da-kuk/E+ via Getty Images

It’s been an odd couple of weeks for Bitcoin (BTC-USD). With the backdrop of the Bitcoin 2022 conference in Miami, there were numerous instances of well-known market participants adding to what are already large holdings of the top cryptocurrency. MicroStrategy (MSTR) CEO Michael Saylor added $190 million in BTC to the corporate balance sheet. Do Kwon, the CEO of Terraform Labs, added even more than that. And yet, Bitcoin still ended up back below $40,000 at Monday’s close.

Strike and Network Demand

Michael Saylor or Do Kwon buying Bitcoin is seemingly now a headline that is suffering from the law of diminishing returns. What I assumed would be a larger driver of price though was the announcement during the 2022 conference that Strike will be integrating with Shopify (SHOP). Strike is a payments platform that can now be used by merchants on a B2C basis or by consumers on a peer to peer basis. The P2P functionality is similar to Venmo. Per Strike’s press release:

The Strike integration offers an alternative experience to traditional card networks by leveraging the underlying technology of the Bitcoin Lightning Network to allow for instant, global, cash-final payments while also eliminating legacy processing fees like interchange. Strike’s integration is accessible by any consumer in the world with a Bitcoin Lightning Network-enabled wallet, including more than 70 million CashApp users.

In my view, this is not a small deal. A user of Strike can connect to a traditional bank and load dollars into their Strike account. That same user can then send the dollars to a merchant with nearly instant settlement. From a user interface perspective, the sender uses the Bitcoin network to send dollars with no USD to BTC exchange friction felt by the sender or receiver whatsoever. The merchant benefits from this kind of exchange because the merchant doesn’t need to pay traditional payment processing fees through traditional payment rails.

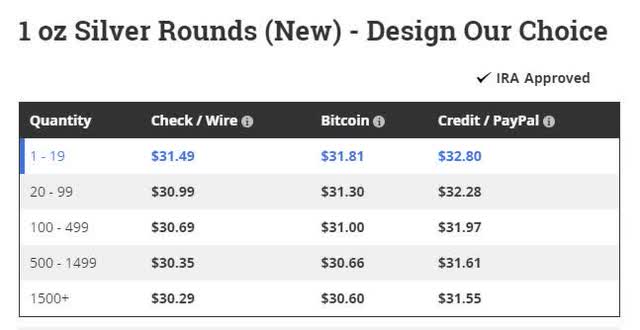

Metal is priced by payment method (SD Bullion)

Anyone who has ever bought physical metal before probably understands the value of buying goods without a credit card processing fee. You can see in the screenshot above that it is already cheaper to buy physical silver with the Bitcoin network than it is to buy silver with a credit card. And this is presumably before this merchant has even adopted Strike integration. For the user, paying for goods through Bitcoin’s Lightning Network might ultimately lead to lower prices for everything since the merchant won’t have to bake the processing fee into the cost of the item. It is advantageous for both merchant and customer to do this.

Exchanges and Network Supply

The exchange flow for Bitcoin is currently at a level that is generally an indicator for positive BTC price moves in the weeks ahead. Will Clemente, lead analyst at Blockware Intelligence, shared this on Twitter late Wednesday morning.

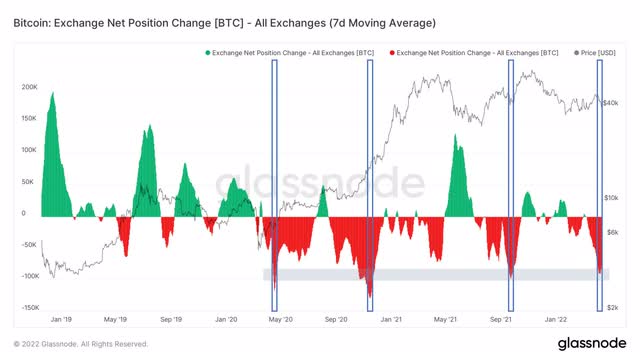

BTC Exchange Flow (Glassnode via Will Clemente)

You can see in this chart that past instances of the deep red outflows from exchanges have generally led to large moves to the upside in the price of BTC. What these outflows indicate is Bitcoin buyers are pulling coins off exchanges and opting to self-custody rather than hold in a more tradeable environment. The implication being the owners intend to hold the coins for a period of time rather than sell any short-term rips.

Of course, the exchange flow metric is just one side of the supply/demand equation. For the exchange outflow to actually result in higher Bitcoin prices, there has to be strong demand for Bitcoin as well. To this point, that demand has not been there to a large enough degree despite the efforts of Michael Saylor and Do Kwon.

The Setup for Traders

From a technical perspective, I’ve had my eyes on the 8-week and 20-week moving averages for quite some time. Those two averages have converged quite a bit over the last 3 weeks. If bulls aren’t totally out of ammo, the 8-week will cross back over the 20-week for the first time this year.

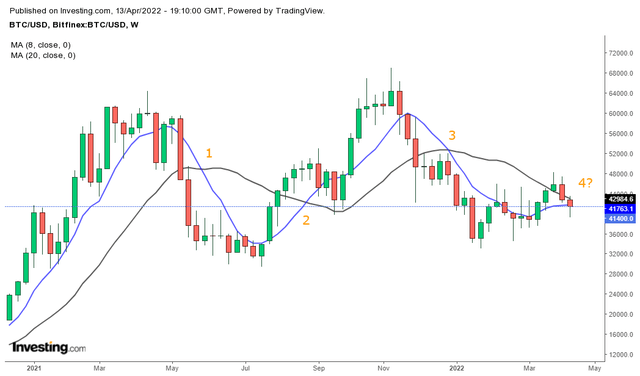

8 Week Vs 20 Week Currently (investing.com)

If the 8-week does manage to cross above the 20-week in a bullish manner, it would be the fourth cross involving the two averages in the last 12 months. The last time this happened was in May of 2020 right before Bitcoin rocketed to new all-time highs.

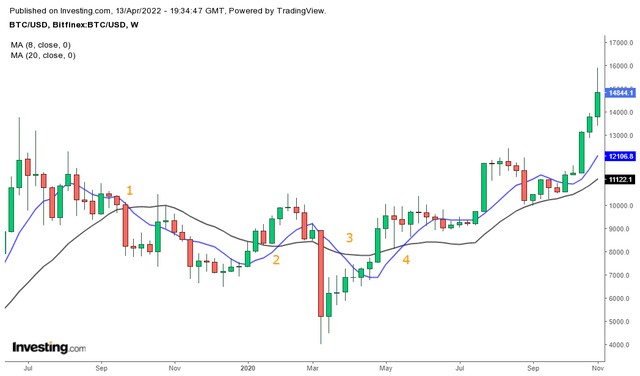

8-Week Vs 20-Week, Q2-20 (investing.com)

Past performance is not a guarantee of future returns and the setup isn’t exactly the same as last time, but even when you go further back in Bitcoin’s history four crosses of the 8 and 20 week moving averages in such a short period of time have generally been an indication of consolidation before new highs. The daily chart shows quite the uphill climb.

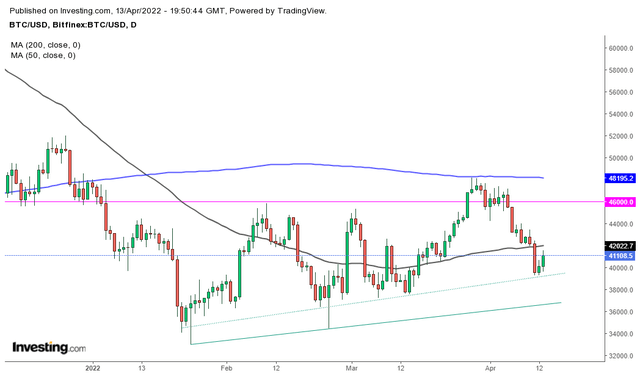

Bitcoin Daily Chart 4/13/22 (investing.com)

In the daily, we can see immediate resistance potential in the 50-day moving average, $46k, and in the 200-day moving average. And that’s if Bitcoin can even hold the higher low trendlines that I’ve drawn as potential pivot points. And to be clear, I’m entirely unconvinced those lines will hold should they be retested. That’s because ultimately the immediate direction might be entirely up to the Nasdaq 100.

The Real Catalyst

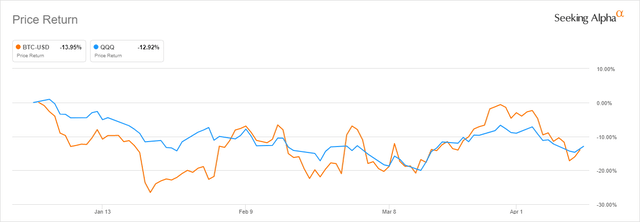

BTC vs QQQ YTD (Seeking Alpha)

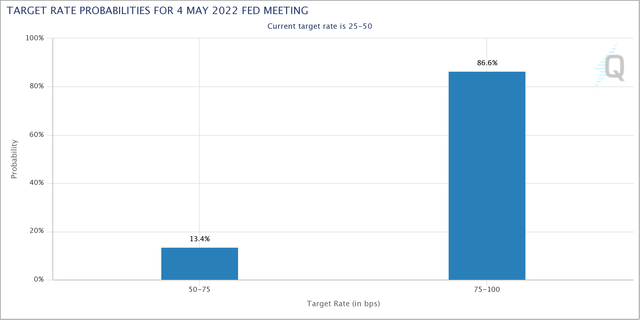

We’ve seen the correlation between Bitcoin and tech for months. Extended valuation metrics aside, stocks have sold off as a result of changing monetary policy fears. CME Group now has a 50 basis point hike in May at an 86.6% probability.

May 2022 Rate Probability (CME Group)

That’s a pretty strong certainty of a 50 bps move. Strong enough that we should be fairly close to the hike being priced into the equity markets at this point. There is the belief the equity market has sold off because of perceived hawkishness in the Fed minutes that were released earlier this month:

Many participants noted that one or more 50 basis point increases in the target range could be appropriate at future meetings, particularly if inflation pressures remained elevated or intensified.

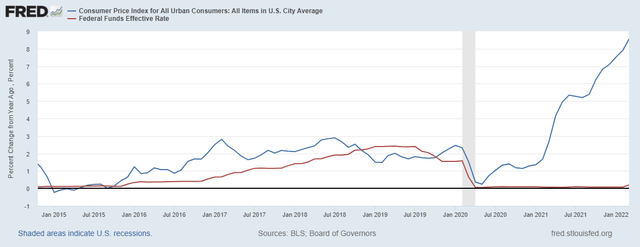

I think the comment about inflation is interesting because we’re now seeing some sentiment that inflation may have finally peaked. If we look at the year-over-year change in CPI, we see that it was March of 2021 when the year-over-year rate moved up from 1.6% to 2.6%. It was one month later where we got a CPI above 4% from the April print.

The point is April’s year-over-year CPI comp will likely not be as extreme as the comps from the last two months. I don’t think it’s a stretch to suggest the year-over-year rate of change for CPI has actually peaked for now.

The minutes also claimed there were internal Fed voices who opted for 25 bps rather than 50 in March because of Ukraine/Russia war uncertainty. If the war is a reason for dovishness, then Wednesday’s announcement of another $800 million in arms support for Ukraine from the United States is probably an indication that peace in that conflict isn’t close.

Of course, what the Fed says it will do and what it actually can do are not exactly synonymous. If high inflation isn’t as large of a concern after the April 2022 number is ready and the war in Ukraine is still a large conflict, will the Fed wiggle out of a 50 bps hike again? We’ll find out.

Risks

Bitcoin is moving like a tech stock. Until that changes, I don’t know that bulls are likely to get a strong breakout to the upside from the range that it currently finds itself. Since broad equities and specifically tech stocks are having a hard time due to Fed policy concerns, Bitcoin could struggle from here. Bitcoin also has several technical resistance levels that figure to be large hurdles going forward.

Summary

I’m bullish Bitcoin long term. I’ve been writing Seeking Alpha articles stating such fairly regularly. Right now, I can’t confidently say Bitcoin won’t go lower from here. Potentially even much lower. What I will say is I’ve positioned much of my portfolio with the assumption that the Fed is incapable of raising interest rates to a large degree. Whether the central bank blames that inability to raise in Russia, inflation slowing down, or deteriorating macro fundamentals is irrelevant.

If I’m correct, I think Bitcoin will move higher when the market realizes rate hikes that have been priced in aren’t coming. I think Bitcoin benefits from a loss of faith in the Fed and the traditional system. I think there are players in the cryptocurrency industry that are making very interesting moves. Companies like Strike can foster greater Bitcoin network adoption without the consumer even realizing they’re using it. There are a lot of hurdles. But Bitcoin holders are taking their coins out of the mix and sitting on their assets. The setup is there for a supply crunch higher. All that is needed is a strong enough catalyst.

One More Thing

I’m really excited to share that I’ll be launching a Marketplace service right here on Seeking Alpha called Heretic Speculator PRO in the next few weeks. As we get closer to the launch, I’ll get into more of the details about the service and the value proposition for subscribers. Make sure you follow me so you don’t miss what’s coming!

Be the first to comment