Mario Tama

Thesis

We updated Altria Group, Inc. (NYSE:MO) investors in our previous article that we saw a solid mean-reversion opportunity in MO as it got hammered by the market toward its September lows.

Accordingly, MO has outperformed the broad market since that article, as it posted a price gain of 8.4%, relative to the S&P 500’s (SP500, SPX) -2% gain. Coupled with a highly attractive NTM dividend yield of nearly 9% at its September lows, it was an excellent opportunity for investors who waited patiently to add.

Altria’s Q3 earnings release has not led to a broad de-rating in MO, given its well-balanced valuation. MO also remains priced at a discernible discount against the S&P 500’s tobacco industry. Its current valuation is also in line with its peers’ median.

However, investors expecting a further re-rating in MO in the current macroeconomic conditions could be in for a disappointment. Altria highlighted that the ongoing macro weakness has also pressured its consumers, despite the strength in its premium segment.

Given the need for Altria to address its growth challenges moving ahead, a marked re-rating in the near term is unlikely, as the market focuses on management’s execution.

Coupled with a more well-balanced valuation and price action that suggests some caution, we move to the sidelines at the current levels.

Revise from Buy to Hold.

Altria Needs To Address Its Forward Growth Challenges

The tobacco industry has been unable to sustain its FY21 growth reversal as consumers pulled back in 2022, coupled with challenging comps. In addition, analysts’ estimates for Altria and its S&P 500 industry peers have continued to be revised markedly downward through October.

However, we expect the extent of the downgrades has already been reflected in its current valuation, as the industry’s forward P/E of 12.7x remains well below the S&P 500’s forward P/E of 16x.

But, the challenge is for the industry to demonstrate its ability to continue delivering operating leverage and lift its profitability even as topline growth continues to come under pressure.

Altria’s JV with Japan Tobacco (JAPAF) is, therefore, necessary to address its challenges to move away from its disastrous experiment with JUUL. Moreover, with Philip Morris International (PM) expected to gain exclusive commercialization rights for IQOS by April 2024, Altria is under pressure to execute its strategic pivot.

Analysts on the call are noticeably concerned with management’s decision, given the regulatory hurdles in the process. An analyst was also worried about whether the 75%(MO) / 25%(JT) economic interest split in the JV is appropriate for Altria’s benefits, as the analyst highlighted:

“Our sense is it feels like giving away a 25% economic share is a huge amount, given that candidly, this is a poorly performing product, a weak number for [the] brand globally without regulatory approval in the US.”

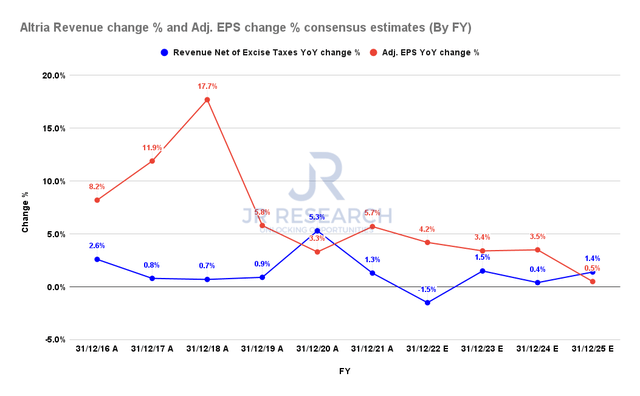

Altria Revenue change % and Adjusted EPS change % consensus estimates (S&P Cap IQ)

Management’s revised FY22 guidance saw it narrow its adjusted EPS estimates to $4.85 (midpoint), with the revised consensus estimates (neutral) pointing to $4.8.

Therefore, Street analysts are not confident that the company could even meet the lower end of its guidance range for FY22. We postulate that Wall Street remains concerned over further macro weakness impacting its premium and discount segment.

Altria’s forward EPS estimates through FY25 are also not constructive, as the company is expected to continue posting decelerating growth.

We believe these estimates are prudent, as it’s incumbent on management to demonstrate its execution on its pivot away from its smokeable products. Therefore, we postulate that a material re-rating is unlikely until the market is convinced of its strategy.

Is MO Stock A Buy, Sell, Or Hold?

MO last traded at an NTM EBITDA of 8.5x, in line with its peers’ median of 8.2x (according to S&P Cap IQ data).

Notwithstanding, we expect its NTM dividend yield of 8.3% to continue drawing in income investors who aren’t concerned with its price moves.

Still, MO’s poor price performance led to a 5Y total return CAGR of 0.1%, well below its 10Y mean of 9.7%. But, as we highlighted earlier, we don’t expect the market to re-rate MO markedly higher until it’s confident of management’s ability to address the challenges relating to its growth algorithm.

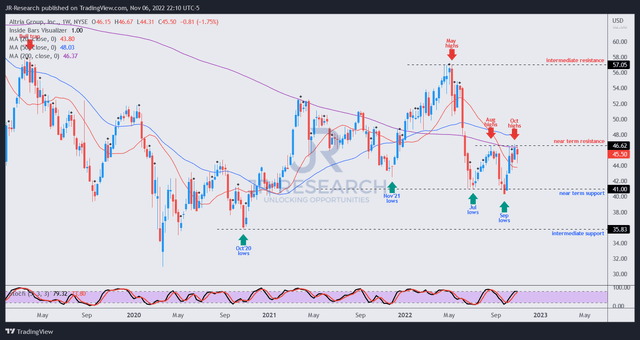

MO price chart (weekly) (TradingView)

As seen above, MO has rallied into its near-term resistance, in line with its previous August highs.

Given the pessimism in September, we believe the rally has justifiably reflected its near-term upside and provided a potential exit point for investors who picked its September lows.

While MO’s momentum could continue to see it move higher toward our previous price target of $50, the reward/risk at these levels is more well-balanced.

Also, the pace of the rally is not constructive, and we expect selling pressure to be robust at these levels to digest the recent optimism.

Revise from Buy to Hold, and we urge investors to be patient again.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment