curraheeshutter/iStock via Getty Images

Published on the Value Lab 31/3/22

It’s getting tougher to find well priced opportunities on the market as a ‘no alternative’ environment sees equities being bid up despite supply side concerns being very real and difficult to surmount for a range of industries. Indeed, stagflation is now the flavour of the day. Nonetheless, we trudge on with another idea, Subsea 7 (OTCPK:SUBCY), a stock on the Norwegian markets, that has the sort of commodity exposures we like without the excessive price tag. With good exposure to the commodity environment as it stands and will likely remain, and with a valuation that we can get behind, we give it a buy rating despite some inflationary pressures on its bottom line that can be combatted.

Talking About Its Markets

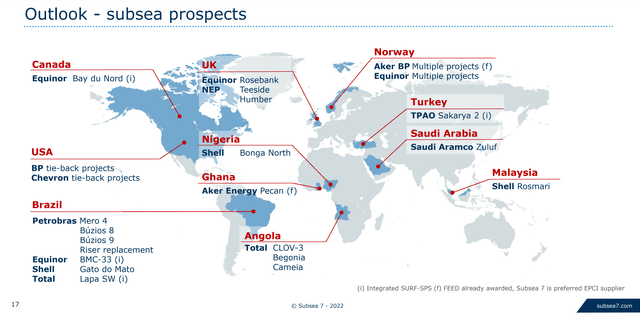

Subsea 7 does major offshore installations, primarily for the oil and gas industry, but also for renewables, with a renewables market appearing particularly in offshore wind. They are one of two major players in this sector, the other being TechnipFMC (FTI), and they are partnering with players like Schlumberger (SLB), Aker BP (OTCPK:DETNF) and Equinor (EQNR) in building out rigs for highly profitable projects, with many names in the Norwegian Continental Shelf. While Svedrup and other NCS projects are a nice feather in their cap, make no mistake that the company has a very global focus.

Markets (Q4 2021 Pres Subsea 7|)

There are 2 major growth drivers for Subsea that are not particularly well reflected in their price, which has trailed down slightly YTD, as well as another with a more long-term horizon. Gas prices being high and the need for traditionally byproduct gas to be bottled and sold due to Russia’s stranglehold on the European supply is going to be a reasons for more business for Subsea 7. With gas being a more friendly commodity in the interim of the renewable transition, there is a secular interest in gas production as well that supports a longer term outlook for Subsea 7. The second thing is of course the high oil prices being a reason to expect more developments. Even if oil prices come down due to the entry of backward players into the market like Venezuela and Iran, a more friendly stance towards these countries as the west diversifies reliance away from the usual suspects, including Saudi Arabia, could still mean more business. The need to onshore as globalisation slows, and a possible backtracking on the renewable transition, would be a good thing for the company, and geopolitical developments have made that more likely.

Finally, the company has a renewable exposure, specifically to offshore developments of wind. Companies like Ørsted (OTCPK:DNNGY) are players here, and have been having a nice rally in stock prices over the last few years due to the hopes put behind these developments, which have been very profitable. The renewable unit is being combined with another Norwegian entity to create a small, listed renewable pureplay engineering company that will hopefully be OSB listed soon. Note that Subsea will has over 70% of this combined company post-consummation, with shareholders of the other entity in the combination receiving shares in this pureplay company which is named Seaway 7. Of course, the fortunes of Seaway will reflect into the fundamental picture for Subsea as they will consolidate their results as a controlling owner. It is currently only worth $60 million, with the value of Subsea’s holding being only about 15% of its current market cap.

A Look At FY Results and Valuation

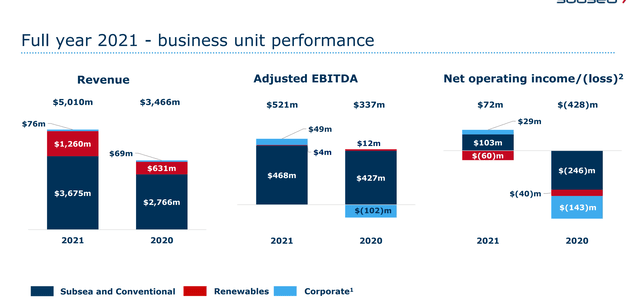

Growth has already been good for the company, and has been done somewhat profitably, with the exception of the renewable division.

FY Data (Q4 2021 Pres Subsea 7)

The renewable division is the operations of Seaway 7, and is still an emerging profit area with further growth in revenues expected as majorly profitable offshore wind projects continue to enter development.

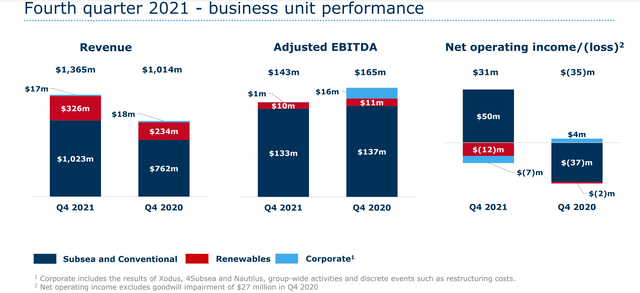

The main reason profitability did not seem to develop so favourably is because in the course of adjusting substantial write-downs of property in 2020, the corporate segment took the losses rather than the operating businesses. However, as an ongoing metric, their adjusted figures are the ones to follow, and they do reflect issues in procurement, with the Q4 being the source of the weakened profit growth.

Q4 Data (Q4 2021 Pres Subsea 7)

While inflation is a concern for the business, and has resulted in about 15% declines in EBITDA in Q4 YoY, the valuation offers a meaning margin of safety even assuming that none of these cost increases can be passed on. Adjusting for minority interests and including the quite low net debt, the company trades for a valuation of around 5x on EBITDA. With profit growth possible in the context of the current commodity environment, and with commodity exposures that allow for secular growth horizons for Subsea 7, a 5x multiple is very low for a well positioned business.

Conclusions

The main risk is inflation, with procurement as an engineering company posing a risk to generating profitable growth. However, with the commodity markets being what they are, and there even being a renewable angle to support the business in the longer term, with renewable already accounting for 25% of revenue, we see no reason to give this stock a laggard multiple where an oligopoly positioning does help in pricing power to pass off procurement issues. With its price even having trailed down 4% from the beginning of the year, we see lots of upside here and rate it a buy.

Be the first to comment