Kamonwan Wankaew/iStock via Getty Images

Strattec Security (NASDAQ:STRT) manufactures and markets automotive access control products including mechanical locks, electronically enhanced locks, passive entry passive start systems, and various related products, and provide full service & aftermarket Support for each VAST automotive group partner’s products.

With over 110 years of history in the automotive security business, the company has become the world’s largest producer of automotive locks and keys since the late 1920s. It has a significant market share in the industry. And with the customer-focused structure, the company works with Original Equipment manufacturers to develop cost-effective and innovative solutions.

The company has been involved in new technology development as the vehicle access system is shifting towards the integrated electro-mechanical system. Over a very long time, significant revenue has been coming from Stellantis (STLA), General Motors (GM), and Ford (F), resulting in low pricing power.

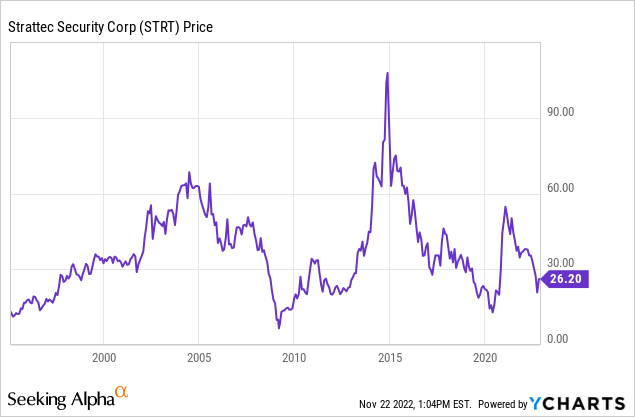

share price (Y-charts)

Currently, as the business is improving consistently, there is a high chance that going ahead, profitability might improve. Also, the stock price has dropped to considerably lower levels. From this price, stock can offer significant upside potential. Still, as the business has historically suffered significantly due to margin fluctuations, a higher concentration of customers might bring considerable risk to the business model. Still, the possibility of further deterioration in the business performance seems low. Therefore, I assign a hold rating as there appears to be a high chance of future profitability growth, but the risk persists due to the cyclicality of the business.

Historical performance

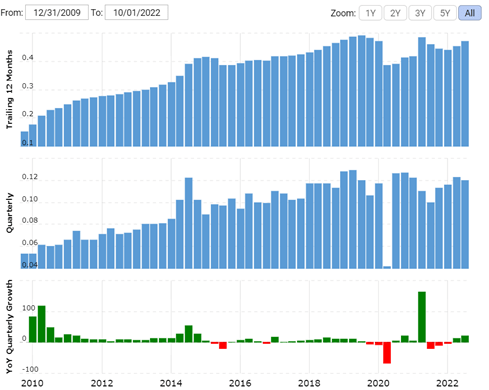

revenue growth (macrotrends.net)

In the last ten years, revenue has grown from $279 million in 2012 to about $452 million by fiscal 2022, which doesn’t seem attractive; also, profit margins have fluctuated a lot over the same period. As a result, the company has produced considerable losses during fiscal 2019 and 2020. Although due to significantly increased profits, the stock had reached to all-time high level of about $105 per share, but due to a consistent drop in the net profits, the stock price started dropping and has reached $26 per share to date. Therefore, overall performance since 2012 seems unsatisfactory.

Also, over the period, the company has grown its operations without any significant reliance on debt facilities. As a result, long-term debt has been significantly low, which provides significant strength and flexibility to the business model.

Also, despite losses, cash flow from operations has remained substantially attractive, which is attributed to efficiently managed working capital. As the generated cash flows have been used for capital expansion, the business has seen slow but consistent growth.

Furthermore, the company’s margins seem substantially low, which might be the reason behind the subdued growth rate. Also having such thin margins shows that the business might not have pricing power over its customers.

Strength in the business model

Strong operating history

Although the profit margins have fluctuated significantly over a very long period, the business has remained profitable and has produced an enormous cash flow from operations. Also note that the company’s financial condition is substantially strong, with very low debt and high liquid assets, which provides the company with substantial strength and flexibility of operation.

Continuous development

The company has collaborated with various international companies to develop innovative products, which might contribute to revenue growth in the upcoming year.

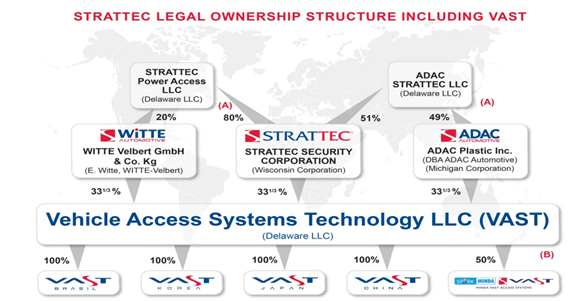

Ownership structure (annual report)

Also, the company holds, about 33% ownership in Vehicle Access System Technology LLC which provides significant strength to the company’s operations.

Risk factors

The top 3 customers contribute significantly to about 65% of the revenue, as a result, these large companies have substantial negotiating power, which has been affecting the overall margins, I believe such pricing pressure might sustain in the future and any increase in competition might put significant pressure on the margins; in such a case, profitability might drop.

As the automotive sector contributes most to the revenue, fluctuations and cyclicality in the auto sector might affect the business performance considerably.

Recent development

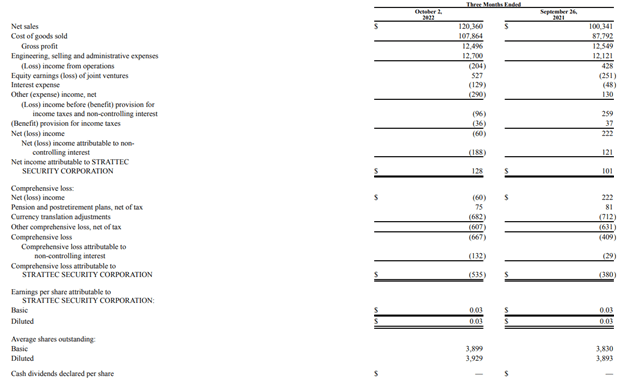

Quarterly results (Quarterly report)

In the latest quarter, revenue increased about 20% from $100 million in the same quarter last year to about $120 million to date, but due to significantly increased raw material costs, profitability has dropped. But due to significant recovery from receivables, the cash flow from operations has remained positive despite the operating loss.

Valuation metrics (seeking alpha)

Currently, the company has been trading for about $103 million whereas it has produced cash flow from operations of $35 million and $10 million in 2020 and 2021, respectively. It seems that the company has been trading for 2.8 and 10 times as per its 2020 and 2021 cash flows, and as the stock price has dropped significantly from its high levels, the stock offers significant upside potential, but due to substantially cyclical operations and increased competition that might put pressure on the margins, I assign a hold rating to the stock.

Be the first to comment