grbender/iStock via Getty Images

A little while ago, I wrote an article on Suburban Propane Partners L.P. (NYSE:SPH), commenting that it was an excellent place to ride out market volatility. I want to revisit the thesis, as the company recently released FYQ3/2022 results.

Suburban delivered YoY growth in revenues and operating income, while paying down debt. Despite volatile commodity prices, gross margin dollars actually increased YoY. Most importantly, the company was able to pay down $43 million in debt and maintained its $0.325 quarterly distribution. I am comfortable sticking with my thesis that investors buy units of Suburban Propane to ride out market volatility.

Decent Quarter Despite Volatile Commodity

The quarterly results were quite uneventful, with Suburban reporting revenues of $300 million, 26% higher than the same quarter last year. Gross margin was 53%, lower than the 65% last year, although gross margin dollars went up to $159 million from 155 million.

In the seasonally soft quarter, operating margin was 4.9%, a slight improvement from 3.3% in FYQ3/2021. YTD, operating margin is 19.3%, slightly less than 19.7% last year, but operating income increased 14.6% YoY. Adjusted EBITDA, as reported by the company, improved by 25.3% YoY to $29.2 million.

Commenting on volumes and pricing, management noted that:

Retail propane gallons sold in the third quarter of fiscal 2022 of 75.5 million gallons decreased 1.6% compared to the prior year, primarily due to the adverse impact of historically high commodity prices on customer buying habits and demand, partially offset by cooler spring temperatures that contributed to higher heat-related demand in certain markets.

However, average propane prices increased 44% YoY, more than offsetting the decrease in volumes.

It was comforting to see that despite a surge in pricing YoY, volume was only modestly down. Moreover, gross margin $ was maintained, which shows management’s ability to manage through volatile commodity prices.

Debt Repayment Brings Down Leverage

One of the key risks I highlighted in my previous article was Suburban’s significant leverage, with $1.1 billion in long-term debt. To management’s credit, they seem to be actively reducing debt, having repaid $43 million in the third quarter. As a result of debt repayment and increased EBITDA, Suburban’s Consolidated Leverage Ratio (“CLR”) ended the quarter at 3.64x, a significant improvement from 3.87x last quarter. Note the key covenant for Suburban is CLR < 5.75x, so it appears well covered at the moment.

Dividend maintained

Suburban also maintained its quarterly distribution at $0.325 per unit, or annualized $1.30. With fiscal YTD CFO of $171 million or $2.70 per unit, this distribution appears well covered as well. Note however, YTD CFO decreased 5.4% YoY, so this is worth monitoring.

More Details On Strategic Opportunities

Finally, Suburban provided some commentary around the nascent renewable energy platform in the commentary and on the earnings call.

In May, we announced a collaboration agreement with Iwatani Corporation of America, a wholly owned subsidiary of Iwatani Corporation to [indiscernible] largest distributor of propane and an only fully integrated supplier of hydrogen. We will work together to help accelerate the adoption of propane plus RDMA, both here in the U.S. and in Japan and to explore opportunities to advance investments in the hydrogen infrastructure in the United States.

In June, we announced a new investment through our suburban renewables platform with an agreement reached with [AderonDac Farms, a family-owned dairy farm in upstate New York to construct, own and operate an [indiscernible] digester system for the production of renewable natural gas from dairy cow manure. These strategic initiatives are on the heels of our $30 million investment for a 25% equity stake in Independence hydrogen, which was announced at the end of the second quarter. Independent hydrogen continues to make great strides in executing on their business toward the build-out of a hydrogen ecosystem.

While the news on the collaboration with Iwatani Corporation (OTCPK:IWTNF) was already known, the renewable natural gas deal with Adirondack Farms is new and interesting.

Nascent RNG Business

Renewable Natural Gas (“RNG”) is pipeline quality natural gas that is made from the decomposition of bio materials such as landfills, livestock, and waste treatment plants. It was all the rage a few years ago as an alternative fuel, and many governments have mandates that a certain percentage of their natural gas use must come from renewable sources. In the Canadian province of Quebec, it is 5% by 2025/26 and 10% by 2030, while in California, it is 12.8% from bio-gas RNG by 2030.

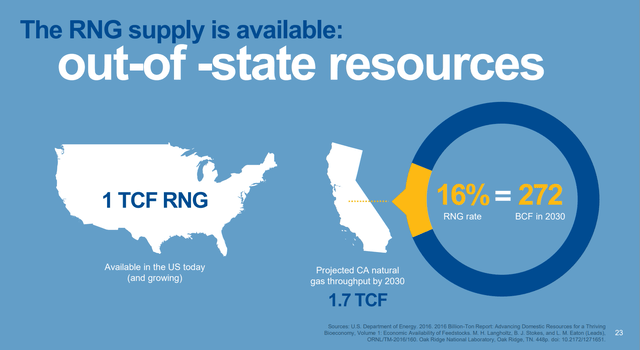

While there is certainly a lot of hype in the literature surrounding RNG, its promise of greenhouse gas reduction without having to replace the existing natural gas infrastructure is alluring. A 2018 presentation by SoCal Gas, based on a 2016 study by the Department of Energy, estimates the U.S. has enough biomass to produce 1 Tcf of RNG (Figure 1). So this is potentially a massive opportunity.

Figure 1 – RNG supply (South California Gas Company)

While early days, investors should pay attention to see how this renewable energy business develops in the coming quarters / years.

Conclusion

In summary, Suburban certainly delivered on my thesis of stability in the latest quarter. While propane prices were volatile, Suburban was able to manage margins and delivered a YoY increase in revenues and operating income. Most importantly, the company was able to pay down $43 million in debt and maintained its $0.325 quarterly distribution. I am comfortable recommending investors buy units of Suburban Propane as a hedge to ride out market volatility.

Be the first to comment