AZaytsev/iStock via Getty Images

Introduction and Overview

Pipestone Energy (OTCPK:BKBEF) is a junior Canadian E&P with its operations concentrated in the Montney near Grande Prairie. In the assessment below we will deconstruct Pipestone within two main contexts and prove that meaningful upside underpins Pipestone, given its operational performance and economic prowess.

- Operational Assessment: Pipestone has demonstrated above-average operational performance as showcased by its top decile production per well relative to peers, significant YoY production growth and several egress facilities supporting future development.

- Economic Assessment: Pipestone has posted both strong top and bottom-line numbers, remains severely undervalued both from an intrinsic value and trading multiples perspective, and is positioned to generate meaningful free cash flow in 2022.

Pipestone is a strong Canadian gas operator, and a clear sector outperformer when compared to the other Canadian E&Ps. As a result, we have a bullish outlook on Pipestone given its strong free cash flow generation and future growth potential. As such we recommend a buy.

Operational Assessment

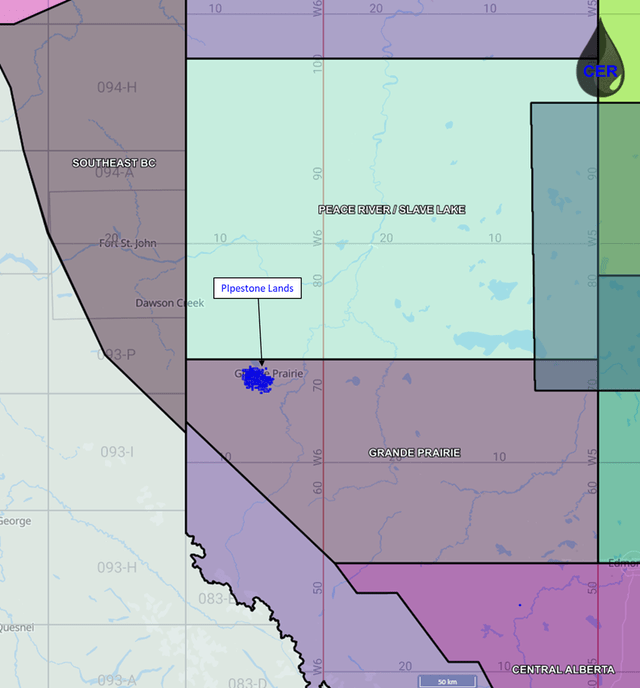

Pipestone is an intermediate upstream Canadian producer and will be compared against other comparable peers with production between 25,000 and 75,000 boe/d. Pipestone is a liquids-rich producer with 43% of its production from oil and NGL’s, and the balance from natural gas. Pipestone’s operations are concentrated in the Grande Prairie region of Alberta, and we will focus our comparison to relative peers within this region.

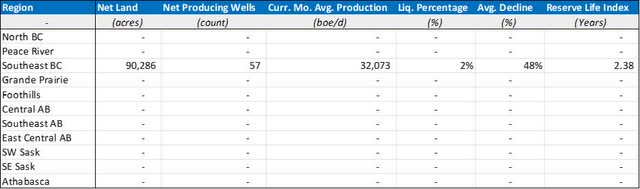

For context, the below table summarizes Pipestone’s position across all regions of the Western Canadian Sedimentary Basin. Note that values may not be exact as they include several underlying assumptions and simplifications.

Figure 1: Summary of Land Position and Production by Region (Source: XI technologies, geoSCOUT, generated and formatted by CER)

Figure 2: Summary of Land Position and Production by Region (Source: XI technologies, geoSCOUT, generated and formatted by CER)

Acreage and Production

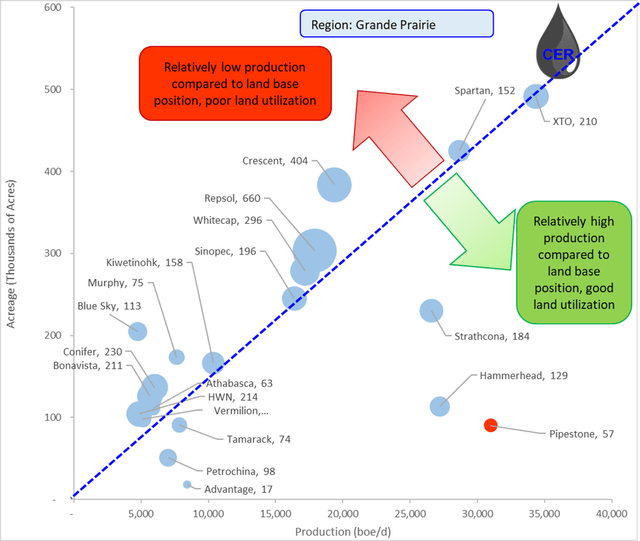

Pipestone maintains some of the highest quality acreage in the region, with some of the highest production per acre relative to peers, while maintaining a relatively modest net well count. This is reflective of highly effective geological mapping, and successful drilling and downhole stimulation activities. Moreover, Pipestone finds itself on some of the most attractive Montney acreage as its situated along the liquids-rich over-pressurized zone (pressure gradient >10 kPa/m) of the Alberta Montney fairway. Lastly, Pipestone finds itself surrounded by several processing facilities (Veresen Hythe, Keyera Pipestone, Tidewater Pipestone, SemCams Wapiti) paving the way for egress optionality as well as supporting the company’s aggressive growth plan. Given the egress versatility, acreage quality and land utilization, Pipestone stands out as a bullish prospect.

Figure 3: Net Acreage (Y-Axis), Production (X-Axis) and Net Well Count (bubble size) by Operator (Source: XI technologies, geoSCOUT, generated and formatted by CER)

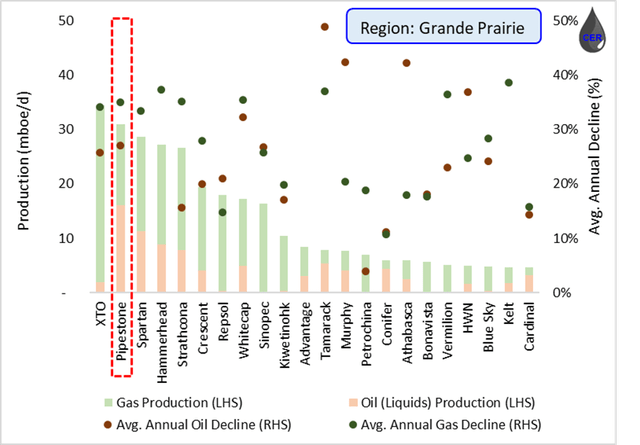

Production Decline and Drilling Activity

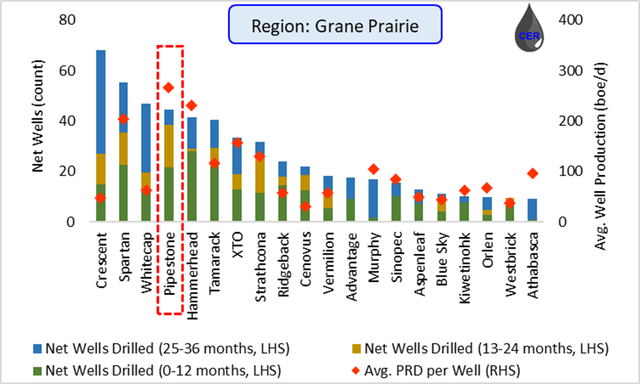

Pipestone maintains some the most competitive acreage in the Montney and is quickly re-investing its FCF to capitalize on the current economic backdrop. As illustrated by the plots below, Pipestone maintains a commanding position in terms of production and drilling activity, relative to other intermediate peers (<75 kboe/d production) in the region. A key point to consider is Pipestone’s relatively high production decline. The company’s future development is closely dependent on successful drilling results and its ability to continue to grow its production. Due to this sensitivity, we will discount Pipestone’s future cash flows (see next section below) at a higher long-term discount rate of 15%, above our base discount rate of 10%.

Moreover, management revised its 2022 capital program to ~C$230 million for the year, driving towards 2022 exit volumes of 37,000 boe/d. Management also re-iterated the three-year outlook volumes to average 32 / 41 / 47 kboe/d through 2022 / 2023 / 2024 respectively. Pipestone spent C$78 million in Q2, with the majority of the expenses attributed to the 10 wells drilled and 8 wells completed. Moreover, management is forecasting an additional 9.5 net wells to be drilled and 7.5 net wells to be completed throughout the remainder of the year. Lastly, Pipestone is piloting inter-well spacing of 200m at its 2-25 pad where average IP30 rates 4.5 MMcf gas and 551 bbl/d liquids were achieved, well above other peers in the area. As illustrated below, Pipestone posts some of the highest production per well compared to peers in the Grande Prairie region, a testament to the team’s D&C effectiveness and the high quality of its acreage, further supporting a bullish outlook and our buy recommendation.

Figure 4: Production (LHS) and Average Annual Decline (RHS) by Operator (Source: XI technologies, geoSCOUT, generated and formatted by CER) Figure 5: Net new drills (LHS) and Avg. Production (RHS) by Operator (Source: XI technologies, geoSCOUT, generated and formatted by CER)

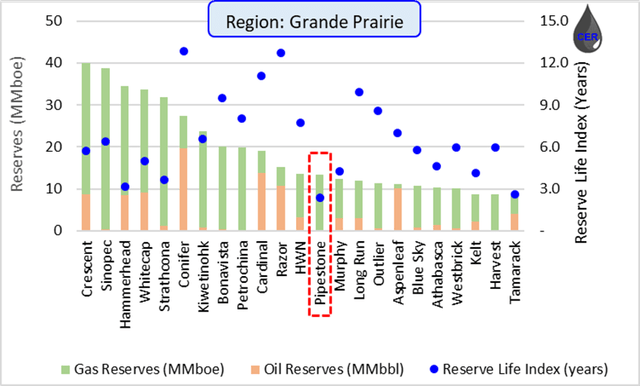

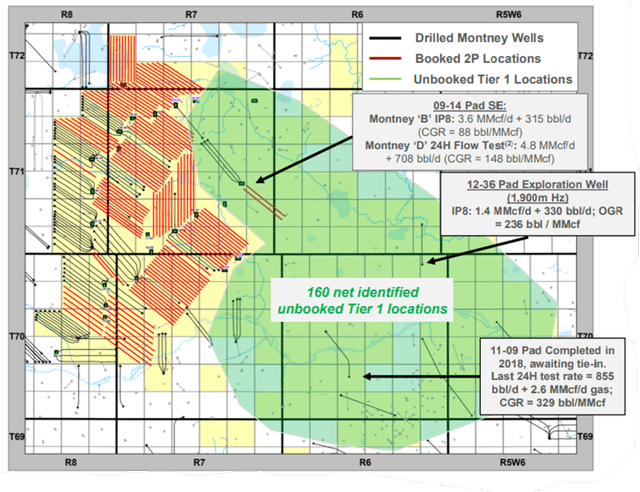

Reserves

Given Pipestone’s size and vintage, the company holds relatively small PDP reserves. However, as of YE21 the company and its Independent Qualified Reserve Estimator (McDaniel) report 149 undeveloped locations supporting growth to ~45,000 boe/d and held flat until 2032. Additionally, pipestone has ~160 unbooked locations on its Central and Eastern acreage blocks supporting further growth to ~55,000 boe/d. The company has began to delineate its unbooked inventory with its 09-14, 12-36, and 11-09 pads which show promising IP8 rates of 915, 563, and 1288 boe/d respectively. Moreover, given the company’s low PDP reserves relative to peers in the area, we will discount Pipestone’s future cash flows (see next section below) at a higher long-term discount rate of 15%, above our base discount rates of 10%.

Figure 6: PDP Reserves (left) and Reserve Life Index (RHS) by Operator (Source: XI technologies, geoSCOUT, generated and formatted by CER) Figure 7: Pipestone Acreage, Booked and Unbooked locations (Source: August 2022 Corporate Presentation)

Economic Assessment

In the following five sections we consider Pipestone’s latest earnings and breakdown its intrinsic valuation; starting with a commodity pricing outlook, production forecast, calculating field and corporate netbacks, and finally by discounting free cash flow back to present value.

Earnings and Return of Capital

Q2 volumes were ~30,800 boe/d in-line with consensus, primarily impacted by turnarounds at the Veresen’s Hythe plant and Keyera’s Wapiti plant. Pipestone posted CFPS of $0.39/share, also in-line with consensus. Pipestone management noted the company’s free cash flow is targeted towards debt reduction and NCIB share buybacks. With a YE 2022 net debt target of C$100 million, in addition to buying back a total of 10 million shares (valued at ~C$ 50 – 60 million) throughout 2022. In Q2, Pipestone bought back 2.8 million shares (valued at ~C$14 million) bringing YTD total to 6.6 million shares (valued at ~C$30 million). In the intrinsic valuation below we will deconstruct Pipestone’s free cash flow outlook to illustrate why the company remains incredibly attractive amid the recent pullback. This is in addition to the meaningful share buyback program outlined by management.

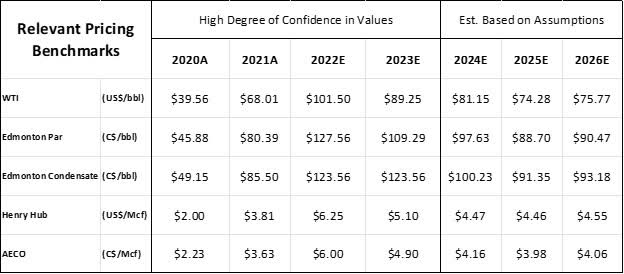

Pricing

Pipestone’s production can be separated into three main streams: light oils (~30%), NGL (~15%) and natural gas (~55%). On average, Pipestone has been able to realize close to benchmark pricing, with the exception of NGL’s falling 10-15% short of Edmonton Condensate & Natural Gasoline benchmarks posted by McDaniels. Where the bulk of the discrepancy can be attributed to product quality, given slightly higher sulfur content.

Figure 8: Commodity Price Outlook (source: McDaniels, generated and formatted by CER)

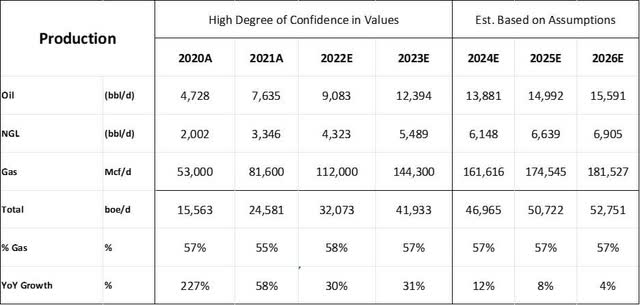

Production

Pipestone’s management provided competitive guidance for 2022, with year-over-year production increasing 30% from 2021, projected to grow another 30% next year, and continuing to grow towards ~55,000 boe/d by 2025. To remain conservative, we have incorporated a lower production growth forecast than management in our valuation, as illustrated below.

Figure 9: Production Outlook (source: 2022 Management Presentation, generated and formatted by CER)

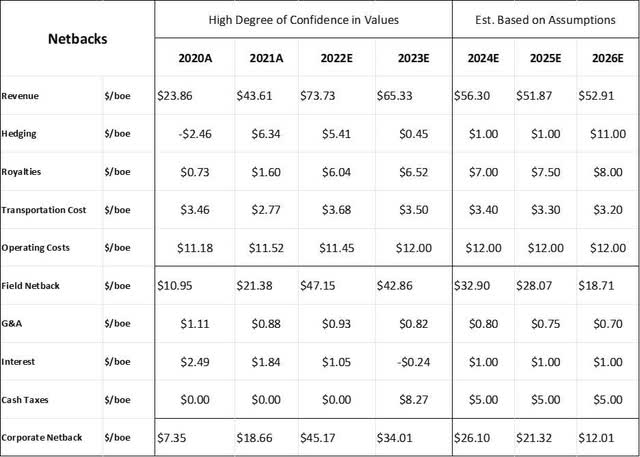

Netbacks

Given the current pricing environment, Pipestone continues to post appealing field and corporate netbacks. As with any oil and gas company, a major risk is a downturn in commodity prices as we have seen over the past month. Pipestone has partially mitigated this risk with both fixed price WTI and AECO swaps through Q1 2023. Currently, roughly 26% of 2022 volumes and 4% of 2023 volumes are currently hedged. Despite the hedging impact, the company is poised to generate meaningful netbacks at >C$45/boe throughout the rest of 2022.

Figure 10: Operational Netback (source: 2022 Management Presentation, generated and formatted by CER)

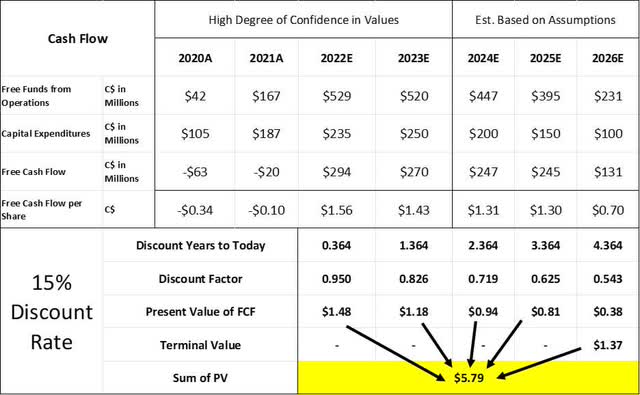

Cash Flow

Given its operational performance (as outlined by its best-in-class production per well), strong netbacks and attractive growth prospects Pipestone is poised to generate meaningful free cash flow over the next four years. Moreover, given the company’s smaller scale, relatively high decline rates, and lower PDP inventory we will discounts Pipestone’s future cash flow at 15%. As such, the present value of Pipestone falls between C$5.5/share and C$6/share, implying an attractive ~30% upside from its current valuation.

Figure 11: Free Cash Flow and Present Value (source: 2022 Management Presentation, generated and formatted by CER)

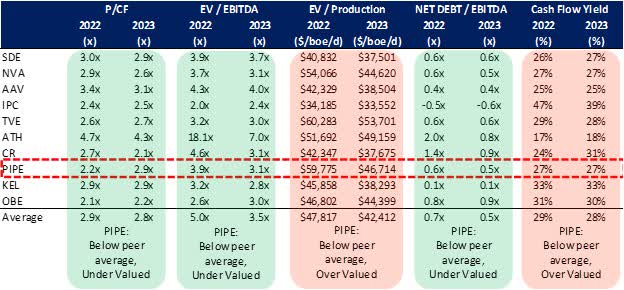

Comparables

Pipestone also remains attractive across several trading multiple metrics compared to Canadian peers of comparable size, as illustrated by the summary table below. Given the implied intrinsic value upside and attractive trading multiple metrics, we believe Pipestone exploration is a buy and we maintain a bullish outlook for the foreseeable future.

Figure 12: Trading Multiples of Various Comparable Peers (source: 2022 Management Presentations, generated and formatted by CER)

Conclusion

Pipestone is a proven Montney operator, enjoying meaningful netbacks in light of the current commodity backdrop, top tier acreage, existing processing facilities in the area and attractive development plan. As far as intrinsic valuation, Pipestone falls between C$5 and C$6 per share given current commodity, production and free cash flow outlook, implying an attractive 30% upside from the current valuation. Furthermore, Pipestone continues to trade at attractive multiples relative to peers, and as such warrants a buy recommendation.

Moreover, let’s consider the most bullish case for investors given the company’s positioning. A monetization opportunity through a corporate sale to a larger peer may soon present itself. Amid the recent market pullback, a pricing floor has begun to develop, partly supported by the uncertainty in Russian supplies. This has motivated many operators to redeploy cash to support growth through acquisitions, given the inflation-induced costly alternative to grow production organically. Several key acquisitions have taken place, (namely XTO/Whitecap, Strathcona/Serafina, Vermilion/Leucrotta) with operators looking to pay a premium for booked inventory, tax pools, and existing infrastructure in-place. All of which, Pipestone is enjoying and could materialize into significant upside for its existing shareholders.

Be the first to comment