Prostock-Studio/iStock via Getty Images

Stride, Inc. (NYSE:LRN) expects to deliver further revenue growth from 2022 to 2025, and notes a growing target market of $100 million. In my view, more licensing of new products, new designs, or acquisitions could occur because LRN has a significant amount of cash. A decrease in governmental budgets to finance public education could affect LRN’s revenue growth. However, the current valuation does seem too low as compared to the sum of potential future free cash flows.

Stride

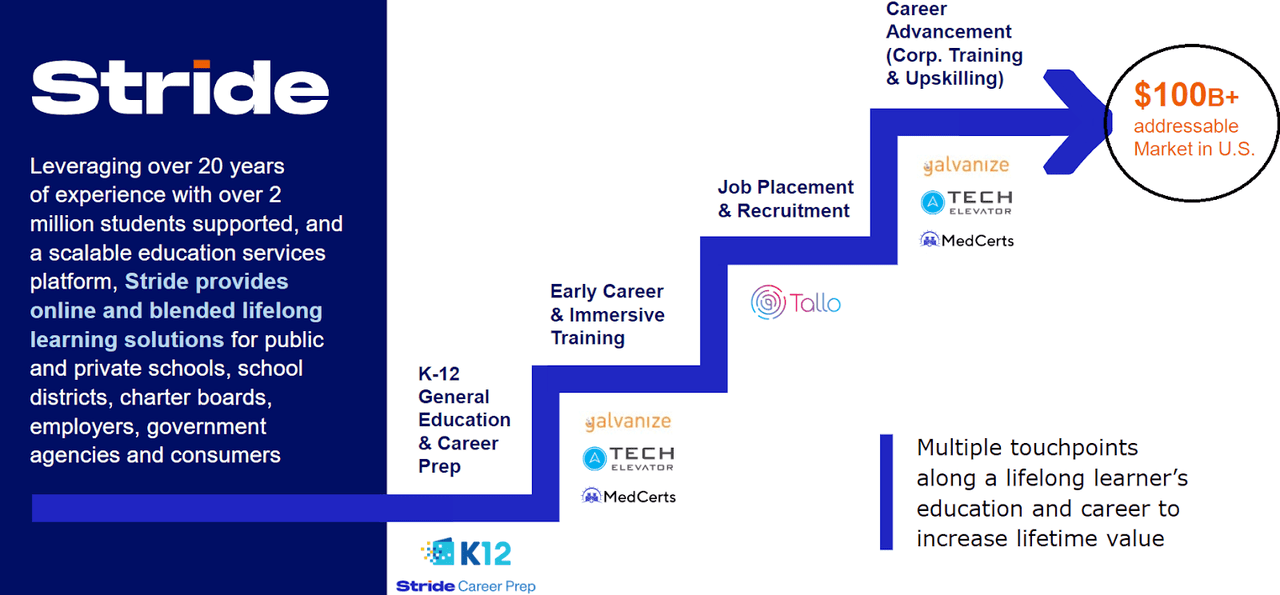

Stride is an education services company offering virtual learning to private schools, school districts, government agencies, and consumers.

10-k

If I can go straight to relevant factors, Stride is targeting a massive target market of $100 billion, and reports close to 2 million students supported. In my view, the client count served is too large to conduct research on the stock.

Q3 FY22 Earnings Presentation

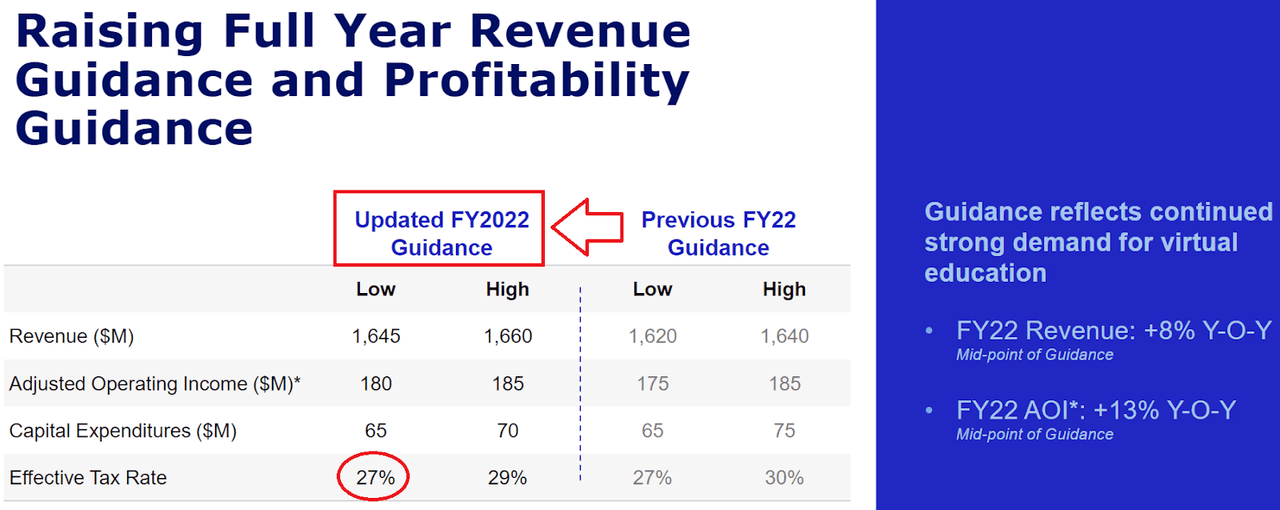

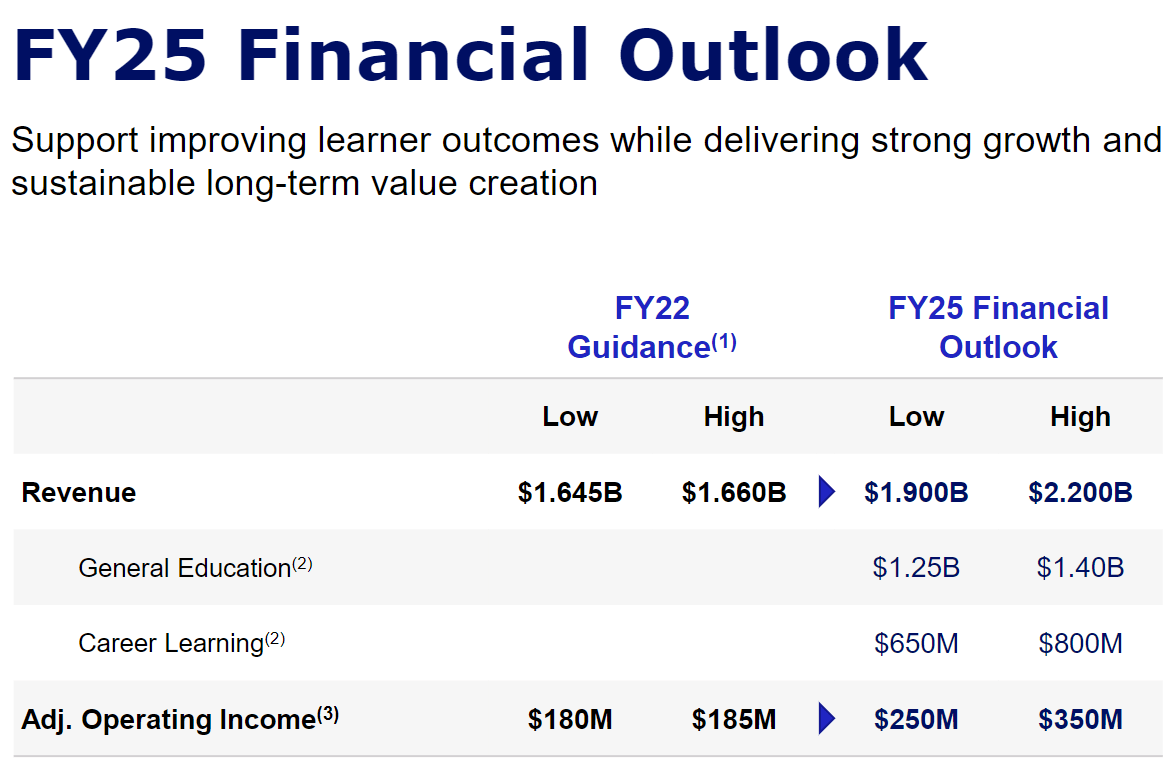

I decided to run financial models on Stride because the company recently updated its forward year guidance. Future 2022 sales growth increased from a minimum guidance of $1.62 billion to $1.645 billion. Management also increased its operating income to a minimum guidance of $180 million.

Q3 FY22 Earnings Presentation

It is also quite beneficial that Stride offered projections until 2025. Management believes that 2025 revenue will likely stay close to $1.9-$2.2 billion, with an operating income close to $250-$350 million.

Q3 FY22 Earnings Presentation

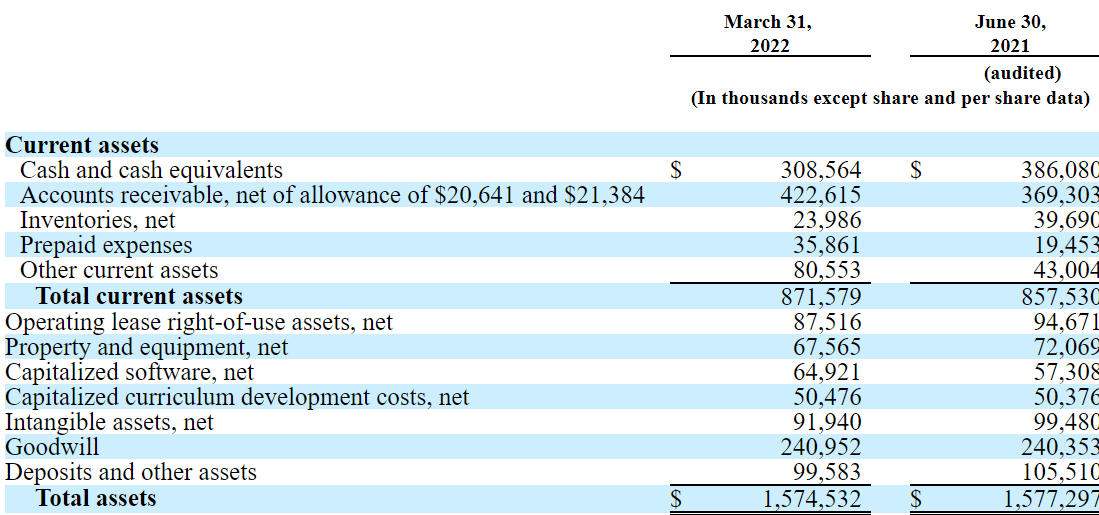

Balance Sheet: $308 Million In Cash And A Small Amount Of Debt

As of March 31, 2022, Stride reported $308 million in cash, $1.57 billion in total assets, and an asset/liability ratio close to 2x. I believe that Stride’s financial situation is stable. In my view, Stride has cash in hand to finance further development of software and more marketing efforts.

10-Q

Stride reports $411 million in long-term debt and net debt close to $140 million. Considering my assumptions of free cash flow, in my opinion, Stride could ask for more debt financing. I don’t believe that the debt outstanding is worrying.

10-Q

With Sufficient Marketing And Engagement Strategies, My DCF Model Implied A Fair Price Of $45.7

Considering the total amount of cash in hand, I believe that Stride will successfully invest a significant amount of cash in hand in marketing. Once students are enrolled, the company appears to own engagement and retention strategies. In sum, I believe that Stride will most likely drive revenue growth up, thanks to appropriate awareness programs. The annual report discussed some of the company’s strategies in more detail:

We, therefore, continue to refine our marketing programs to attract students who are most likely to succeed in a non-classroom based environment with the expectation of increasing academic success and student retention, recognizing that all students are eligible to enroll consistent with state requirements. Once students are enrolled, programs such as Strong Start Onboarding, Single Point of Contact Advisors, Social-Emotional Learning and Face-to-Face/Blended Programs provide early intervention and focused engagement and retention strategies, which strive to help students stay on track, improve engagement and, ultimately, give students a better chance at academic success. Source: 10-K

I also believe that further products will most likely help Stride bring more revenue growth. Stride could design new products, or sign licensing agreements with other platforms. Let’s note that more products will more likely expand the company’s addressable market, which may explain how revenue could trend further north.

We seek to expand our addressable market by offering career readiness training beyond our traditional K-12 market and into adult education and corporate training. Source: 10-K

We intend to continue to expand our product line and offerings, both internally and through licensing. This includes pursuing development and licensing of curriculum and platforms that are accessible from tablet and mobile devices and leveraging adaptive learning technologies and solutions. Source: 10-K

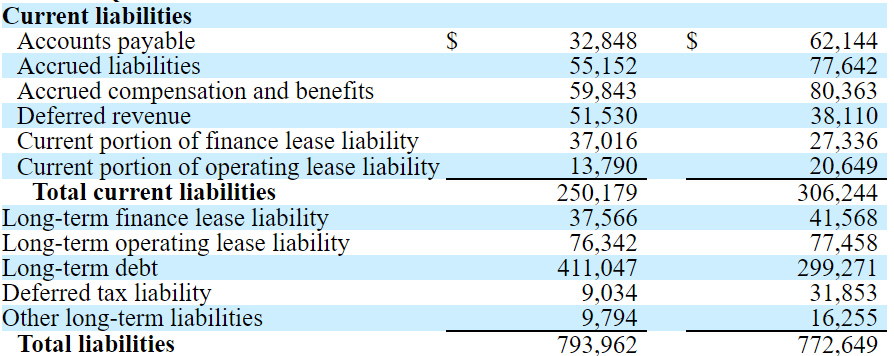

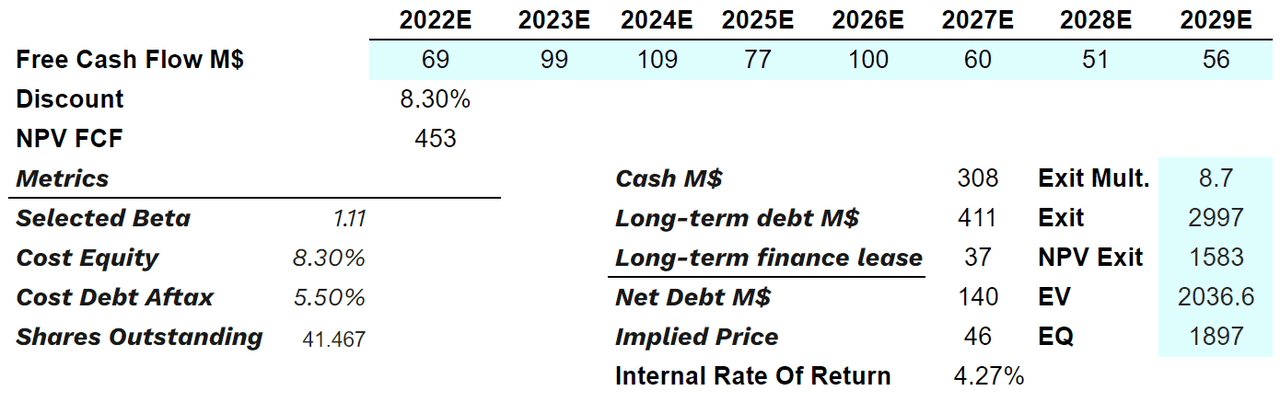

With sales growth between 8% and 3% from 2022 to 2029, I obtained 2029 net sales of $2.1 billion. I also assumed an EBITDA margin of 16%-18% and an operating margin between 10% and 12%. Finally, my results include 2029 EBIAT of $173 million.

Arie Investment Management

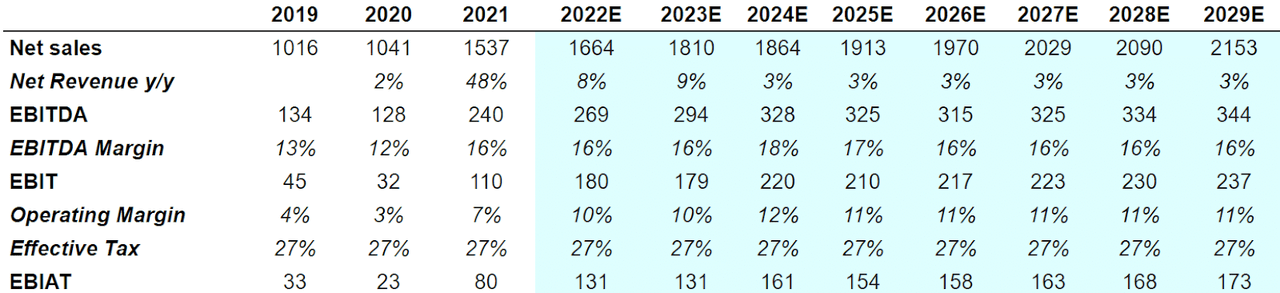

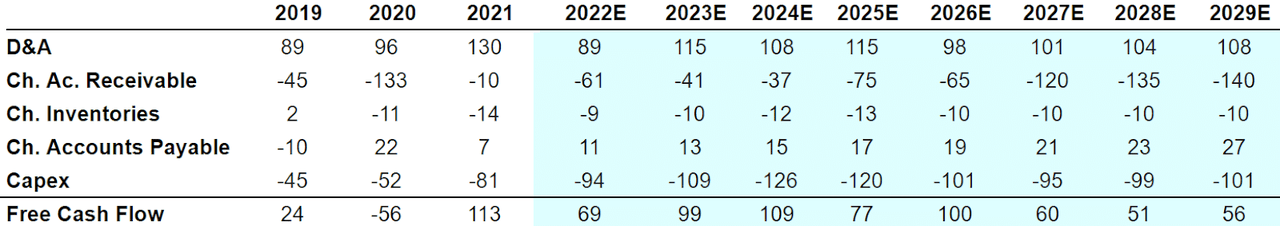

In the past, changes in working capital ranged between close to zero and -$117 million, D&A was close to $90 million, and capex was around $52 million. My numbers are close to the figures reported by Stride in the past. The results obtained include free cash flow around $51 million and $109 million.

Ycharts

Arie Investment Management

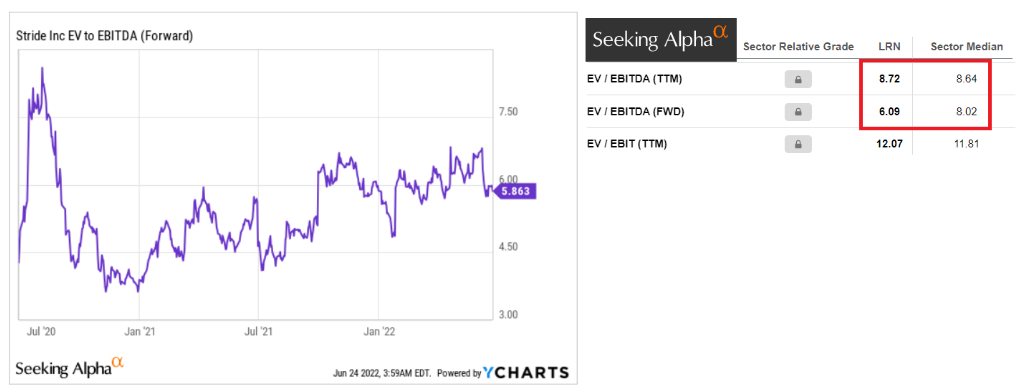

I used a discount of 8.3%, which is close to the weighted average cost of capital reported by other investment advisors. I also used a beta of 1.11, cost of equity of 8%, and cost of debt of 5%. Using the sum of free cash flows from 2022 to 2029 with a discount of 8.3%, the net present value stands at $453 million. If we also use an exit multiple of 8.7x, which is close to the median of the industry, the exit would be worth $2.9 billion.

Ycharts

Finally, my results include an enterprise value of $2 billion, an equity value of $1.8 billion, and a fair price of $45.7 per share. The internal rate of return would stand close to 4.27%.

Arie Investment Management

Worst-Case Scenario Would Lead To A Valuation Of $15

Stride receives financing from public schools, which receive funds from governmental budgets. Economic recessions or many other causes may lower the funds associated with public schools, which may be detrimental for Stride. In the worst-case scenario, the revenue growth may lower significantly, which could reduce Stride’s equity valuation:

The public schools we contract with are financed with government funding from federal, state and local taxpayers. Our business is primarily dependent upon those funds with a majority of our revenue coming from our comprehensive school-as-a-service offerings in both the General Education and Career Learning markets. Budget appropriations for education at all levels of government are determined through a legislative process that may be affected by negative views of for-profit education companies, recessionary conditions in the economy at large, or significant declines in public school funding. The results of federal and state elections can also result in shifts in education policy and the amount of funding available for various education programs. Source: 10-K

Stride could suffer from academic performance. If students enrolled in the company’s courses don’t pass their exams, complaints or changes in the regulations could lower Stride’s revenue growth. The company disclosed these risks in the last annual report.

Consistently poor academic performance, or the perception of poor performance, could also lead to closure of an online public school or termination of an approved provider status in some jurisdictions, or to passage of legislation empowering the state to restructure or close low-performing schools. For example, a 2016 Nevada law expanded a charter authorizer’s ability to terminate a charter based upon academic performance or to reconstitute a school’s governing board, and a 2013 Tennessee law with academic performance criteria applying only to virtual schools. Source: 10-K

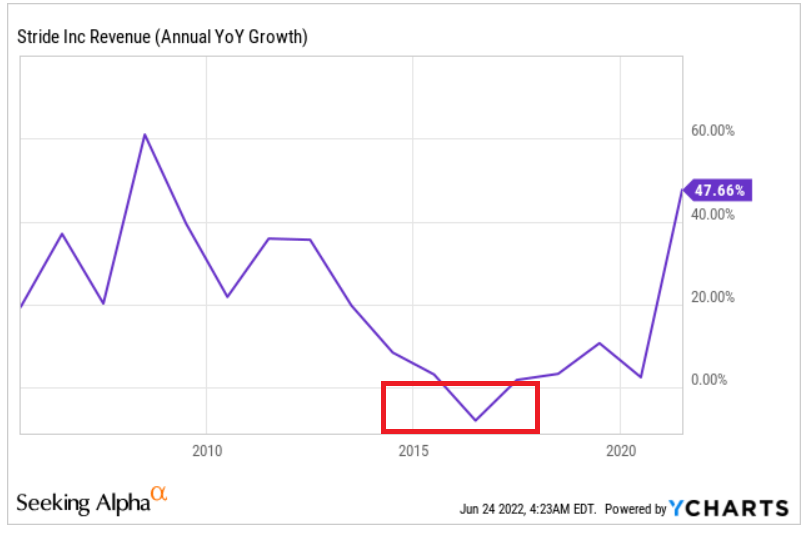

I wasn’t very pessimistic about my worst case scenario because Stride didn’t deliver a lot of negative sales growth in the past. There does not seem to be a crisis in the education industry because people receive education every year.

U.S. Education Market is prognosis to record CAGR of nearly 4.5% in 2021-2028. Upgrading of education system in the U.S. will proliferate expansion of size of U.S. education industry. Source: Zion Market Research

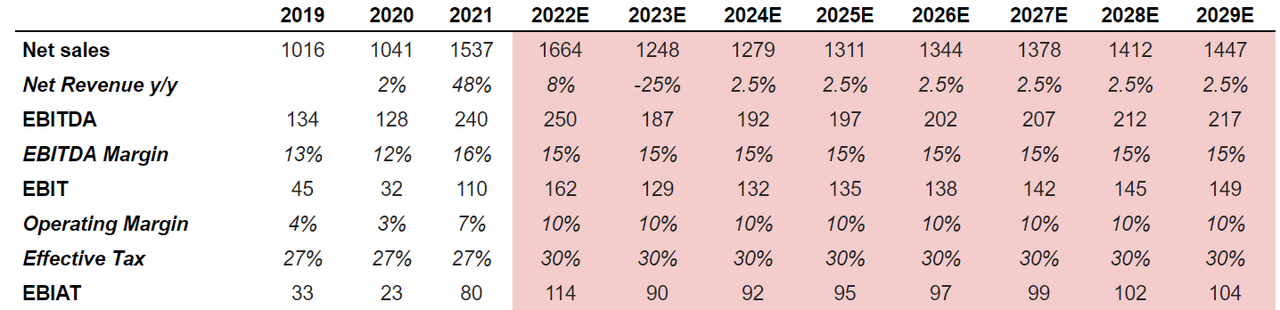

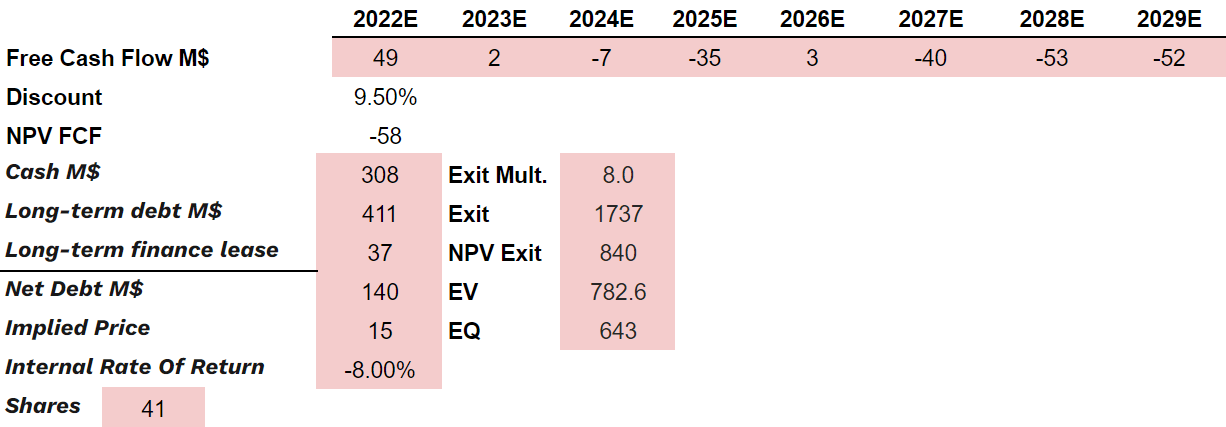

I hardly see this industry as a cyclical sector. With this in mind, I used -25% sales growth in 2023 and 2.5% sales growth from 2024 to 2029. I also used an EBITDA margin close to 15%, effective tax of 30%, and operating margin of 10%. These assumptions lead to 2029 EBIAT of $104 million.

Ycharts

Arie Investment Management

If we sum future free cash flow with a discount of 9.5%, and also use an exit multiple of 8x, the total implied enterprise value would be $782 million. Finally, the implied fair price would be $15.

Arie Investment Management

With A Sufficient Number Of Acquisitions, Stride Could Reach A Valuation Of $80 Per Share

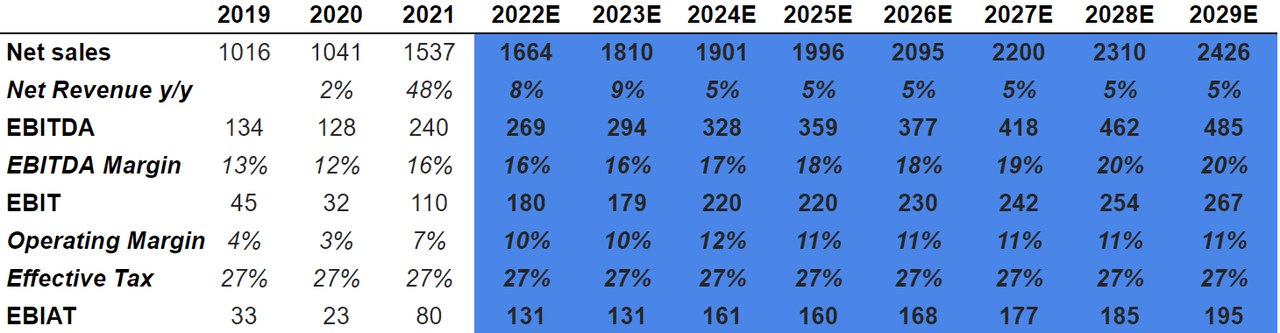

Under the best-case scenario for Stride, I assume that in the next seven years, management will find beneficial acquisitions. In my view, considering the cash in hand and previous acquisitions, I believe that new acquisitions are somewhat likely. With a few business combinations, I believe that future revenue growth will be larger than market growth.

We may pursue selective acquisitions that complement our existing educational offerings and business capabilities, and that are natural extensions of our core competencies.

In January 2020, we acquired Galvanize to expand the Company’s adult learning offerings to include data science and software engineering, technology staffing and developing talent and capabilities for companies. In November 2020, we acquired Tech Elevator and MedCerts to continue our expansion into adult learning. Tech Elevator provides in-person and remote immersive training in software development for consumers and enterprises. MedCerts offers online allied healthcare training, including certification preparation and job placement support. Source: 10-K

In the best-case scenario, I used sales growth around 5% from 2024 to 2029, and an EBITDA margin of 20% from 2028 to 2029. 2029 EBIAT would stand at $195 million.

Arie Investment Management

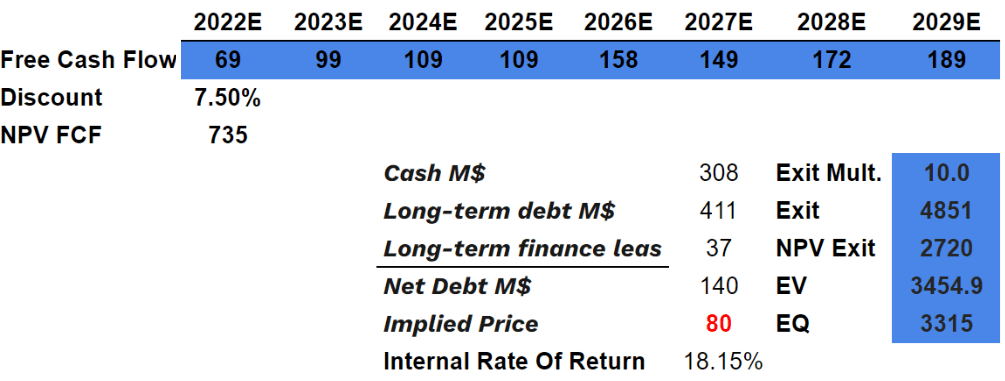

With a discount of 7.5% and free cash flow between $69 million and $189 million, the total net present value would stand at $735 million. With an exit multiple of 10x EBITDA, the exit would stand at $4.85 billion, the equity would be $3.315 billion, and the implied price may be close to $80 per share.

Arie Investment Management

Conclusion

Stride is designing and licensing more and more educational products, which is increasing the total target market. Right now, management claims to target a total market of $100 billion. Besides, the company has cash in hand to finance further acquisitions or marketing expenses, which will likely lead to revenue growth. I envision risks from a decrease in governmental budgets to finance public education. However, the current valuation does seem too low. In my view, the fair price is significantly higher than the current market price.

Be the first to comment