DanielIngelhart/iStock via Getty Images

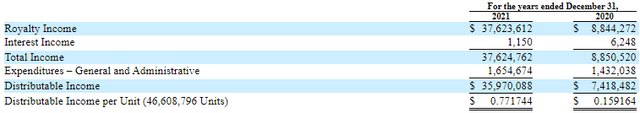

The price of San Juan Basin Royalty Trust (NYSE:SJT) units has soared lately as the price of natural gas has risen. Before investors jump on the SJT bandwagon, they need to look into the details of this trust. Because of the recent greatly increased production, the trust may be out of reserves by 2030, since they can’t buy additional assets. The price of natural gas needs to increase and remain at a higher level to justify the current price of SJT.

Business Model

San Juan Basin Royalty Trust is a non-mortgage widely held fixed investment trust (NMWHFIT). The trust does not “own over 150,000 acres of land in the San Juan Basin in New Mexico” that was stated in a different Seeking Alpha article. The trust does, however, have a 75% net overriding royalty interest. This is completely different from ownership of land. (“Net Overriding Royalty Interest: A share of gross production from a property, measured by net profits from operation of the property and carved out of the working interest”.) The trust was created in 1980 and the last amended indenture became effective in 2007. (text of amended trust indenture).

Key Points:

*96.8% of royalty income comes from natural gas and 3.2% from oil

*Trust has no employees

*151,900 gross (119,000 net) producing acres

*Total of 5,390 gross (1,140.0 net) wells

* Trust has no control over operations

*Approval of 75% of unitholders is needed to sell more than 1% of the assets (not just 75% of voting unitholders-a “non-vote” is the same as a no vote)

*No debt

*46,608,796 units

*Trust can’t buy additional assets

*No hedging

Recent Results

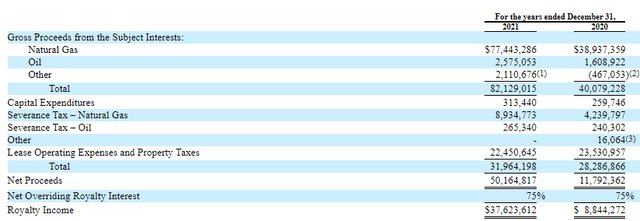

Annual Income Statements

Annual Income Statement (sec.gov)

Annual Income Statement (sec.gov)

(2021 ave. gas $3.20 and $54.72 oil – 2020 ave. gas $1.51 and $31.47 oil)

The income that is distributed to unitholders depends on three major factors: production, expenses, and price for natural gas/oil. The trust has no control over any of these variables. Hilcorp Energy bought the San Juan Basin interest from ConocoPhillips (COP) in 2017. Hilcorp is owned by Jeffery Hildebrand and is the largest privately owned oil and natural gas company in the U.S. Hilcorp controls all operations. (See below.) While SJT does not sell their natural gas at the Henry Hub, the SJT unit price is highly correlated to the Henry Hub spot price.

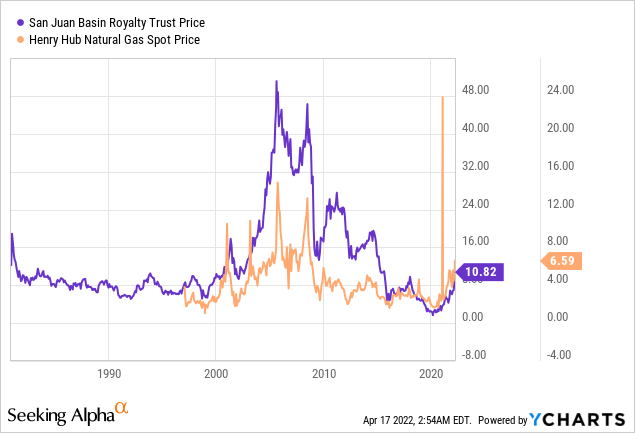

SJT can’t buy additional assets, so it has to depend solely on the reserves for future results. As can be seen below, production increased sharply in 2021 to 11,029 MMcf from 3,558 in 2020 as energy prices increased. Natural gas production in 2021 was 29% of the estimated natural gas reserves at the start of 2021. At first glance, this would imply the trust would have enough reserves to produce at that level for only 2022 and 2023. Because natural year-end gas prices used to estimate reserves increased from $1.985 MMBtu (Henry Hub) to $3.598, reserves were revised upward 56,309 MMcf for December 31, 2021. Adding the beginning reserves and the upward revised amount, natural gas production in 2021 was 11.7% of reserves. Assuming the natural gas price used to determine the latest reserve numbers and the same production level as 2021, the trust will use all their reserves by the end of 2029. Investors should, however, remember these estimates by consultants tend to be conservative.

The reserve numbers are a little misleading because 17% of their natural gas reserves are coal seam natural gas, which is less valuable than conventional natural gas because of higher carbon dioxide content and it costs more to produce.

Annual Reserve and Production

Annual Reserve and Production Numbers (sec.gov)

(Note: For estimating reserves in 2021, the adjusted volume-weighted average gas price over the life of the properties is $3.05 per Mcf and for 2020, the adjusted volume-weighted average gas price over the life of the properties is $1.44 per Mcf.)

For those readers interested in very long-term reserves and production numbers, I included a table going back to 2002 in my 2016 SJT article. It is important to consider what I wrote in 2016: “Monthly Distributions Total NG royalty production from 2002 through 2015 was 245,402 mcf which is actually greater than 2001 year-end reserve figure of 176, 815 mcf and there were still reserves at year-end 2015”. This clearly shows reserve numbers are often rather conservative and production methods improve over time.

According to a statement in their recent 10-K, Hilcorp is planning on spending $1.9 million on CAPEX in 2022, which is an increase from a little over $300k in 2021, mostly doing 24 well recompletions and workovers. This should help increase production in 2022 and 2023.

Remember the trust itself has no control over CAPEX. It is decided solely by Hilcorp. The indenture requires that Hilcorp “will conduct and carry on the maintenance and operation of the Subject Interests with reasonable and prudent business judgment and in accordance with good oil and gas field practices… however, nothing contained in this Section 6.01 shall be deemed to prevent or restrict Assignor from electing not to participate in any operation which is to be conducted under the terms of any operating agreement…if such election is made by Assignor in good faith.” The reality is that Hilcorp can do or not do what they want. Hilcorp can allocate resources, including manpower, to maximize their entire company’s profits, which could mean that there is not much done in the fields where the trust has their net overriding royalty interest, in the future. This is a risk of owning a trust instead of an operating company.

In addition, based on my reading of the 1980 conveyance, it seems that the trust’s net overriding royalty would not apply to any natural gas found by drilling wells deeper than the “Basin-Dakota Gas Pool”. That natural gas would not be subject to the overriding royalty, in my opinion. This would limit potential new reserves if existing wells are now drilled deeper. The 10-K also states that “Rights to production, if any, from deeper formations are retained by Hilcorp”.

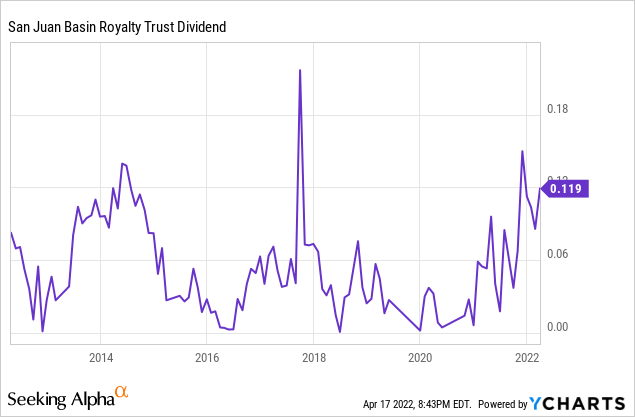

Monthly Distributions

SJT pays a monthly distribution. This is not actually a “dividend”. It is taxed as ordinary income and not at the lower qualified dividend tax rate. The monthly distribution is a “delayed” payment. For example, the production during January 2022 resulted in a $0.119104 distribution per unit that was paid on April 14. Because of the complexity of income tax issues, SJT unitholders often buy SJT units in IRA accounts and are therefore able to ignore the tax issues. Besides trying to figure out the impact of depletion, investors are confused between the total distributions received in a tax year and what their taxable income is for the year. For tax purposes, the IRS uses the trust’s income for the year and not the distributions for the year. Remember, the distributions are “delayed”. Unitholders who hold units in a taxable account get 1099-MISC and 1099-INT forms (the trust has a very small amount of interest income) to be used to determine their income tax. This is a trust and not a MPL; therefore, no K-1 forms.

Reserves Have Become A Problem

Depleting the reserves is a serious problem that investors need to factor into their valuation of SJT units. As noted above, it seems that the trust may have only about eight years of natural gas production remaining if they continue production at 2021 levels. Using $0.847573 annual distribution that sums up 12 months of distributions based on 2021 production that accounts for the delay in monthly payments and not based on actual distributions in 2021, multiplied by eight years of remaining production, the total is about $6.78. This total does not factor in the present value issue or the impact of depletion. This $6.78 is significantly lower than the current unit price of $10.82. To justify the higher price, investors must be assuming that the reserve estimates are too conservative or that natural gas prices will increase and remain high for the next 8-10 years or some combination of both.

The trust’s website states 10-15 years for the remaining life of the trust, but I am not sure how current that answer is in a Q & A section. I think I read that same answer before the 2021 very large increase in production.

Natural Gas Prices

Finally, the major issue-price of natural gas. I did not expect that Putin would actually invade Ukraine. I assumed he was just beating his chest and eventually would negotiate some type of favorable deal for himself. I did not expect that he had some very serious mental issues. The “Putin issue” makes forecasting natural gas prices very difficult, if not impossible. Europe may ban at some point the importation of Russian natural gas, but it could be months before the ban becomes effective. Coal imports were banned but that ban does not become effective until mid-August. I hope there could be some type of resolution to the war before then.

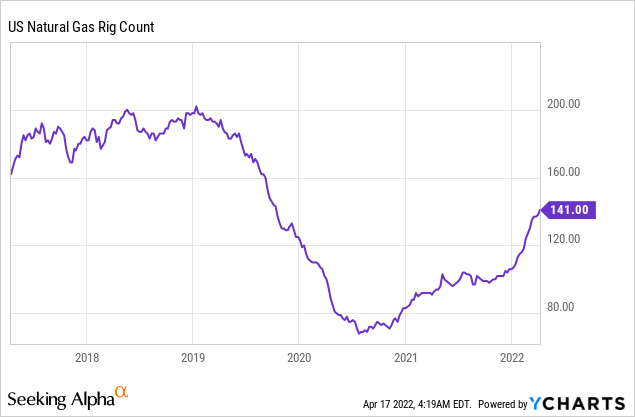

In the U.S., the natural gas rig count is still far below the level of a few years ago. Some drilling companies might be holding back because they worry that the current high energy prices may only be temporary or that the campaign to end fossil fuel use in the U.S. might actually be a reality before they can recoup the expenses of new exploration/drilling. If the Republicans do gain control of Congress in January, it is much less likely that any major legislation will pass over the next two years that will have a serious negative impact on the domestic energy industry. This could result in a lot more drilling, which then would have a negative impact on energy prices.

My complex econometric model for estimating quarterly natural gas price over the next two years is worthless because of the very high standard deviation of the results. This inability to estimate prices increases the risk of owning SJT units. The reality is that any natural gas price forecast is currently just a guesstimate, in my opinion.

Conclusion

I think many traders are ignoring San Juan Basin Royalty Trust’s business model. It is basically a liquidating trust that will run out of reserves and because of the recent very large production increase, SJT could find itself “dry” quicker than many expect.

SJT units most likely will continue to trade with the price of energy, especially natural gas. For those investors extremely bullish on natural gas prices they may want to include SJT in their list of potential candidates to buy, especially in IRA accounts. Before buying SJT, investors should consult with their accountants.

Because I only have guesstimates for energy prices and I am uncertain about the trust’s reserve amounts, I rate SJT units neutral/hold.

Be the first to comment