conceptualmotion/iStock via Getty Images

I last reviewed Supernus (NASDAQ:SUPN) in 03/2022’s “Supernus: New Beginnings” (“New Beginnings“). Since that time, Supernus has garnered FDA approval and continues waiting on its 10/2022 PDUFA for its SPN-830 (apomorphine infusion device).

In this article, I discuss its progress in advancing its product franchises, its pipeline and its deal outlook.

On 05/2022, Supernus Launched QELBREE For Patients 6 to 17 Years Of Age

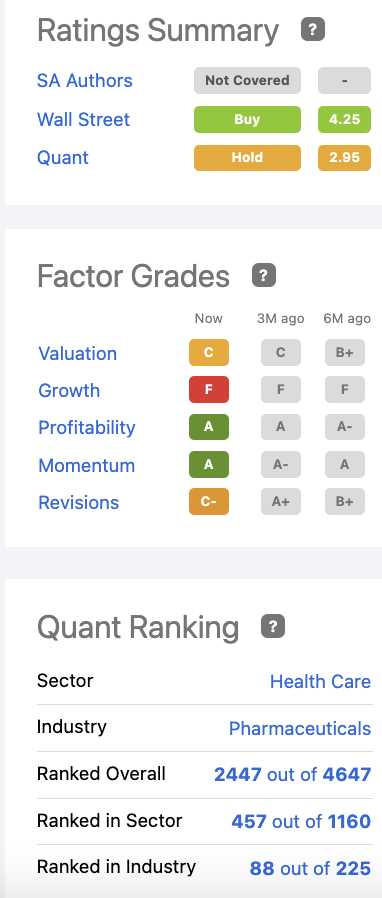

Good news for Supernus arrived in the form of the FDA’s 05/02/2022 approval of QELBREE (viloxazine extended-release capsules) in treatment of adults with ADHD; previously it had only been approved to treat pediatric patients 6 years and older. The label expansion was a big deal, as shown by the slide below from Supernus’ 06/2022 presentation at the Jefferies Healthcare Conference:

The label expansion opened the market to twice as many eligible patients as had previously been eligible for pediatric QELBREE.

There are lots of FDA approved treatments for ADHD. However, QELBREE is not just another me-too therapy. It enters the list as the first new nonstimulant therapy option for adults in 20 years. With its more rapid onset of impact, it has significant appeal over its older nonstimulant competition, Strattera and Intuniv and their diverse cheap generics.

When QELBREE was approved for pediatric patients, an analyst pegged its peak sales potential at $400 million. QELBREE’s potential is significant. How significant is for the future to determine? Its true size will be unknowable until its launch in adults gets more established, likely not until 2023.

Anecdotes and unsatisfactory comparisons will have to suffice until then. If everything goes just right, it has near blockbuster potential.

Supernus Has A Struggling PD Franchise That Needs A Win On Its Upcoming PDUFA Date

In ‘New Beginnings,’ I described the four pillars of Supernus newly acquired PD franchise as follows:

- APOKYN (apomorphine hydrochloride injection) for the acute, intermittent treatment of hypomobility, “off” episodes in patients with advanced PD, acquired in its 04/2020 US WorldMeds deal;

- MYOBLOC (rimabotulinumtoxinB) injection, in treatment of certain conditions associated with PD also acquired from US WorldMeds, produces only nominal revenues (lumped with “other” in excerpt above);

- GOCOVRI (amantadine) extended release capsules approved for patients receiving levodopa-based therapy in treatment of dyskinesia and in PD patients experiencing OFF episodes, acquired in its 10/2021 Adamas deal;

- OSMOLEX (amantadine) indicated for the treatment of PD was also acquired in the Adamas deal, like MYOBLOC it produces minimal revenues and is lumped with “other”.

The only two components that track from its 2021 10-K list of disaggregated revenues (page 112) are APOKYN and MYOBLOC. Both of these came in with its 2020 US WorldMeds deal. Its subsequent 10/2021 Adamas deal brought it GOCOVRI and OSMOLEX.

Supernus’ disaggregated revenues table (page 14) from its Q1, 2022, 10-Q continues to lump revenues for OSMOLEX and MYOBLOC in with its inconsequential “others”. Accordingly, its two deals brought in four PD therapies, but only one in each deal that really matters.

The 10-Q (p. 14) lists nice Q1, 2022 revenues of $18.4M for APOKYN and ~$22.6M for GOCOVRI. These are not outstanding numbers as they sit for Q1, but they show potential for GOCOVRI.

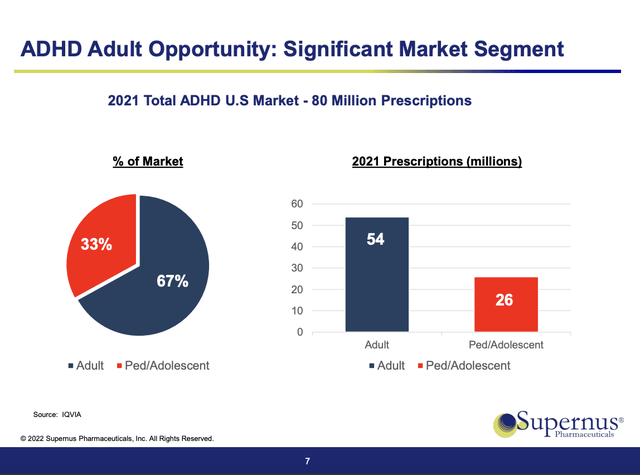

New Beginnings discusses GOCOVRI in some detail. Originally approved in 2017, it received an important label expansion in 2021. Its expanded label approved it:

…as an adjunctive treatment to levodopa/carbidopa in patients with Parkinson’s disease experiencing OFF episodes, in addition to its indication for the treatment of dyskinesia in patients with Parkinson’s disease receiving levodopa-based therapy, with or without concomitant dopaminergic medications.

Adamas CEO McFarlane enthused that the expanded indication doubled the size of the patient population for which GOCOVRI was approved. New Beginnings pointed to potential peak sales of $750 million. Judging from Supernus’ results to date, as shown by its Jefferies Healthcare Conference (06/2022) slide below, it has to spur a serious giddy-up on GOCOVRI to reach anywhere near such a peak sale total:

Supernus GOCOVRI’s Q1, 2022 10-Q revenues annualized come to ~ $90.4M. At such a level its future will likely shine bright in Supernus’ product portfolio but will be unremarkable in any wider arena.

As for APOKYN, its revenues for Q1, 2022 were down from $21.7M in Q1, 2021. Its upcoming 10/2022 PDUFA for SPN-830 looms large. Insofar as this application originally generated an RTF, its approval admits of significant doubt.

Supernus’ Q1, 2022 Was Mixed With Its Outlook Calling For More Of The Same

Supernus reported a mixed Q1, 2022. It is pretty much in a rut. Recently, it has been trading in a channel between ~$24 and ~$31. Its most recent guidance from its Q1, 2022 earnings call confirmed its prior guidance as follows:

For the year ended 2022, the company reiterates its prior financial guidance for total revenue combined R&D and SG&A expenses and GAAP and non-GAAP operating earnings. As such, we expect total revenues to be in the range from $640 million to $680 million comprised of net product sales and royalty revenue. For the full year of 2022, we expect combined R&D and SG&A expenses to range from $460 million to $490 million. This range includes the expected significant increase in marketing spend in the second and third quarters that Jack mentioned, as they relate to continue to support QELBREE that’s launched in the adult market.

Now that QELBREE has moved up to the product category and of its pipeline, its pipeline (Jefferies presentation slide 5) is looking denuded. It has its SPN-830 waiting on its PDUFA. Next on its pipeline are two phases 2 candidates, SPN-840 in PD and SPN-820 for treatment resistant depression. Below is one phase 1 molecule in treatment of epilepsy.

The balance of its pipeline consists of three preclinical and two molecules in discovery. It’s no wonder that CEO Khattar spoke passionately during Supernus’ Q1, 2022 earnings call about how Supernus was on the hunt for pipeline acquisitions. He reflected on how targets represented a mixed bag. Those with cash resources were setting high prices on potential deal molecules.

Companies that were short of cash tended to be more reasonable. As for Supernus, it has cash to do a deal and:

…continue[s] to look at the different things that are available out there, … focused on trying to expand … our pipeline… [H]opefully, we will launch the pump pending FDA approval in the first quarter of next year. The latest assets in our pipeline is in Phase II. So if we can find something at a later stage that will be ideal, and we’re fairly agnostic, whether that is in neurology or psychiatry.

Supernus is on the outlook for acquisitions; however, investors should be mindful that some consider that it is, itself, an acquisition target. An 05/2022 report on Supernus’ Seeking Alpha news feed cited Supernus as one of a group of most likely small-cap merger candidates.

That could well be, but I’m not sure where the attraction lies. Its pipeline is subpar. Its therapies have potential in some cases, but none of them are exceptional. As an acquisition target, one has to ask where’s the beef?

Conclusion

Supernus is doing fine in an era when so many little Pharmas are struggling. That separates it from many of its peers in a positive way. However, as a target for investment dollars, it has but modest appeal.

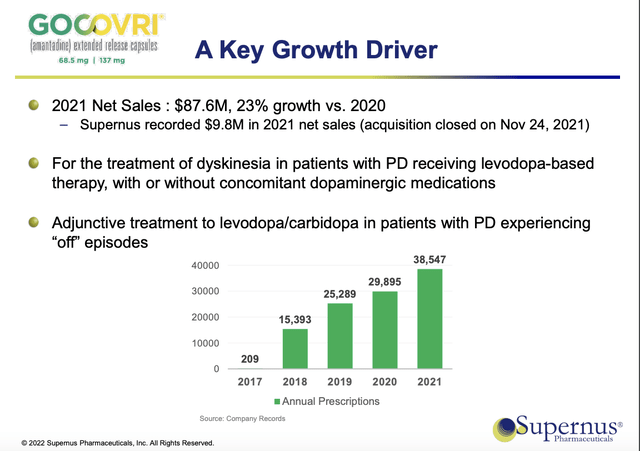

Its Seeking Alpha ratings as shown by its ratings panel below is wholly unremarkable:

seekingalpha.com

Accordingly, the ratings panel provides an eloquent portrayal of an investment in Supernus.

Optimists can point to big potential in QELBREE and GOCOVRI. Realists may resist, refusing to move based on blue sky projections. As matters now stand, Supernus is a work in progress. GLTA.

Be the first to comment