Drew Angerer

There was one key two word addition to the Fed’s statement on Wednesday that took a while for many bulls to accept. This new statement added that the Fed needs to get rates to “sufficiently restrictive.” Let’s discuss why that probably means we’re far from any pivot.

What Does The Fed Mean Restrictive?

When Fed Chair Powell talks about getting policy right he’s been adding a term in speaking and now officially added it to the Fed’s recent statement, restrictive.

Restrictive means that the Fed wants to contain inflation through a simple formula.

As long as the Fed’s Fed Funds rate is below the rate of inflation they are considered ‘behind the curve’ and have to continue to be tough to catch inflation.

I’ve said many times to subscribers and probably publicly that putting out inflation is like putting out a forest fire. The softer they go the easier it spreads. They have to go full force all at once to hope to extinguish it.

As much as Powell and Co have talked tough, they’ve really been behind inflation by the math and they have been too soft. They’ve allowed inflation the chance to spread and rise.

Fed Funds rates have consistently been way behind inflation in this cycle.

Yes they did a series of 75bp hikes. Yes that covered ground, but still leaves them behind the rate of inflation.

As tough as Powell speaks, his moves are soft allowing inflation to run.

As long as they don’t catch up to this forest fire (inflation) the longer it can run, spread and keep going higher.

Fed Chair Powell said many times in his press conference that they don’t really know the ultimate rate they need to get to. He is telling the truth. As long as they don’t have their rates higher than inflation, inflation can continue to rise.

To get to restrictive, they need to get their rates higher than inflation.

Let’s see what that is.

Their primary measure of inflation is PCE Price.

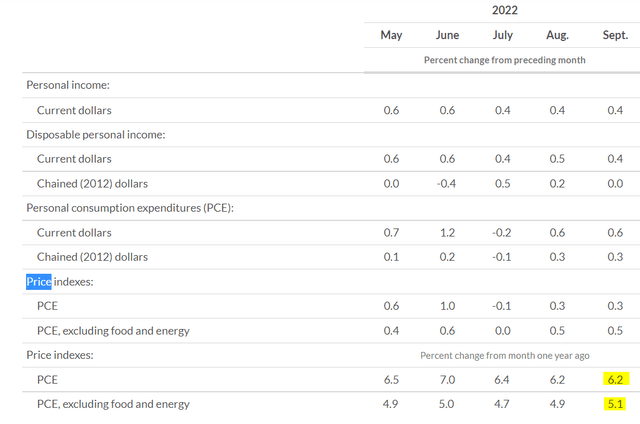

PCE Price Latest Read (BEA.gov)

PCE price “topline” is currently at 6.2% annual. “Core” is at 5.1% annual.

Powell has said in the past that topline inflation is what’s affecting consumers most. Consumers’ monthly budgets are affected by gas, oil and food and so is a main focus of the Fed.

But whether you think the Fed is focused on topline or core either way Fed funds are below the rates of inflation 5.1% and 6.2%.

But the Fed’s release said they want to be ‘sufficiently restrictive.’

Restrictive would be a touch higher, say 5.2% and 6.3% officially.

How Much Is Sufficiently?

Word math: How much is ‘sufficiently?’

I would guess that sufficient is 1-3%. I’m giving you my opinion. I would argue its more than 0.5%. It could be more than 1-3%.

So based on that math and the Fed’s Wednesday statement would tell you Fed funds need to be between 6.1% and 9.2% (5.1 + 1 and 6.2 + 3).

Let’s midpoint that.

Fed funds, according to the Fed statement need to be, uh…

Drum Roll.

Midpoint.

7.65%.

The current Fed funds rate stands at 4%.

That would mean to get to ‘sufficiently restrictive’ the Fed would need to raise rates from here by 365 basis points.

7.65 – 4 = 3.65%.

Even though they are talking about reducing the 75bp hike increments, they would need roughly five more 75bp increments to get to ‘sufficiently restrictive’ using my midpoint.

I ask you, five more 75s, what would that do to markets?

If you said kill ’em, I agree.

What Pivot?

If you raise rates in only 25 or 50 bp increments going forward that would mean you’d have another 10 or 20 rate hikes ahead to get to ‘sufficiently restrictive.’ Another couple of years of rate hikes. What’s a couple of years between friends.

But as longs the Fed stays behind the rate of inflation and soft-pedals it, like that forest fire, inflation is at risk of rising (spreading).

The market wants a pivot because it’s been trained to be bullish during a decade-plus bull run.

But based on Powell’s comments and official statement I think we’re far from a pivot.

Thursday CPI

We’ll be making a call in our service what to expect for Thursday’s CPI. It’s not an easy business predicting economic data, but there are ways to try to predict these key numbers and hopefully react accordingly to the report. Obviously CPI is expected to be market moving.

Conclusion

We said to subscribers when the release came out that it was worth shorting into that rally Wednesday. The market ended up dropping big when market participants heard it straight from Powell’s mouth. That one statement mentioned enough times above in this article was a glaring early hint. There were too many bulls hoping for a pivot. Based on simple word math we’re far from a pivot and probably in for some rough sledding in markets.

Be the first to comment