jacoblund/iStock via Getty Images

By Rob Isbitts.

Summary

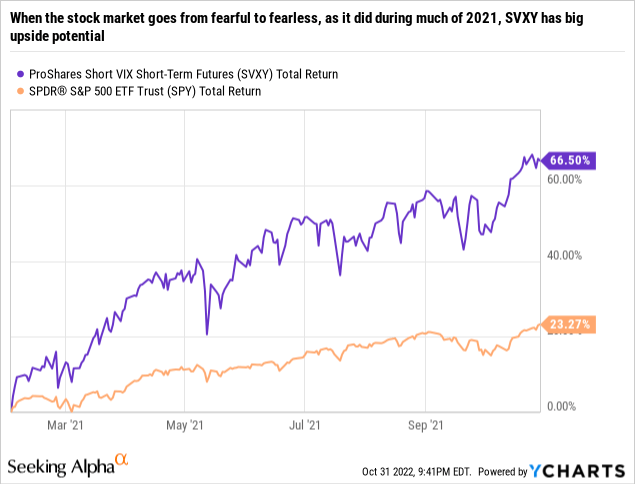

ProShares Short VIX Short-Term Futures ETF (BATS:SVXY) doesn’t invest in the stock market. However, it tends to track it quite well much of the time. In particular, in extreme “V-bottoms” in the market, it can be a sneaky, quirky, wonderful way to contribute to your portfolio’s overall profit pursuit. We rate it Buy, and note that while it should be used in small doses, it is one of the few bullish exchange-traded funds (“ETFs”) that may make sense to hold during parts of a bear market cycle.

Strategy

SVXY aims to deliver one-half of the opposite of the performance of the S&P 500 VIX Short-Term Futures Index each day. That’s a mouthful, so let’s unpack it to better explain what this ETF does.

The S&P 500 VIX Index (VIX) is perhaps the most commonly-used benchmark when investors want to judge how volatile the S&P 500 Index (SP500) is. While technically, VIX is a short-term, forward-looking index, today’s marketplace has made VIX its own animal. In other words, VIX itself is treated like a security, and while you can’t trade it directly, there are futures contracts traded on it. And, back in 2011, that gave birth to SVXY, one of a small number of ETFs that try to capture the movement of the VIX in a nice neat ETF wrapper.

SVXY does not seek to be a mirror image of the VIX, but rather half the mirror image. Bottom line, if VIX down 10%, SVXY would be expected to go up 5%, and vice-versa. VIX is a “fear indicator,” so it typically rises when the market is worried and falling. Likewise, when the market has a sigh of relief, VIX can drop, and drop quickly. Those are the most opportune times to own SVXY, since it is the opposite of a falling VIX, i.e., a rising stock market.

Proprietary ETF Grades

-

Offense/Defense:

-

Segment:

-

Sub-Segment:

-

Correlation (vs. S&P 500):

-

Expected Volatility (vs. S&P 500):

Holding Analysis

SVXY invests in cash instruments to back up a short position in futures contracts on the VIX. Specifically, those futures contracts expire about 1 month and 2 months in the future. The fund managers roll over contracts before they expire, to maintain that posture. This creates price movement that aims to be -50% of the movement in the price of the VIX.

Strengths

SVXY gives investors access to a market area that many might wish to have, if they knew what it was. Volatility can be, well, very volatile. It is based on future expectations (30 days in advance) of how much the S&P 500’s price will fluctuate up and down. So, in markets that are highly-volatile, SVXY could be a great “bounce” position to own. Particularly in bear markets (like the one in 2022), a small position in SVXY can have an outsized positive impact on a portfolio, since bear market rallies typically happen in a flash, and with great urgency on the part of “buy-the-dip” fans.

Weaknesses

Falling VIX typically means rising S&P 500, and that is where SVXY often shines. However, the opposite is just as true. So, if you are waiting around for the VIX to fall and market to rise, and it does just the opposite, your SVXY position can lose money at a rate higher than the S&P 500.

Opportunities

In our opinion, the potential for a sustained bear market in the S&P 500 beyond 2022 is like a rallying cry for investors to get familiar with SVXY. We have used it on and off in our model portfolio, but it is typically the smallest or one of the smallest positions. Even when we are very bearish, SVXY can still be useful, as it takes up relatively less space in the portfolio (if used as we do), but on market bounces, it can fly higher. To us, that seems like a better reward-risk tradeoff than just trying to pick our way through the potential winners in the stock market. In that respect, SVXY can be a sidekick to whatever equity portfolio allocation one has set up.

Threats

The biggest reason to use SVXY as a garnish and not a main course in a portfolio is simple: it can lose a lot of its value very quickly. In that sense, it is a lot like owning call options on the S&P 500. If the market rises, you put up a modest amount and made a hefty gain. If the market falls, you can lose much of what you risked. That’s why the biggest threat we see to SVXY is not in the ETF vehicle itself. It is when investors try to force it to be a bigger role-player than it ever should be. In other words, they take a good idea and let greed ruin it. We suggest not letting that happen, by knowing what you own, and what its reward-risk potential is.

Proprietary Technical Ratings

-

Short-Term Rating (next 3 months): Buy.

-

Long-Term Rating (next 12 months): Hold.

Conclusions

ETF Quality Opinion

SVXY is an ETF we like to keep on our radar at all times, due to its rare ability to capitalize on rapid, bullish turnarounds in the stock market. We like the simple way it is constructed, and it is a nice tool to have in the tool box as tactical investors.

ETF Investment Opinion

We rate SVXY a Buy. That said, it is a classic “tactical” position, and never a buy-and-hold ETF. Our Buy rating is more of a reflection that it can be useful as a substitute for having a larger equity position when the bear market appears to still have a ways to go. Big S&P 500 bounces like we saw in June and October of 2022 are par for the course in bear markets. So, in addition to scouting for equity ETF positions that can provide some relative return in downturns and market-level or better returns in upswings, SVXY is an attractive supplementary position at times. But once again, we advice caution in using it. Understand it, study its history and avoid using SVXY to excess.

Be the first to comment