Hispanolistic/E+ via Getty Images

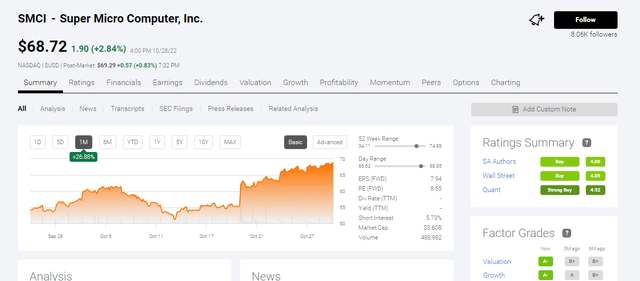

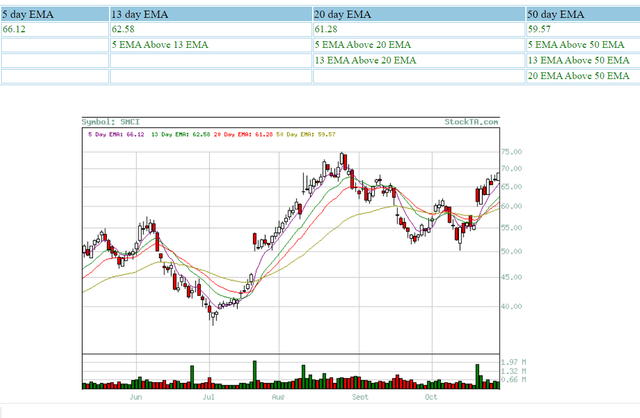

The substantial +26.88 one-month performance of Super Micro Computer (NASDAQ:SMCI) should inspire you to rake in the profit. Cashing out paper gains after a massive gain is the most prudent thing to do. On the other hand, Seeking Alpha Quant, SA Authors, and Wall Street still believe SMCI is a buy. I respectfully disagree with their assessments.

Profit taking while the stock still trades above $68 is the right thing to do. Averaging up while SMCI already touts a YTD gain of +50.64% is not ideal.

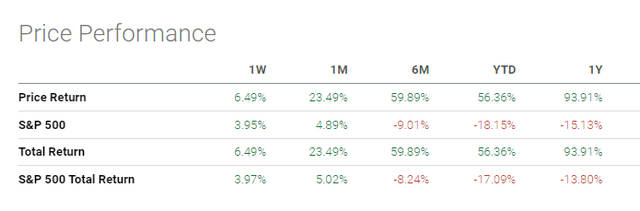

A hold-for-greater-gains is the second-best option. It is very tempting indeed for momentum traders to stay long on Super Micro because of the chart below. SMCI is a red-hot momentum stock this year.

If you think that the upward momentum will continue, then go long or average up on SMCI. Market emotion-gauge technical indicators remain bullish on this stock. In spite of the big one-month rally, SMCI’s RSI score is only 65.36. It has not reached the oversold score of 70.

The Exponential Moving Average indicator is also bullish on SMCI. The 5-day EMA is 66.12. EMA is bullish when the 5-day EMA is greater than 13-day, 20-day, and 50-day EMA score.

The stochastic oscillator is another accurate barometer of market emotion SMCI touts a stochastic score of 92.32. This score triggered a short-term bullish trade alert called stochastic oversold buried. In layman’s terms, the trade alert is saying this stock’s fast stochastic number has averaged above 80 for the past five trading days.

Take Profits Before There’s a Bearish Reversal?

The $700 billion tech rout that happened last week convinced me that we should be more prudent. Data center operators like Google (GOOG) and Facebook (META) lost more than $100 billion each in market cap. This brutal treatment could infect Super Micro. Investors are nervous. They are cashing out of tech-related companies. A bearish contagion could derail the upward momentum of SMCI.

When there’s a dumping attack on giant firms, midget companies like Super Micro Computer might get injured by falling debris. Data center operators are the biggest customers of server hardware/custom compute hardware vendors like Super Micro. A big boost to its rack-scale server infrastructure products is why Super Micro achieved $5.2 billion revenue for F2022. The 46% YoY increase in sales is thanks to the 2020/2021 COVID-19 tailwind. Most of the world went work-from-home and learn-from-home at the onset of the pandemic in early 2020.

The big data center operators saw their stocks get hammered because investors lost confidence in them. The knee-jerk reaction of beleaguered managers is usually to will be to announce cost-cutting and other investor-assuring promises. Cost-cutting entails reduction of the workforce and lower budget for new equipment, travel, recreation, and other employee perks.

It will be hard for Super Micro’s management to sustain that 46% TTM revenue CAGR. The global server industry has a market size of $89.91 billion. Unfortunately, its CAGR is now only 7.9%. Super Micro’s handicap is that it is engaged in the low-growth server hardware industry.

Losing the COVID-19 Tailwind

My fearless forecast is that the evaporation of the COVID-19 data center tailwind could only give Super Micro a forward 5-year average revenue CAGR of 16 to 18%. The past 5-year revenue CAGR of SMCI is only 14.61%. A big spike in YoY revenue is not sustainable for SMCI. Super Micro Computer Inc. is a dwarf among giants. It is not yet among the top server hardware vendors.

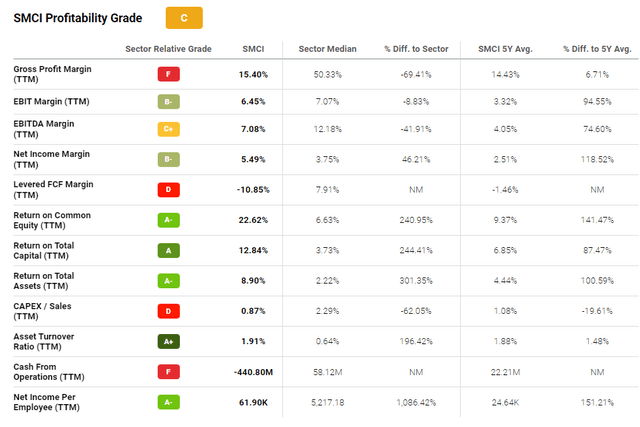

A midget competing against giants will operate on very low margins.

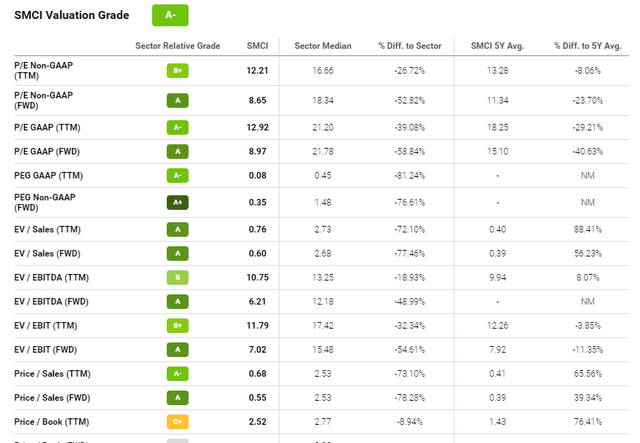

It is an obvious headwind that SMCI has a very low 15.40% gross operating margin. The chart illustrates why the positive momentum of SMCI could not last another 12 months. The low profitability of Super Micro is a bad metric when you couple it with the uncertainty over the sustainability of that 46% revenue CAGR. A gross margin of less than 16% is also likely why SMCI has very affordable valuation ratios. Low-profit companies usually do not get high valuation.

The low forward P/E of 8.97x is still not enough to offset that 15.40% gross margin. Super Micro Computer is like selling its data center products at very low pricing.

My Verdict

The huge 1-month price performance of +26.88% smells like hedge fund team spirit. Quitting while you are ahead is the best trait of long-term winners. Cash out the paper profits before the big traders do so.

The other option is to be greedier. The momentum technical indicators are still saying SMCI is a buy. Hold on and wait for more capital gains before raking in the profits.

I hope you understood why the dumping of data center-heavy tech stocks has repercussions for a small vendor like Super Micro Computer Inc. SMCI is a server-centric company that could suffer from future cost-cutting of data center and server farm operators. A difficult server market scenario could cause that 15.40% gross margin to go even lower.

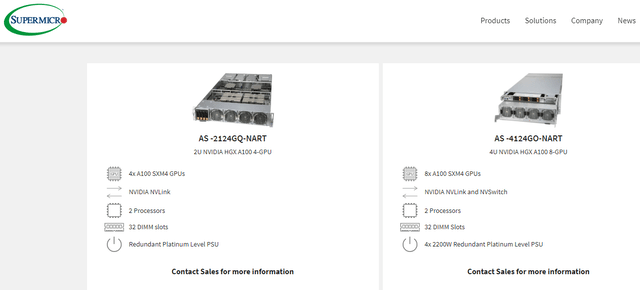

The saving grace against weakened rack-server sales would be AI and ML GPU accelerator sales. Being a reseller still increases revenue numbers. Super Micro should aggressively market itself as a vendor of AI inference processors and ML GPU accelerators. Super Micro will never become a top 5 server vendor.

My takeaway is that Super Micro must aggressively expand on the $10.41 billion AI hardware industry. This niche market has a high 26.96% CAGR. This is better than the traditional server industry’s 7.9% CAGR.

Better profitability is highly desirable for Super Micro. Its Altman Z-score is only 3.98 – below the safe score of 4. SMCI’s Piotroski F-score is only 4. This is far from the highest score of 9. I conclude that SMCI doesn’t offer good value at current price level.

Be the first to comment