Sundry Photography

Introduction

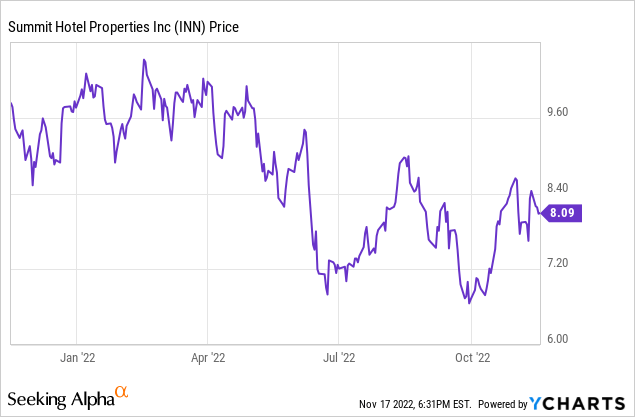

As it’s been five months since I last discussed Summit Hotel Properties (NYSE:INN), it’s time for an update as we can now have another look at the preferred shares which are trading as (NYSE:INN.PE) and (NYSE:INN.PF) with the Q2 and Q3 results now in hand. I’m mainly interested in the preferred dividend coverage ratio and the asset coverage ratio. The hotel sector is getting back on track after two difficult COVID-related years, and earnings and balance sheets are improving.

A look at Q3 and the first nine months of the year

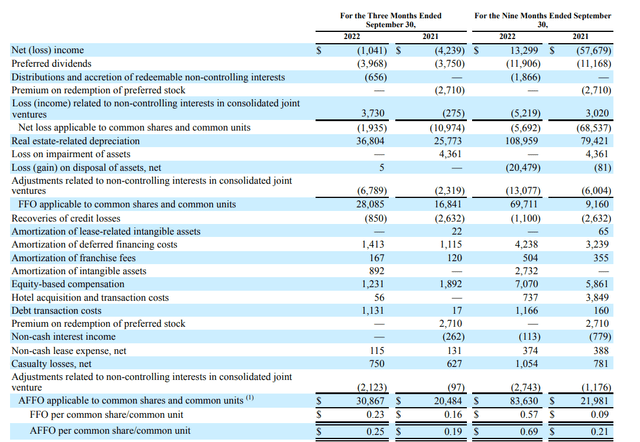

As we all know, the income statement is irrelevant for a REIT, so I’d like to jump straight to the FFO and AFFO calculation. As you can see below, the starting point of the FFO calculation is the net loss of $1M, but the FFO is clearly positive with a total result of $28.1M in the third quarter of this year.

Summit Hotel Properties Investor Relations

The AFFO is even higher than the FFO as there are a few additional non-recurring and/or non-cash elements that are applied to adjusted the FFO. The table above clearly shows Summit Hotel’s AFFO was $30.9M resulting in a FFO and AFFO per share of respectively $0.23 and $0.25.

Of course, the summer months are traditionally very strong months for hotel operators. That being said, this doesn’t meant the winter months are disastrous for Summit. The REIT reported an FFO of $0.12 in the first quarter and $0.22 in the second quarter of this year, so seeing an FFO of $0.23 in the third quarter isn’t a surprise. The 9M 2022 FFO came in at $0.57 per share and that’s a pretty decent result.

What does this mean for the preferred shares?

That’s also good news for the preferred dividends because those preferred dividends are already included in the FFO and AFFO calculation. If we would look at the 9M 2022 results, we see the $69.7M in FFO already includes $11.9M in preferred dividends. This means the FFO result before taking the preferred dividends into account was just under $82M. This means that based on the results in the first nine months of the year, the preferred dividend coverage ratio was almost 700%. And looking at the Q3 results, the preferred dividend coverage ratio even slightly exceeded 800%.

That’s great, but let’s not forget the final quarter of the year will be weaker. INN reported an FFO of $0.14 in the final quarter of last year, so we should definitely expect a QoQ decline but I wouldn’t be surprised to see a full-year FFO per share of in excess of $0.70. And at $0.70, the preferred dividend obviously remains very well-covered, so I don’t see any issues there.

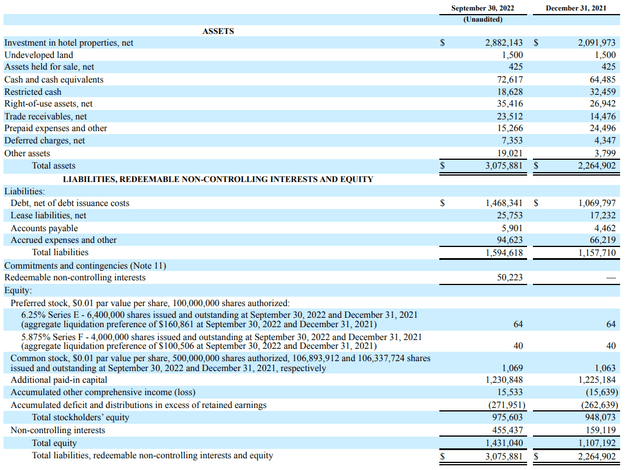

The balance sheet is more interesting. As you can see below, Summit Hotel Properties has approximately $976M in equity, of which about $260M is contributed by the preferred shares (there are 6.4M Series E and 4 million Series F preferred shares outstanding). This means there’s about $716M in equity ranked junior to the preferred shares. That should be fine.

Summit Hotel Properties Investor Relations

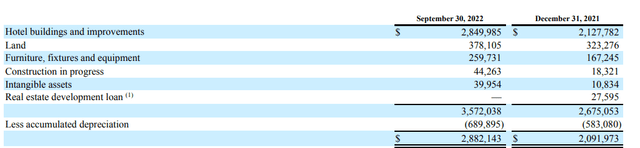

The main question obviously is how credible the book value of the assets is. Is the $2.88B in hotel properties realistic?

Looking at the notes to the financial statements, we see the book value already includes almost $700M in accumulated depreciation. The acquisition cost of the assets exceeded $3.5B.

Summit Hotel Properties Investor Relations

This doesn’t mean that we should use the $3.57B as some of the assets are rightfully being depreciated but even if you would only look at the acquisition cost of the land and buildings, you end up with a value of in excess of $3.2B. Seeing this value, and considering how strong the hotels are performing, I’d say the book value of the assets is quite realistic.

Summit Hotel Properties Investor Relations

Investment thesis

I own both series of the preferred shares, and although the preferred dividend yield currently exceeds 8.5% on both series (which usually is a sign of distress, even in this high interest rate climate), I think the risk/reward ratio is still fine. The hotel operations are running smooth and as Summit is only paying a symbolic dividend of $0.04 per quarter (for a dividend yield of just around 2%), the balance sheet is getting safer. This means the preferred shares are getting safer as well.

Be the first to comment