kupicoo/E+ via Getty Images

StoneCo (NASDAQ:STNE) is a payment processing and merchant software provider in Brazil that has hit a rough patch, mainly due to the economic deterioration in Brazil. We have previously covered the company, but with hindsight it is clear that we were way too early in turning positive on the company. That said, we think the company has hit bottom and is now in on the path to recovery. We’ll mention a few of the data points that make us confident this is the case and that current prices still offer value despite a significant share price increase after the most recent earnings call.

The first reason for optimism is that the company continues growing at an incredibly quick pace, with revenue increasing 87% year over year in Q4 2021. Another reason for optimism is that the company is already seeing some margin improvements in early 2022, and it will refocus the business on profitability this year. It had a challenging 2021 but strong growth and underlying positive fundamentals remain. StoneCo is also experiencing an initial recovery from the spike in interest rates through repricing, and is therefore better positioned to improve profitability going forward. The company is also reorganizing into two divisions to improve execution, financial services and the software division. Finally, the company is guiding to strong growth continuing for 2022 while a profitability improvement is to be expected.

Payments Business

The main business for StoneCo remains the payment processing business, which has as a main indicator the TPV (Total Payment Processed), and which despite being low-margin, is growing quite quickly and tends to be fairly recurrent. StoneCo decided to use the payment processing data it had to start offering credits, but this hasn’t worked out very well so far, so the company is going back to the drawing board to re-imagine this product. Compounding the problem that the models were not very well perfected was the fact that interest rates in Brazil increased significantly, dramatically increasing funding costs for StoneCo, which decided for the most part not to pass along these higher costs to its clients right away as to maintain good customer relationships and growth.

Fortunately StoneCo has now started to gradually reprice, and is already seeing positive results in Q1 2022, expecting higher takes rates going forward and improvement in margins. This should be an ongoing process throughout 2022.

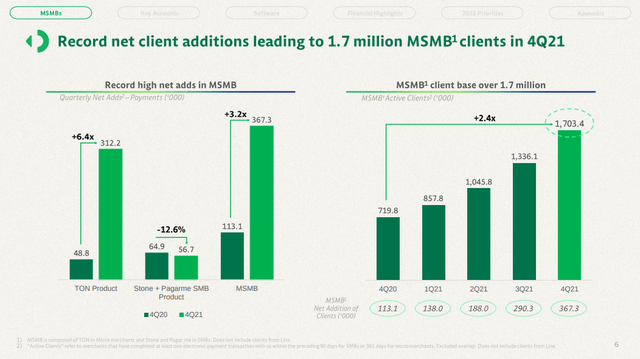

In the much more positive side, StoneCo managed to increase customers by a record amount last quarter, reaching over 1.7 million MSMB (micro, small, medium businesses) clients.

Additional encouraging signs include the fact that in January 2022 StoneCo saw a significant increase in take rates of MSMB’s to 2.02% from 1.71% in Q4 2021, helped by repricing that started in November 2021. The company also reported that MSMB TPV growth was above +80% y/y for both January and February of this year.

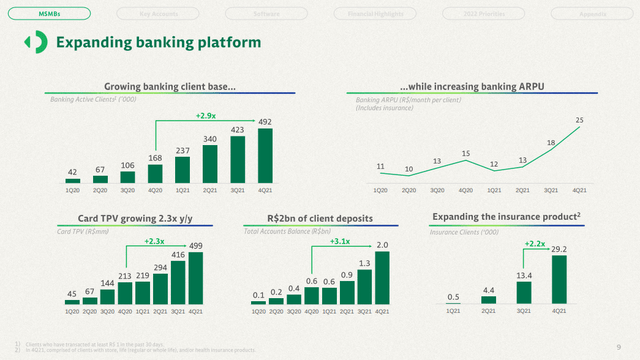

Banking Platform

Beyond payments, StoneCo is developing promising businesses in banking services including credit cards, insurance, and deposits. As can be seen in the slide below, while from a small base, all these services are quickly growing and will become meaningful to the company soon. We like the initiative of the company to constantly seek how to serve its customers better and always looking to find new business opportunities.

Software Business

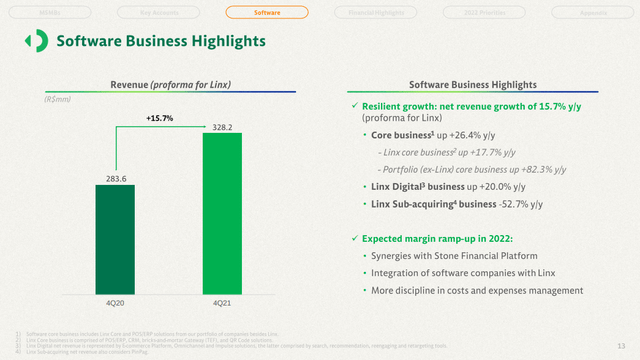

While only about a fifth of the business, the software division is becoming increasingly important and can be particularly strategic in helping the company maintain profitability thanks to the higher margins that this type of business tends to have.

Just like payments, the business is also expected to have a margin ramp-up in 2022, thanks to synergies between the original StoneCo. software business and the Linx acquisition, and more discipline in costs and expense management.

To get an idea of the types of software offerings this division has think point of sale (POS) and enterprise resource planning (ERP) solutions that help companies better manage their day-to-day business activities, from procurement and supply chain operations, to digital and omni-channel sales solutions.

Financials

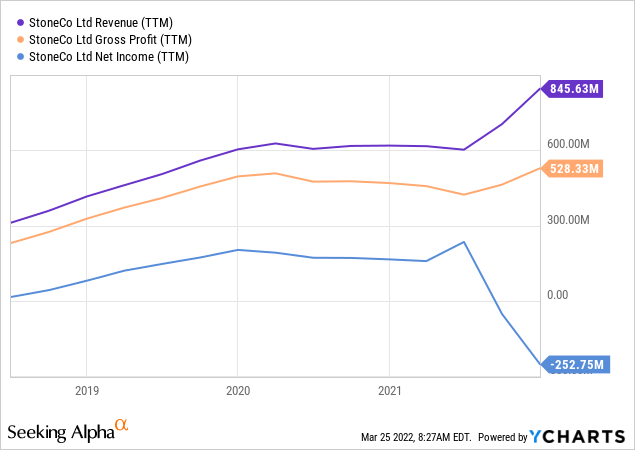

Looking at the company’s financials we can see several things straight away. First, growth decelerated during the COVID lock-downs period, mostly 2020, but has since recovered. Second, while revenue and gross profit continued increasing during 2021, net income profitability took a drastic dive due to decreasing margins for the reasons we have already talked about. The good thing is, as we’ve mentioned, there are green shoots of margin improvements in 2022, and management has declared that they will focus much more on profitability this year than they did last year.

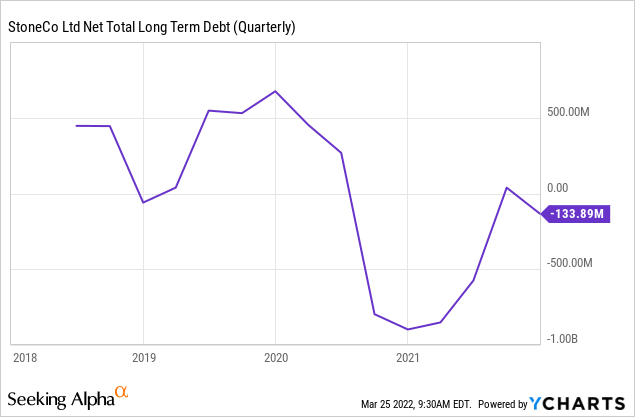

One thing to pay attention to moving forward is the net cash position of the company. Due to the Linx acquisition and negative free cash flow in Q4 2021, the company depleted what at one point was a very solid cash reserve. Given the economic situation in Brazil and the decrease in profitability last year, we would feel a lot more comfortable that the business can survive until better times come if it has a larger cash pile again.

Valuation

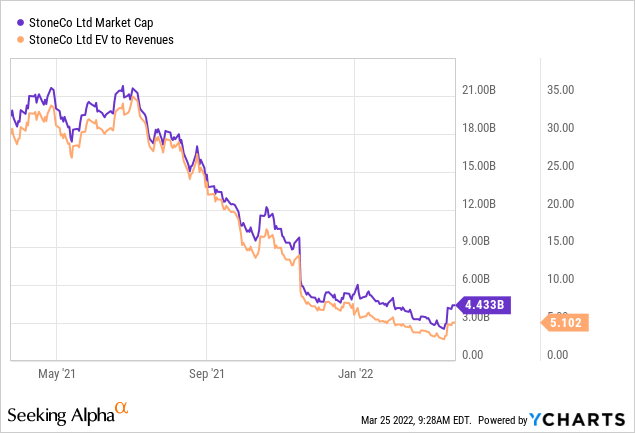

In 2021 when high-growth companies were richly valued the company was trading at what can be argued was an extreme valuation of more than 30x EV/Revenues. Since then shares have come down and are currently trading at what we view as a very reasonable multiple of ~5x EV/Revenues. This can even be argued is cheap for a company growing as fast as StoneCo is, although it might have to reassure investors it can improve margins before it is significantly re-rated by investors.

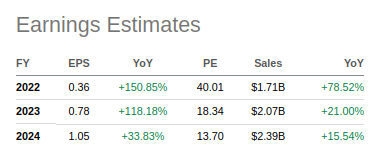

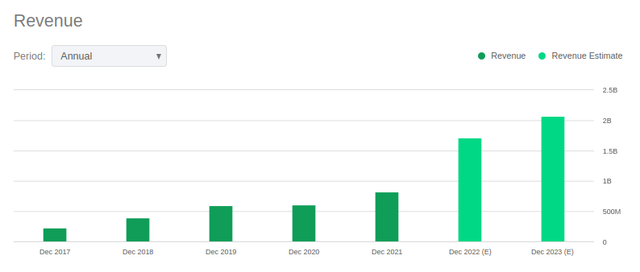

In the graph below we can see how much revenue is expected to grow this year and next, by 2023 it should exceed $2 billion if things go according to plan.

Looking at earnings shares currently look expensive, but if analyst’s are right, the company should earn more than $1 per share by fiscal year 2024. Putting the FY24 PE at ~13x, which for a company almost doubling revenue every year we would argue is really cheap. That is why we believe shares will trade much higher as more evidence comes in showing that the company is indeed seeing margin improvement.

Seeking Alpha

2022 Outlook

For 2022 the company is guiding for a better balance between strong growth and profitability. It should also considerably advance its banking and credit card products, and re-launch its credit offering with much better risk models.

In the software side we should continue seeing organic growth and margin improvement, focusing on enabling customers to become omni-channel. There should also be opportunities to cross-sell financial products to software clients.

The company is undergoing a management reorganization that should help it refocus and better execute its business strategy. We can expect fewer new client additions, but improved margins and profitability going forward. In fact the company is already guiding to adjusted pre-tax income above R$140.0 million in Q1 2022, which is much higher than the R$17.2 million it earned in Q4 2021.

Conclusion

StoneCo is a very interesting company operating in an economy with many challenges, but also many opportunities. So far it has been able to continue growing at a spectacular pace, but macroeconomic realities and some execution mistakes had a negative impact on margins last year.

We believe that as the company shows improving margins along 2022, while maintaining a good level of growth, the share price should re-rate much higher. We think this is a good company that simply went through a difficult period due to a combination of external factors and internal execution mistakes, but from what was shared during the last earnings call we believe the company is again on the right path.

Be the first to comment