AndreyPopov/iStock via Getty Images

Author’s note: This article was released to CEF/ETF Income Laboratory members on March 21st, 2022.

The BlackRock Multi-Sector Income Trust (NYSE:BIT) is an actively-managed, diversified, leveraged bond CEF, focusing on high-yield bonds. BIT’s diversified holdings, strong 9.4% distribution yield, good 5.0% discount to NAV, low interest rate risk, and industry-beating returns, make the fund a strong, well-rounded investment, and a buy. As BIT focuses on high-yield bonds, and due to its use of leverage, it is not an appropriate for more risk-averse investors.

BIT – Basics

- Investment Manager: BlackRock

- Expense Ratio: 1.70%

- Distribution Yield: 9.43%

- Discount to NAV 5.03%

- Total Returns CAGR 5Y: 8.17%

BIT – Investment Thesis

BIT is an actively-managed diversified, leveraged bond CEF. It is administered by BlackRock, the largest investment management firm in the world. BIT’s investment thesis is quite thorough, and rests on the fund’s:

- Diversified holdings, with investments in most relevant bond sub-asset classes, but focusing on high-yield bonds

- Strong 9.4% distribution yield, making the fund a perfect investment for income investors and retirees

- Good 5.0% discount to NAV, which boosts yields and potential capital gains alike

- Low duration, which significantly reduces risk and potential capital losses when interest rate rise

- Market-beating returns, with the fund generally outperforming its index on a NAV and price basis

BIT’s many benefits combine to create a strong fund and investment opportunity, and one which is particularly well-suited for more risk-seeking income investors and retirees. Let’s have a look at each of the points above.

Diversified Holdings

BIT is a diversified bond CEF, investing in all relevant bond sub-asset classes, but focusing on high-yield bonds. BIT’s holdings include high-yield corporate bonds, investment-grade corporate bonds, mortgage-backed securities, securitized products, bank loans, and more. These sub-asset classes are somewhat different to each other, so their combination serves to somewhat decrease portfolio risk and volatility. BIT remains a bond fund, with all the risks that entails.

The fund almost exclusively invests in dollar-denominated securities from U.S. issuers, but has small investments denominated in foreign currencies, or from foreign issuers. BIT is actively-managed, so security selection and sector weights are chosen / dependent on the fund’s investment management team.

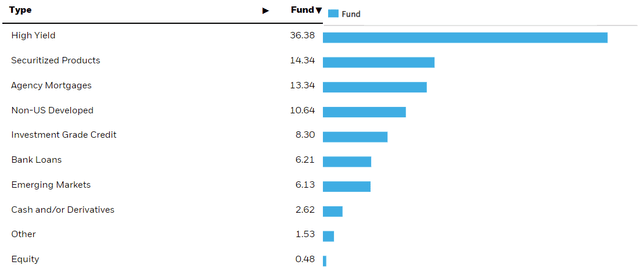

Sector exposures are as follows.

BIT Corporate Website

As can be seen above, BIT’s holdings are well-diversified from a sector perspective. Diversification serves to reduce portfolio risk and volatility, and is a benefit for the fund and its shareholders. In my opinion, and taking into consideration the above, BIT could function as a core portfolio holding.

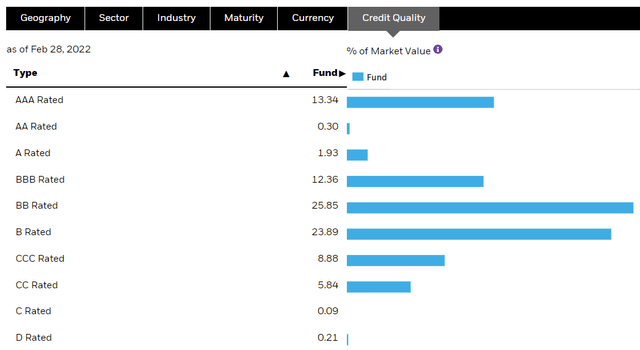

Although BIT is a well-diversified fund, it focuses on non-investment grade, high-yield bonds. These currently account for over 70% of the fund’s holdings, with higher-quality segments, mostly mortgages, accounting for the rest.

BIT Corporate Website

Focusing on non-investment grade bonds has important implications for the fund and its shareholders.

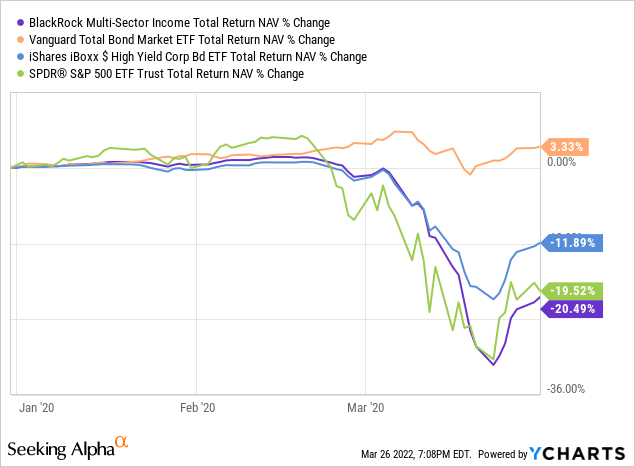

These bonds are riskier than average, and particularly exposed to economic conditions. When times are good, which they generally are, corporate revenues and earnings are high, bonds are paid back in full, and BIT profits from hefty coupons and stable prices. When times are tough, which they sometimes are, corporate revenues and earnings plummet, bankruptcies and defaults increase, and BIT’s holdings see lower prices and, in some cases, no more coupon payments. In practice, BIT would likely sell any bond before default, but it would do so at rock-bottom prices. As such, the fund is likely to experience significant losses during downturns and recessions. As an example, the fund saw NAV losses of 20% during 1Q2020, the onset of the coronavirus pandemic, and the most recent downturn. Losses were significantly greater than those of most broad-based bond indexes, as well as those focusing on high-yield bonds, but comparable to those of the S&P 500.

BIT is a relatively risky investment, but not excessively so. As such, the fund is broadly inappropriate for more risk-averse investors, but appropriate for most others.

On a more positive note, risky bonds tend to carry high coupon rates, which brings me to my next point.

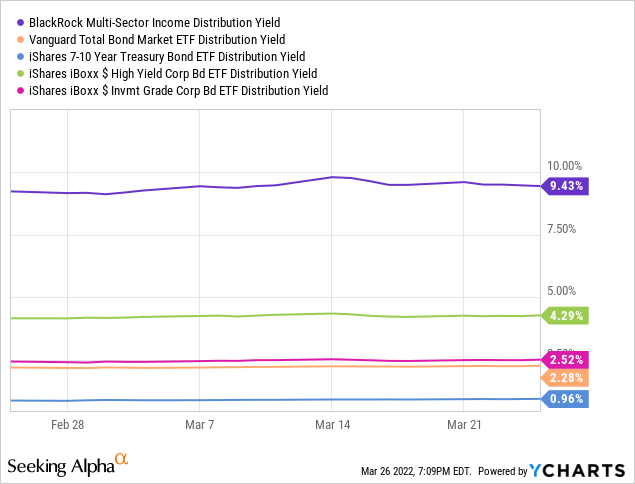

Strong 9.4% Distribution Yield

BIT currently sports a strong 9.4% distribution yield. It is very high on an absolute basis, significantly higher than that of most relevant bond sub-asset classes, and more than twice as much as high-yield bond indexes. It is an incredibly strong yield, a significant benefit for the fund and its shareholders.

BIT’s distributions are also incredibly stable, with the fund paying uninterrupted monthly distributions since early 2013. Distributions have even grown by about 6.0% since inception, or less than 1.0% annualized. BIT’s yield is incredibly strong, and stable, and growing to boot.

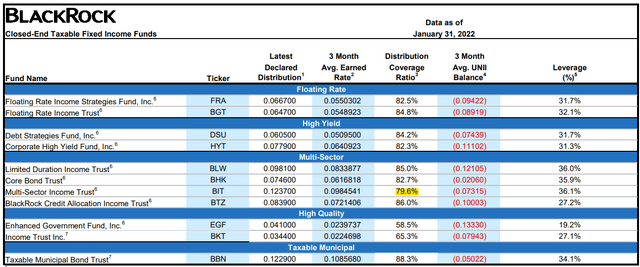

BIT’s distribution seems mostly sustainable, but the situation is complicated. As per the fund’s investment managers, BIT sports an 80% distribution coverage ratio. Meaning, distributions are mostly covered by underlying generation of income, but not fully-covered.

BIT Corporate Website

On the other hand, the figures above do not take into consideration potential capital gains, trading profits, investment alpha, or other sources of returns. Distributions might be more or less sustainable after accounting for these factors. These factors ultimately feed into a fund’s NAV per share, so we can analyze said metric to understand a fund’s long-term distribution sustainability. BIT’s NAV per share has decreased by 13% since inception, roughly in-line with NAV losses for most high-yield corporate bonds. Importantly, losses are concentrated in the past couple of months, during which interest rates have risen due to skyrocketing inflation, and credit spreads have widened due to increased perceptions of risk.

In my opinion, BIT’s distributions are mostly long-term sustainable, hence the fund’s stable NAV per share from 2013 to 2021. Current NAV losses are due to interest rate movements and market sentiment. As underlying economic fundamentals remain strong, these do not endanger the fund’s underlying generation of income, returns, or distribution sustainability. On the other hand, funds can only experience so much decline in NAVs before cutting distributions to conserve cash and keep NAVs afloat. Under current conditions, a distribution cut is possible, although much will depend on evolving market conditions. Although a distribution cut would be undoubtedly a negative, it is not a given, and the fund’s yield would almost certainly remain quite high regardless.

In the long term, I think the fund is likely to experience growing dividends, as the Federal Reserve is hiking intervention rates, leading to higher interest rates across the economy. It takes a few years for higher interest rates to be reflected in rising distributions for most bond funds, so investors are unlikely to benefit from these trends in the short-term, but the long-term outlook is broadly positive.

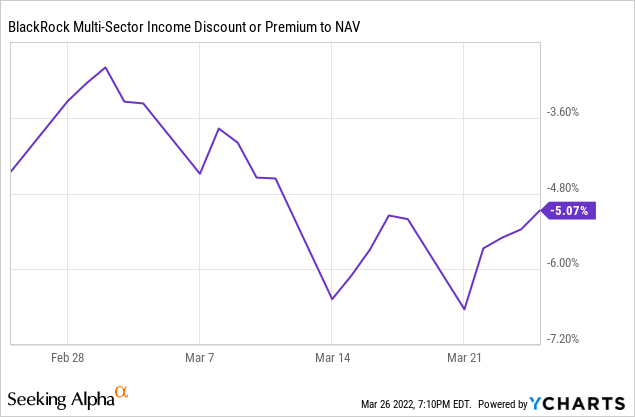

Good 5.0% Discount to NAV

BIT currently trades with a 5.0% discount to NAV, a reasonably good, albeit not fantastic, figure. The fund’s current discount is slightly above its one-year average, although it did trade with a larger discount during 2020.

Discounts to NAV are analogous to lower share prices, and so boost potential capital gains distribution yields, ultimately benefitting investors. A 5.0% discount to NAV means that for every $1.0 invested in BIT, investors are entitled to $1.05 in assets and income. Those extra five cents per dollar means higher potential capital gains and income, and although the impact is not enormous, it is still a positive for investors.

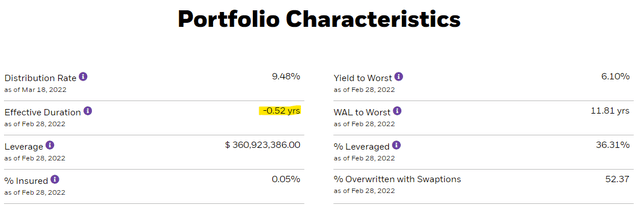

Low Duration

Interest rates are a significant source of risk for most bond funds, but that is not the case for BIT. Some context first. In general terms, most bond funds currently hold relatively low-yielding bonds, as interest rates cratered in 2020, because the Federal Reserve slashed rates to ameliorate the effects of the pandemic. Interest rates are now rising, as the Federal Reserve hikes rates to combat surging inflation. Rising rates cause investors to sell their current low-yielding bonds, to replace them for higher-yielding alternatives. Doing so leads to lower prices for these lower-yielding bonds, and for capital losses for their investors, including most bond funds. Although almost all bonds suffer capital losses when rates rise, the relative magnitude of said losses varies, being dependent on several characteristics. Interest rate sensitivity can be measured, through a metric called ‘duration’.

BIT itself sports an incredibly low duration, negative, in fact. Unlike the vast majority of bond funds, which suffer significant losses when rates rise, BIT is almost completely insulated from rising rates, and even benefits a bit from these.

BIT Corporate Website

BIT’s negative duration is due to the fund hedging its interest rate exposure through interest rate swaps. In simple terms, the fund holds financial derivatives which rise in value and post profits when rates rise, but decrease in value and post losses when these decrease. The impact from said derivatives almost completely cancels out the fund’s underlying interest rate sensitivity, which cuts in the opposite direction. The end result is a fund which is almost completely insulated from interest rate movements, but slightly benefits from higher rates.

BIT’s low duration is a significant benefit for the fund and its shareholders for two reasons.

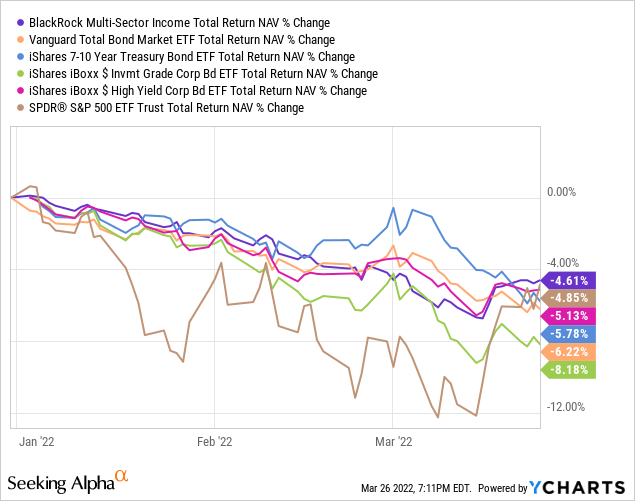

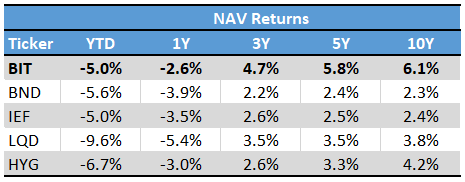

First, the fund’s low duration helps to reduce capital losses when rates are rising, as they currently are. BIT’s low duration has allowed the fund to outperform on a NAV basis relative to all relevant bond sub-asset classes and equities YTD, although only slightly so. BIT’s performance looks even stronger accounting for the fund’s use of leverage. By all accounts, the fund should have underperformed relative to its peers, due to the leverage. The fact that it managed to outperform instead is incredibly positive news.

Second, BIT’s low duration is indicative of a strong investment management team, and investment alpha. Remember, BIT is an actively-managed fund. The fund sports a low duration because its investment managers thought this would be beneficial for investors, and they were right. A strong investment management team can make all the difference, and BIT’s recent outperformance is indicative of a strong investment management team. Which brings me to my next point.

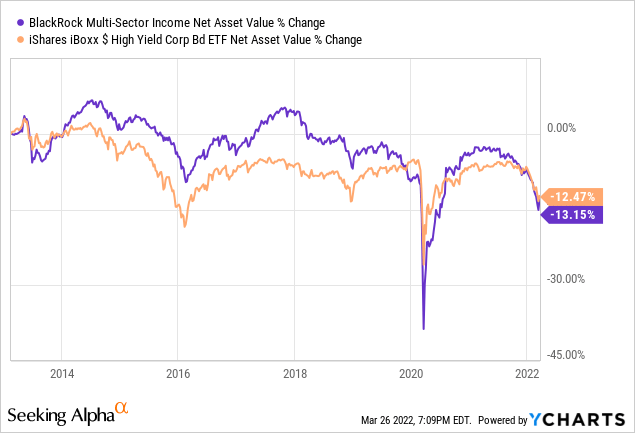

Market-Beating Returns

BIT’s performance track-record is quite strong, with the fund consistently outperforming its peers on a NAV basis. Of particular importance is the fund’s strong risk-adjusted returns. BIT significantly outperforms during bull markets and in the long-term, while performing adequately during downturns and recessions, a strong value proposition. Although BIT is a relatively risky fund, it is not excessively risky, nor is the fund guaranteed to underperform when markets are down. The fund’s outperformance is due to its high-yield focus, use of leverage, and consistent generation of alpha.

Seeking Alpha – Chart by author

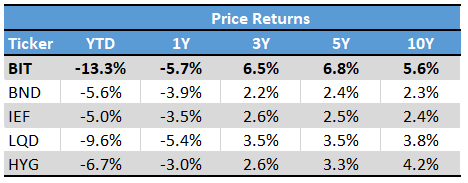

On a more negative note, the fund’s price returns are moderately lower than NAV since inception, significantly lower in the past year. BIT’s lackluster price returns are almost exclusively due to widening discounts in the past few months. Although widening discounts are a negative for the fund current shareholders, they are a positive for future and prospective investors.

Seeking Alpha – Chart by author

Conclusion – Strong Buy

BIT’s diversified holdings, strong 9.4% distribution yield, good 5.0% discount to NAV, low interest rate risk, and industry-beating returns, make the fund a strong, well-rounded investment, and a buy.

Be the first to comment