gremlin

Thesis highlight

I believe Sun Country Airlines Holdings (NASDAQ:SNCY) is fairly valued as of today, and investors should look to invest when the valuation is cheaper. The airline travel and cargo industries are dynamic and ever-evolving markets. Businesses that come up with strategies to suit market trends stand to benefit in the long term.

SNCY operates Sun Country Airlines which has a strategy of flying routes with high demand and switching routes when the demand goes down. Their low acquisition cost of aircraft, paired with operating only on high-demand routes and days, translates to huge profit margins for SNCY.

Company overview

SNCY operates Sun Country Airlines which is among the new hybrid air carriers. A hybrid air carrier operates on a low-cost business model while aiming to provide high-quality service. SNCY uses shared resources to support its collaborative scheduled service, charter, and cargo businesses. Their main focus is serving leisure, VFR (visiting friends and relatives), and charter customers.

SNCY also provides CMI services to Amazon, which provides SNCY with an aircraft in accordance with a sublease agreement. SNCY then gives Amazon, which is SNCY’s only CMI customer (S-1), the crew, maintenance, and insurance needed to run the plane.

(From S-1: CMI service” means an arrangement whereby a cargo customer provides SNCY with aircraft, pursuant to a sublease, and SNCY provides crew, maintenance and insurance to operate such aircraft on the customer’s behalf. Amazon is currently SNCY’s only CMI service customer).

Investments merits

Resilient business model

SNCY operates a value-oriented network of businesses, including scheduled service, collaborative charter, and cargo. They share resources across these businesses to generate high returns, attain high operating margins, and reduce the seasonality impact of the travel industry. To achieve this, capacity allocation is optimized based on: different markets, the timing of the year, the day of the week, and the line of business.

In essence, SNCY shifts its flights to markets with peak demand, and away from markets experiencing low demand. This is done with a higher frequency than the other large US passenger airlines. This flexibility to shift to high-demand markets and away from low-demand markets generates a higher return and a higher operating margin. In this model, the effects of a shrinking economy and industry are less obvious than in a traditional scheduled service carrier.

Bespoke scheduling strategy

SNCY alternates their capacity based on the day of the week, month, and line of business to capture the most profitable flying opportunities available in their MSP home markets and their network of non-MSP markets. This means their routes vary widely throughout the year depending on where demand is high.

Their agile peak demand strategy allows them to act and adapt quickly to days with strong demand, resulting in a higher total revenue per available seat mile (TRASM). This strategy was of great benefit in 2020, during the industry contraction occasioned by COVID-19, when SNCY was able to switch capacity from low-demand areas to high-demand markets within the United States as COVID-19 infection rates went up from region to region. SNCY remains seasonal, with scheduled service accounting for only 1% of their daily year-round routes from July 2021 to April 2022.

Apart from basing capacity shifts on the season or day of the week, SNCY also shifts their aircraft between their scheduled service and charter businesses to optimize returns on assets. This is guided by ‘Power Patterns’, which entail scheduling aircraft and crew on hybrid trips. These trips are a combination of scheduled service and charter legs to rapidly replace an initial low-margin scheduled service flight with a charter opportunity.

SNCY’s ability to adjust is supported by a variable cost structure and the cross-utilization of resources, both people and assets, between their lines of business. Their collaborations through cross-utilization have increased since they started offering CMI services. This is because pilots are sent to different places and can switch between regular flights, cargo flights, and charter flights.

Low capital-intensive strategy

By purchasing mid-life Boeing 737-800 aircraft, SNCY incurs a low aircraft ownership cost compared to purchasing a new Boeing 737 aircraft, which has a higher ongoing maintenance and repair cost. The low ownership cost translates directly to lower unit costs during periods of lower utilization. SNCY can focus on flying during high-demand periods to generate more TRASM and park the aircraft during low-demand seasons at a lower cost than other airlines.

SNCY also does not have an aircraft order book since they only purchase mid-life aircraft. This plays to their advantage because, unlike other airlines, SNCY is not locked into large future capital expenditures above market aircraft prices. By only purchasing mid-life aircraft, they can take advantage of dropping aircraft prices by purchasing only when they need to.

SNCY’s family aircraft fleet is highly reliable and has proven its high completion factor during harsh weather conditions. The fleet also has operational and cost advantages; for example, they allow crew scheduling and training to be optimized. They also have a low maintenance cost.

Post-COVID recovery

SNCY claims that they are better positioned to benefit from the post-Covid rebound in airline travel. They attribute this claim to their peak-demand strategy and how they focus on leisure and VFR travelers, who they expect will be the first to fly at levels similar to pre-Covid levels. Before COVID-19, low-cost carriers and ultra-low-cost carriers saw passenger boarding grow at a 7% annual growth rate from 2014 to 2019 because of an increased need for air travel in the US. (Source:S-1). This rate declined following the COVID-19 pandemic.

In the past, when the economy has shrunk because of something like COVID, leisure and VFR travelers have always been the first to return to normal flight rates.

I urge readers to take a look at my latest writeup on SABR with regards to an update on the travel recovery situation.

Expanding to other states

Upon resumption of normal air travel in the US, SNCY plans to grow the network both from MSP (Minneapolis – St. Paul International Airport) and outside MSP by sticking to their strategy of focusing on seasonal markets and flying on days of the week with high demand. The long-term reduction in their unit cost has expanded the markets that they can serve and operate at a profit. Due to this, they have identified more than 250 new market opportunities. SNCY plans to reopen markets it had closed during the COVID-19 pandemic. With a history of opening and closing stations to meet seasonal needs, there is a good chance that the re-opening will work.

SNCY plans to grow its network at its hub in Minneapolis to reach its maximum potential. This they will do by adding frequencies on the routes they already serve and adding new routes to maximize their large and loyal customer base around Minneapolis. Their long-term strategic plans show that there are growth opportunities at MSP that are about 40% of the growth opportunities for SNCY’s scheduled service capacity.

Pre-covid, SNCY was growing fast outside MSP. With the low customer-friendly fares that have been received in the upper Midwest and in other markets where they can serve profitably on a seasonal or day-of-the-week basis, they expect to grow again once the air travel market resumes normalcy. In the upper Midwest, SNCY is focusing on cold-to-warm weather leisure in Madison and Wisconsin, among others.

SNCY has added more seats on large leisure trunk routes that are popular during times of high demand. The elevated fares during the high peak travel seasons make these routes highly profitable for SNCY in normal environments. Such routes include Los Angeles to Honolulu and Dallas to Mexican beach destinations during the summer months. SNCY’s long-term strategic plans have identified new non-MSP markets that equate to 60% of their scheduled service capacity growth opportunities.

3Q 2022 earnings review

The company’s adjusted EPS of $0.12 surpassed the $0.04 expected by analysts, according to Bloomberg. Total revenues in the third quarter of 2022 were $222 million, with scheduled service TRASM increasing by 39% year on year. SNCY’s total adjusted operating expense was $206 million in the third quarter of 22 due to lower aircraft utilization and the new pilot contract that began on January 20, 2022. Among all these, what excites me the most is that SNCY’s BOD has authorized a $50 million share repurchase program (I believe it’s the first among the industry post-COVID), and they plan to enter an Accelerated Share Repurchase agreement for $25 million to cover half of its commitment in the near future.

In addition, SNCY has made great strides in training and retaining pilots, but the company is still experiencing staffing constraints. As a result, management is focusing on removing training bottlenecks to boost scheduled service capacity and bring passenger aircraft utilization back up to 2019 levels. In 3Q22, the company’s passenger aircraft were only used for 6.4 hours, but by 2023, management hopes to have reached their goal of 8 hours per day. Over the next six months, I anticipate an increase in passenger aircraft utilization at SNCY, which will reduce the company’s unit cost pressures.

It’s also worth noting that management has expressed optimism about the future of all SNYC business segments by saying that they anticipate continued strong demand and pricing trends. Due to Hurricane Ian, the company lost $1 million in revenue in the third quarter of 22. Since then, the company’s management has been slowly reducing west Florida capacity plans until the end of the year as consumer confidence in traveling to the affected area recovers.

Valuation

Price target

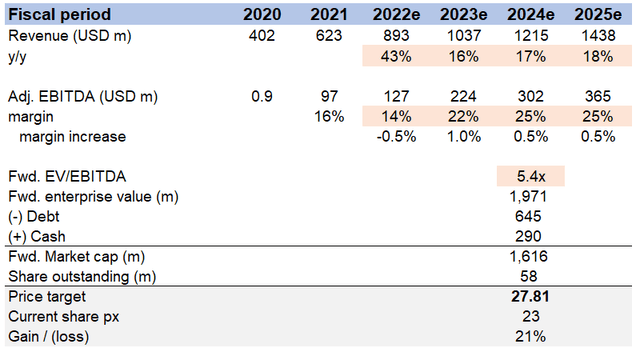

My model suggests a price target of $27.81 or 21% upside in FY24 from today’s share price of $23. This assumes that revenue growth will grow in the mid-to-high-teens, EBITDA margins will expand to at 25%, and the forward EV/EBITDA multiple will be 5.4x in FY24e.

For FY22e, I used the midpoint of 4Q22 guidance and L9M3Q22 to estimate. For FY23e and beyond, I assumed mid-to-high teens growth on the assumption that SNCY can continue to capture share and expand into new markets.

In terms of adj. EBITDA margins, I assume margins will grow above pre-covid levels as SNCY further optimizes its cost structure and increases rates.

As for how much SNCY is worth, it trades at 5.4x forward EBITDA right now, and I assumed that the multiples wouldn’t change.

Risks

COVID lockdowns happening again

Despite all signs globally signaling normalcy resuming in all industries, we can’t completely rule out the chance of lockdown ever happening again. If it does, the impact on the travel industry, particularly air travel, will be massive, and the stock price of SNCY will suffer.

Recession

Travel and cargo services are affected by global economic conditions and trends. Unfavorable economic situations reduce aviation spending among individuals and corporations. Leisure travelers are SNCY’s primary market focus. Travel is an optional cost for this group, and when faced with financial challenges, they may opt for less expensive modes of transportation, such as road travel.

Competition

There is a lot of competition in the airline industry. The competition is in the form of routes, fares, and levels of service. Existing airlines, LCCs, ULCCs, and new airlines all compete for passengers, especially those traveling in economy or similar classes.

Conclusion

I believe SNCY is fairly valued as of today and investors should look to invest when the valuation is cheaper. SNCY targets doing business only in seasons and days with high travel demand and, subsequently, high profit margins. Because of their low aircraft acquisition costs, they can park their aircraft during low-demand seasons. High travel seasons and days appear several times a year and weekly. SNCY’s flexibility also allows them to switch routes easily and efficiently with minimum cost.

Be the first to comment