SeventyFour/iStock via Getty Images

REIT Rankings: Self-Storage

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on July 12th.

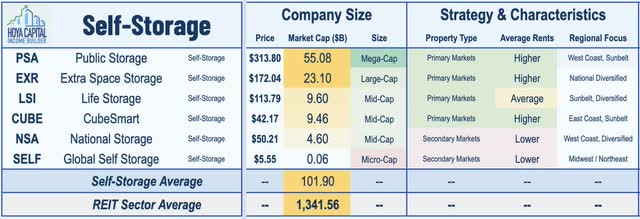

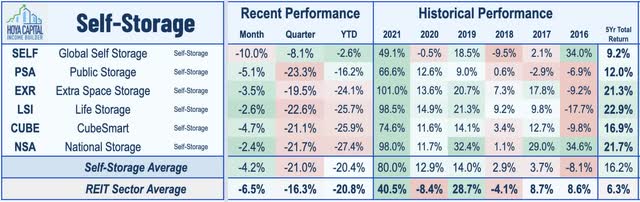

Self-Storage REITs – usually known for their recession-resistant characteristics and “sticky” demand profile – have lagged in recent months despite a stellar slate of earnings results and upbeat interim updates. Few REIT sectors have defied expectations as repeatedly and comprehensively as storage REITs since the start of the pandemic, and while several pandemic-fueled tailwinds are waning, the long-term outlook remains quite compelling. In the Hoya Capital Self-Storage REIT Index, we track the five major self-storage REITs, which account for roughly $100 billion in market value: Public Storage (PSA), Extra Space Storage (EXR), CubeSmart (CUBE), Life Storage (LSI), National Storage (NSA), along with micro-cap Global Self Storage (SELF).

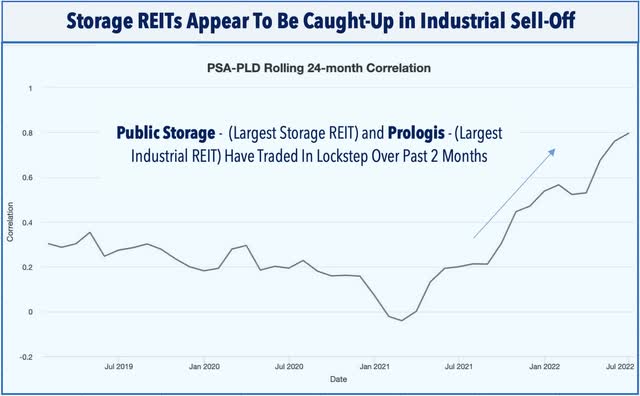

The recent market environment – characterized by a rotation into more recession-resistant sectors – would normally be quite favorable for storage REITs, which should be benefiting from the recent retreat in interest rates which certainly helped revive many other interest rate-senstive property sectors. Storage REITs, however, appear to be caught up in the bearish sentiment surrounding industrial REITs – a rather distant “cousin” to the storage sector – exhibiting an unusually high correlation over the past several months that we don’t believe is justified by fundamentals. As illustrated below, the correlation coefficient in the daily returns of Public Storage – the largest storage REIT – and Prologis (PLD) – the largest industrial REIT – have exhibited a near-perfect positive correlation – suggesting that pricing has become temporarily dislocated from underlying fundamentals.

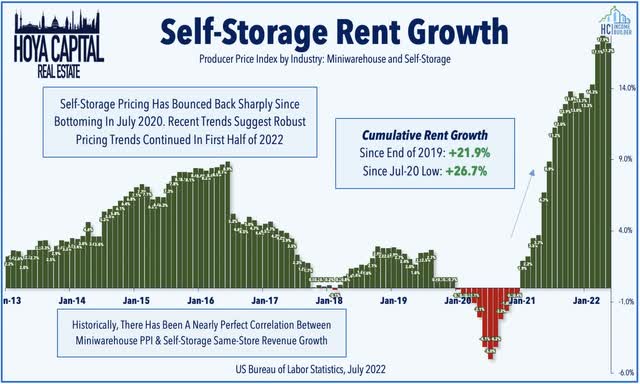

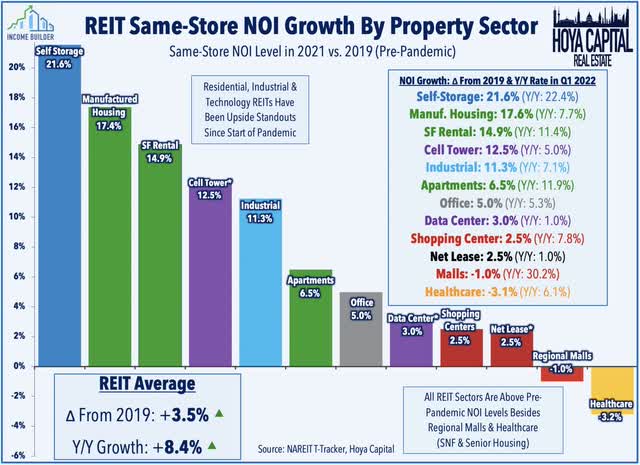

Stumbling into the coronavirus pandemic with challenged fundamentals and an outlook for near-zero growth amid oversupply challenges, self-storage demand came roaring back to life beginning in late 2020 as booming housing market activity amplified favorable demographic tailwinds to drive record occupancy levels and double-digit rent hikes. The Producer Price Index for self-storage facilities – which has historically exhibited a near-perfect correlation with rent growth – illustrates this incredible turnout which has continued through the first half of 2022. The most recent PPI report showed another brisk month-over-month gain of 1.8%, pushing the year-over-year advance to 17.2% – just below the prior month’s record-high rate of 17.9%. Notably, the past three months have exhibited an acceleration in rent growth with annualized growth averaging 24.0%, up from the 9.6% rate in the prior three months.

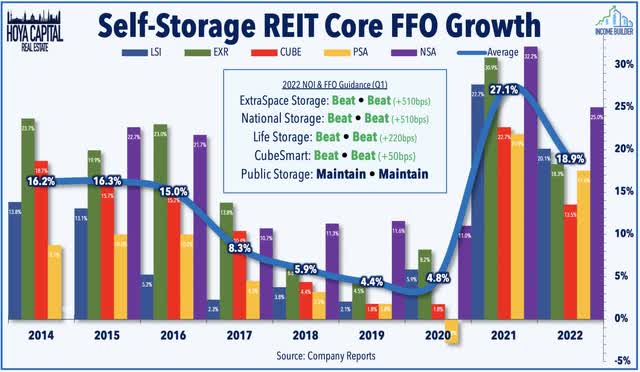

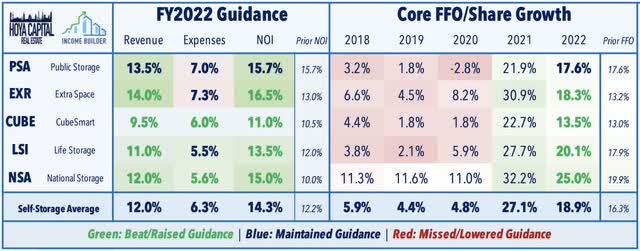

As discussed in our Real Estate Earnings Recap, self-storage REITs continue to ride one of the most impressive turnarounds in recent memory and posted yet another “beat and raise” quarter in Q1. If not for Public Storage, which held its full-year outlook steady in Q1, it would have been the fifth-straight quarter that all five storage REITs raised their full-year outlook for both primary metrics – Fund From Operations (“FFO”) and same-store Net Operating Income (“NOI”). Driven by record-high rent growth, historically high occupancy levels, and accretive external growth through acquisitions and development, storage REITs delivered FFO/share growth of 27.1% in 2021 – far exceeding the prior record-high of 16.3% in 2015 – and the updated outlook for 2022 calls for FFO growth of another 18.9% this year. In fact, the 260 basis point upward revision from its prior FFO outlook was the highest among REIT sectors in Q1.

Results from Extra Space (EXR) were most impressive, raising its full-year outlook, commenting that it’s “off to an exceptional start in 2022, driven by high occupancy and strong pricing power.” EXR now sees FFO growth of 18.3% this year – up 510 basis points from its prior outlook – and raised its same-store NOI growth by 350 bps to 16.5%. National Storage (NSA) was a close second, matching EXR’s 510 basis point increase in its full-year FFO growth outlook while revising its NOI outlook higher by 500 basis points to 15.0%. CubeSmart (CUBE) raised its full-year FFO growth outlook by 50 basis points to 13.5% and also raised its same-store NOI growth outlook by 50 basis points to 11.0% while noting a “continuation of positive trends from 2021.” Public Storage (PSA) reiterated its full-year FFO and NOI growth outlook, likely related to uncertainty over the timing and logistics of the PS Business Parks (PSB) acquisition by Blackstone, which will trigger a special dividend later this year for PSA shareholders for its 41% ownership stake in PSB.

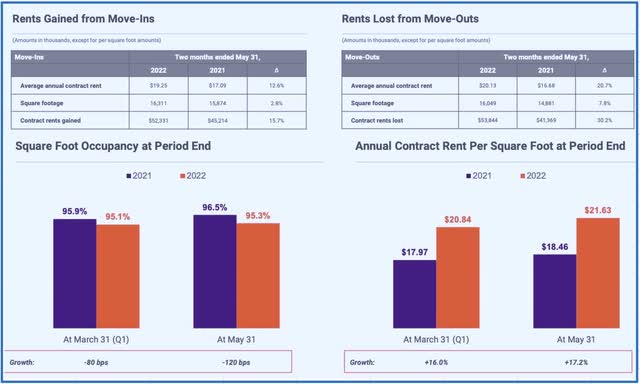

Recent updates provided in early June during REITweek – which came in the midst of a rather unexplained sell-off for the sector – showed that the storage momentum continued deep into the second quarter. Public Storage noted that move-in rates in April and May were signed at rates 12.6% higher than the same period in 2021, which was an acceleration from the robust trends in Q1. Life Storage noted similar pricing trends with move-in rates higher by 9% year-over-year in May while ExtraSpace noted that discounting on lease rates was materially lower in early Q2 compared to the same time in 2021. As expected, occupancy rates have trended modestly lower from record-high rates set last year as some move-out activity was deferred by the pandemic, but through the end of May, occupancy rates were still within about a percentage point of last year’s record-highs and roughly even with Q1.

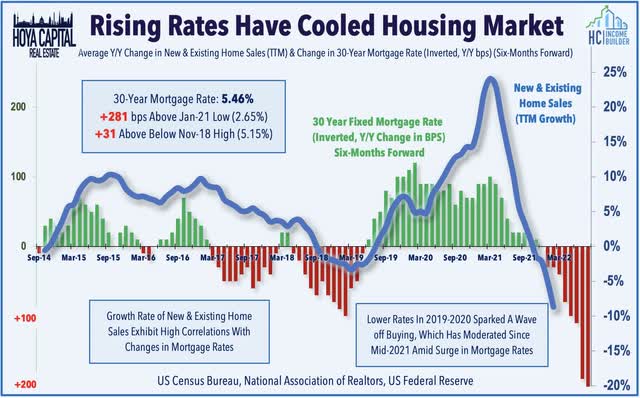

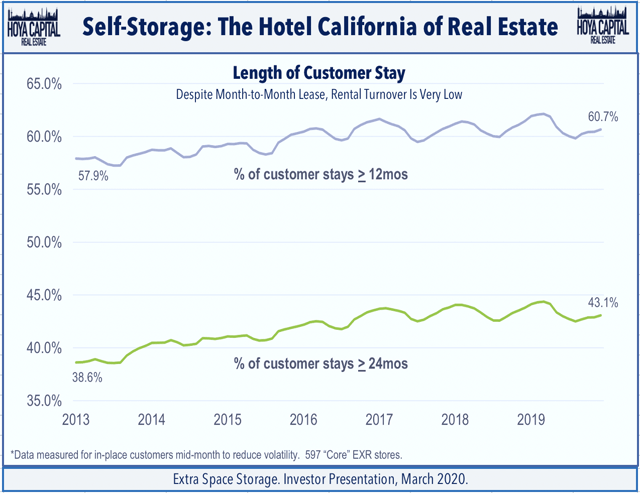

Storage demand is closely-correlated with housing market turnover – specifically home sales and rental turnover – and expectations of moderating activity in the housing sector have been anticipated since late last year from the effects of rising mortgage rates and from some “mean reversion” effects following the pandemic-driven boom in 2020 and 2021. The trends towards smaller homes and high-density urban markets reversed during the pandemic as households sought additional space and more at-home amenities in the new “hybrid” work environment, but affordability issues and soaring residential rents have again started to temper some of this demand. That said, the magnitude of the recent sell-off goes far beyond any reasonable scenario of near-term demand moderation resulting from slowing housing market activity, as storage demand is quite “sticky” with nearly half of renters staying longer than two years, and about a quarter of renters staying for at least a decade.

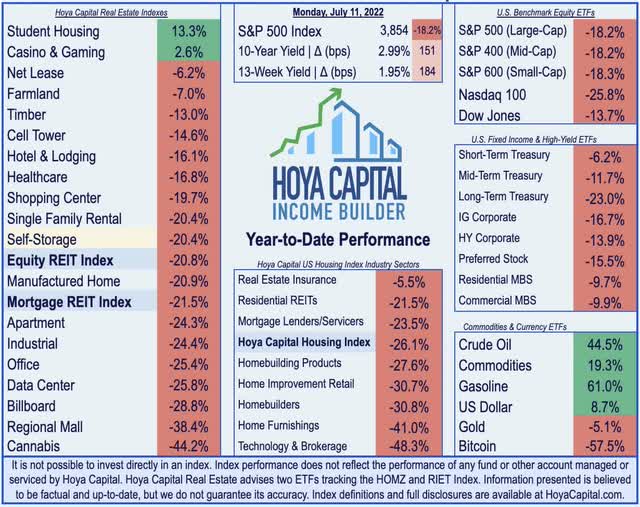

Self-Storage REIT Performance

Despite the stellar first-quarter results and signs of continued momentum deep into the second quarter, storage REITs have sold off significantly over the past quarter with declines of more than 20% since late April. Exhibiting an unusually high correlation with industrial REITs during this time – a linkage that we view as fundamentally unwarranted – the sell-off was simultaneous to the plunge related to reports of Amazon’s logistics overcapacity issues. Having led to the upside for much of 2022, the recent weakness brings the storage REIT sector to levels that are in line with the declines of the broad-based REIT average for the year. The Hoya Capital Self-Storage REIT Index – a passive market-cap-weighted index – is now lower by 20.4% for 2022, slightly above the 20.8% decline from the Vanguard Real Estate ETF (VNQ) and lagging the 18.2% decline from the S&P 500 ETF (SPY).

The weakness this year follows robust total returns of nearly 80% in 2021, as storage REITs were the second-best-performing property sector last year which was a much-needed reversal of fortunes after storage REITs lagged the REIT Index in three of the prior four years. The selling pressure this year – and over the past quarter in particular – has been seemingly uncorrelated with fundamentals with National Storage dragging on the downside despite posting perhaps the strongest Q1 results compared to consensus expectations, while Public Storage has been the leader among the five major storage REITs despite posting the weakest relative earnings results in Q1. Micro-cap Global Self Storage has interestingly escaped the selling pressure, seemingly consistent with the thesis that storage REITs are caught up as “proxies” in a broader bet against industrial REITs.

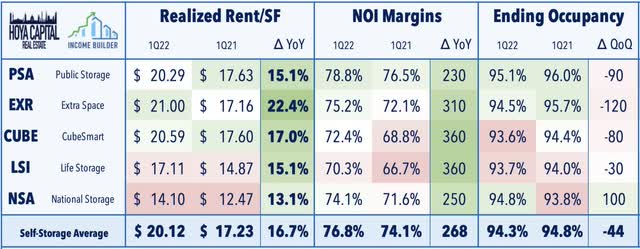

Deeper Dive into Earnings Reports

The record-high surge in same-store NOI growth was driven by two factors: a 16.7% average rise in realized rents and a 270 basis point improvement in NOI margins and was partially offset by a modest 45 basis point decline in average occupancy rates. As expected, with “full occupancy” across most facilities, rent growth will continue to be the primary driver of same-store performance in 2022. Storage REITs had previously expected rent growth on new leases to be flat-to-negative in 2022 and had expected to lean heavily on rent increases on existing leases to drive NOI growth, but recent updates indicate that new lease rates are trending far ahead of prior expectations.

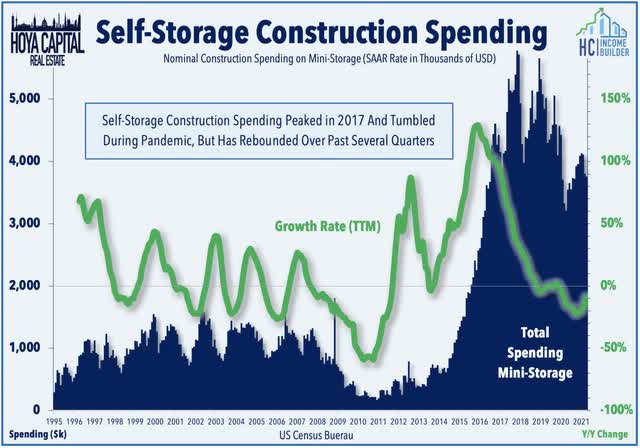

Importantly, on their earnings calls, all five major storage REITs discussed their expectation for moderating supply growth in 2022 and into 2023 as the lagged effects of the weak pre-pandemic fundamentals along with elongated construction timelines continue to suppress speculative development, which should help to alleviate the oversupply issues that weighed on fundamentals in the late 2010s. Consistent with this commentary in earnings calls, construction spending data from the Census Bureau has indicated that the peak in development appears to have occurred in 2017 and declined by more than 10% in 2021, but soaring rents and record-high occupancy rates have spurred a rebound in starts over the past several quarters.

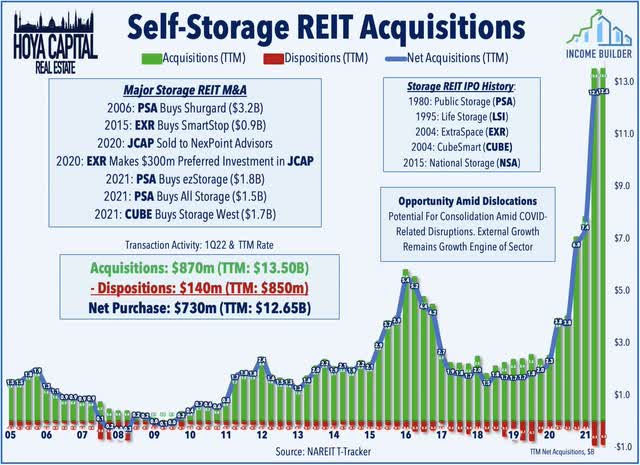

Acquisition and consolidation opportunities should remain plentiful over the next decade for these storage REITs following the late-2010s supply boom, and we did indeed acquisition activity ramp up over the past several quarters as these REITs acquired more than $13B in assets over the past year. Fueling this record pace was a pair of acquisitions from Public Storage: a $1.8B acquisition of ezStorage – a 48-property portfolio in the Washington DC region, and a $1.5B acquisition of All Storage, which owns 56 properties in the Dallas market. Additionally, earlier this year, CubeSmart completed a $1.7B acquisition of Storage West – an owner and operator of 59 self-storage assets in Southern California, Phoenix, Las Vegas, and Houston.

Deeper Dive: Self-Storage Fundamentals

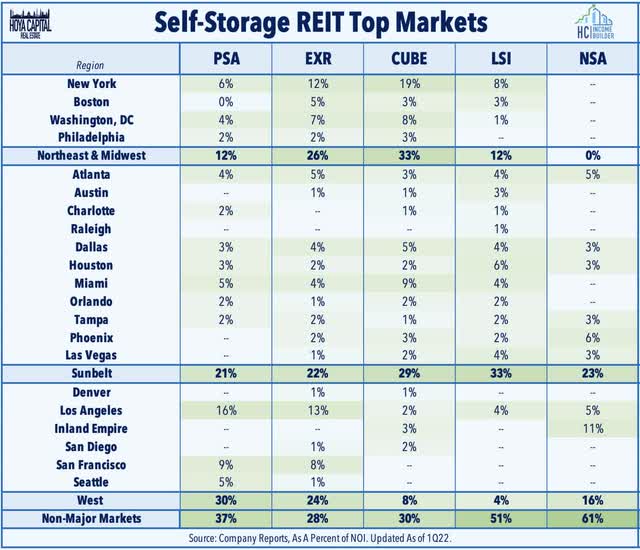

There are roughly 50,000 self-storage facilities in the United States, and proximity to one’s home (generally 3-5 miles) is typically cited as the most important feature. One in ten US households rent a self-storage unit, and 70% of self-storage customers are residential, with the other 30% split between businesses, students, and the military. The self-storage industry remains a highly fragmented industry, and these six REITs own roughly 20% of the total square footage in the US. The three largest REITs – Public Storage, CubeSmart, and Extra Space – operate relatively higher-rent portfolios in more primary markets, while Life Storage, National Storage, and Global Self Storage operate facilities with lower rents in secondary and tertiary markets.

Self-storage REITs comprise roughly 5-8% of the broad-based “Core” REIT ETFs and also comprise roughly 3-4% of the Hoya Capital Housing Index, which tracks the performance of the US housing industry. Rent collection has remained essentially spotless throughout the pandemic, consistent with our predictions early in the pandemic in which we projected that collection rates should remain resilient because rents are essentially “collateralized” by a renter’s stored possessions as unpaid rents result in the repossession and auction of the goods within the storage locker. Storage units are the “Hotel California” of the REIT sector: once you’re checked in, “you never leave.”

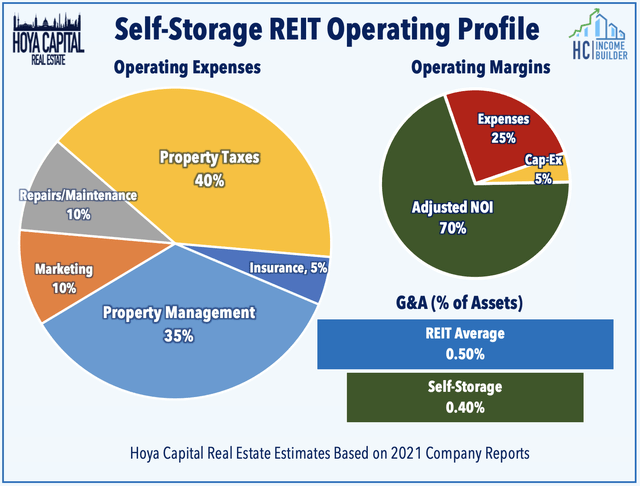

Revenue and expense management technology, brand value, and cost of capital have historically given these REITs a competitive advantage over private market competitors and smaller brands. Additionally, the operating efficiency of the self-storage business is second to none in the real estate sector, commanding some of the highest NOI margins in the real estate space at over 70% while requiring minimal ongoing capital expenditures to maintain the facilities. A double-edged sword for these REITs, the ease and efficiency at which operators can enter the market has resulted in a wave of speculative supply growth coming online over the last half-decade, a large chunk of which has come from developers with limited previous experience in the self-storage business.

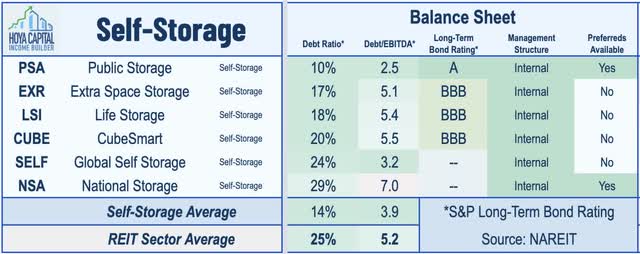

Importantly for their external growth prospects, self-storage REITs operate with some of the most well-capitalized balance sheets across the real estate sector. On average, self-storage REITs operate with debt ratios that are well below the REIT sector average of 25%, led by Public Storage, which operates with perhaps the most conservative balance sheet within the REIT sector with one of the few, coveted “A-rated” long-term bonds. CubeSmart, Life Storage, and Extra Space all hold investment-grade long-term bond ratings as well. All six self-storage REITs operate with debt ratios below 30%.

Self-Storage REIT Dividend Yield

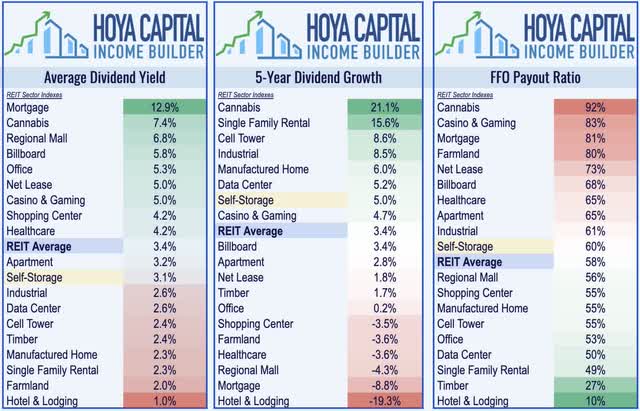

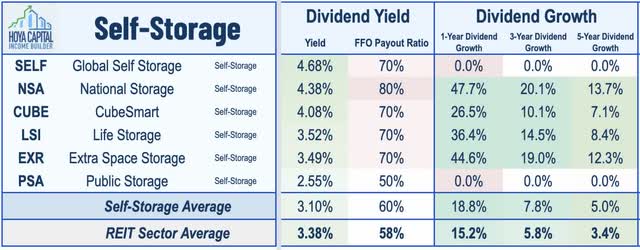

Storage REITs were one of the only property sectors that went completely unscathed by the wave of coronavirus-related dividend cuts that swept across the REIT universe in 2020 and were among the leaders in dividend growth in 2021 as well. Storage REITs pay an average dividend yield of 3.1% which is slightly below the market-cap-weighted REIT sector average of 3.4%. Self-storage REITs pay roughly 60% of their available cash flow, leaving plenty of cash flow to fuel accretive growth through acquisitions and development.

Diving deeper into the sector, we note that the dividend yield ranges from a high of 4.68% from micro-cap Global Self Storage to a low of 2.55% from Public Storage. Notably, CubeSmart, National Storage, and Extra Space have been among the leaders in dividend growth across the REIT sector over the past five years with 7-11% average annual dividend growth rates.

Takeaway: Storage Sell-Off Is an Opportunity

Self-Storage REITs – usually known for their recession-resistant characteristics – have sold off in recent months despite a stellar slate of earnings results and upbeat interim updates. Storage REITs appear to be caught up in the bearish sentiment surrounding industrial REITs– a rather distant “cousin” to the storage sector– an unusually-high correlation that we believe is unwarranted. Few REIT sectors have defied expectations as comprehensively as storage REITs since the start of the pandemic, and while several pandemic-fueled tailwinds are waning, the long-term outlook remains quite compelling. While the slowdown in housing market activity will temper incremental demand, the “stickiness” of revenues remains underappreciated. We see the recent weakness as an opportunity to shift into recession-resistant REITs with strong balance sheets, low cap-ex needs, and above-average growth potential.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment