Darren415

This article was first released to Systematic Income subscribers and free trials on Oct. 31.

Welcome to another installment of our Preferreds Market Weekly Review, where we discuss preferred stock and baby bond market activity from both the bottom-up, highlighting individual news and events, as well as top-down, providing an overview of the broader market. We also try to add some historical context as well as relevant themes that look to be driving markets or that investors ought to be mindful of. This update covers the period through the last week of October.

Be sure to check out our other weekly updates covering the business development company (“BDC”) as well as the closed-end fund (“CEF”) markets for perspectives across the broader income space.

Market Action

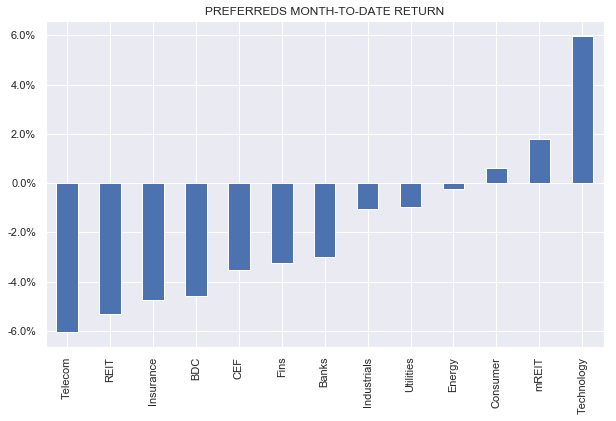

Preferreds had a good week with all sub-sectors seeing positive returns. Over October, however, most sectors finished lower.

Systematic Income

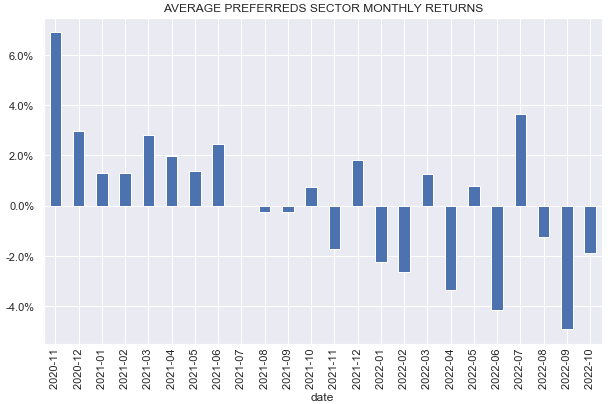

Unlike CEFs and BDCs, preferreds delivered a negative return in October – the third negative monthly return in a row.

Systematic Income

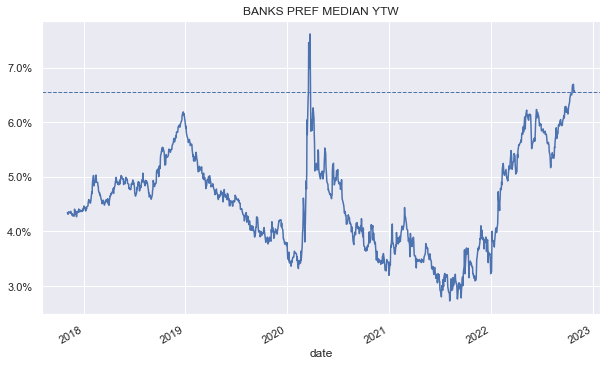

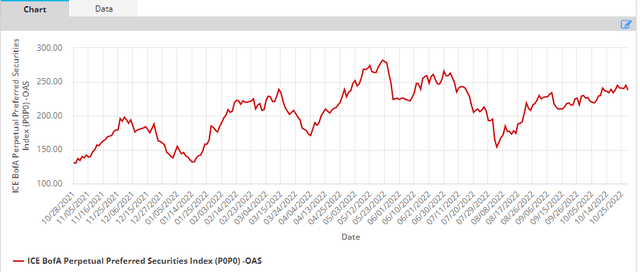

In contrast to BB-rated corporate bonds, for instance, whose credit spreads have rallied by 0.7% from 3.76% in October, preferreds credit spreads have actually widened in October as the following chart shows. Overall, preferreds offer good value at the moment, particularly in the institutional sector which boasts a lower duration.

Bank preferreds, for instance, many of which are or are close to investment-grade, boast yields close to 7%.

Systematic Income

Market Commentary

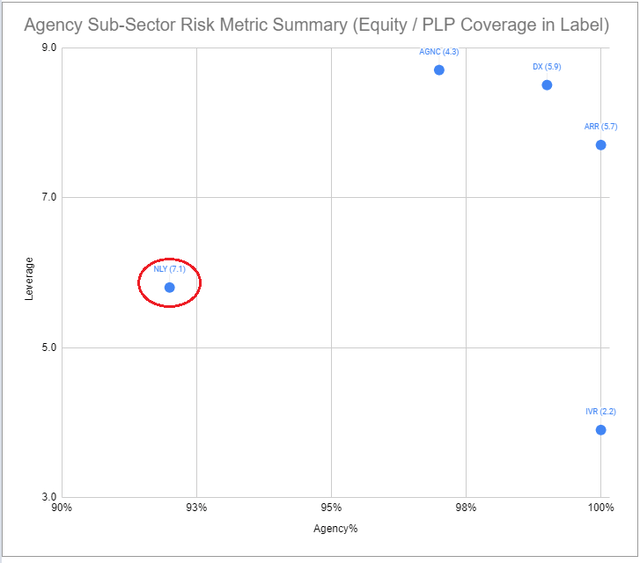

Agency mREITs have kicked off Q3 earnings in the sector.

AGNC (AGNC) book value fell around 20% – the highest pace in the post-COVID period and almost as large as the 23% drop in Q1-2020. AGNC issued $289m worth of common during the quarter as well as $150m of the new AGNCL. Net-net, this, in addition to the book value drop, has caused equity coverage to fall from 5.2x to 4.3x – a far cry from a double-digit level in 2019.

AGNC Series C (AGNCN) is currently callable and it does make sense for AGNC to redeem it for 2 reasons. One, the newly issued AGNC Series L has a much lower coupon right now than AGNCN and the drop in the company’s stockholders’ equity has increased the weight of preferreds in the capital structure, increasing the total financing cost of the company (since preferreds interest expense is above the cost of repo).

It is entirely possible that the company is keeping AGNCN alive to maximize their exposure to Agencies which, at current valuations, makes a lot of sense. It also jibes with the fact that leverage has actually increased (to 8.7x) and the MBS basis sensitivity of book value rose to a 3-year high figure of 19% (i.e. 19% drop in book value for a 25bp rise in Agency spreads). When/if the Agency basis starts to revert, AGNCN could actually be redeemed and the company will then also lower its leverage.

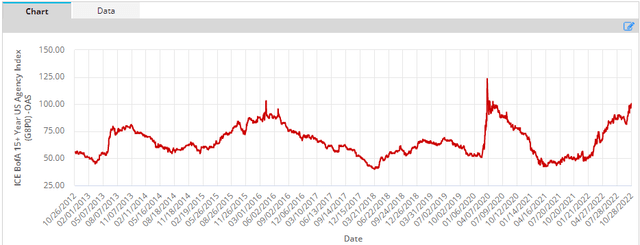

More broadly, what’s interesting is that Agency valuations are much more extreme than the valuations of other fixed-income sectors – they are trading at their peak this year and not far off their COVID peaks.

If valuations move to their peak GFC levels, we would expect a 40-50% book value drop for AGNC (resulting in equity coverage of around 2x), although it’s hard to imagine it getting there (and the Fed not doing anything). Based on this, it can make sense to overweight Agency mREIT preferreds relative to other credit assets. For instance, high-yield corporate credit spreads are more than 1% below their 2022 peak, about half their COVID peak levels and a quarter of their peak GFC levels.

Dynex Capital (DX) saw pretty similar results. It tends to run a lower-leverage portfolio so its book value fell a more modest 16%. Leverage increased sharply however to 8.5x from 6.6x. DX tends to be much more nimble with leverage than other mREITs so this jump means they are seeing good value in Agencies. Like AGNC and Annaly Capital (NLY), DX also issued common shares. Equity/preferreds coverage fell to 5.9x.

Annaly also declared results. Book value fell around 15% while leverage fell as well. A very compelling aspect of NLY is the convexity in its behavior. Specifically, this has to do with how it responds to large book value drops. In Q3, the company issued 16% more common shares. The net result is that while book value fell 15%, equity, which is the thing that actually matters to preferreds, fell only 1.2%. As the book value has been falling this year, the company grew its common shares by a huge 29%.

AGNC and DX have also issued new common shares but not nearly in as large amounts. In other words, a large book value drop causes NLY to issue common shares, softening the impact on preferreds. And if we see a big rise in book value, NLY will likely do nothing (i.e. they won’t buy back 29% of their shares), leaving preferreds much better off from an organic rise in equity.

This convexity of little equity coverage loss to the downside and a big potential equity coverage gain to the upside is a nice profile for preferreds to have. In this sense, NLY preferreds offer much higher convexity than its counterparts in the sector. There is no guarantee NLY will keep being so bold with common equity issuance to the downside but the fact is they have been so far, leaving their preferreds much better off than others in the sector.

The other thing worth highlighting is that NLY tends to be somewhat more conservative. For example, while DX and AGNC increased their leverage levels in Q3 (to 8.5x and 8.7x), NLY actually moved it lower substantially from 6.6x to 5.8x.

A higher level of leverage is more attractive for investors in common shares who are bullish Agencies. However, preferreds holders are much more interested in downside risk than upside gains so, all else equal, they prefer lower leverage levels.

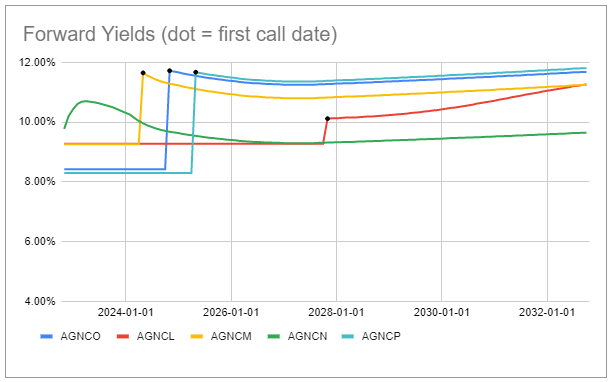

Let’s have a look at what yields are on offer within the sector.

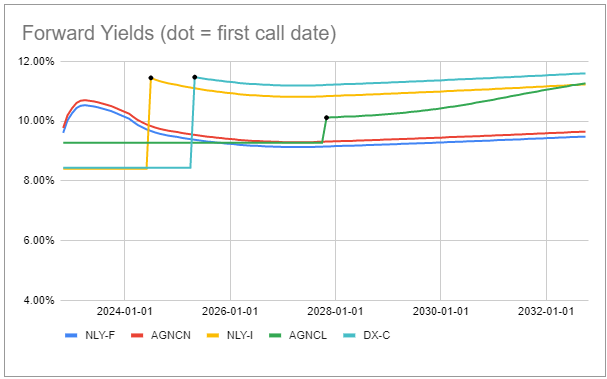

The chart below shows forward yields of the AGNC suite. There is no slam dunk “best” stock here. Stocks with higher yields in the near term like AGNCN and AGNCM are expected to have lower yields in the longer term and vice-versa. In this sense, the pricing is pretty efficient. Overall, we see value in AGNCN in the near term and AGNCL in the longer-term.

Systematic Income Preferreds Tool

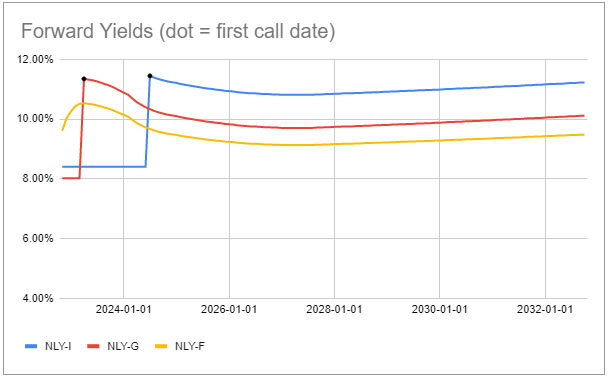

In the NLY suite we like NLY.PF and NLY.PG.

Systematic Income Preferreds Tool

If we combine the shortest call and longest call AGNC and NLY preferreds with DX.PC, we get the following picture. Over the longer-term, DX.PC offers a lot of value in our view, however, Apr-2025 is a long-time to wait for a bump in the coupon and by then Libor could easily be significantly lower than it is today or what is priced into Libor forwards.

Systematic Income Preferreds Tool

In fundamental terms, we continue to favor NLY in the sector – it has the highest equity/preferred coverage in the Agency mREIT preferreds sub-sector and the lowest leverage. As mentioned above, it has also been most aggressive in issuing common shares, boosting equity preferred coverage.

Be the first to comment