RiverNorthPhotography/iStock Unreleased via Getty Images

Investment Thesis

Sunoco LP (NYSE:SUN) has managed to pay a steady dividend despite significant fluctuations in oil prices. It has done a good job of reducing its debt levels. The demand for fuels that Sunoco supplies is expected to remain robust over the next few decades, that should help the company generate a steady dividend income for its investors in the years to come.

Business

Sunoco is primarily involved in gasoline distribution. The company operates in Fuel distribution and Marketing and Other segments. It purchases gasoline from small and large oil companies and distributes it across 40 states on the East Coast, Midwest, South Central, and Southeast regions of the United States. Sunoco LP is also one of the largest motor fuel distributors in the United States for the Chevron (CVX), Texaco, ExxonMobil (XOM), and Valero (VLO) brands. Businesses from other segments include partnering with retail operators. The company also earns lease income from leasing and sub-leasing real estate.

Industry Transition from Fuel-Based Vehicles to EVs

Electric vehicle (“EV”) purchases have surged in the United States. Americans are purchasing more EVs than ever before. In Q3 FY22, EV sales increased by 67% year-on-year. Additionally, EV sales as a percentage of total sales have increased to 5.6% from 2.9% in 2021. However, Sunoco believes that the industry’s shift from fuel-based vehicles to electric vehicles should take decades and will not happen anytime soon.

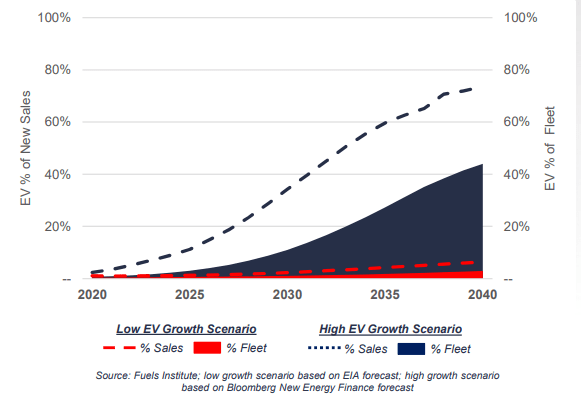

The chart below depicts low and high EV growth possibilities for the next 20 years. Even in a high-growth scenario, EVs account for just 44% of the U.S. fleet in 2040. In a low-growth scenario, however, the proportion of EVs in the U.S. fleet is fairly low.

Fuels Institute

This shows that the demand for gasoline, diesel, and other fossil fuels will remain robust in the coming decades.

Financial Performance

Sunoco has outperformed the market in recent years. Its motor fuel sales climbed 39% year-on-year in Q3 FY22, from $4,666 million to $6,468 million. In Q3 FY22, gross profit on motor gasoline sales increased by $75 million year on year. This was mostly attributable to an increase in the number of gallons of motor fuel sold. The gasoline blending business, which the company began in Q3, also contributed to its quarterly performance.

The company is working hard to reduce its costs. When compared to the same quarter last year, Sunoco’s volumes grew by 1% in Q3 2022. The drop in RBOB and diesel prices has boosted the company’s profitability. Furthermore, the ongoing volatility in commodity prices during the quarter has offered significant support to margins. Its solid capital allocation approach has produced strong returns in the past.

The company reported an increase in its operating expenses for the quarter, primarily driven by NuStar and Gladieux Energy acquisitions and bringing its Brownsville terminal into operation.

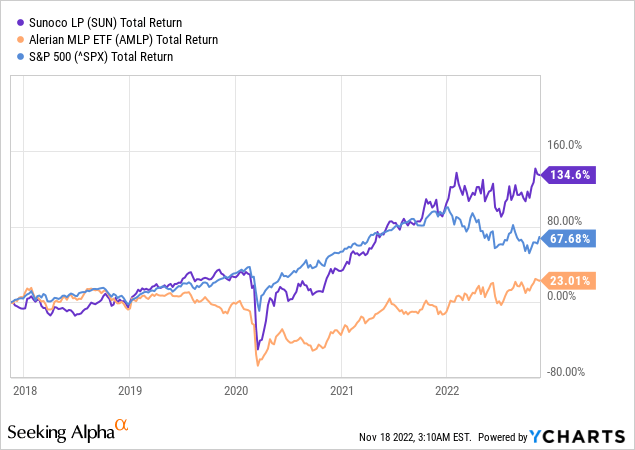

Like several other energy stocks, Sunoco outperformed the broader market over a 5-year timeframe.

The above chart shows the cumulative total return of Sunoco, the S&P 500 Index (SPX), and the Alerian MLP ETF (AMLP). Since 2018, Sunoco stock has outperformed the S&P 500 by over 66% and AMLP by over 110%.

Improved Outlook

Sunoco has raised its full-year outlook following an impressive third-quarter performance in FY22. In 2022, the company forecasts adjusted EBITDA to increase by 13% year on year. The acquisition of Peerless Oil and Chemicals for $70 million broadens the company’s presence in the Caribbean and Puerto Rico, which are important markets for motor gasoline. This provides Sunoco with a reason to be optimistic about its success in 2023. Despite several macroeconomic worries, Sunoco plans to generate a consistent cash flow.

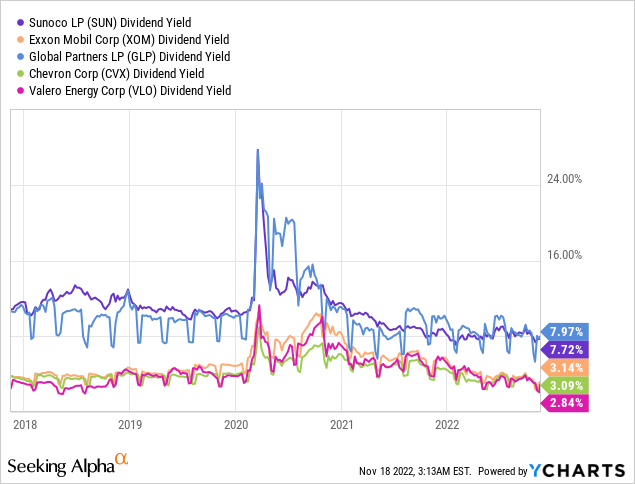

A Solid Dividend Yield

Sunoco stock offers an attractive yield of 7.7%, which is higher than most top energy companies.

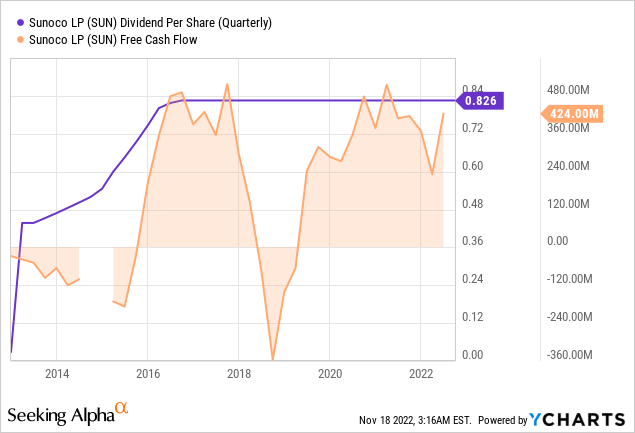

The chart below shows free cash flow and dividends paid by Sunoco over a 10-year period. Since mid-2018, its free cash flow has been on the rise. Although the company’s cash flow became negative temporarily, it maintained a steady dividend. That shows the company’s commitment to pay a steady dividend to its shareholders.

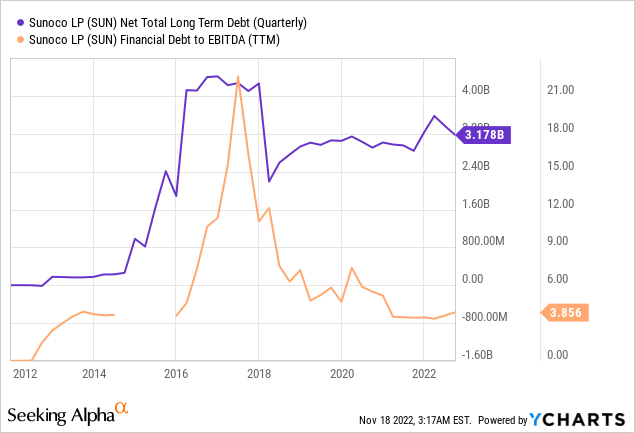

At the same time, Sunoco is trying to keep its leverage under check.

The slight rise in the debt seen in the chart above is due to the recent acquisitions of NuStar and Gladieux Energy.

Seeking Alpha’s proprietary Quant Ratings rate Sunoco stock as “hold.” It is rated high on Valuation parameter, but low on Growth factor.

Risks

Rising oil prices and increased environmental concerns continue to be Sunoco’s key concerns. The company is also vulnerable to interest rate risk. The business has $704 million in credit facility as of September 2022. A one-percentage-point change in the variable interest rate has a large annualized impact on its interest expenditure.

A variety of factors, such as changes in regulations, pricing, and demand for products and services, may also have an impact on the company’s cash flows.

Conclusion

Sunoco continues to seek new investment opportunities, both organically and through acquisitions. Its recent acquisition of Peerless Oil & Chemicals should allow it to extend its midstream and gasoline distribution operations into new markets. Sunoco estimates an EBITDA multiple of 5x to 6x for the transaction. It believes Peerless Oil & Chemicals has a lot of room to grow beyond its current activities.

Sunoco’s robust business model, which is bolstered by solid gross margin optimization, laser-like attention on expenditures, and reliable operations, will aid in significant cash flow generation. This will in turn help to ensure long-term dividend growth. Overall, Sunoco LP stock looks appealing for dividend investors.

Be the first to comment