venuestock

In early October, I recommended to readers to start accumulating the Simplify Volatility Premium ETF (NYSEARCA:SVOL), as spot VIX was trading at distressed levels, which historically had yielded good future returns.

With spot VIX now back in the low 20s, the mean reversion trade that I highlighted in early October is now largely complete. SVOL can still generate returns, but it will require markets staying calm. I think investors should consider taking some money off the table.

Brief Fund Overview

Readers who want to learn more about the details of the Simplify Volatility Premium ETF should take a look at my initiation article.

Briefly, SVOL ETF seeks to provide investment returns that correspond to 0.2x to 0.3x the inverse of the S&P 500 VIX short-term futures index, with tail hedge for extreme events.

Buy When There’s Blood In The Streets

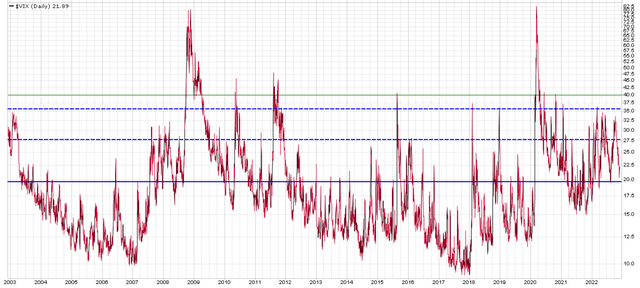

Volatility is a mean reverting asset, so it perfectly follows the investing idiom, “buy when there’s blood in the streets.” Back in October, we had the situation where spot VIX was approaching 2 standard-deviation (“SD”) from the mean, as shown in Figure 1.

Figure 1 – Long term chart of spot VIX (Author created with price chart from stockcharts.com)

Sure enough, spot VIX peaked at 34.5 on October 12, 2022, shortly after my article was published.

Today, with spot VIX trading in the low 20s (spot VIX reached a low of 20.3 during the low-volatility Thanksgiving week), we are near fair value for volatility, i.e., the forward return profile is not as skewed in investors’ favor.

SVOL Can Still Make Money

To be clear, I am not predicting a market collapse (although it is certainly possible, given the slew of economic data releases and Fed Chair Powell’s speech on November 30, 2022). What I am saying is that the “mean reversion” trade is done, since we are back at the mean.

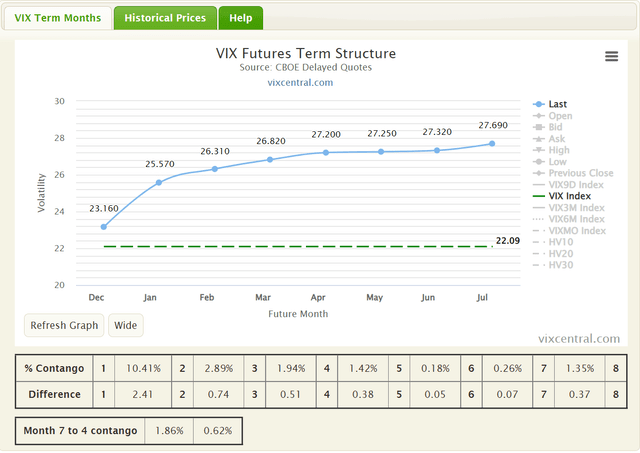

Forward returns for the SVOL ETF will have to come from the VIX term structure. Since SVOL shorts the 1st and 2nd VIX futures, if volatility remains contained and the curve remains in contango, then as time passes, the 1st and 2nd futures should “roll down” to converge to spot VIX, generating returns for SVOL. Figure 2 shows the current VIX curve. Note that the curve is now in contango (futures price are higher than the spot price), dramatically different from the inverted curve back in October.

Figure 2 – VIX term structure (vixcentral.com)

Risks To SVOL

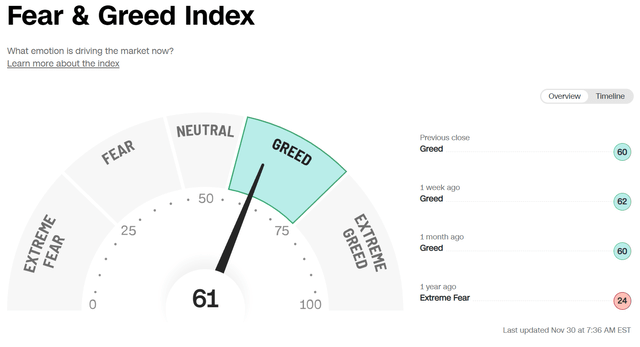

The risk to SVOL is a pick up in volatility, as investors have become rather complacent in a matter of weeks. In fact, the CNN Fear and Greed indicator has turned back into Greed territory, as investors are more afraid of missing the rally than further declines (Figure 3).

Figure 3 – Markets back to greed (cnn.com)

Conclusion

The mean reversion trade that I highlighted in early October is now largely complete. Simplify Volatility Premium ETF can still generate returns, but it will require markets staying calm. I think investors should now consider taking some SVOL money off the table.

Be the first to comment