless connectivity product lineup and the automotive industry. I think these acquisitions are part of why I believe SYNA is set up for long-term success.

SYNA’s Opportunities in Their Broad Market

In this section, we will be talking about the opportunities that SYNA has in its broad markets. This section will talk about opportunities that SYNA can utilize and make it one of its growth drivers in the intermediate future. I’ll include different opportunities in the IoT, PC, and Mobile markets.

Display and Touch Integrated Circuits For Automobiles

Recent automobiles have touch integrated circuits. OEM auto companies such as Ford (F) and Toyota (TM) use SYNA’s touch integrated circuits for their vehicles. I think this is a significant growth avenue for SYNA since display and touch integrated circuits in automobiles will be a norm in the future. The global automotive smart display has an addressable market that is expected to grow from $7.81 billion in 2021 to $8.81 billion in 2022 at a compound annual growth rate (CAGR) of 12.8% and is expected to reach $12.71 billion in 2026 at a CAGR of 9.6%, which means that this is a growing market that SYNA can capitalize.

Voice-Driven Smart Devices Coupled With AI Technology

SYNA can also expand its growth opportunities in the global speech and voice recognition market, where smart devices improve home automation to achieve security and convenience. It has an addressable market projected to grow from USD 9.4 Billion in 2022 to USD 28.1 Billion by 2027. It is expected to grow at a CAGR of 24.4% from 2022 to 2027. Since people are encouraged to work from home, not only can it lead to high demand for speech and voice recognition technology, but it also gives better convenience in accessing different devices at home.

Cursor Control and Fingerprint Authentication Through Touchpads

Assuming that PC demands will increase, SYNA is in a solid position to grow in the PC market. Since they have proven themselves to be one of the best cursor control and fingerprint authentication products, SYNA can increase its revenue in this market.

These are some of the products that create growth opportunities for SYNA. Customer and consumer demands will determine what product or market management should put their focus on. Right now, since the IoT market is doing well, management is putting their focus on this market. SYNA is not limited to only these opportunities, but so far I only included these three since I think this is where SYNA can really excel.

Financial Analysis

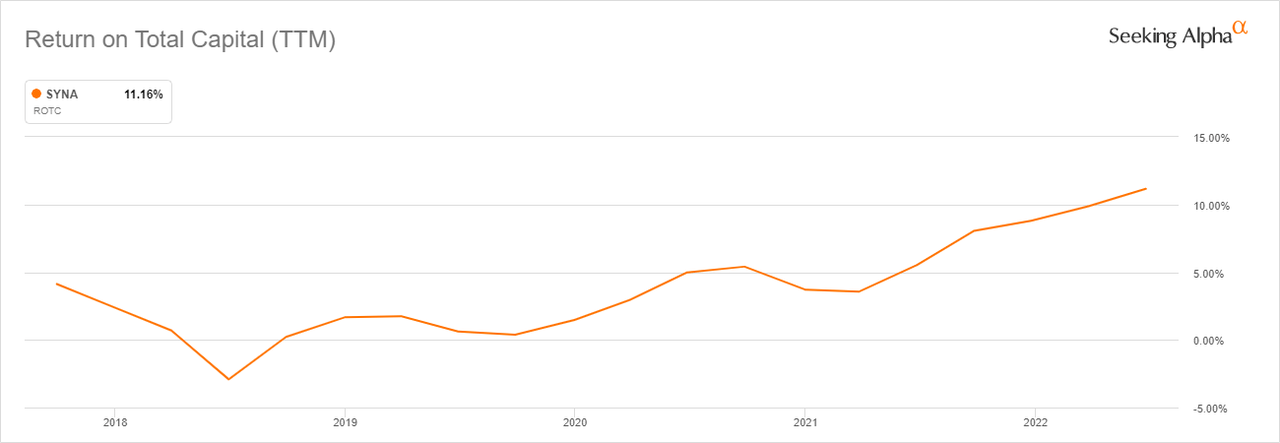

Seeking Alpha – SYNA ROTC (TTM)

SYNA has been efficient with its money, and it can be proven through its growth of Return On Total Capital (ROTC) over the past five years. Investors may expect long-term stock returns if the company maintains its ROTC growth in the following years.

Management plans to have a share repurchasing program with an authorization of $577 million in the fourth quarter of FY2022 that will hopefully create inorganic growth and might increase SYNA’s share price. I think that share repurchasing is a good use of cash and can bring positive returns since management is confident in its long-term potential.

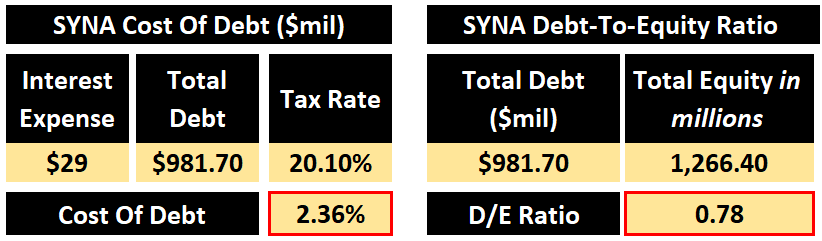

Author – Data From SYNA’s Q4’2022 Earnings Results

For short-term liquidity, SYNA has $824 million in cash and cash equivalents with $1.4 billion in current assets and $463 in current liabilities, which means that SYNA will not pose any short-term liquidity problems proven by a 3.03 current ratio. Moving over to the long-term liquidity of the company, SYNA spent $29 million in interest expenses and has a total debt of $982 million. With an effective tax rate of 20%, the company has a low cost of debt of 2.36%. The company also has relatively low debt levels since the company only has $982 in total debt. Divide that by the total equity of 1.3 billion, and we get a low debt-to-equity ratio of 0.78.

Valuation

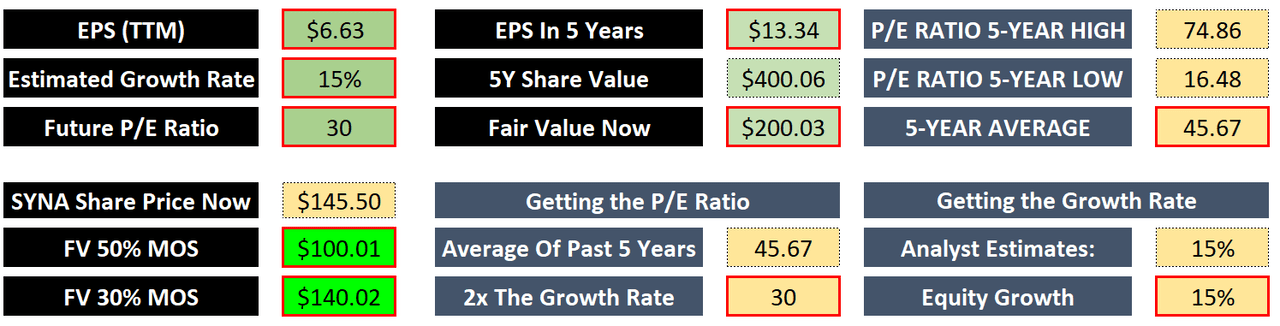

Author – Data From Seeking Alpha, Yahoo Finance, MSN Money, and Rule One Equity Growth Rate Calculator

Moving over to the valuation of the company, I calculated the company’s fair value using three significant numbers:

-

The trailing-twelve-month earnings per share (EPS)

-

The estimated growth rate

-

The future price-to-earnings (P/E) ratio of the company

The company had a TTM EPS of $6.63 so let’s get that number out of the way. To get the five-year estimated growth rate of the company, I compared the analyst estimates and the company’s equity growth rate using historical data. However, I was met with similar numbers, so I used 15% for SYNA’s estimated growth rate. To get the future P/E ratio, I took the average of SYNA’s 5-year historical high and low to get a 5-year average P/E ratio of 45.67, the other method I used to determine the future P/E ratio was simply to multiply the growth rate. I chose to multiply the growth rate giving me a 30 P/E ratio since I prefer to be conservative by choosing a P/E ratio slightly lower than the actual future P/E ratio.

With these numbers in mind, I multiplied the growth rate with the TTM EPS to get the 5-year $13.34 EPS estimate. I then multiplied the 5-year EPS estimate with the future P/E ratio to get the 5-year estimated share value. According to the Rule of 72, if we divide 72 by the annual growth rate, we get the time it takes for our money to double. So, dividing 72 by our preferred annual rate of return (in my case, it’s 15%) means our money would be roughly doubled in 5 years. So in our case, we divide the 5-year estimated share value by 2 (we use two because our money is doubled in about five years), leaving us with a fair value of $200 today.

The current stock price of SYNA is about $146, which is cheaper than its fair value. That would mean we should buy it right away, right? Not necessarily, you see. These valuations will only work if everything goes according to plan. That’s why we need to apply a margin of safety. I’d recommend having a 30-50% margin of safety. It depends on your preference on how risky you want to invest in a stock, but around that range should be more than safe. So if we had an FV of $200 today and applied a 50% margin of safety (MOS), we would get an ideal share price of $100. However, if you choose to have a 30% MOS, we would get an ideal share price of $140, which is close to today’s share price of $146. Based on my current valuation, I rate the stock as a buy since it’s closer to the company’s fair value with an applied margin of safety of 30%.

Risks

A Decline in Its IoT Market

The company heavily relies on its IoT market for revenue. Any disruption in their IoT market can significantly affect the company’s overall performance. The IoT market accounts for 70% of SYNA’s revenue. If there’s a sudden decline in this market, it will negatively affect SYNA.

Taiwan and China Situation

Since the COVID-19 pandemic kickstarted the global chip shortage, if the Taiwan and China situation worsens, it may cause another global chip shortage. Taiwan makes around 65% of the world’s semiconductors, which means that if manufacturing is disrupted, it can negatively affect the whole semiconductor industry. This time, it can be more damaging since there will be a risk of halting wafers and semiconductors in China and Taiwan.

Investor Takeaway

I think that SYNA is affordable right now. With their IoT showing promising results, I believe that the company can maneuver through its short-term headwinds. They also have a lot of growth opportunities they can explore within their broad markets and diverse product lineups. It all depends on where the demands are and what market management decides to focus on. SYNA also has a share repurchasing program which can increase the stock’s price in the short term and may help boost SYNA’s share price since it’s undervalued. The company has no short-term liquidity problems (but they might use some cash for the share repurchases, $577 million in share repurchasing), low debt levels, and has plans to pay down its outstanding debt.

According to my valuation, the company has a fair value of $200. With a margin of safety of 30%, the company has an estimated fair value of $140, which is relatively close to the company’s current share price. That’s why I rate the stock as a buy. I look forward to following the company and am curious to see how the company will perform in the foreseeable future.

Thank you so much for reading my article, have a great day!

Be the first to comment