Hispanolistic

Stratasys Ltd. (NASDAQ:SSYS) delivers a significant amount of cash and expertise in the M&A markets. I believe that further investments in research and development and more agreements with channel partners could bring significant revenue growth. I do see risks from lower acceptance of 3D printing solutions and failed M&A operations. However, considering my own projections of future free cash flow, in my view, the current stock price does seem too low. My discounted cash flow model did result in a significant upside potential in the stock valuation.

Stratasys: Acquisition Of Partners And Adoption Of 3D Printing Will Likely Enhance Revenue Generation

Stratasys offers additive manufacturing services with innovative 3D printing solutions. Clients come from very different industries such as aerospace, automotive, consumer products, and healthcare. The company also has a significant number of printers with a large number of software available for different materials.

Source: Company’s Website

In my view, considering the recent adoption of 3D printing solutions from clients in different sectors, it is a great moment to study Stratasys Ltd. The most recent news includes an agreement with Axial3D to serve a majority of hospitals in many countries around the world.

We believe that by working together with Axial3D, we can remove the barriers to entry for the remaining majority of hospitals in many countries around the world, dramatically growing the use of 3D printing in pre-surgical planning so it is truly a standard part of patient care

It is also worth mentioning that Stratasys is acquiring a significant number of partners and competitors, which will likely enhance FCF growth. A clear example is Riven, which was acquired by Stratasys after some period of collaboration. From now on, clients will be able to use Riven’s offerings in Stratasys’ GrabCAD Print software.

The Berkeley, Calif.,-based start-up has been a Stratasys connectivity software partner and its cloud-based software solution will now be fully integrated into Stratasys’ GrabCAD® Additive Manufacturing Platform, benefiting customers using any Stratasys 3D printer running GrabCAD Print software.

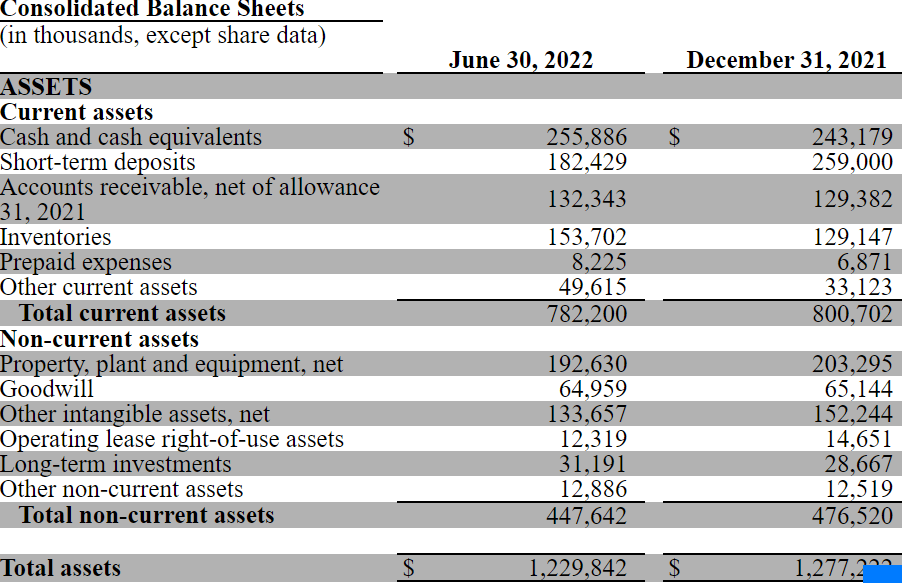

Balance Sheet

As of June 30, 2022, the company reported $255 million in cash and $182 million in short-term deposits. With the current market capitalization below $1 billion, I believe that the total amount of liquidity is significant, and Stratasys appears quite undervalued.

Source: Quarterly Report

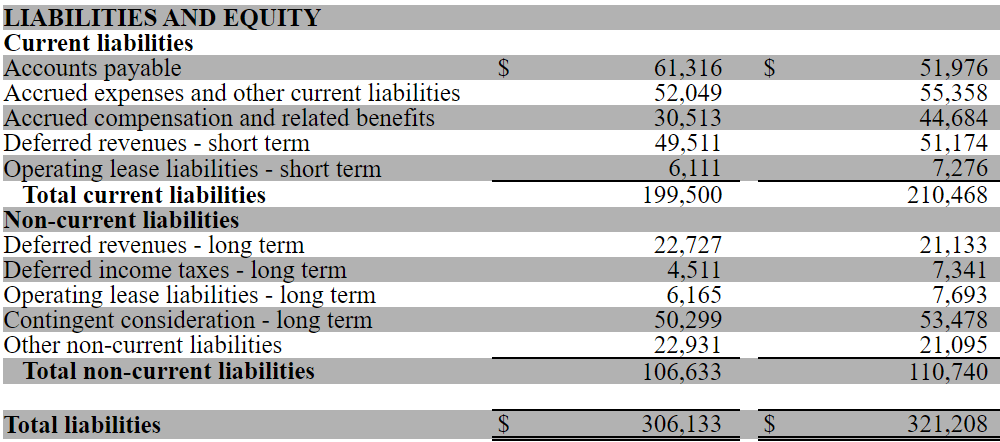

Stratasys does not report long term debt, which most investors will likely appreciate. Total liabilities stand at $306 million, so the asset/liability ratio is equal to 3.9x. In sum, I believe that Stratasys Ltd. is in good shape.

Source: Quarterly Report

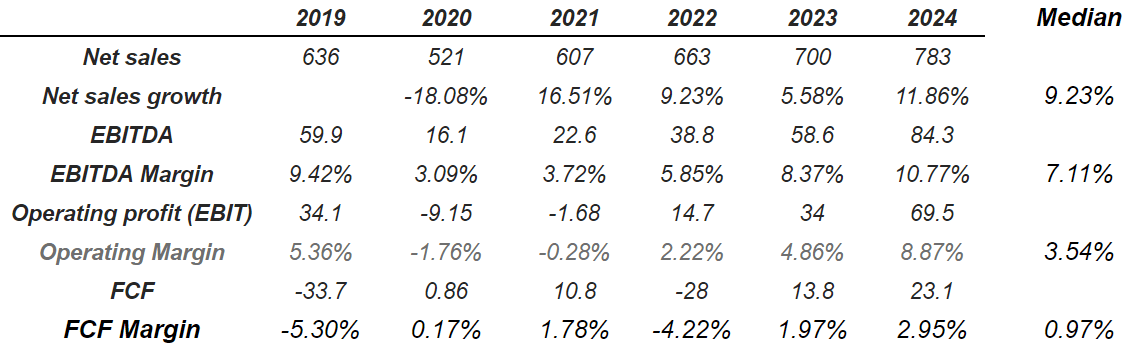

Other Financial Analysts Are Expecting 11% Sales Growth In 2024, With 10% EBITDA Margin and Close to 3% FCF Margin

In my view, the optimism of other financial analysts about Stratasys Ltd. is worth mentioning. Other analysts believe that sales growth could stay close to 5%-11% in 2023-2024, the EBITDA margin from 2019 to 2024 would stay at around 7%, and the FCF margin could be close to 1%. I used some of these figures for my base case scenario, so please have a look at them.

Source: Marketscreener.com

Base Case: Proliferation of 3D Content, And Application Will Likely Bring Substantial Growth

In my view, the proliferation of 3D content and further advancements in AM technology platforms will likely help Stratasys grow. As soon as more manufacturers identify new applications, and the company’s offering increases, revenue growth will likely grow because the target market will be more significant.

We expect to see that growth result in a major shift towards more manufacturing application solutions as compared to primarily focusing on design and prototyping. We will continue to invest in the identification of new applications (especially manufacturing applications) for which our proprietary printing technologies, software and materials are appropriate. This approach has resulted in the broadest offering of Polymer 3D printing solutions in our industry, serving an unequalled array of end markets. Source: 20-F

I also expect a gradual increase in the number of channel partners working with Stratasys Ltd. As a result, the company’s network will likely go to new regions, and may become visible for more clients. In this regard, let’s note that Stratasys Ltd. is making significant efforts to make the brand more popular as well as to increase awareness of 3D printing solutions.

As part of this strategy, we intend to grow awareness of 3D printing solutions for prototyping and manufacturing and to develop industry-specific sales channels as part of our effort to commercialize a broader range of new manufacturing and production applications. Source: 20-F

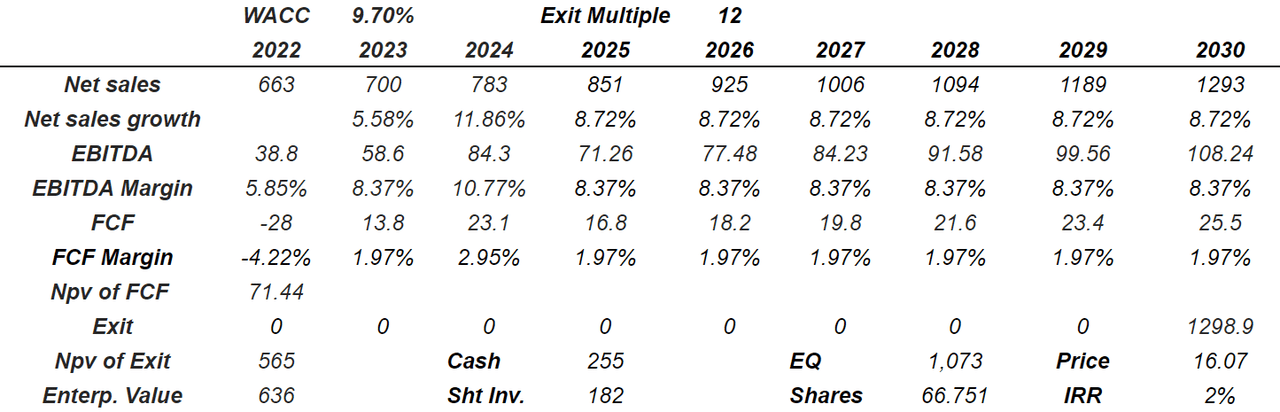

Under this case, I used a WACC of 9.7%, net sales growth close to 8%, and an EBITDA margin of 8.37% from 2024 to 2030. The results include 2030 FCF close to $26 million and FCF margin around 1.9%. If we also use an exit multiple of 12x, the total enterprise value would stand at $636 million. Now, if we sum cash of $255 million and short term investments of $182 million, and divide by the share count, the implied price would be $16.07 with an IRR of 2%.

Source: Author’s Materials

Best Case Scenario

Under my best case scenario, I expect that the company’s R&D efforts and new innovation related to Stratasys’ PolyJet and FDM printing technologies will bring further revenue. I also assumed that the company’s EBITDA margin will likely remain relatively elevated as Stratasys’ position in the market will be enhanced.

We will seek to extend our technological capabilities by addressing manufacturing applications and continuing to invest in our R&D efforts, which focus on enhancing our 3D PolyJet and FDM printing technologies

Source: 20-F

I also assumed that management will use a certain amount of cash for inorganic growth. It means that Stratasys Ltd. will acquire certain competitors which may bring revenue growth. Management may also bring technological innovations from smaller competitors.

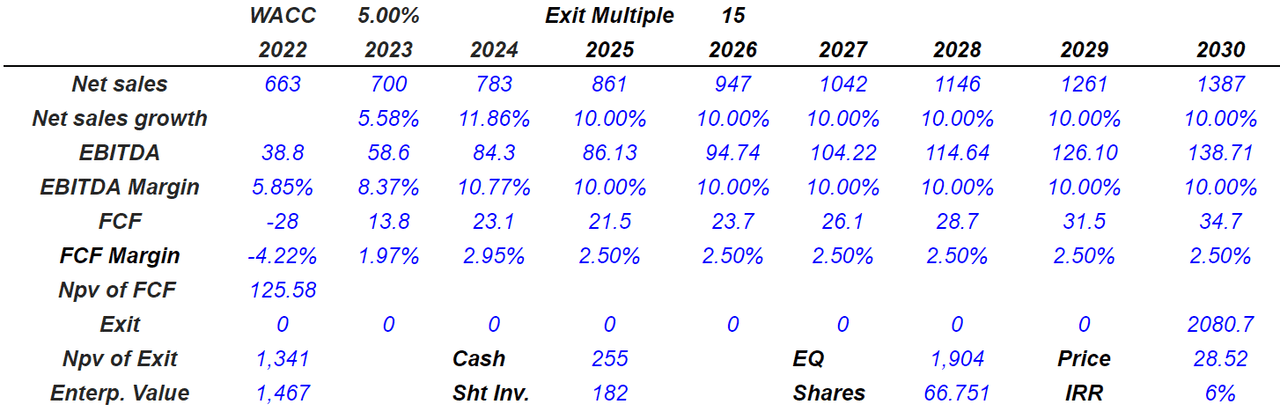

Under optimistic assumptions, I assumed net sales growth around 10%, an EBITDA margin of 10%, and 2030 FCF margin of 2.5%. The results would include net sales of $1.3 billion, 2030 FCF close to $35 million, and an implied enterprise value of almost $1.5 billion. The implied equity valuation would be almost $1.905 billion, with a fair price of $28.5 per share and an IRR of 6%.

Source: Author’s Materials

Risks Would Include Lower Acceptance Of 3D Printing Or Failed Acquisitions

The company acquired several businesses in the past to increase its polymer suite of solutions. Under this case scenario, I assumed that some of these acquisitions would not be as successful as expected. I am talking about obtaining lower synergies than expected. In addition, the solutions acquired may not perform in the near future.

We acquired Origin Laboratories, Inc., or Origin, and its P3™ Programmable PhotoPolymerization technology in December 2020, which we believe will help to further strengthen our position in that area. In order to further expand our polymer suite of solutions across the product life cycle, in 2021, we acquired UK-based RP Support Ltd., or RPS, a provider of industrial stereolithography 3D printers and solutions, and Xaar 3D Ltd., or Xaar, and its powder-based SAF technology, thereby accelerating our growth in production-scale 3D printing. Source: 20-F

Stratasys Ltd. may also suffer from lower acceptance of 3D printing. If clients start to realize that their products were done using this technology, they may not appreciate it. As a result, I believe that revenue growth would be lower than initially expected.

If the commercial marketplace does not continue to transform towards the broader acceptance of 3D printing and DDM as alternatives for prototype development and traditional manufacturing our results of operations may be adversely affected as a result. Source: 20-F

Stratasys may also suffer from competition in the 3D printing industry. Peers may lower the price of their products, which may damage Stratasys’ revenue and perhaps the company’s margins. If Stratasys has to lower its own prices, the valuation of the company would diminish.

If our business is not able to offset price reductions resulting from these pressures, or decreased volume of sales due to contractions in the market, by improved operating efficiencies and reduced expenditures, then our operating results will be adversely affected. Source: 20-F

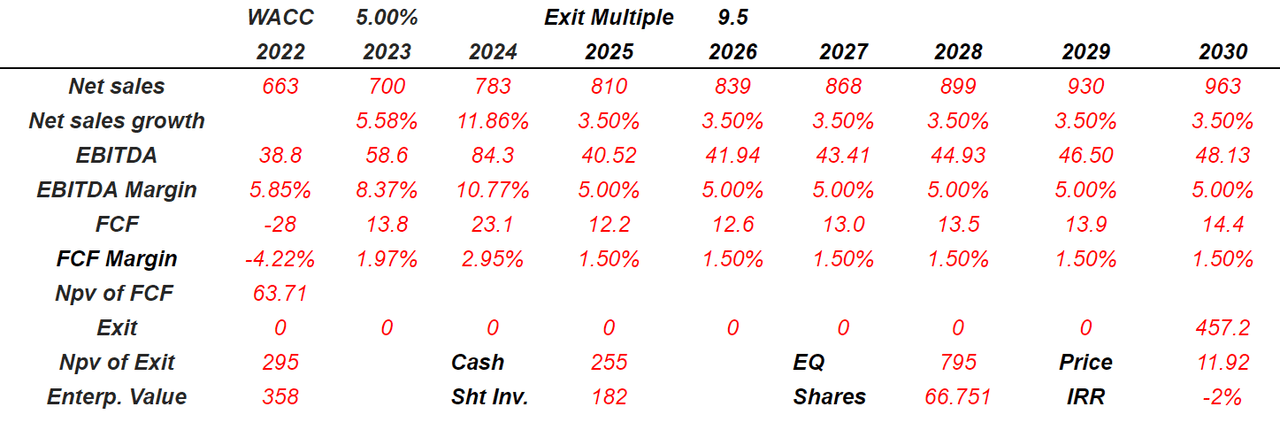

Under very pessimistic conditions, I assumed net sales growth around 3.5%, an EBITDA margin of 5%, and 2030 FCF margin of 1.5%. My results would include 2030 FCF of $15 million, an enterprise value of close to $360 million, and an implied equity of $795 million. Finally, the fair price would be close to $11.95 per share with an IRR of -2%.

Author’s Materials

My Takeaway

With a considerable amount of cash in hand and operating in the growing 3D printing industry, Stratasys will likely experience sales growth. Under normal circumstances and optimistic assumptions, my DCF model resulted in a valuation that is higher than the current market price. In my view, most investors don’t seem to understand how M&A could be a great catalyst of revenue. Besides, new innovations and channel partners in new different industries could multiply the target markets. Yes, failed acquisitions and lower acceptance of 3D additive manufacturing may happen, but in my view, the downside risk in the stock price is small.

Be the first to comment