da-kuk

Every three months, we take a snapshot of the expectations for future earnings in the S&P 500 (SPX) at approximately the midpoint of the current quarter, shortly after most U.S. firms have announced their previous quarter’s earnings.

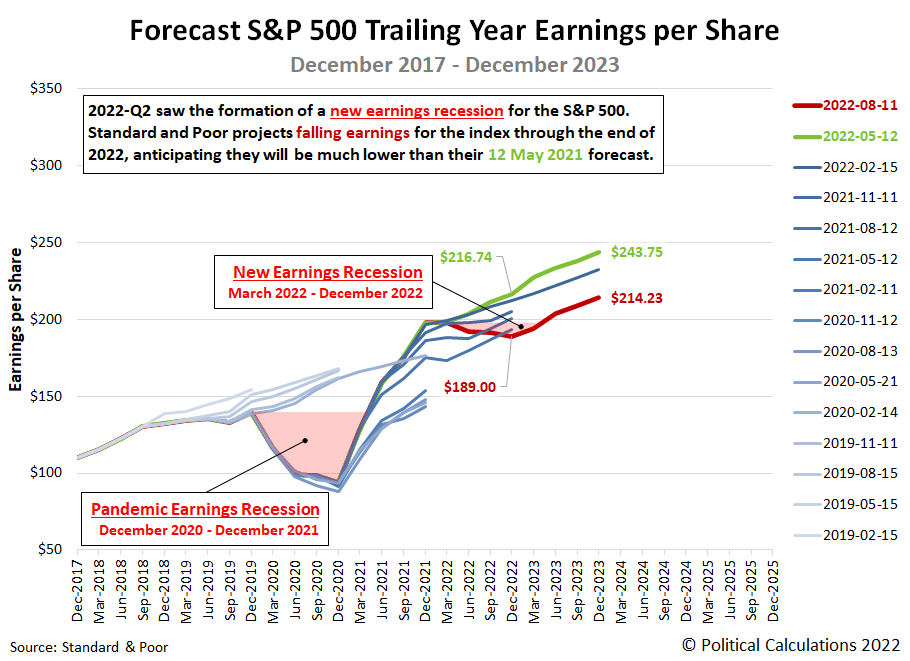

The outlook for S&P 500 earnings has deteriorated since our last update three months ago. Standard and Poor now projects a new earnings recession, lasting through December 2022. The following chart illustrates how the latest earnings outlook has changed with respect to previous snapshots:

Unlike the semantic games played by pedantic douchebags over the accepted definition of a recession for the U.S. economy, an earnings recession has a simple definition:

“Earnings recession” is usually interpreted as two consecutive quarters of decline. In the case of the market, that would mean that corporate earnings dropped for two quarters in a row.

There is a minor dispute over whether that means consecutive quarter-on-quarter declines or if it means consecutive declines over two quarters with respect to the same quarters a year earlier. However, that dispute is moot in this case. The updated outlook for the S&P 500’s reported earnings qualifies as an earnings recession under both these interpretations.

In the chart, we’ve identified the period in which the quarter-on-quarter decline in earnings interpretation was met by both the Pandemic Earnings Recession (December 2020-December 2021) and the projected new earnings recession (March 2022-December 2022). The regions of the chart we’ve shaded in light red indicate the periods where the year-over-year interpretation of an earnings recession is met.

Whether the S&P 500’s earnings per share actually experiences an earnings recession through the rest of 2022 now depends entirely on the earnings reports of the index’ 505 component firms over the months ahead. Our next snapshot of the index’ expected future earnings will be in three months.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment