MOZCO Mateusz Szymanski

Stryker Corporation (NYSE:SYK) is a leading Healthcare Equipment company with a solid growth track record, as witnessed by its past 5-year average growth rate of 8%. To determine if Stryker’s growth outshines the other companies in the industry, we conducted an analysis to determine the best growth company in the global Healthcare Equipment industry.

We first analyzed the size and growth of the global Healthcare Equipment market by calculating its total addressable market, or TAM, and compared it with our global healthcare sector forecast. Subsequently, we calculated the SAM by breaking down the industry into its market segments based on the 2021 market revenue and market forecast CAGR.

We then determined which of the Top 10 companies has the highest past 5-year average revenue growth, analysts’ forward 3-year growth, and forward 3-year growth based on our forecasts, respectively.

From there, we then computed a forecasted CAGR for the 3 companies identified according to their revenue segment breakdown with the market forecast CAGR. Based on our computed forecast CAGR for the 3 companies, we determined that Stryker indeed has the highest growth outlook among the 3 companies at a total forecasted CAGR of 8.39%. This supports our position that Stryker has the best growth prospects within the industry.

TAM: Size and Growth of the Global Healthcare Equipment Market

According to Fortune Business Insights, the global medical devices market is projected to grow from $488.98 bln in 2021 to $718.92 bln by 2029 at a CAGR of 5.5%.

We then determine if the CAGR is reasonable by projecting the CAGR of the whole healthcare sector. We computed the forecasted growth rate of the healthcare sector by multiplying the historical healthcare expenditure as a percentage of the global GDP average growth rate between 2016 to 2019 with the forecasted GDP growth rate. The historical healthcare expenditure % of GDP is obtained from the World Bank, whereas the GDP forecast of 2% per year through 2028 is obtained based on the Economic and Budget Analyses report by the U.S. administration.

|

Healthcare Expenditure |

2022-2026 |

|

Healthcare Expenditure as a % of GDP Growth |

0.236% |

|

Forecasted GDP growth |

2.000% |

|

Forecasted Healthcare Sector growth |

2.005% |

Source: World Bank, Whitehouse, Khaveen Investments

As shown in the table above, the Healthcare sector is forecasted to grow at a CAGR of 2.005% until 2026, which is lower than our forecasted CAGR of the global medical devices market (5.5%). Thus, we believe that this indicates the Healthcare Equipment industry is forecasted to outpace the Healthcare sector growth rate.

SAM: Which Healthcare Equipment Sub-Industry Company Could Benefit the Most?

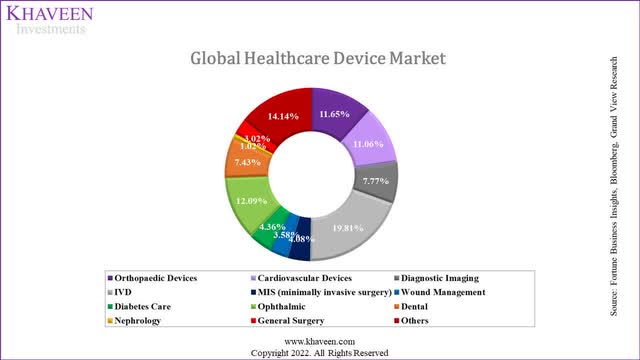

We then analyzed which global medical devices market segment has the highest forecasted CAGR and the largest revenue in 2021 to determine which Healthcare Equipment company could benefit the most.

|

Healthcare Equipment Market Segments |

2021 Revenue ($ bln) |

CAGR |

|

Orthopaedic Devices |

56.97 |

6.60% |

|

Cardiovascular Devices |

54.08 |

6.90% |

|

Diagnostic Imaging |

37.97 |

5.80% |

|

IVD |

96.87 |

6.00% |

|

MIS (Minimally Invasive Surgical Instruments) |

19.96 |

9.80% |

|

Wound Management |

17.49 |

6.20% |

|

Diabetes Care |

21.32 |

6.60% |

|

Ophthalmic |

59.1 |

5.00% |

|

Dental |

36.32 |

7.40% |

|

Nephrology |

5.00 |

5.00% |

|

General Surgery |

14.75 |

8.29% |

|

Others |

69.15 |

5.50% |

|

Total |

488.98 |

Source: Fortune Business Insights, Bloomberg, Grand View Research, Khaveen Investments.

Fortune Business Insights, Bloomberg, Grand View Research, Khaveen Investments

We obtained the 2021 revenue and forecasted CAGR for each segment from Fortune Business Insights, Grand View Research, and Bloomberg. As shown, the IVD segment had the largest revenue in 2021 with $96.87 bln, whereas the Minimal Invasive Surgical Instruments segment has the highest forecasted CAGR of 9.80%. Based on Fortune Business Insights, the surge in demand in the IVD market is due to the rapid introduction of new techniques for COVID-19 diagnosis. Furthermore, based on our previous analysis, Quidel is the only “pure-play POC diagnostic company.”

Additionally, Grand View Research stated that the high growth of the Minimal Invasive Surgical Instruments market could be driven by the increasing usage and acceptance of surgical robots for minimally invasive surgeries. We believe that Stryker would benefit from the high growth Minimal Invasive Surgery market, as it has robotic surgery systems which enable surgeons to perform minimally invasive surgeries.

SOM: Which Company Has Highest Growth Potential?

To determine which company has the highest growth, we then compiled the past 5-year average revenue growth, analyst forward average 3-year revenue growth forecast, and also the forward 3-year revenue growth forecast based on our previous analysis for the top 10 Healthcare Equipment companies we identified in our previous coverage on Abbott.

|

Revenue Comparison Metrics |

Past 5-year Average Growth |

Analyst Consensus 3-year Forward Average |

Our 3-year Forward Average Estimate |

|

Roche (OTCQX:RHHBY) |

4.61% |

-0.13% |

3.18% |

|

Abbott (ABT) |

14.05% |

0.01% |

3.31% |

|

Thermo Fisher Scientific (TMO) |

17.40% |

6.96% |

6.62% |

|

Medtronic (MDT) |

0.75% |

2.83% |

5.22% |

|

Becton Dickinson (BDX) |

10.55% |

0.61% |

1.80% |

|

Stryker |

8.07% |

6.73% |

9.12% |

|

Boston Scientific (BSX) |

7.19% |

7.11% |

8.65% |

|

Zimmer Biomet (ZBH) |

0.38% |

-1.90% |

-0.26% |

|

Danaher (DHR) |

12.07% |

4.33% |

4.03% |

|

Baxter International (BAX) |

6.66% |

8.55% |

– |

Source: Seeking Alpha, Khaveen Investments

We determined the companies with the highest based on the 3 metrics in the table above which are: Thermo Fisher Scientific, Baxter International and Stryker. Following this, to obtain the SOM based on the SAM, we examined the segment breakdown of these three companies based on the GICS classification to determine the CAGR forecast to be used for each segment to identify the company with the highest forecasted growth rate.

|

Thermo Fisher Scientific Segments |

% |

GICS Classification |

Forecast CAGR |

Adjusted CAGR |

|

Analytical Instruments |

15% |

Life Sciences Tools & Services |

2.00% |

0.30% |

|

Specialty Diagnostics |

15% |

Health Care Equipment |

6.00% |

0.90% |

|

Life Sciences Solutions |

35% |

Life Sciences Tools & Services |

2.00% |

0.70% |

|

Laboratory Products & Biopharma Services |

35% |

Biotechnology |

2.00% |

0.70% |

|

Total |

100% |

2.60% |

Source: Thermo Fisher Scientific, Khaveen Investments.

|

Stryker Segments |

% |

GICS Classification |

Forecast CAGR |

Adjusted CAGR |

|

MedSurg and Neurotechnology |

56% |

Health Care Equipment |

9.80% |

5.49% |

|

Orthopaedics and Spine |

44% |

Health Care Equipment |

6.60% |

2.90% |

|

Total |

100% |

8.39% |

Source: Stryker, Khaveen Investments.

|

Baxter International Inc Segments |

% |

GICS Classification |

Forecast CAGR |

Adjusted CAGR |

|

Renal Care |

30.51% |

Health Care Equipment |

5.00% |

1.53% |

|

Medication Delivery |

22.53% |

Health Care Distributors |

2.005% |

0.45% |

|

Pharmaceuticals |

17.92% |

Pharmaceuticals |

2.005% |

0.36% |

|

Clinical Nutrition |

7.54% |

Health Care Distributors |

2.005% |

0.15% |

|

Advanced Surgery |

7.64% |

Health Care Equipment |

5.500% |

0.42% |

|

Acute Therapies |

6.12% |

Health Care Equipment |

5.000% |

0.31% |

|

BioPharma Solutions |

5.23% |

Biotechnology |

2.005% |

0.10% |

|

Patient Support Systems |

0.90% |

Health Care Services |

2.005% |

0.02% |

|

Front Line Care |

0.55% |

Health Care Equipment |

5.80% |

0.03% |

|

Surgical Solutions |

0.21% |

Health Care Equipment |

8.29% |

0.02% |

|

Other |

0.85% |

2.005% |

0.02% |

|

|

Total |

100.00% |

3.40% |

Source: Baxter International, Khaveen Investments

Based on our calculations in the tables above, the company in the Healthcare Equipment market with the highest total revenue forecast CAGR is Stryker at 8.39%, followed by Baxter International (3.4%) and Thermo Fisher Scientific (2.6%).

Verdict

All in all, the Healthcare Equipment industry is forecasted to grow at a CAGR of 5.5%, outpacing our estimated growth of the Healthcare sector of 2% through 2026. Furthermore, we analyzed and identified the breakdown of the healthcare equipment market segments with the IVD segment as the largest ($96.87 bln) while the Minimal Invasive Surgical Instruments segment has the highest forecasted CAGR of 9.80%. We shortlisted 3 of the fastest-growing healthcare equipment companies and forecasted their revenue CAGR based on their segments.

Overall, we determined Stryker to have the highest total revenue growth forecast at 8.39%. Based on our previous Stryker analysis, we highlighted several factors driving its growth including “deferred procedures and aging population supporting neurotechnology and spine growth” as well as its focus on orthopedics robotic surgery which is in the minimally invasive surgical market which is projected to have the highest segment growth (9.8%).

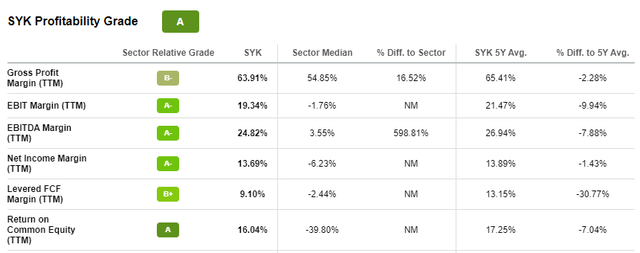

As seen above, the company has healthy margins across the board. We view this especially favorably, considering the sector median margins are mostly negative.

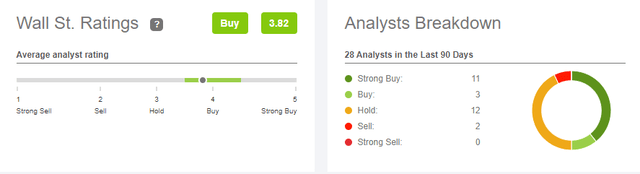

Additionally, Wall Street consensus for Stryker is Bullish. Given that the stock price has dropped by 5.8% since our last coverage, we revised our previous rating for Stryker Corporation from a Hold to a Buy with a target price of $265.62 (DCF Valuation), representing an upside of 14%.

Be the first to comment