Grafner/iStock via Getty Images

Intro

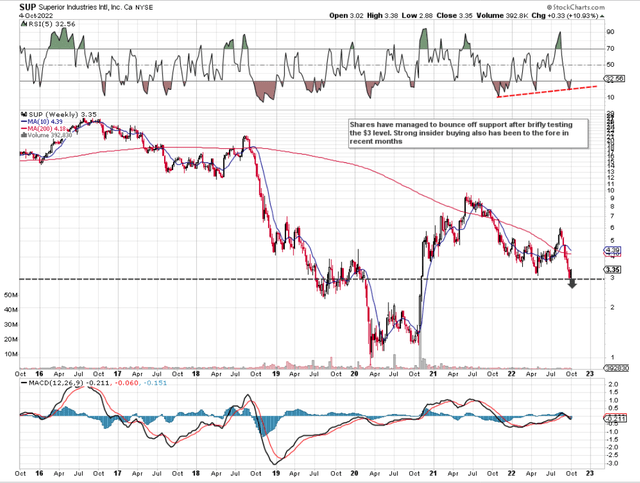

If we look at an intermediate chart of Superior Industries International, Inc. (NYSE:SUP) (aluminum wheel supplier), we can see that the $3 level (where there is strong resistance) seems to put an end to the decline we have seen in recent sessions. Bulls will now be hoping shares can push on above their 10-day moving average ($3.35) which would be a strong technical indicator that the bottom is indeed in for this stock. Furthermore, apart from the bullish divergence which is now emerging in the stock´s RSI momentum indicator, what is encouraging from a long-term standpoint is that insiders have been buying since June at prices above the prevailing share price. These trends foster confidence concerning future growth.

SUP Technicals (Stockcharts.com)

With all beaten-down value plays, we like to focus on profitability trends, the balance sheet, and obviously the valuation from a number of angles. Regarding profitability, the company reported its second-quarter numbers at the beginning of August where a convincing bottom-line beat ($0.07 per share) was recorded. Top-line sales also beat expectations and grew by over 24% over the same period of 12 months prior. Therefore, let’s delve into the ramifications of the second quarter earnings report to see if we can gain some insights into whether this earnings trend can indeed continue.

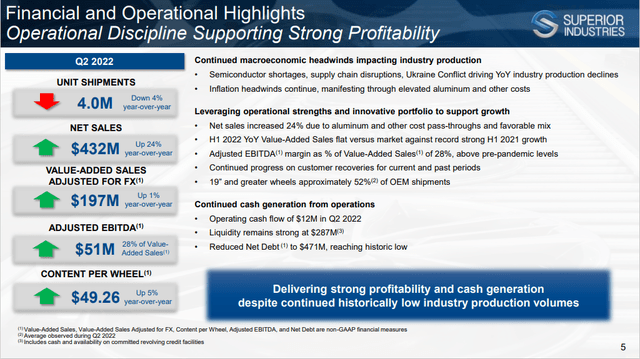

SUP Q2 Earnings

The main highlight of the earnings report was the strong margin growth, which when combined with the strong top-line growth facilitated the earnings beat in the quarter. Preservation of margins is crucial in inflationary cycles as it ensures that higher costs do not eat into the company´s profitability over time. Although Superior is executing on its cost control initiatives with $8 million in savings earmarked for this year alone, this industry in terms of production remains meaningfully lower compared to pre-Covid levels. Although management cited near-term momentum, this is still a worrying trend because it puts a time element on proceedings especially if inflation remains at elevated levels.

So, basically, what investors must consider is that it is inflation that is driving Superior’s top-line forward. Suffice it to say, if high inflation continues, at some point, the existing collaboration between customers (In terms of customers taking their fair share of the weight regarding higher costs) also suppliers may be difficult to attain. On the flip side, when one takes into account the success of the company´s CI & ECI programs to date, Superior definitely has significant operating leverage at its disposal which would drive earnings forward in the event of a strong recovery in this industry.

Superior´s Financial Highlights Q2 (Company Website)

Balance Sheet

The worst-case scenario for Superior is that if interest rates continue to follow inflation higher, the company is not only going to have problems meeting its costs but also its debt. Interest expense in the second quarter, for example, made up almost 40% of the company´s operating profit. Although the company continues to generate cash flow ($12 million in Q2), which in one sense is masking the risk of the sizable debt on the balance sheet, $580 million of long-term debt total is significant, especially given the company´s present market cap of a mere $90 million. Management stated on the earnings call that it has no near-term debt maturities pending and liquidity remains strong, but you can bet the market will be quick to punish Superior here if indeed the positive cash-flow trend were to end for example.

Value

Taking into account the above potential headwinds (Balance sheet debt & Sustained inflation), there is always a tradeoff when it comes to valuation, and this may explain why insiders have been buying Superior stock recently. Superior´s forward sales multiple of 0.05 and the forward cash-flow multiple of 0.61 really demonstrate how cheap shares are from both a sales and cash-flow perspective. Management has guided approximately $130 million in generated operating cash flow this year, so if this number is achieved, the balance sheet will continue to be protected. This is why we believe the market is pricing in at least a short-term bottom. Irrespective in the short term of whether pent-up demand will make itself known in Superior´s financials, shares are heavily oversold at present which is why we should see a strong bounce here soon enough.

Conclusion

Given Superior´s operating leverage, shares could easily double in price rather quickly if trading conditions cooperate. However, headwinds such as semiconductor shortages and inflation could cut any rally short which is why investors must remain cautious with this play. We look forward to continuous coverage.

Be the first to comment